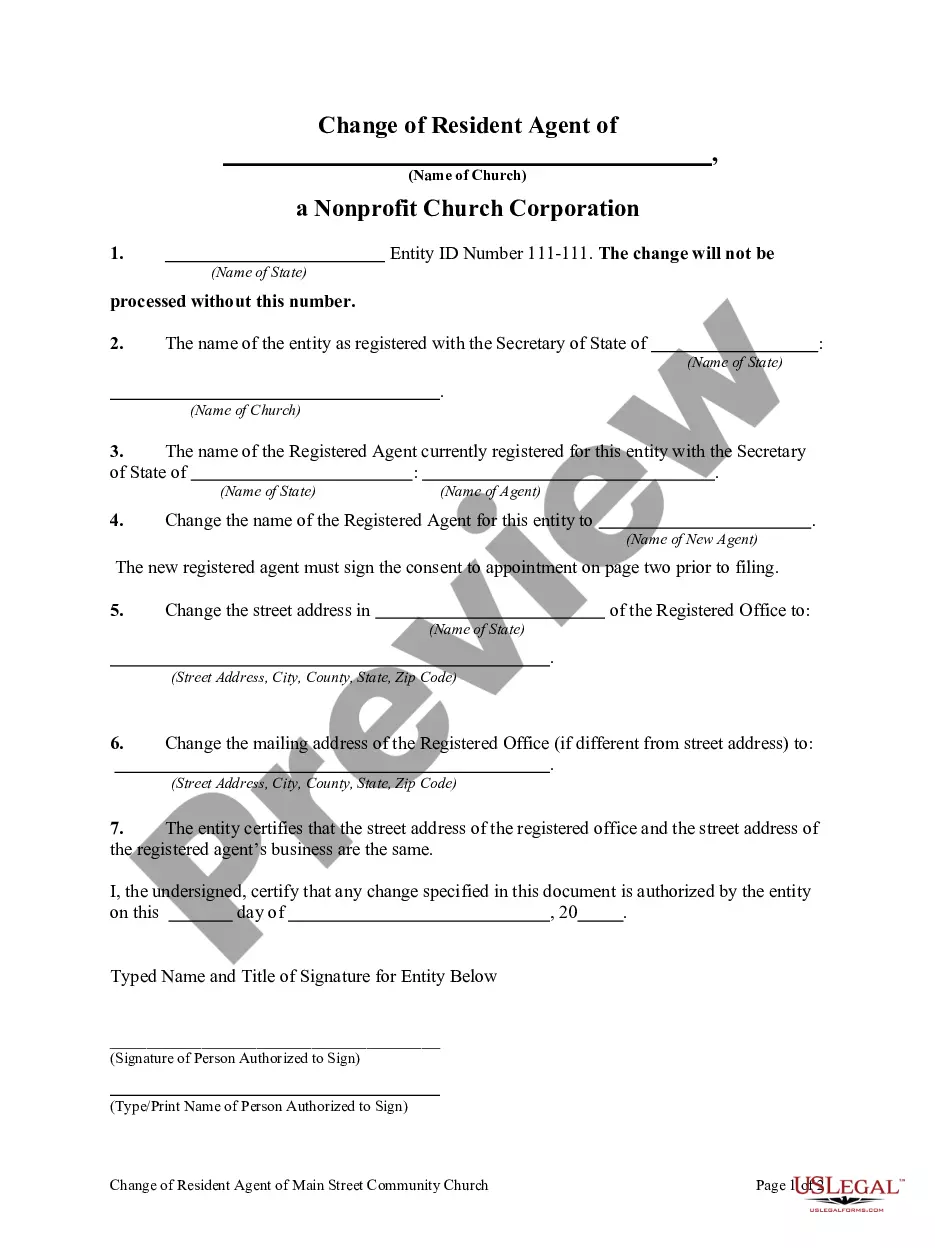

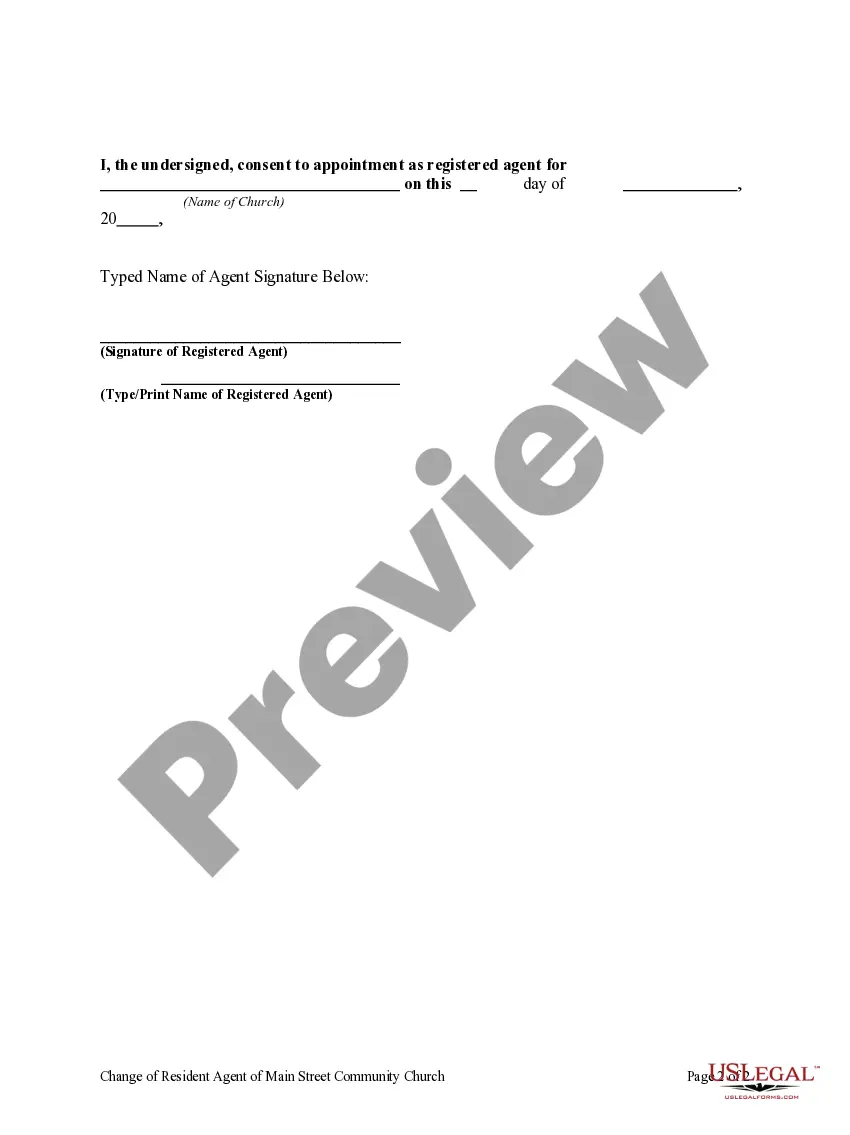

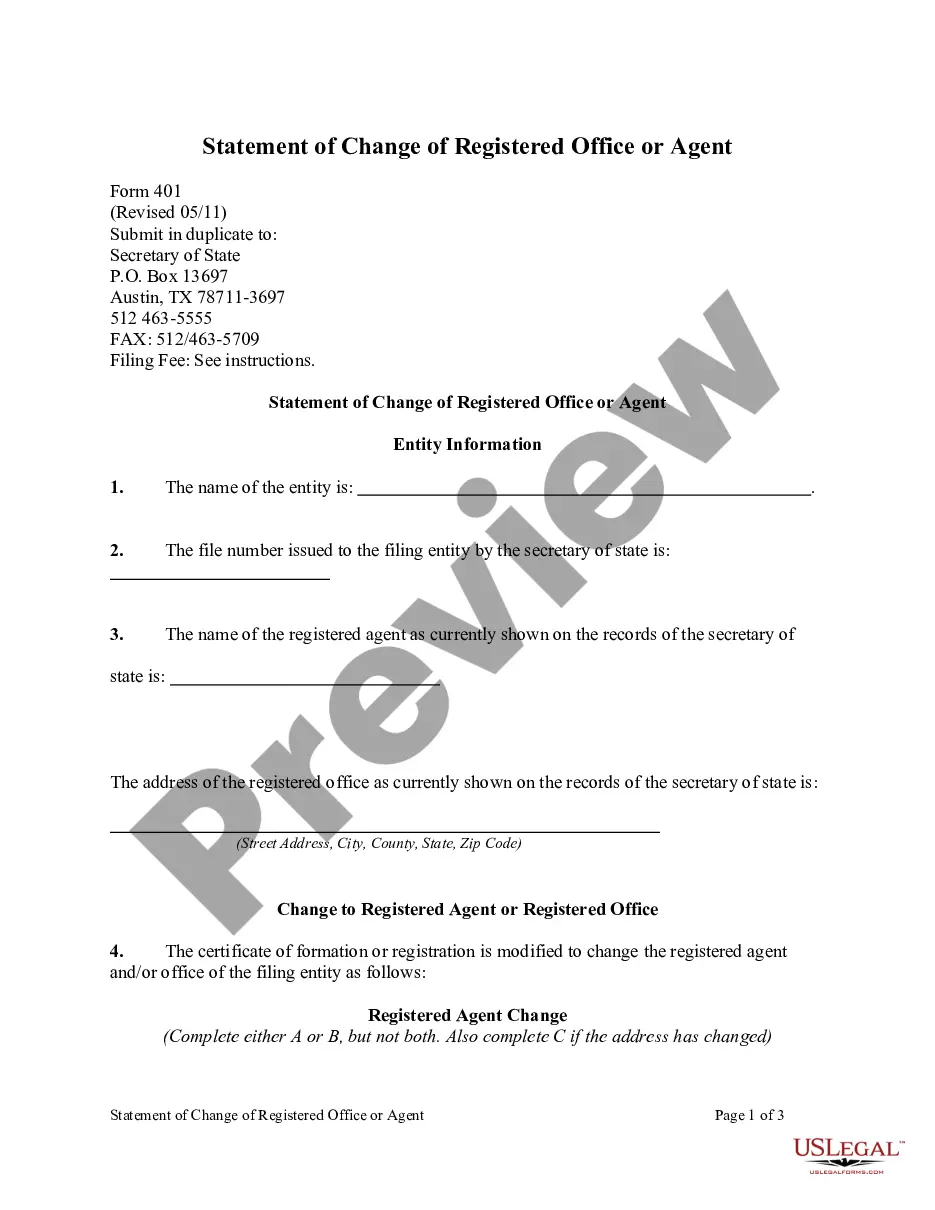

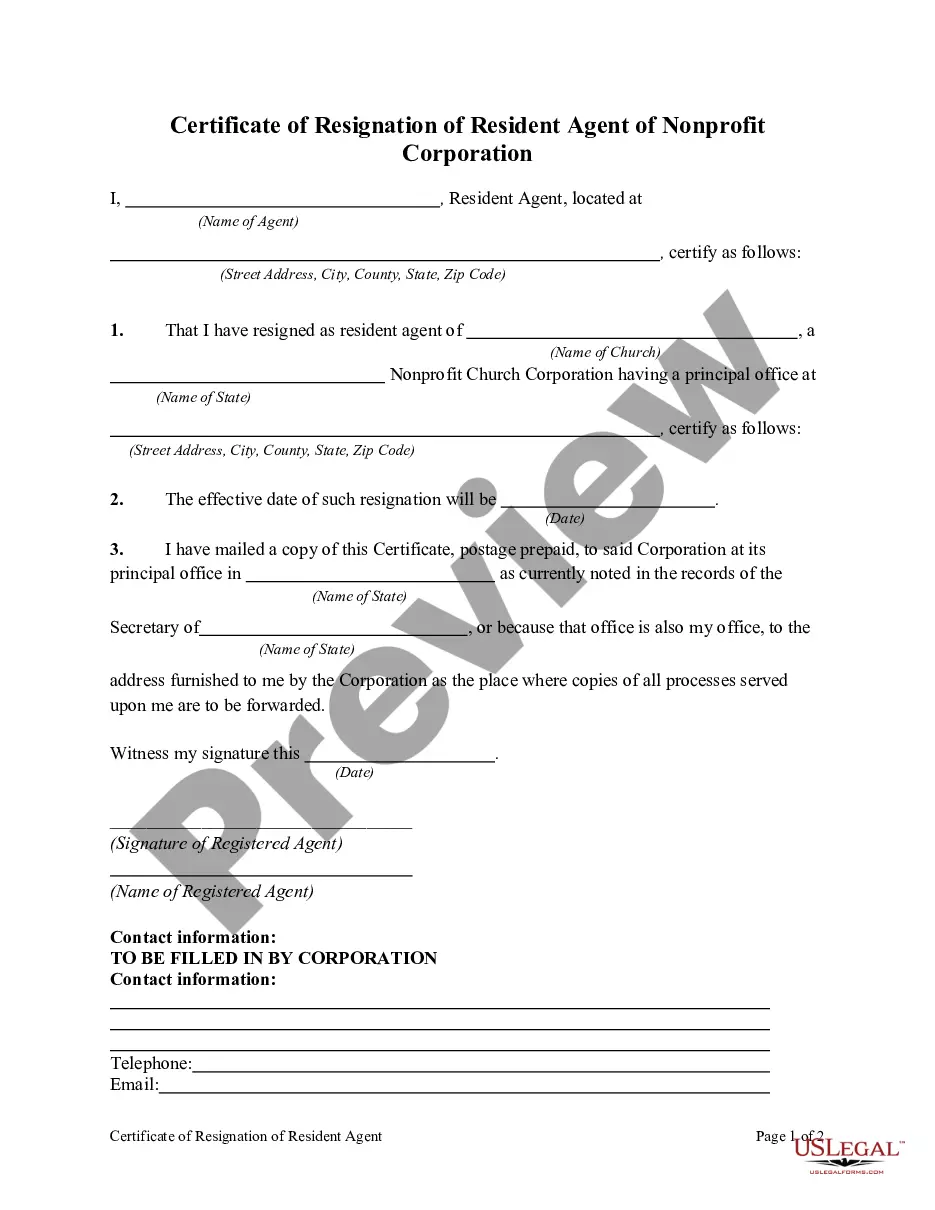

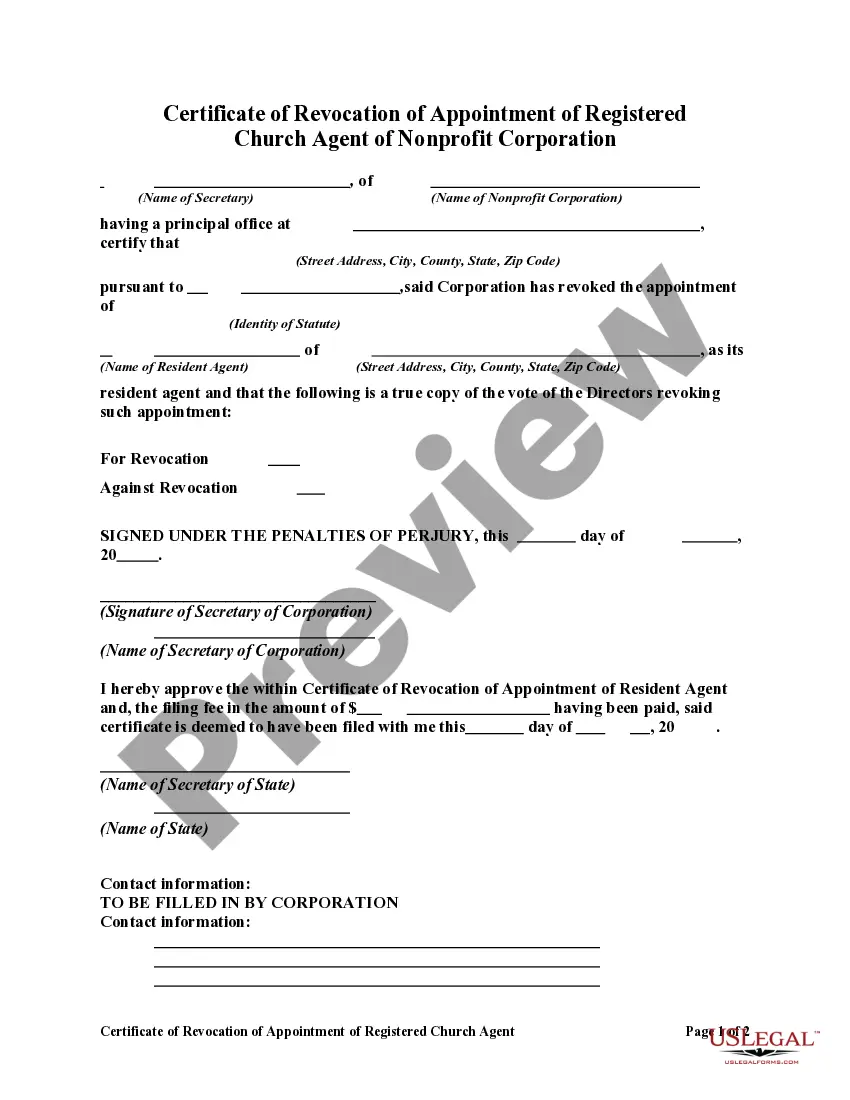

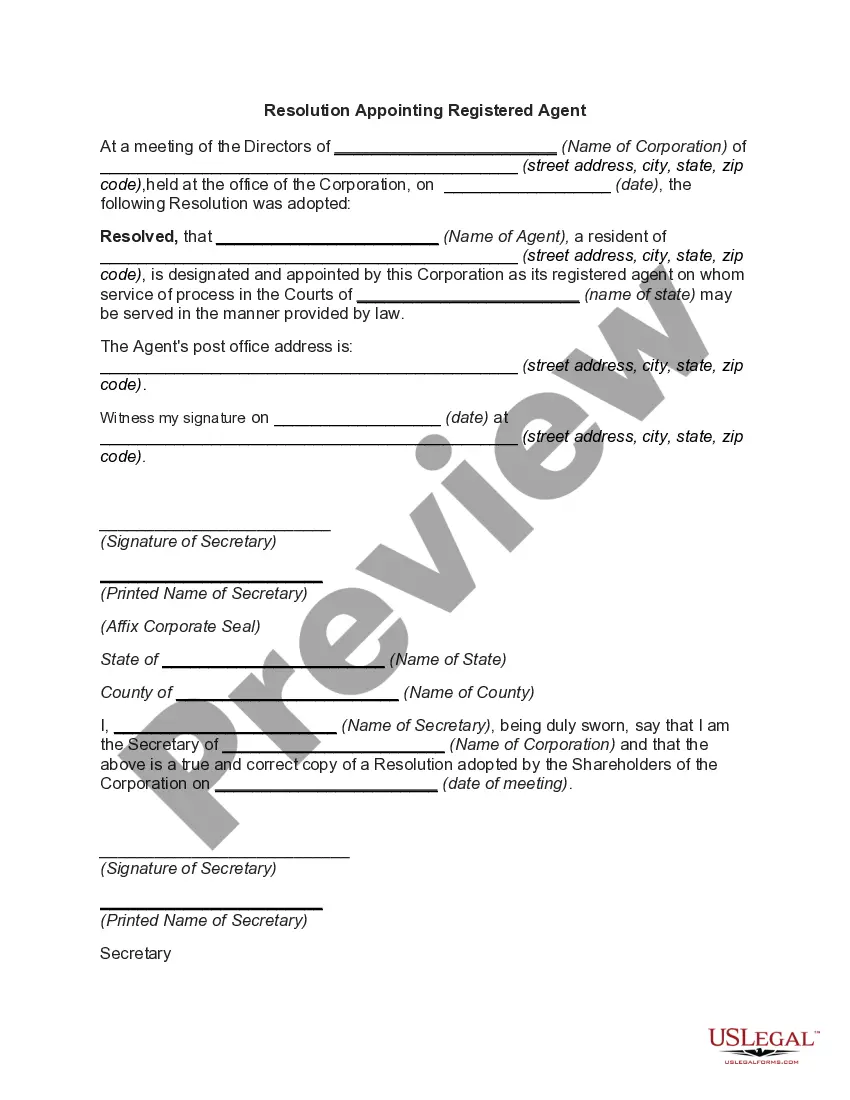

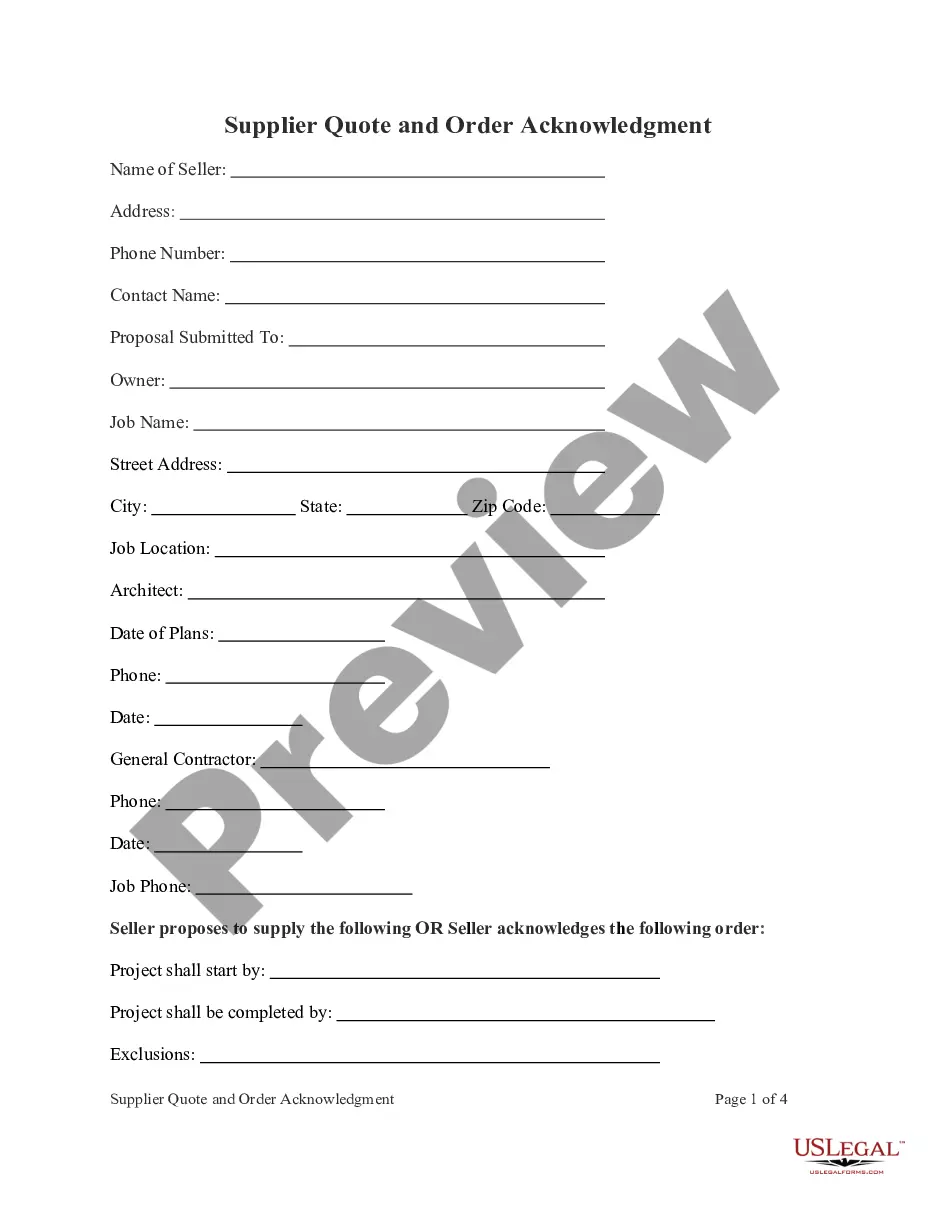

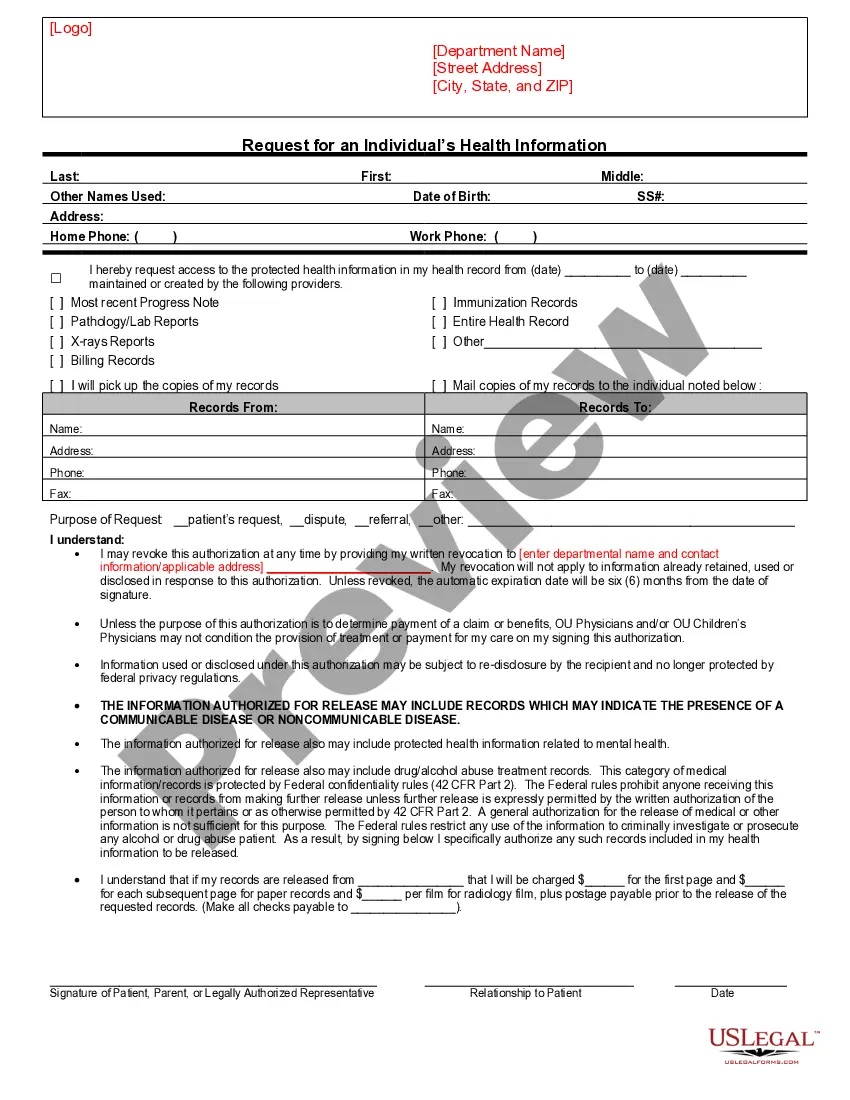

This form is used as formal notice to the state of a change in resident agent.

Montana Change of Resident Agent of Non-Profit Church Corporation

Description

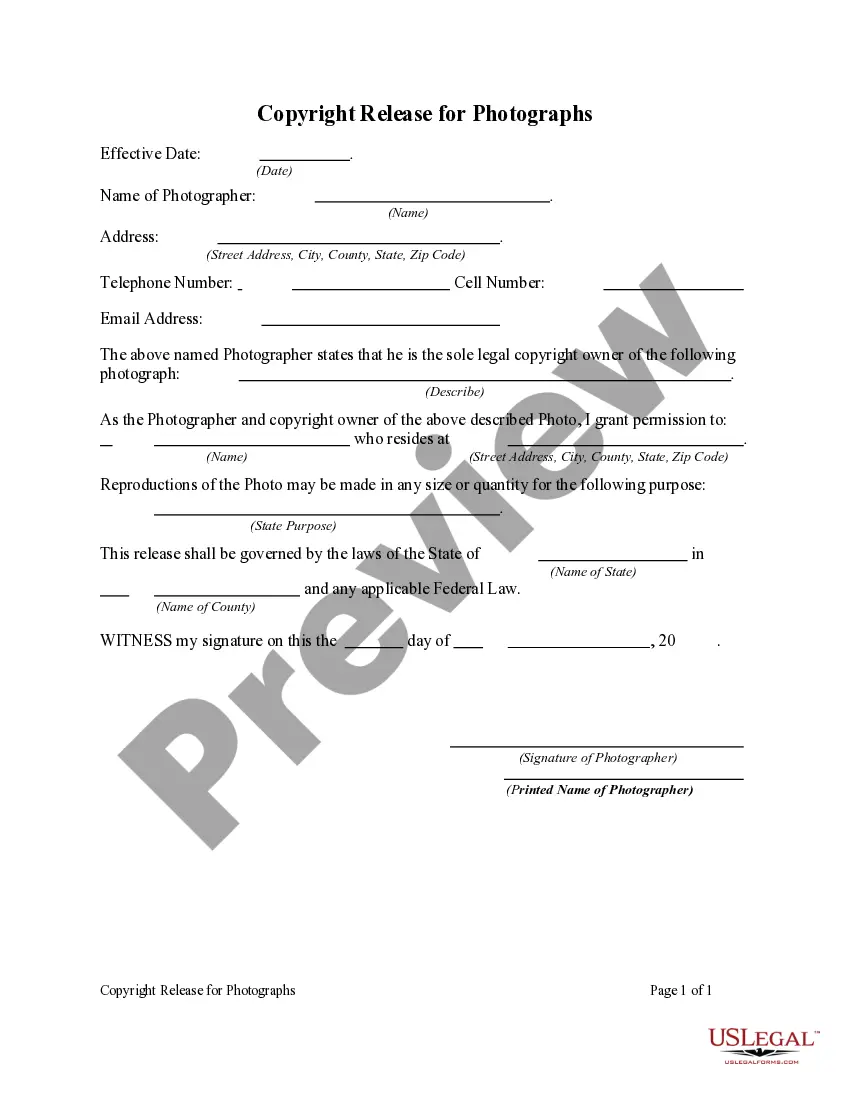

How to fill out Change Of Resident Agent Of Non-Profit Church Corporation?

Are you presently in a role where you frequently require documentation for either a business or individual.

There are numerous legal document templates accessible online, but finding reliable ones is not straightforward.

US Legal Forms provides a wide variety of template forms, such as the Montana Change of Resident Agent of Non-Profit Church Corporation, designed to comply with state and federal regulations.

Once you have the appropriate form, click Acquire now.

Select your desired subscription plan, complete the necessary details to create your account, and pay for the order using your PayPal or credit card.

- If you are already familiar with the US Legal Forms website and have an account, simply Log In.

- Afterward, you can download the Montana Change of Resident Agent of Non-Profit Church Corporation template.

- If you do not possess an account and wish to start using US Legal Forms, follow these steps.

- Locate the form you need and confirm it is for the correct city/area.

- Use the Review button to examine the document.

- Check the description to ensure you have chosen the right template.

- If the form is not what you're looking for, utilize the Lookup section to find a template that meets your requirements.

Form popularity

FAQ

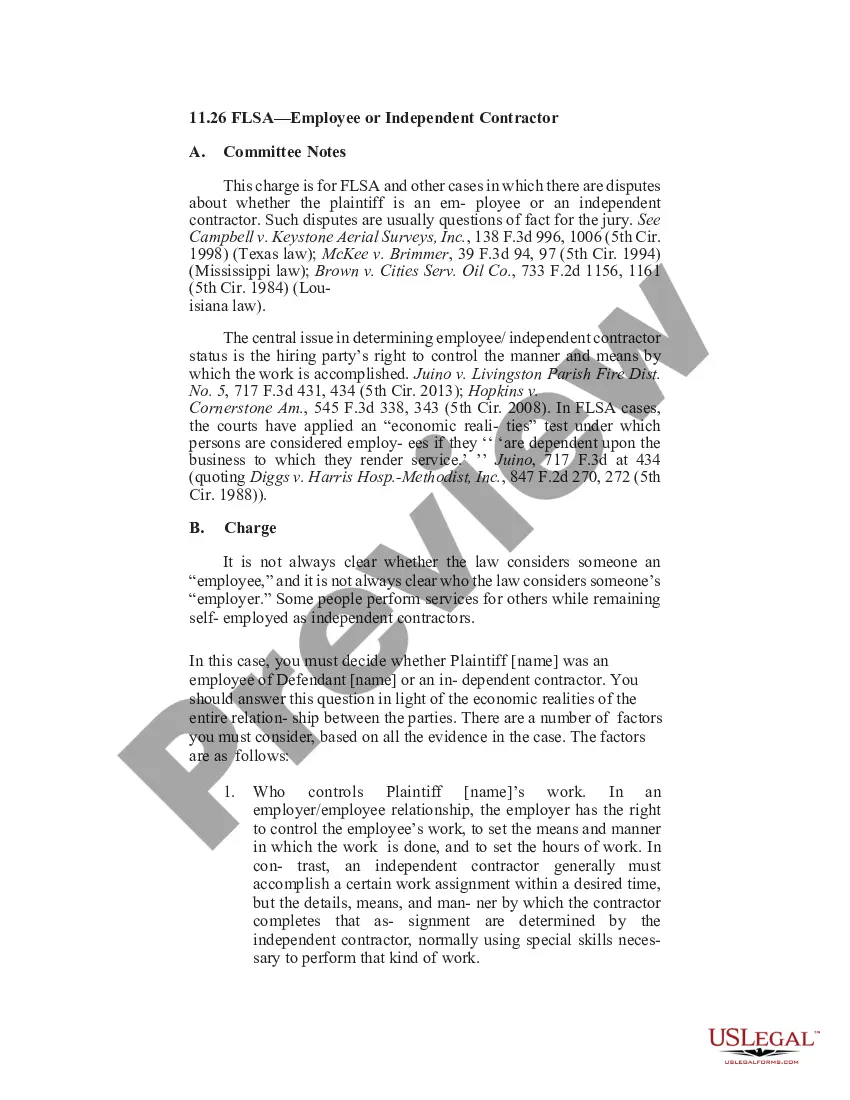

To make amendments to your Montana Corporation, you submit the completed Articles of Amendment for Profit Corporation form to the Secretary of State by mail, fax or in person, along with the filing fee.

Steps to Dissolving a NonprofitFile a final form. In this type of dissolution, the IRS mandates that the board of directors of the nonprofit organization complete certain requirements to "dissolve," or shut down, the 501(c)(3).Vote for dissolution.File Form 990.File the paperwork.22-Sept-2020

Notice of Dissolution of a Nonprofit Corporation Section 35-2-722 of the Montana Code Annotated requires a public benefit or religious corporation to provide written notice to the Attorney General of its intent to dissolve at or before the time it delivers articles of dissolution to the Secretary of State.

Once the decision has been made to dissolve, the nonprofit must stop transacting business, except to wind down its activities. The assets of a charitable nonprofit can only be used for exempt purposes. 6feff This means that assets may not go to staff or board members.

To change your registered agent in Montana, you must complete and file a Statement of Change of Registered Agent form with the Montana Secretary of State. The Montana Statement of Change must be submitted by online and has no fee to file. However, you can pay $20 for one day service or $100 for one-hour processing.

Any corporation may for legitimate corporate purpose or purposes amend its articles of incorporation by a majority vote of its board of directors or trustees and the vote or written assent of two-thirds of its members if it be a non-stock corporation, or if it be a stock corporation, by the vote or written assent of

An entity registered with the Secretary of State as a registered agent must maintain an active good standing status and an address within the State of Montana whether as a Commercial or Noncommercial Registered Agent. A business entity cannot serve as its own registered agent.

Changing articles of incorporation often means changing things like agent names, the businesses operating name, addresses, and stock information. The most common reason that businesses change the articles of incorporation is to change members' information.

Corporations that, in separate filings, have amended sections of the original Articles of Incorporation, can use the Restated Articles of Incorporation (Form DC-4) to restate the entire articles of incorporation so that there is only one document to reference in the future.

A corporation can amend or add as many articles as necessary in one amendment. The original incorporators cannot be amended. If amending/adding officers/directors, list titles and addresses for each officer/director.