Letter from attorney to opposing counsel requesting documentation concerning homestead exemption for change of venue motion.

Montana Sample Letter for Change of Venue and Request for Homestead Exemption

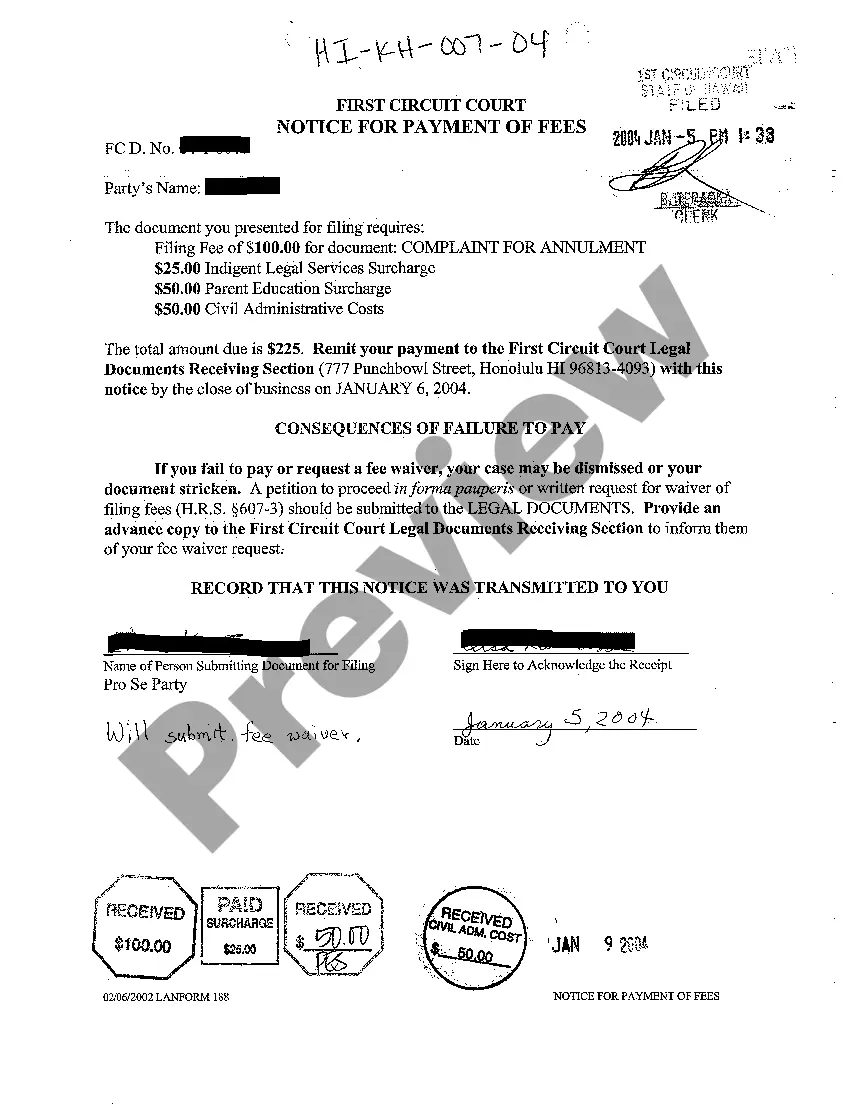

Description

How to fill out Sample Letter For Change Of Venue And Request For Homestead Exemption?

If you have to full, down load, or print authorized papers templates, use US Legal Forms, the most important assortment of authorized kinds, that can be found on the web. Make use of the site`s basic and convenient lookup to discover the papers you want. Various templates for company and individual reasons are categorized by groups and claims, or search phrases. Use US Legal Forms to discover the Montana Sample Letter for Change of Venue and Request for Homestead Exemption in just a number of click throughs.

Should you be already a US Legal Forms buyer, log in for your profile and then click the Obtain switch to find the Montana Sample Letter for Change of Venue and Request for Homestead Exemption. You can also accessibility kinds you previously delivered electronically in the My Forms tab of your own profile.

If you use US Legal Forms the very first time, refer to the instructions under:

- Step 1. Make sure you have chosen the shape for that correct metropolis/region.

- Step 2. Take advantage of the Preview option to look over the form`s information. Don`t neglect to read through the information.

- Step 3. Should you be unhappy with all the develop, take advantage of the Research industry at the top of the display screen to get other variations of the authorized develop design.

- Step 4. After you have located the shape you want, select the Acquire now switch. Opt for the prices strategy you like and put your references to sign up for an profile.

- Step 5. Process the deal. You can use your charge card or PayPal profile to complete the deal.

- Step 6. Pick the formatting of the authorized develop and down load it in your device.

- Step 7. Full, modify and print or sign the Montana Sample Letter for Change of Venue and Request for Homestead Exemption.

Each authorized papers design you get is the one you have eternally. You may have acces to each and every develop you delivered electronically with your acccount. Select the My Forms area and choose a develop to print or down load again.

Remain competitive and down load, and print the Montana Sample Letter for Change of Venue and Request for Homestead Exemption with US Legal Forms. There are many expert and express-distinct kinds you can utilize for the company or individual requires.

Form popularity

FAQ

Applying for the Homestead Exemption in Montana involves a straightforward process. First, you need to gather the necessary documentation to prove your eligibility. Then, submit your application along with the Montana Sample Letter for Change of Venue and Request for Homestead Exemption to your local county office. For a smooth experience, consider using uslegalforms to access templates and guidance tailored to help you complete your application successfully.

Yes, Montana offers a property tax exemption for seniors. This exemption helps lower the property tax burden for qualifying individuals aged 62 and older. To take advantage of this benefit, seniors may need to provide a Montana Sample Letter for Change of Venue and Request for Homestead Exemption, ensuring they meet the eligibility criteria. By utilizing resources available through uslegalforms, seniors can navigate the application process with ease.

Homesteading remains a viable option in many states, including Montana, where it continues to provide homeowners with important legal protections. By designating your primary residence as a homestead, you can guard against certain creditors and enjoy tax benefits. If you want to explore this further, a Montana Sample Letter for Change of Venue and Request for Homestead Exemption can guide you in making your case effectively.

Yes, you can still homestead in Montana, and many residents take advantage of this opportunity. This legal designation helps protect your home from certain claims and provides potential tax benefits. If you are looking to establish or change your homestead status, a Montana Sample Letter for Change of Venue and Request for Homestead Exemption can be a useful tool in this process.

To qualify for homestead exemption in Montana, you must own and occupy the property as your primary residence. Additionally, you need to meet certain criteria regarding income and property value. If you are preparing to apply, consider using a Montana Sample Letter for Change of Venue and Request for Homestead Exemption to help streamline your application process and clarify your situation.

To move your homestead exemption in Florida, you must file a new application with your local property appraiser’s office at your new address. This process typically involves providing proof of residency and any necessary documentation. While this process differs from Montana's regulations, you can use a Montana Sample Letter for Change of Venue and Request for Homestead Exemption as a template to help you articulate your request clearly.

Yes, homesteading is still legal in Montana. This means that residents can claim their primary residence as a homestead, enjoying the benefits of legal protections and potential tax exemptions. If you are considering this option, you may want to draft a Montana Sample Letter for Change of Venue and Request for Homestead Exemption to formalize your intentions.

The Montana homestead exemption statute allows homeowners to protect a portion of their home equity from creditors. Specifically, it provides legal protections for a primary residence, helping to ensure that individuals can maintain their homes in times of financial distress. If you’re looking to navigate this process, using a Montana Sample Letter for Change of Venue and Request for Homestead Exemption can be an effective way to communicate your needs.