North Carolina Minutes of Organizational Meeting of Directors for a 501(c)(3) Association

Description

How to fill out Minutes Of Organizational Meeting Of Directors For A 501(c)(3) Association?

Have you ever been in a situation where you need documents for either work or personal purposes almost every day.

There are numerous legal document templates accessible online, but finding reliable ones can be challenging.

US Legal Forms offers a wide array of form templates, including the North Carolina Minutes of Organizational Meeting of Directors for a 501(c)(3) Organization, that are designed to comply with federal and state regulations.

Once you find the right form, click Purchase now.

Choose the pricing plan you want, enter the required information to create your account, and pay for the transaction using your PayPal or credit card.

- If you are already familiar with the US Legal Forms website and have an account, simply Log In.

- Then, you can download the North Carolina Minutes of Organizational Meeting of Directors for a 501(c)(3) Organization template.

- If you do not have an account and wish to start using US Legal Forms, follow these steps.

- Locate the form you need and ensure it corresponds to the correct city/area.

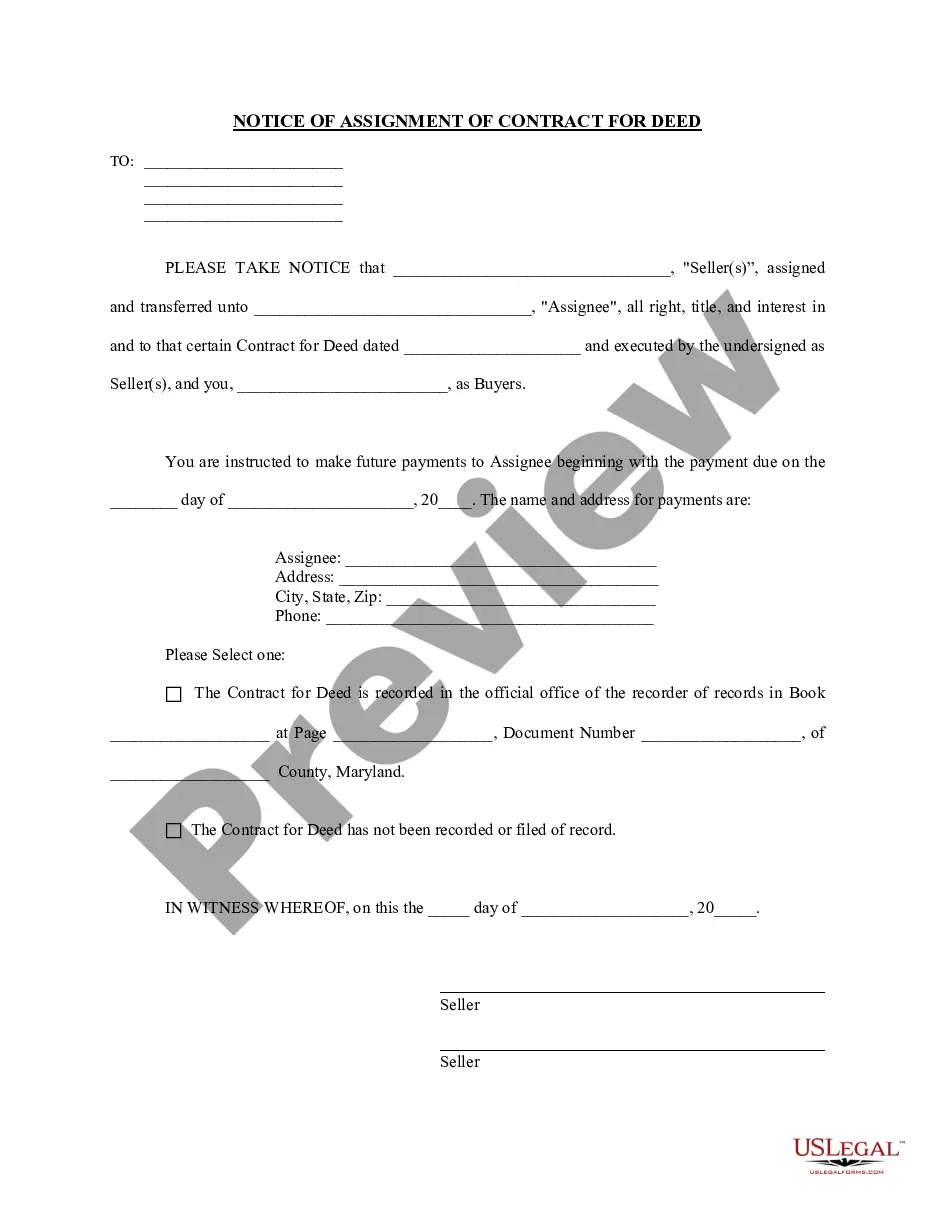

- Utilize the Preview button to review the form.

- Read the description to confirm you have selected the right form.

- If the form isn’t what you are looking for, use the Search field to find a form that suits your requirements.

Form popularity

FAQ

In a nonprofit organization, the Executive Director or Chief Executive Officer typically operates as the primary leader or 'boss.' This individual carries the responsibility of managing daily operations and implementing the board's strategic direction. When focusing on the North Carolina Minutes of Organizational Meeting of Directors for a 501(c)(3) Association, it is important to understand the Executive Director's role in executing the nonprofit's mission.

Yes, your organization must keep copies of all meeting minutes. The IRS and most state laws (section 3.151 of the Texas Business Organizations Code) require that corporations, including nonprofit corporations, keep copies of their meeting minutes.

Nonprofit meeting minutes are a necessary form of record-keeping for all non-profit organizations. Nonprofit meeting minutes serve as the official (and legal) record of board and committee meetings. They are presumed to be correct and are considered legal evidence of the facts they report.

The IRS expects (and state law usually dictates) that a board of directors should meet a minimum of once a year, and best practices suggest four times a year. During these meetings, the annual budget is passed, and operational and strategic decisions requiring votes are discussed.

Appropriate board minutes should contain the following:The names of those members who are present and who are absent.The time the board meeting begins and ends.The existence or absence of a quorum.A concise summary of the action taken by the board.The names of the persons making and seconding motions.More items...

Most states require that corporations take board meeting minutes, but the exact format is left up to the company. Minutes don't need to be filed with the state, but they must be kept on file for at least seven years.

Nonprofit meeting minutes are a necessary form of record-keeping for all non-profit organizations. Nonprofit meeting minutes serve as the official (and legal) record of board and committee meetings.

7 things to include when writing meeting minutes1 Date and time of the meeting.2 Names of the participants.3 Purpose of the meeting.4 Agenda items and topics discussed.5 Action items.6 Next meeting date and place.7 Documents to be included in the report.

Appropriate board minutes should contain the following:The names of those members who are present and who are absent.The time the board meeting begins and ends.The existence or absence of a quorum.A concise summary of the action taken by the board.The names of the persons making and seconding motions.More items...

Plain and simple, Robert's Rules says that the secretary of an organization has to (1) keep minutes and (2) make them available to members that ask for them. Yes, this means that if Ms. Archives-Lover wants copies of the minutes from every meeting for the last 26 years, she gets them.