This form is a generic example that may be referred to when preparing such a form for your particular state. It is for illustrative purposes only. Local laws should be consulted to determine any specific requirements for such a form in a particular jurisdiction.

Montana Assignment of Portion of Expected Interest in Estate in Order to Pay Indebtedness

Description

How to fill out Assignment Of Portion Of Expected Interest In Estate In Order To Pay Indebtedness?

Choosing the best lawful document web template can be quite a battle. Obviously, there are a lot of templates available on the net, but how can you discover the lawful kind you require? Make use of the US Legal Forms internet site. The services offers a large number of templates, for example the Montana Assignment of Portion of Expected Interest in Estate in Order to Pay Indebtedness, that can be used for enterprise and personal requirements. All the varieties are checked out by specialists and meet state and federal requirements.

In case you are presently authorized, log in in your accounts and then click the Obtain button to obtain the Montana Assignment of Portion of Expected Interest in Estate in Order to Pay Indebtedness. Utilize your accounts to look throughout the lawful varieties you may have bought formerly. Proceed to the My Forms tab of your respective accounts and acquire yet another backup in the document you require.

In case you are a new customer of US Legal Forms, listed below are simple instructions for you to follow:

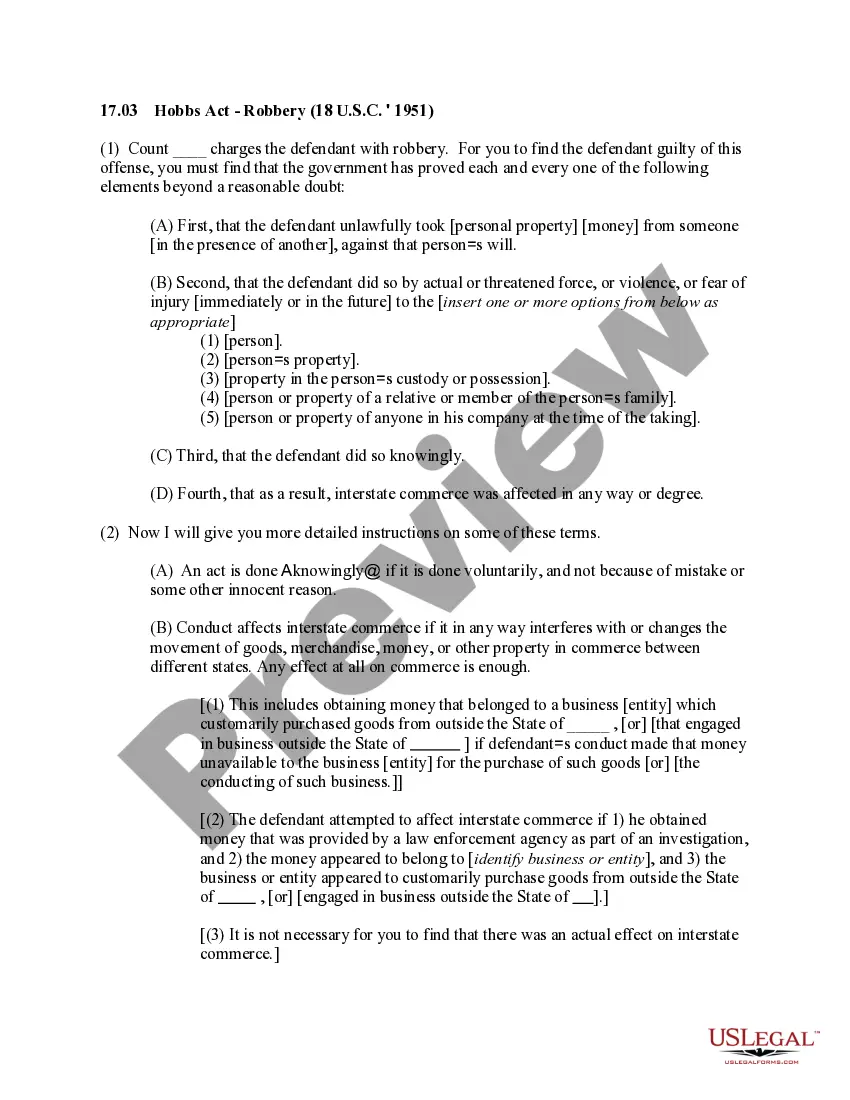

- Very first, make sure you have selected the right kind to your area/area. You may check out the form using the Review button and read the form description to make sure this is basically the right one for you.

- In the event the kind fails to meet your requirements, use the Seach field to get the proper kind.

- When you are certain that the form is proper, click on the Get now button to obtain the kind.

- Pick the costs strategy you need and type in the essential details. Create your accounts and pay money for the transaction using your PayPal accounts or charge card.

- Opt for the submit formatting and down load the lawful document web template in your product.

- Total, revise and produce and signal the acquired Montana Assignment of Portion of Expected Interest in Estate in Order to Pay Indebtedness.

US Legal Forms is definitely the greatest local library of lawful varieties that you can discover various document templates. Make use of the service to down load appropriately-made documents that follow status requirements.

Form popularity

FAQ

The most important rights of estate beneficiaries include: The right to receive the assets that were left to them in a timely manner. The right to receive information about estate administration (e.g., estate accountings) The right to request to suspend or remove an executor or administrator.

If you have recently received an inheritance, you may be able to redirect all or part of that inheritance to other people. This can be achieved through a Deed of Variation. You can redirect your inheritance to anyone you want.

Assignments of beneficial interests are generally used: Where a person has a share in the beneficial interest of a property that they no longer wish to retain. Where the lender refuses to consent to a transfer of equity.

Collection of Personal Property by Affidavit ? This procedure may be initiated 30 days after a person dies, if the value of the entire estate (less liens and encumbrances) does not exceed $50,000.

Assignments, however, almost never apply to a beneficiary's interests in a trust. Usually, a trust prohibits beneficiaries from assigning their interest in the trust before distribution. The anti-assignment provision protects undistributed trust assets from claims by a beneficiary's creditors.

The executor ? the person named in a will to carry out what it says after the person's death ? is responsible for settling the deceased person's debts. If there's no will, the court may appoint an administrator, personal representative, or universal successor and give them the power to settle the affairs of the estate.

Section 72-3-1101 of the Montana Code provides that after 30 days have elapsed since the decedent's death, any person indebted to the decedent shall make payment of the indebtedness to a person claiming to be the successor of the decedent upon being presented an affidavit made by or on behalf of the successor.

A beneficial interest is the right to receive benefits on assets held by another party and is often evident in matters concerning trusts. Most beneficial interest arrangements are in the form of trust accounts, where an individual, the beneficiary receives income from the trust's holdings but does not own the account.