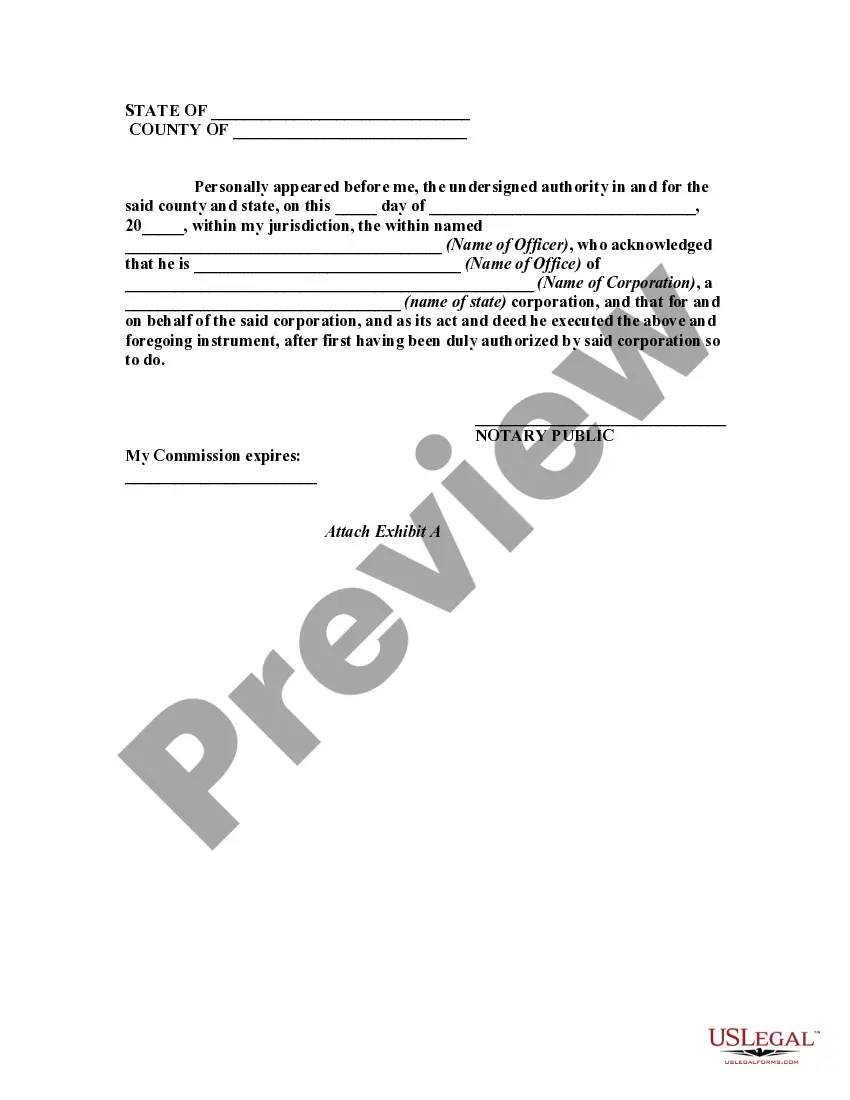

Most states have statutes that provide that a mortgage or deed of trust may be discharged in the county land records by the recorder of deeds. Generally these statutes proved that a certificate must be filed with said recorder and executed by the mortgagee or on its behalf and acknowledged as prescribed by law. The certificate must specify that the mortgage has been paid or otherwise satisfied or discharged, and should make a reference to the book and page containing the original mortgage or deed of trust.

This form is a generic example that may be referred to when preparing such a form for your particular state. It is for illustrative purposes only. Local laws should be consulted to determine any specific requirements for such a form in a particular jurisdiction.