Montana Sample Letter for Checks for Settlement

Description

How to fill out Sample Letter For Checks For Settlement?

Selecting the optimal legal document template can be a challenge. Clearly, there are numerous templates available online, but how can you acquire the legal form you require? Utilize the US Legal Forms website. The platform offers thousands of templates, including the Montana Sample Letter for Checks for Settlement, which can be utilized for business and personal purposes. All forms are reviewed by experts and comply with state and federal regulations.

If you are already registered, Log In to your account and click on the Download button to access the Montana Sample Letter for Checks for Settlement. Use your account to search through the legal forms you may have purchased previously. Navigate to the My documents section of your account and obtain another copy of the document you need.

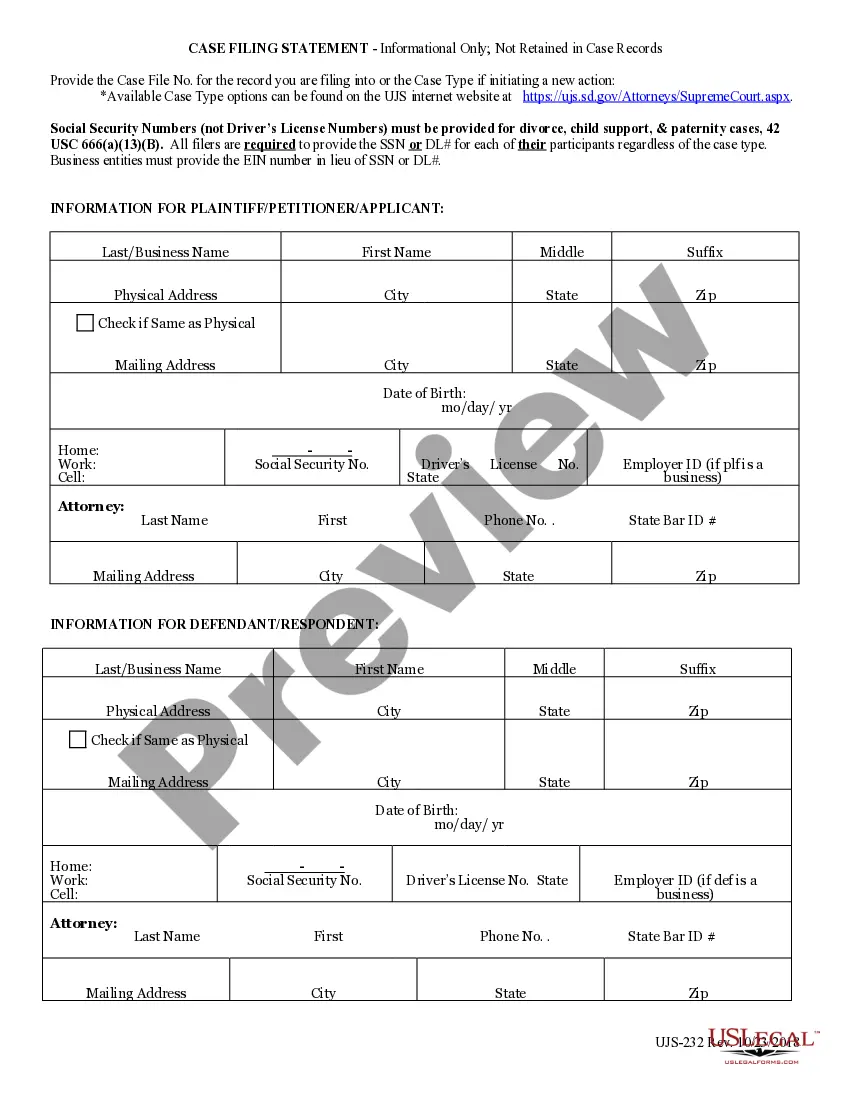

If you are a new user of US Legal Forms, here are simple steps to follow: First, ensure you have selected the correct form for your city/county. You can preview the form using the Preview button and review the form description to confirm it is the appropriate one for you. If the form does not meet your requirements, utilize the Search field to find the correct form. Once you are certain that the form is suitable, click the Purchase now button to obtain the form. Choose the pricing plan you prefer and enter the required information. Create your account and complete the transaction using your PayPal account or credit card. Select the file format and download the legal document template to your device. Complete, edit, print, and sign the acquired Montana Sample Letter for Checks for Settlement.

Take advantage of this resource to simplify your legal documentation process.

- US Legal Forms is the largest repository of legal forms that offers a wide variety of document templates.

- Make use of the service to download professionally crafted documents that adhere to state requirements.

- Navigate the website with ease to find the necessary forms.

- Ensure compliance with local laws when selecting documents.

- Access your previous purchases with convenience.

- Benefit from expert-reviewed legal forms for your needs.

Form popularity

FAQ

To write a settlement check, start by ensuring you have the necessary details, including the payee's name, the amount, and a brief description of the purpose. It is important to clearly indicate that this check is for settlement purposes, perhaps by including 'Settlement Payment' in the memo line. Using a Montana Sample Letter for Checks for Settlement can provide a clear template, making the process smoother. This approach not only ensures accuracy but also helps maintain proper records for both parties involved.

To write a letter for a settlement amount, begin by stating the context of the dispute and your proposed settlement figure. Include any necessary details that support your offer, such as evidence of damages or agreements made. Using a Montana Sample Letter for Checks for Settlement can provide you with a solid framework to enhance your letter’s clarity and impact.

Creating a settlement letter involves drafting a clear and concise document that outlines your offer and the reasons for it. Start with a polite introduction, followed by the specifics of your offer, and conclude with an invitation for discussion. A Montana Sample Letter for Checks for Settlement can help you organize your thoughts and present them effectively.

A settlement offer typically includes a clear statement of the proposed amount, any conditions for acceptance, and a brief explanation of the rationale behind the offer. It should be concise and straightforward, avoiding technical jargon. You can refer to a Montana Sample Letter for Checks for Settlement for a visual guide on how to format and present your offer.

An acceptable settlement offer is one that is fair, reasonable, and backed by relevant evidence. It should take into account the specifics of the case, the damages incurred, and the goals of both parties. When crafting your offer, consider using a Montana Sample Letter for Checks for Settlement to maintain clarity and professionalism.

To write a settlement offer letter, start by clearly stating your purpose and outlining the terms of your offer. Provide supporting information to justify your request. You can reference a Montana Sample Letter for Checks for Settlement to structure your letter effectively, ensuring you present your case professionally and clearly.

Common mistakes in settlement letters include vague language, missing essential details, and unrealistic demands. Often, people forget to express the rationale behind their offer. Utilizing a Montana Sample Letter for Checks for Settlement can guide you in creating a clear and compelling letter, reducing the likelihood of errors.

A claim settlement letter is a formal document sent to an insurance company or party involved in a claim to finalize the terms of a settlement. It typically includes details about the claim, the amount being offered, and any conditions attached. Using a Montana Sample Letter for Checks for Settlement can simplify this process, ensuring you cover essential aspects effectively.

A settlement offer letter is a document you send to propose a resolution for a dispute, often related to financial compensation. For instance, you may use a Montana Sample Letter for Checks for Settlement to clearly outline the terms of your offer and the reasons behind it. This example helps clarify your intentions and sets the stage for negotiation.

When writing a letter for final settlement, ensure you clearly state that this letter represents your final position regarding the matter. Include any necessary details about the agreement and the amount due. Using a Montana Sample Letter for Checks for Settlement can simplify this process, making it easier for you to create a comprehensive and compelling final settlement request.