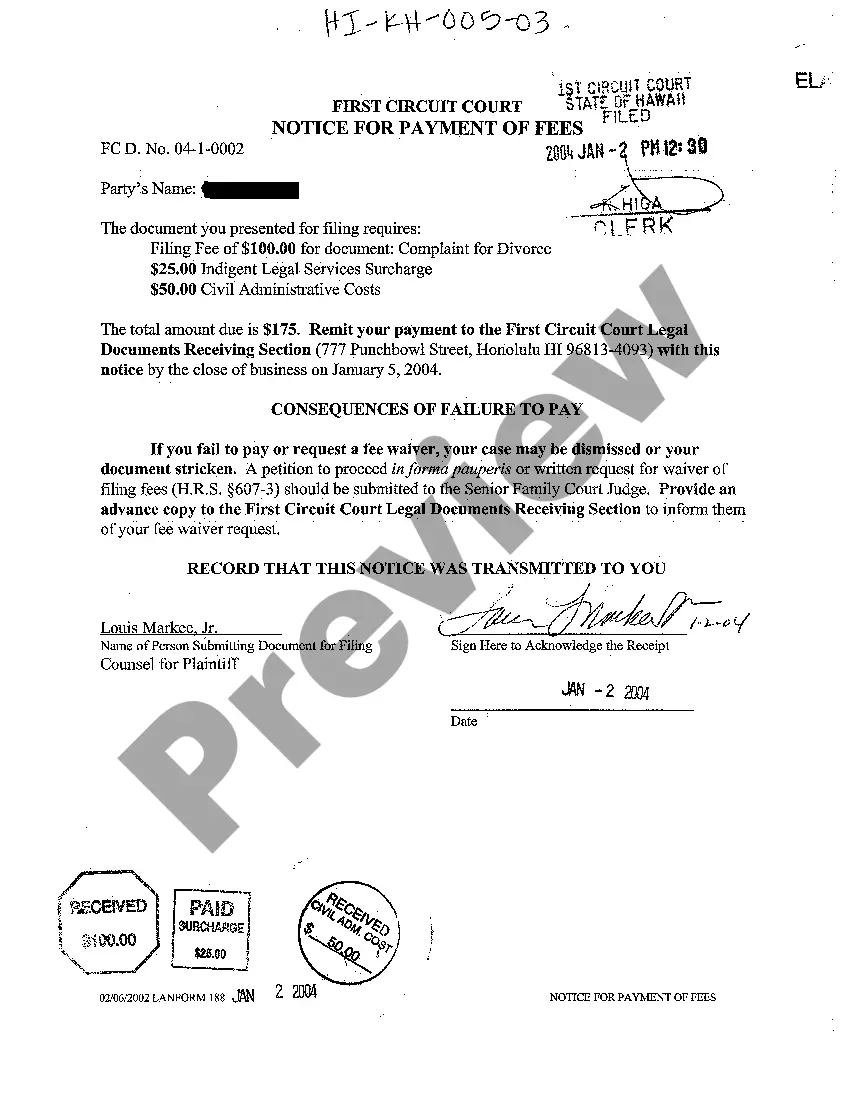

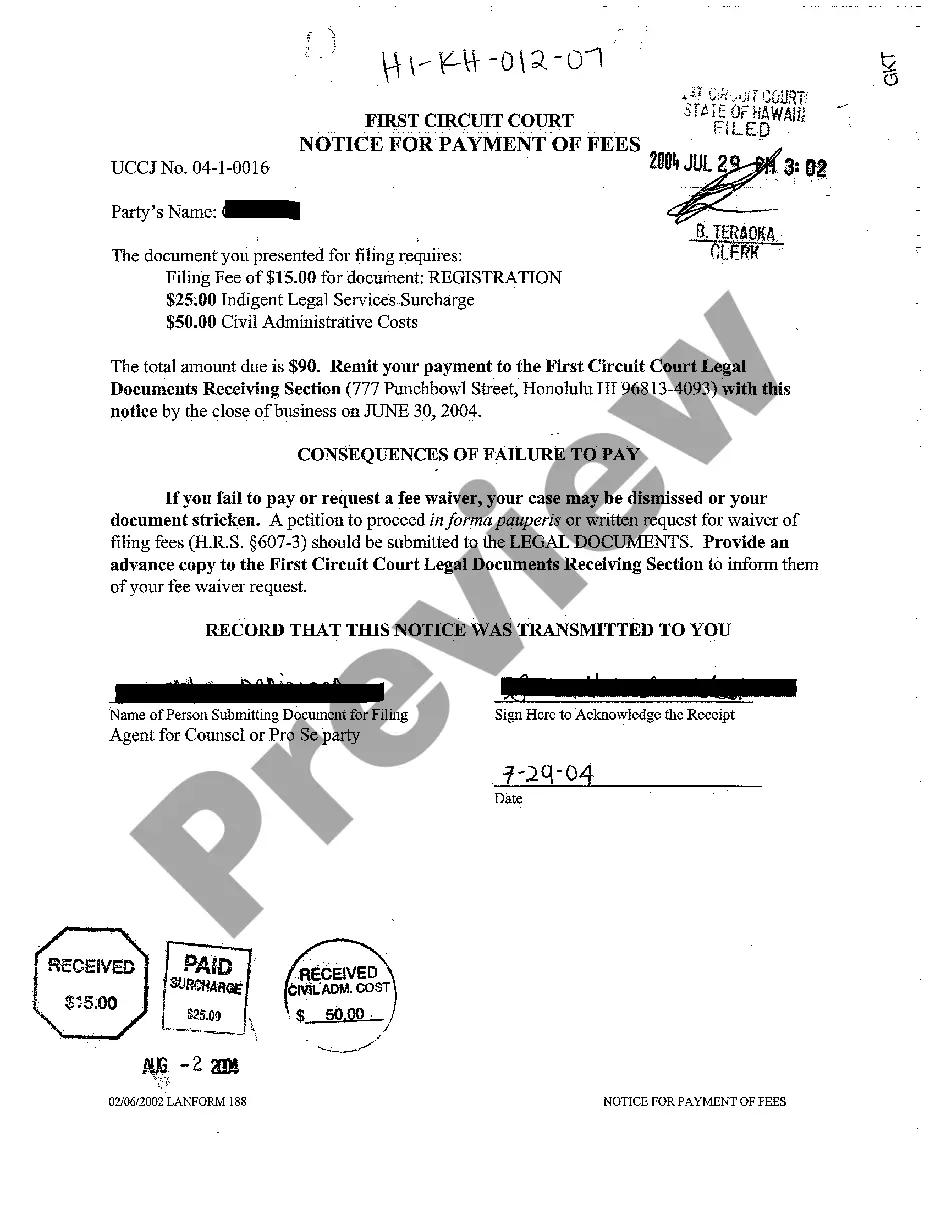

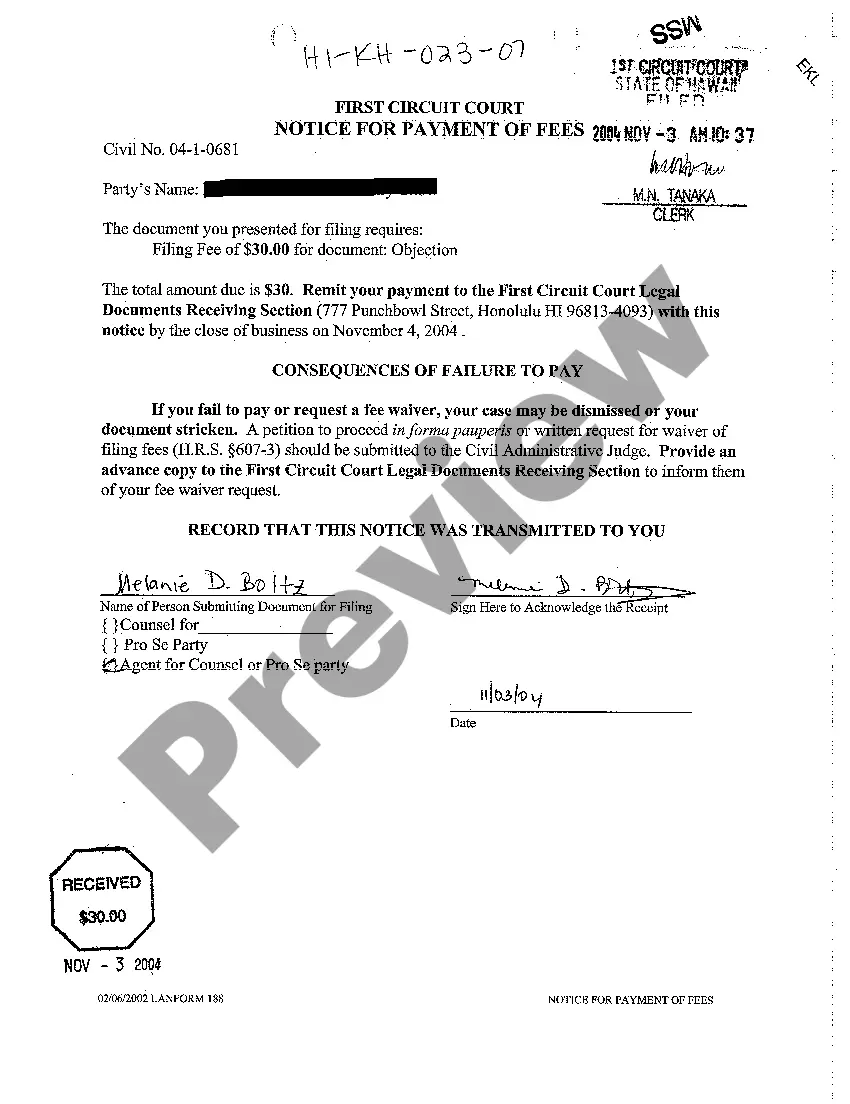

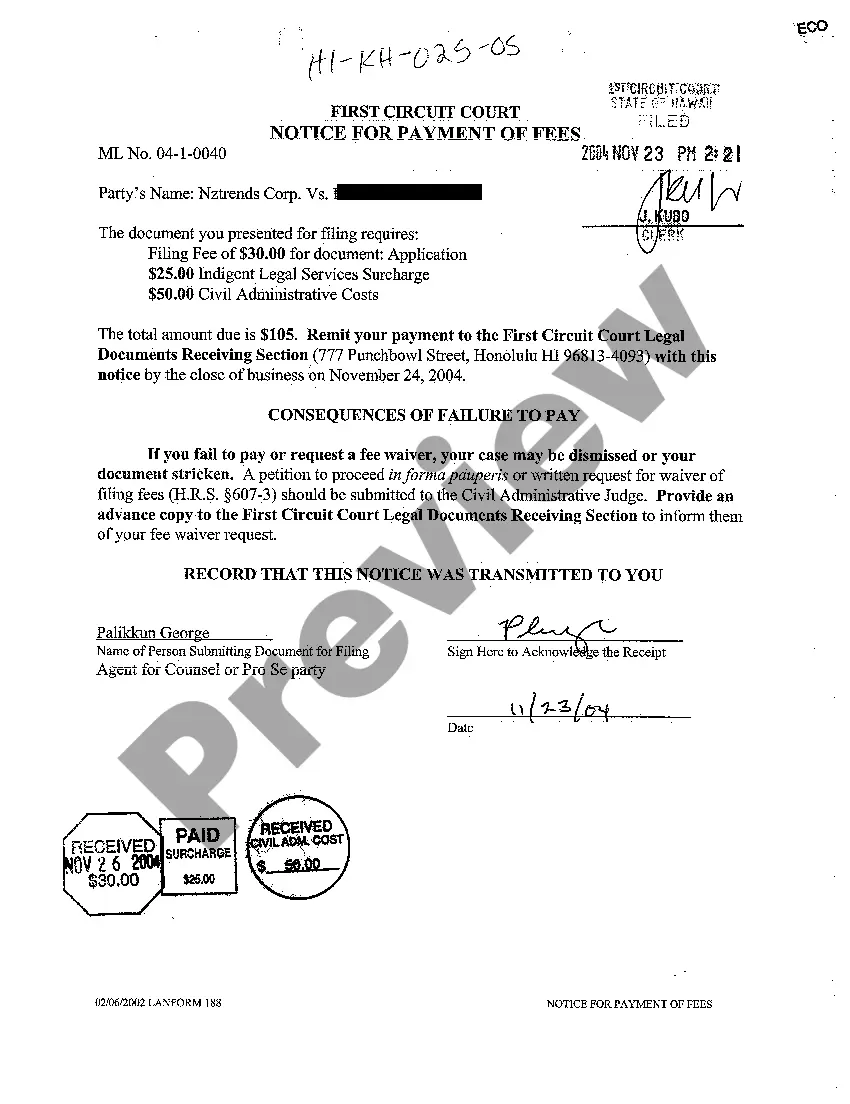

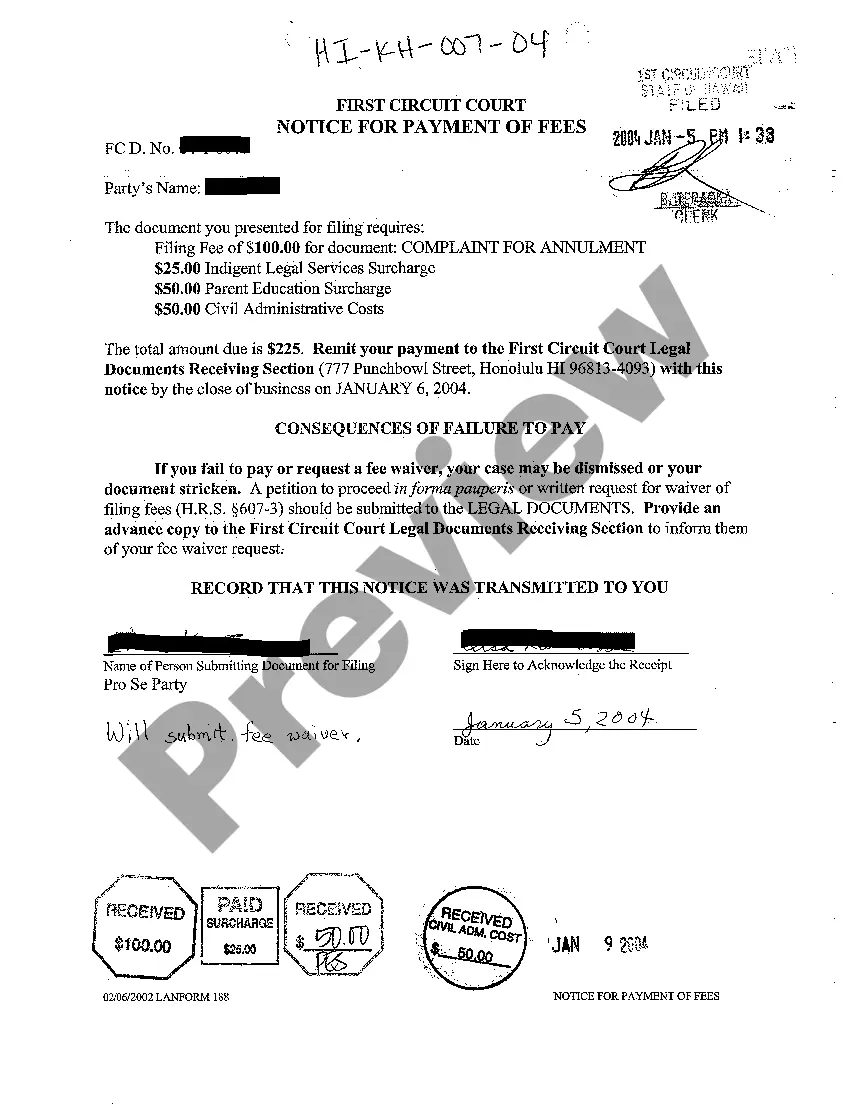

Hawaii Notice for Payment of Fees

Description

How to fill out Hawaii Notice For Payment Of Fees?

Among numerous paid and complimentary illustrations that you can find online, you cannot guarantee their precision.

For instance, who produced them or if they possess the necessary qualifications to fulfill your requirements.

Always remain composed and make use of US Legal Forms! Obtain Hawaii Notice for Payment of Fees documents crafted by expert lawyers and evade the expensive and time-consuming task of searching for an attorney and then compensating them to prepare a document that you could do yourself.

Select a pricing plan to register for an account. Remit payment for the subscription via your credit/debit/credit card or Paypal. Retrieve the form in the required file format. Once you have enrolled and completed your purchase, you can utilize your Hawaii Notice for Payment of Fees as frequently as needed or as long as it remains valid in your location. Modify it in your preferred offline or online editor, complete it, sign it, and print it. Achieve more for less with US Legal Forms!

- If you hold a subscription, access your account and locate the Download button next to the file you need.

- You will also have the ability to view all of your previously saved documents in the My documents section.

- If you're using our service for the first time, adhere to the instructions below to obtain your Hawaii Notice for Payment of Fees quickly.

- Confirm that the document you locate is recognized in the state where you reside.

- Review the template by utilizing the information for the Preview feature.

- Click Purchase Now to initiate the ordering process or search for another template using the Search bar found in the header.

Form popularity

FAQ

Closing an LLC in Hawaii involves several steps, including the submission of a final tax return and a formal dissolution document to the state. Make sure to settle any outstanding fees or obligations, which a Hawaii Notice for Payment of Fees can help clarify. For effective management of these requirements, consider using a platform like uslegalforms, which can assist you in navigating these processes smoothly.

The maximum claim amount in Hawaii’s small claims court is set at $5,000, making it a straightforward option for settling disputes quickly. This limit encourages individuals to resolve minor disputes efficiently. When you submit your claim, consider including a Hawaii Notice for Payment of Fees to properly outline any associated costs.

For regular claims courts in Hawaii, there is typically no upper limit, but you should consider how claims over $40,000 are handled differently. These cases often demand more comprehensive legal processes and documentation. A Hawaii Notice for Payment of Fees provides a useful framework for ensuring that all fees and expenses are transparent and manageable.

In Hawaii, the general limit for lawsuits in civil court depends on the type of claim. If you are pursuing a standard civil case, there is no strict cap, but larger claims require more formal proceedings. This is where a Hawaii Notice for Payment of Fees may come into play to help ensure that all fees related to your claim are properly outlined and addressed.

An EFT penalty occurs when a taxpayer fails to make required electronic payments as mandated by the state of Hawaii. This penalty can result in added fees and complications in your tax filings. To stay informed and avoid such penalties, refer to the Hawaii Notice for Payment of Fees for useful insights on ensuring that your electronic payments are made correctly.

The G45 and G49 forms in Hawaii serve different purposes concerning tax payments. G45 is the general excise tax return, while G49 is a form for long-term rental of real property. Understanding the Hawaii Notice for Payment of Fees can clarify which form applies to your situation, ensuring accurate compliance and timely payments.

In Hawaii, failing to comply with mandatory EFT requirements may result in penalties. Not making the required electronic payments can lead to additional charges, which may complicate your tax situation. Be sure to check the Hawaii Notice for Payment of Fees for specific guidelines and to avoid potential penalties associated with EFT.

Mail form n=20 to the address indicated on the document, often related to the Hawaii Notice for Payment of Fees. Double-check that all sections of the form are correctly completed before submitting. If you are uncertain about the mailing address or need further assistance, uslegalforms offers templates and guidance that can clarify the process for you.

To establish a payment plan in Hawaii, begin by reviewing the options available through the Hawaii Notice for Payment of Fees. You can usually apply online or by contacting the tax authority directly for forms and instructions. It helps to prepare your financial details to show your ability to make regular payments. For further assistance, uslegalforms can provide structured templates to streamline your application process.

You should mail Hawaii form G-49 to the address specified on the form or consult the Hawaii Notice for Payment of Fees for detailed instructions. Typically, this will be the Department of Taxation at the appropriate address for your district. Before mailing your form, ensure all required information is accurate and complete to avoid delays. For more guidance on mailing procedures, uslegalforms offers valuable templates that can assist you.