Montana Subordination, Non-Disturbance, and Attornment Agreement of a Lease regarding a Commercial Loan

Description

How to fill out Subordination, Non-Disturbance, And Attornment Agreement Of A Lease Regarding A Commercial Loan?

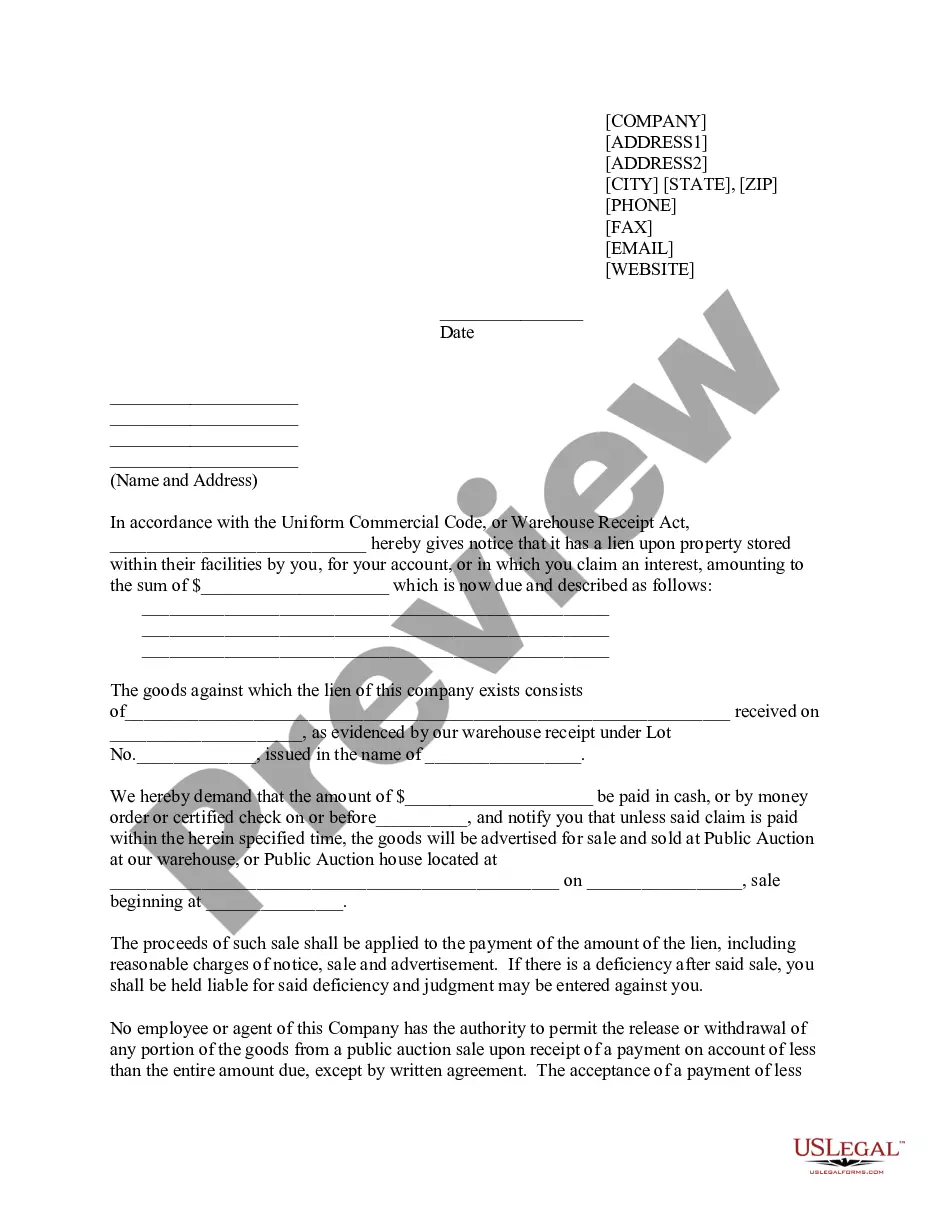

Choosing the right authorized document format could be a struggle. Naturally, there are plenty of templates available online, but how do you get the authorized kind you require? Utilize the US Legal Forms site. The service provides a large number of templates, such as the Montana Subordination, Non-Disturbance, and Attornment Agreement of a Lease regarding a Commercial Loan, which can be used for organization and private requires. Each of the types are checked out by pros and satisfy state and federal demands.

If you are previously registered, log in for your accounts and click the Acquire key to find the Montana Subordination, Non-Disturbance, and Attornment Agreement of a Lease regarding a Commercial Loan. Make use of your accounts to look from the authorized types you have ordered formerly. Proceed to the My Forms tab of the accounts and have another backup of your document you require.

If you are a fresh consumer of US Legal Forms, listed below are basic recommendations that you can follow:

- First, make certain you have chosen the right kind to your area/region. You may look through the shape using the Preview key and read the shape information to make sure this is the right one for you.

- In the event the kind does not satisfy your needs, take advantage of the Seach field to discover the right kind.

- Once you are certain the shape is acceptable, go through the Get now key to find the kind.

- Opt for the rates program you need and enter the essential information and facts. Create your accounts and pay for an order with your PayPal accounts or credit card.

- Pick the document formatting and download the authorized document format for your gadget.

- Total, change and print out and signal the received Montana Subordination, Non-Disturbance, and Attornment Agreement of a Lease regarding a Commercial Loan.

US Legal Forms is the greatest library of authorized types where you can find numerous document templates. Utilize the service to download expertly-created files that follow condition demands.

Form popularity

FAQ

The primary effect of an SNDA is that the tenant agrees to subordinate its lease to the mortgage in exchange for the lender agreeing not to disturb the tenant if the lender forecloses its superior security interest in the real property.

A subordination clause serves to protect the lender if a homeowner defaults. If this happens, the lender then has the legal standing to repossess the home and cover their loan's outstanding balance first. If other subordinate mortgages are involved, the secondary liens will take a backseat in this process.

A nondisturbance clause is a provision in a mortgage contract that ensures that a rental agreement between the tenant and the landlord will continue under any circumstances. This is done primarily to protect the renter from eviction by the mortgagor if the property is foreclosed upon by the lender.

What Is a Subordination Agreement? A subordination agreement is a legal document that establishes one debt as ranking behind another in priority for collecting repayment from a debtor. The priority of debts can become extremely important when a debtor defaults on their payments or declares bankruptcy.

A subordination agreement prioritizes debts, ranking one behind another for purposes of collecting repayment from a debtor in the event of foreclosure or bankruptcy. A second-in-line creditor collects only when and if the priority creditor has been fully paid.

What is Subordination? Subordination is putting something in a lower position or rank. Therefore, a subordination agreement puts the lease below the mortgage loan in priority. Mortgage lenders want the leases to be subordinate to the mortgage. That way, the mortgage loan is paid first if there is a foreclosure.

Subordinate financing is debt financing that is ranked behind that held by secured lenders in terms of the order in which the debt is repaid. "Subordinate" financing implies that the debt ranks behind the first secured lender, and means that the secured lenders will be paid back before subordinate debt holders.

A subordination is a process where the second lender asks the first lender if they will ?let go? of a particular class of collateral. The most common subordination agreements take place with accounts receivable and inventory. These are current assets that can be used to secure a working capital line of credit.