Montana Assignment of Interest in Trust

Description

How to fill out Assignment Of Interest In Trust?

Have you found yourself in a circumstance where you frequently require documents for either your business or particular tasks.

There is an assortment of legal document templates accessible online, but acquiring reliable versions can be challenging.

US Legal Forms offers an extensive collection of form templates, such as the Montana Assignment of Interest in Trust, designed to comply with federal and state regulations.

Choose a convenient file format and download your document.

Access all the document templates you have purchased in the My documents section. You can obtain another copy of the Montana Assignment of Interest in Trust at any time if needed. Just select the required form to download or print the document template.

- If you are already acquainted with the US Legal Forms website and possess an account, simply sign in.

- Subsequently, you can download the Montana Assignment of Interest in Trust template.

- If you lack an account and wish to start utilizing US Legal Forms, follow these instructions.

- Select the form you require and confirm it pertains to the correct location/county.

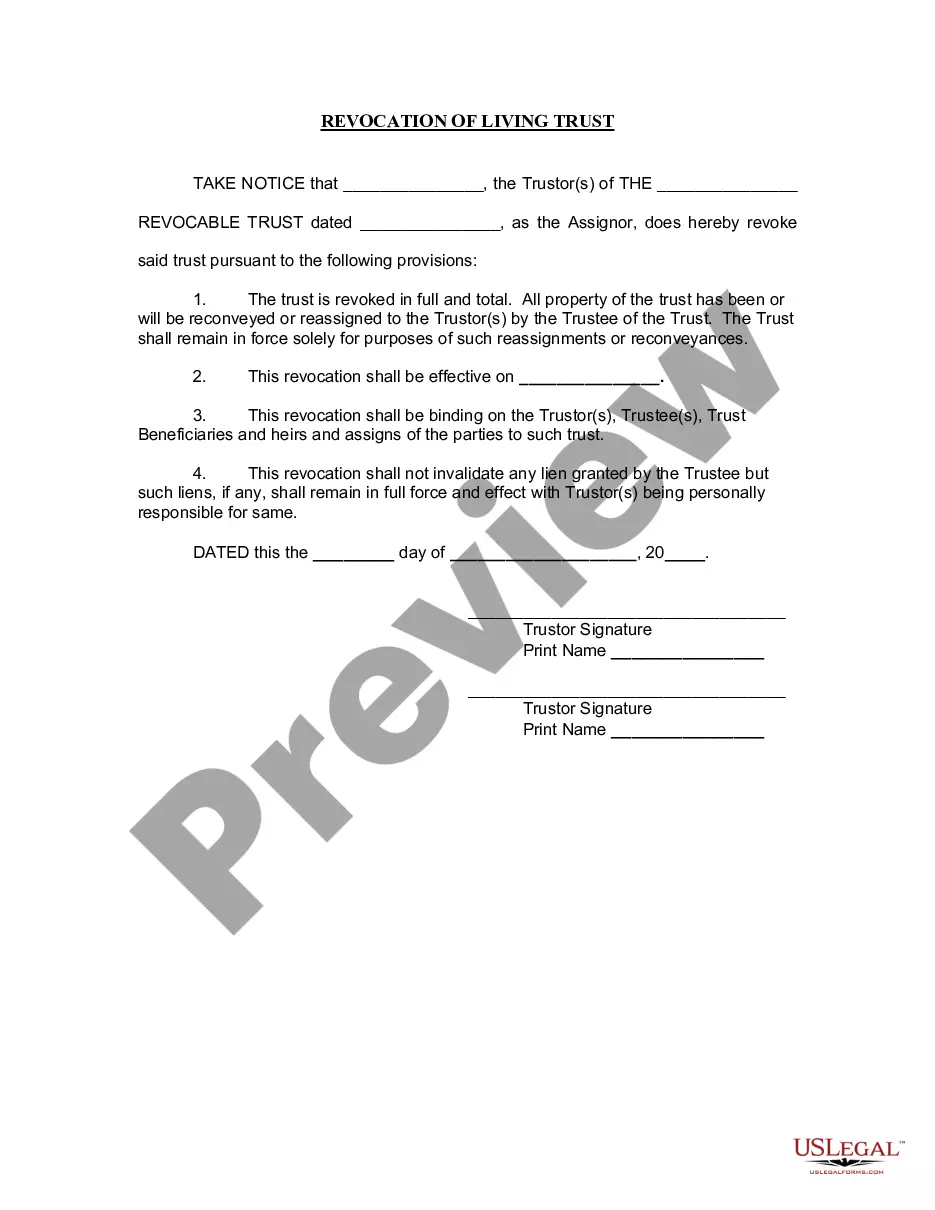

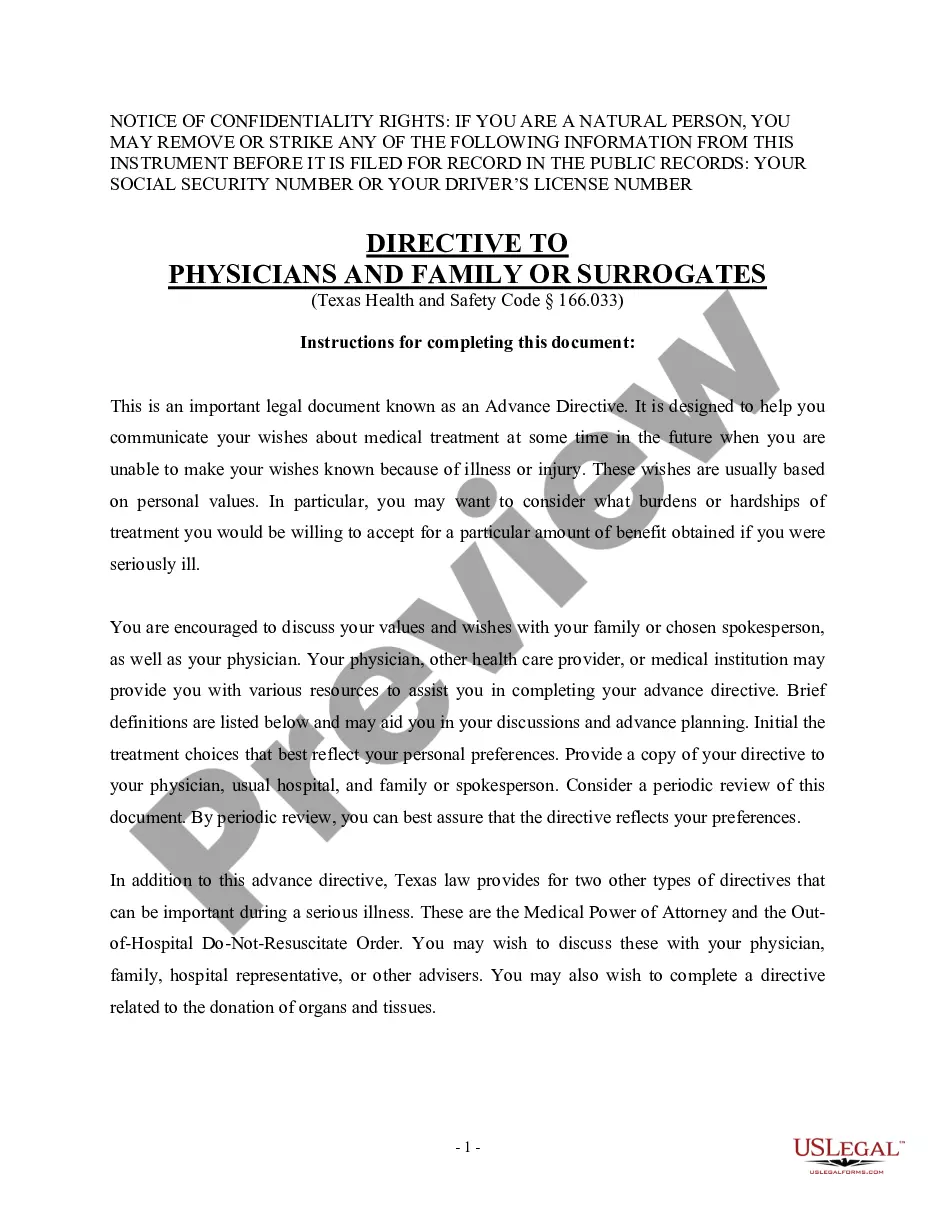

- Use the Preview feature to review the form.

- Read the description to ensure you have chosen the correct document.

- If the form does not meet your expectations, use the Lookup field to find the document that satisfies your needs and requirements.

- Once you find the appropriate form, click Acquire now.

- Select the pricing plan you prefer, complete the necessary information to establish your account, and purchase the order using your PayPal or credit card.

Form popularity

FAQ

The amount of interest a trust generates can vary significantly based on the type of investments made and current market conditions. Trust accounts can yield different interest rates, so it is crucial to review and select the right financial instruments. Many people choose to work with financial experts to optimize their Montana Assignment of Interest in Trust for better returns. This approach can safeguard assets while ensuring they work effectively.

A trust may be "qualified" or "non-qualified," according to the IRS. A qualified plan carries certain tax benefits. To be qualified, a trust must be valid under state law and must have identifiable beneficiaries. In addition, the IRA trustee, custodian, or plan administrator must receive a copy of the trust instrument.

As of January 1, 2020, 34 States have enacted a version of the Uniform Trust Code (Alabama, Arizona, Arkansas, Colorado, Connecticut, Florida, Illinois, Kansas, Kentucky, Maine, Maryland, Massachusetts, Michigan, Minnesota, Mississippi, Missouri, Montana, Nebraska, New Jersey, New Hampshire, New Mexico, North Carolina,

Trustees are trusted to make decisions in the beneficiary's best interests and often have a fiduciary responsibility, meaning they act in the best interests of the trust beneficiaries to manage their assets.

Trust Interest means an account owner's interest in the trust created by a participating trust agreement and held for the benefit of a designated beneficiary.

A nonqualified trust is limited to pay out according to the five-year rule (death before the IRA owner's required beginning date) or single life expectancy payments based on the decedent's age (death after the IRA owner's required beginning date).

When it comes to limited partnerships and LLCs, or limited liability companies, the business interest of the company is only partly yours. However, you can transfer your portion of the business interest to a Trust as long as you secure a document of transfer, sometimes called an Assignment of Interest.

The trustee cannot do whatever they want. They must follow the trust document, and follow the California Probate Code. More than that, Trustees don't get the benefits of the Trust. The Trust assets will pass to the Trust beneficiaries eventually.

The trustee acts as the legal owner of trust assets, and is responsible for handling any of the assets held in trust, tax filings for the trust, and distributing the assets according to the terms of the trust.

A qualified beneficiary is a limited subset of all trust beneficiaries. In effect, the class is limited to living persons who are (a) current beneficiaries, (b) intermediate beneficiaries, and (c) first line remainder beneficiaries, whether vested or contingent.