Montana Sample Letter for Applying Check to Accounts

Description

How to fill out Sample Letter For Applying Check To Accounts?

Choosing the right legal papers design can be quite a have a problem. Needless to say, there are tons of templates available on the net, but how will you obtain the legal develop you will need? Take advantage of the US Legal Forms internet site. The service provides 1000s of templates, like the Montana Sample Letter for Applying Check to Accounts, that you can use for organization and private needs. Every one of the varieties are checked out by specialists and satisfy state and federal requirements.

In case you are previously registered, log in in your account and click the Acquire button to get the Montana Sample Letter for Applying Check to Accounts. Utilize your account to look with the legal varieties you possess bought in the past. Proceed to the My Forms tab of your own account and have another version of your papers you will need.

In case you are a brand new customer of US Legal Forms, listed here are easy instructions so that you can stick to:

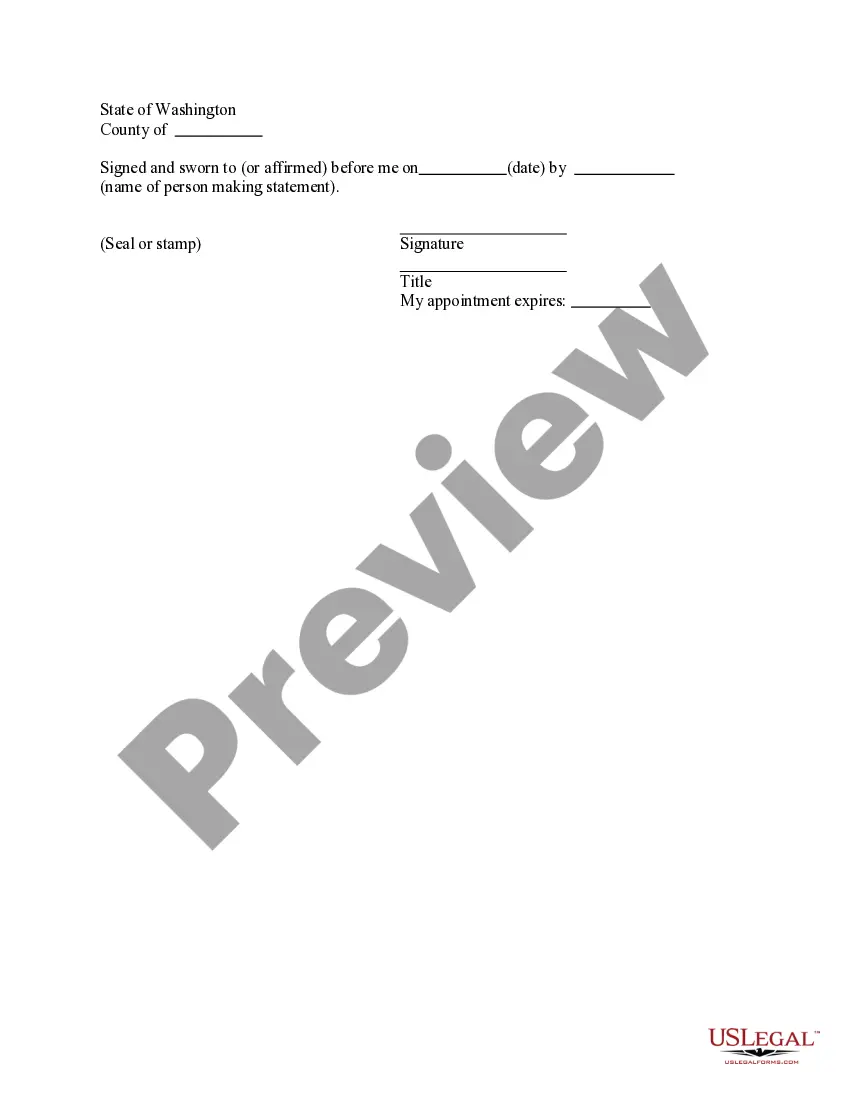

- First, ensure you have chosen the appropriate develop to your town/area. You can look through the form while using Review button and study the form description to make certain this is the right one for you.

- When the develop does not satisfy your expectations, make use of the Seach field to find the appropriate develop.

- Once you are positive that the form is acceptable, click the Purchase now button to get the develop.

- Pick the prices prepare you want and type in the essential info. Build your account and pay for the order with your PayPal account or bank card.

- Select the file formatting and download the legal papers design in your product.

- Full, revise and printing and indication the obtained Montana Sample Letter for Applying Check to Accounts.

US Legal Forms is the most significant local library of legal varieties for which you can find various papers templates. Take advantage of the service to download skillfully-produced papers that stick to express requirements.

Form popularity

FAQ

What Is a Clearance Certificate? A clearance certificate is a certificate that verifies an entity has paid all its tax liabilities at the time the entity ceased to exist or transferred to a new owner. It also applies to the tax liabilities of a deceased individual when managing their estate upon death.

Call Us. To speak to a Citizen Service Representative, call our Call Center: Phone. (406) 444-6900.

You request payment online at uiclaimant.mt.gov for each week you want to get paid. The UI week begins on Sunday and ends on Saturday at midnight. Benefit payment weeks must be claimed in order. If you file a week late, you will be required to provide information as to what prevented you from filing timely.

What are the MT CPE Requirements? Montana CPAs must complete 120 hours of CPE including at least 2 hours of Ethics and 60 hours in Technical courses every 3-year Rolling Reporting Cycle. How many credits can MT CPAs complete via Self Study courses? Montana CPAs can complete all 120 credits via Self Study courses.

A Tax Certificate verifies that the entity has paid all taxes currently due and filed all required Montana tax returns, including through the entity's final year of existence in Montana.