Montana Multistate Promissory Note - Secured

Description

How to fill out Multistate Promissory Note - Secured?

US Legal Forms - one of the largest collections of legal documents in the USA - provides a selection of legal form templates you can download or print.

By using the website, you can access thousands of forms for business and personal use, organized by categories, states, or keywords. You can find the latest versions of forms like the Montana Multistate Promissory Note - Secured in seconds.

If you already have a subscription, Log In and obtain the Montana Multistate Promissory Note - Secured from the US Legal Forms library. The Download button will appear on every form you view. You can access all previously downloaded forms in the My documents tab of your account.

Process the payment. Use your credit card or PayPal account to complete the transaction.

Select the format and download the form to your device.

- Ensure you have selected the correct form for your city/county.

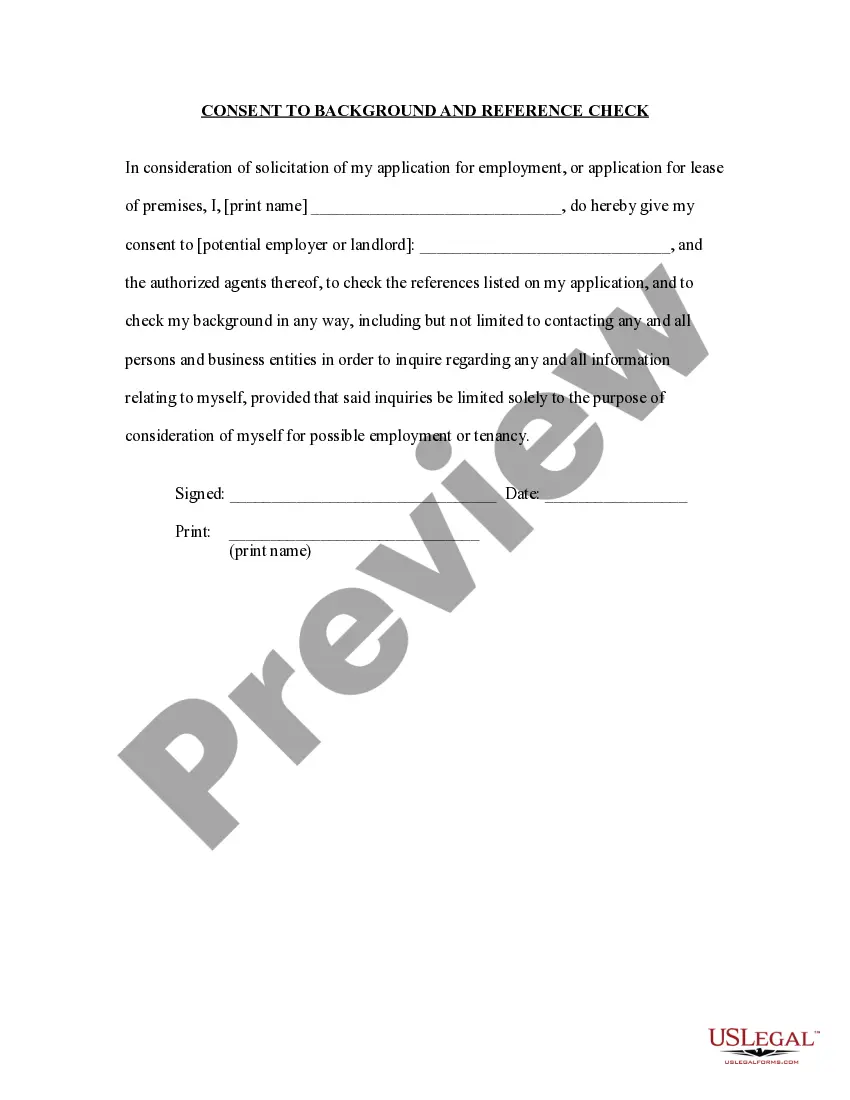

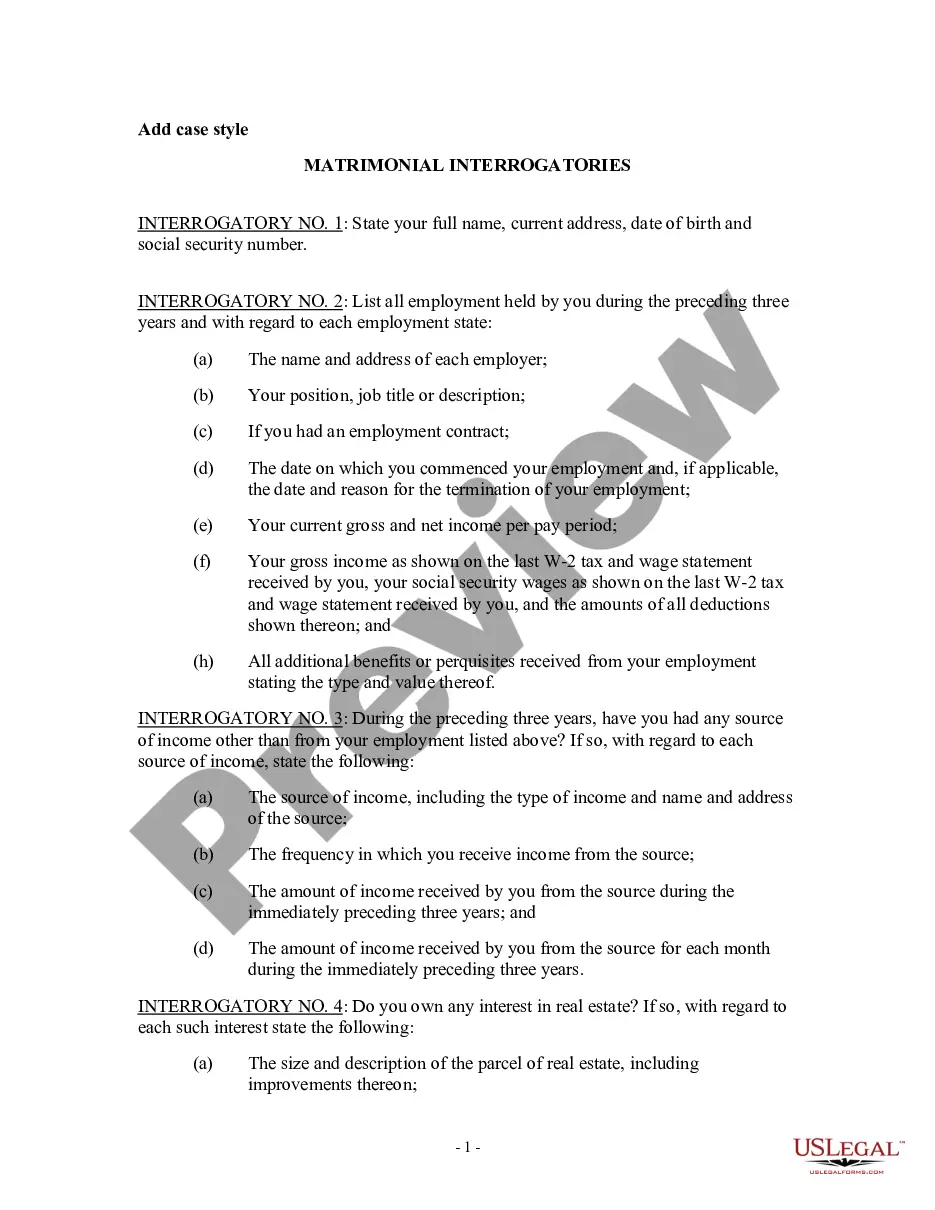

- Click the Preview option to review the form's content.

- Check the form details to confirm you have selected the correct form.

- If the form does not meet your needs, utilize the Search feature at the top of the screen to find one that does.

- If you are satisfied with the form, confirm your choice by clicking the Buy now button.

- Then, select your preferred pricing plan and provide your details to set up an account.

Form popularity

FAQ

Yes, there is a standard format for a promissory note. It should consist of key elements such as the date of the agreement, names of the parties involved, repayment terms, and any collateral information. Utilizing a professionally drafted Montana Multistate Promissory Note - Secured format ensures compliance with legal standards and eases the lending process.

Obtaining your Montana Multistate Promissory Note - Secured is a straightforward process. You can create and customize your note through platforms like USLegalForms, which provide templates tailored to your needs. Once you fill out the necessary details, you can easily download or print your document for use. This accessibility ensures you have the essential legal documentation ready when you need it.

Yes, a Montana Multistate Promissory Note - Secured is backed by collateral. This means that if the borrower defaults, the lender can seize the asset pledged as security. Collateral provides an added layer of protection for lenders, making these notes a more reliable choice. When entering into a secured promissory note agreement, it is vital to understand the specific terms regarding the collateral.

A promissory note can be either secured or unsecured depending on its terms. In the case of a Montana Multistate Promissory Note - Secured, the note is backed by collateral, which decreases the risk for the lender. Without collateral, it is considered unsecured, which increases potential financial risk. Understanding the differences can significantly affect your borrowing strategy.

Yes, a promissory note is a legally binding document. When you create a Montana Multistate Promissory Note - Secured, it represents a formal commitment to repay borrowed funds. This legally enforceable agreement ensures that both parties understand their obligations, offering peace of mind. Therefore, clear terms and proper documentation are crucial.

Securing a promissory note with real estate involves specifying the collateral in the agreement. By creating a Montana Multistate Promissory Note - Secured, both parties establish the terms regarding the property. The note should clearly state that the property acts as collateral, providing recourse for the lender in case of default. This adds significant security to the lending process.

No, a promissory note does not need to be secured. However, securing a Montana Multistate Promissory Note - Secured with collateral offers an extra layer of protection to the lender. Without security, there is a higher risk involved for lenders, which may lead to stricter repayment terms. Choosing a secured note is often a wise move for both parties.

Yes, a promissory note secured by land functions as a mortgage note. When you use real estate as collateral, the Montana Multistate Promissory Note - Secured becomes a formal agreement which ensures the lender can claim the property if the borrower defaults. This structure provides significant protection for lenders, enhancing trust in the lending process.

An unsecured promissory note is typically not classified as a security. Instead, these notes focus more on the commitment to repay rather than asset backing. In the context of a Montana Multistate Promissory Note - Secured, the emphasis lies on having collateral, which distinguishes secured from unsecured notes. Therefore, understanding these classifications can impact your financial decisions.

A Montana Multistate Promissory Note - Secured must contain essential components to be valid. It should include the amount borrowed, the interest rate, repayment schedule, and the signatures of both the borrower and lender. Additionally, a clear description of the collateral is vital for secured notes. Always ensure that these elements are present to protect your rights.