Montana Employee Evaluation Form for Nonprofit

Description

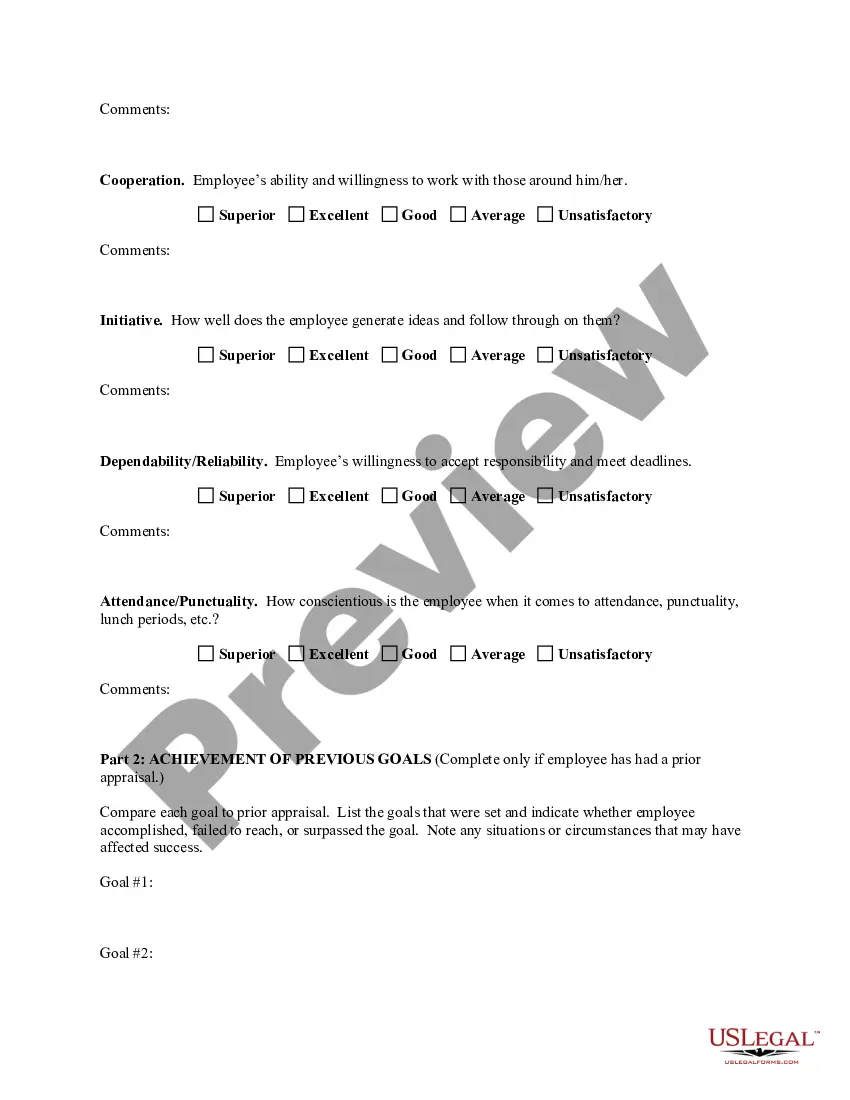

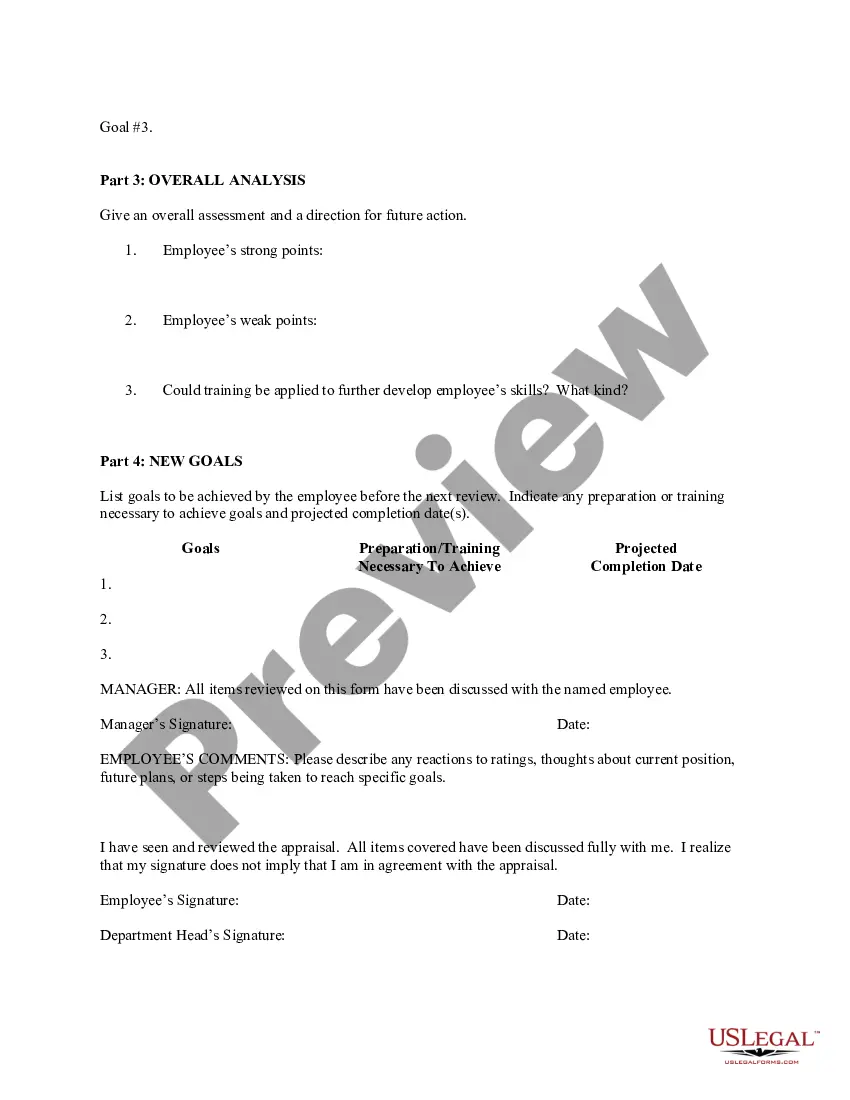

How to fill out Employee Evaluation Form For Nonprofit?

If you aim to be extensive, obtain, or create authorized document templates, utilize US Legal Forms, the largest collection of legal forms available online.

Take advantage of the site’s simple and user-friendly search to find the documents you need.

Many templates for business and personal purposes are organized by categories and states, or keywords.

Step 3. If you are not satisfied with the form, use the Search field at the top of the screen to find other versions of the legal form template.

Step 4. After you have located the form you need, click the Acquire now button. Choose the pricing plan you prefer and enter your information to register for an account.

- Utilize US Legal Forms to acquire the Montana Employee Evaluation Form for Nonprofit in just a few clicks.

- If you are currently a US Legal Forms member, Log Into your account and click the Download button to get the Montana Employee Evaluation Form for Nonprofit.

- You can also access forms you have previously saved in the My documents tab of your account.

- If you are using US Legal Forms for the first time, follow the steps below.

- Step 1. Ensure you have selected the form for the appropriate city/state.

- Step 2. Use the Review option to check the form's content. Do not forget to read the description.

Form popularity

FAQ

Most states do have their own version of a W-4 form, though the names and specifics may vary. These forms serve a similar purpose of allowing employees to specify their state withholding allowances. If you're dealing with employees in Montana, make sure you refer to the Montana Employee Evaluation Form for Nonprofit to align with state regulations.

Most nonprofit groups track their performance by metrics such as dollars raised, membership growth, number of visitors, people served, and overhead costs. These metrics are certainly important, but they don't measure the real success of an organization in achieving its mission.

The three main documents: the articles of incorporation, the bylaws, and the organizational meeting minutes; the nonprofit's directors' names and addresses (or the members' names and addresses if your nonprofit is a membership organization); and.

To start a nonprofit corporation in Montana, you must file nonprofit articles of incorporation with the Montana Secretary of State online at Montana.gov. The articles of incorporation cost $20 to file.

Being 501(c)(3) means that a particular nonprofit organization has been approved by the Internal Revenue Service as a tax-exempt, charitable organization.

Actually, no! These terms are often used interchangeably, but they all mean different things. Nonprofit means the entity, usually a corporation, is organized for a nonprofit purpose. 501(c)(3) means a nonprofit organization that has been recognized by the IRS as being tax-exempt by virtue of its charitable programs.

So2026. how much does it cost to start a nonprofit? The answer is it's complicated. Generally, you need an investment of $500 at a bare minimum, but costs can be as high as $1,000 or more.

One way of starting a nonprofit without money is by using a fiscal sponsorship. A fiscal sponsor is an already existing 501(c)(3) corporation that will take a new organization under its wing" while the new company starts up. The sponsored organization (you) does not need to be a formal corporation.

There Are Three Main Types of Charitable Organizations Most organizations are eligible to become one of the three main categories, including public charities, private foundations and private operating foundations.

The exempt purposes set forth in section 501(c)(3) are charitable, religious, educational, scientific, literary, testing for public safety, fostering national or international amateur sports competition, and preventing cruelty to children or animals.