Montana Recap Sheet Instructions are the instructions for completing a Montana Recap Sheet. A Montana Recap Sheet is a form used by the state of Montana to track the financial information of individuals, businesses, and organizations. It is used to summarize income and expenses and to calculate net income, tax liability, and other financial information. There are two types of Montana Recap Sheet Instructions — Individual and Business. Individual Montana Recap Sheet Instructions are for individuals who are filing their own taxes, including those who are self-employed. These instructions include how to complete the individual income and expense sections, how to calculate net income, and how to calculate taxes. Business Montana Recap Sheet Instructions are for businesses who are filing their own taxes. These instructions include how to complete the business income and expense sections, how to calculate net income, and how to calculate taxes. Both types of Montana Recap Sheet Instructions include information on filing deadlines, forms required to complete the recap sheet, and where to send the completed recaps.

Montana Recap Sheet Instructions

Description

Get your form ready online

Our built-in tools help you complete, sign, share, and store your documents in one place.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Looking for another form?

How to fill out Montana Recap Sheet Instructions?

Completing official documents can be a significant hassle if you lack accessible fillable templates. With the US Legal Forms online repository of formal paperwork, you can trust the forms you acquire, as they all align with federal and state regulations and have been validated by our specialists.

Obtaining your Montana Recap Sheet Instructions from our platform is as easy as 1-2-3. Existing users with an active subscription simply need to Log In and hit the Download button after finding the appropriate template. Then, if desired, users can retrieve the same document from the My documents section of their account. However, even if you are a newcomer to our service, registering with a valid subscription will only take a few moments. Here’s a concise guide for you.

Haven’t you tried US Legal Forms yet? Register for our service today to obtain any official document swiftly and effortlessly every time you need to, and keep your paperwork organized!

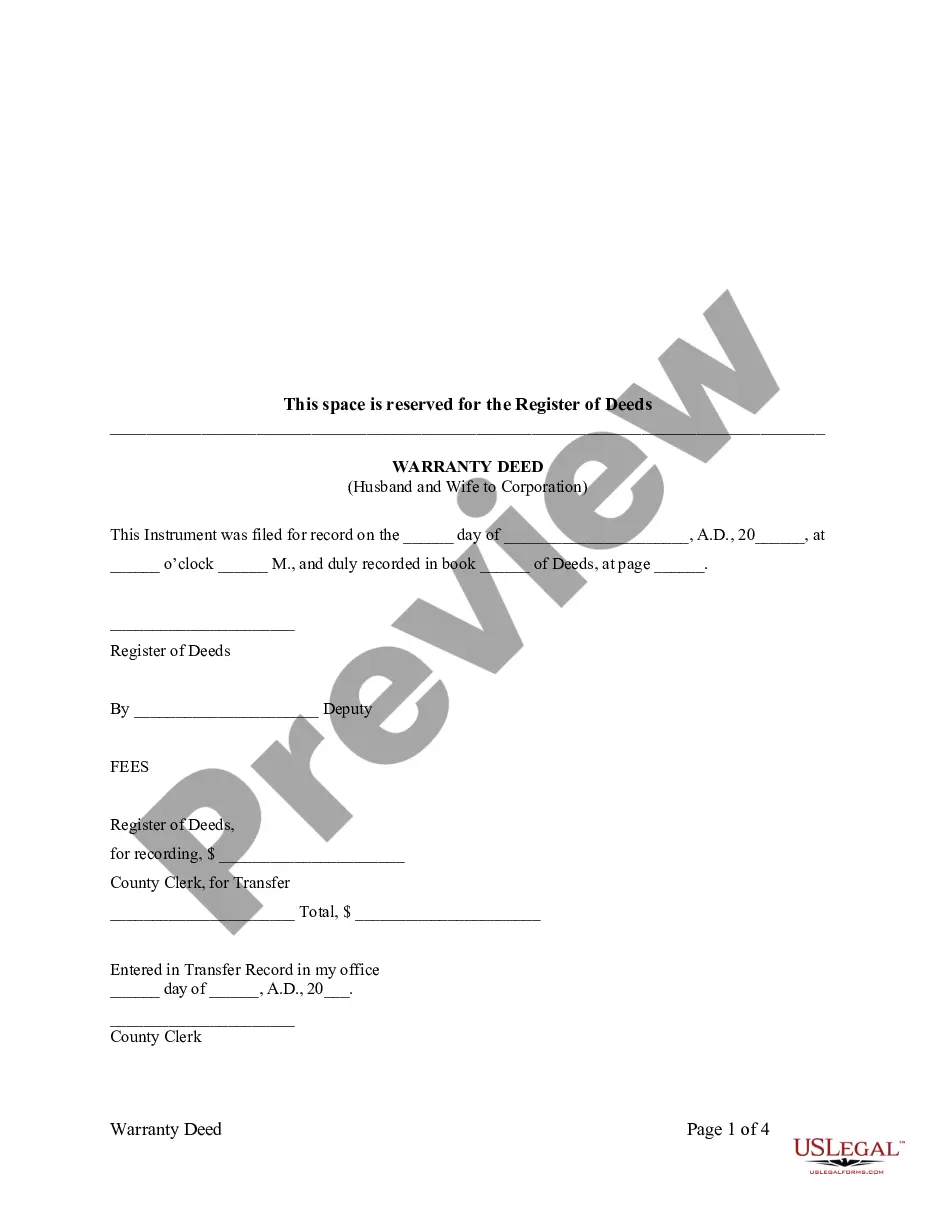

- Document compliance verification. You should carefully review the contents of the form you intend to use and verify if it meets your requirements and adheres to your state law stipulations. Previewing your document and reviewing its general description will assist you in this process.

- Alternative search (optional). If there are any discrepancies, explore the library using the Search tab above until you discover a suitable template, and click Buy Now when you find the one you desire.

- Account registration and document purchase. Create an account with US Legal Forms. After account confirmation, Log In and choose your preferred subscription plan. Make a payment to proceed (PayPal and credit card options are available).

- Template download and further use. Choose the file format for your Montana Recap Sheet Instructions and click Download to save it to your device. Print it to complete your documents manually, or utilize a feature-rich online editor to prepare an electronic version more quickly and efficiently.

Form popularity

FAQ

You may receive weekly compensation of 66 2/3 percent of your wages at the time of injury ? up to the maximum rate (see chart below).

Work comp is solely funded by premiums paid by employers based on the amount of payroll they pay in the various job categories or class codes.

Form ERD-991 First Report of Injury or Occupational Disease (FROI). (click link above) Employees must submit a written and signed First Report of Injury (FROI) within 12 months from the date of their accident or occupational disease. They can submit this form to you, EMPLOYERS or the Department of Labor and Industry.

You may receive weekly compensation of 66 2/3 percent of your wages at the time of injury ? up to the maximum rate (see chart below).

Exempt Employments The most common employments that are exempt are: Sole proprietors, working members of a partnership, working members of a limited liability partnership and working members of a member-managed limited liability.

Montana requires every employer to provide their employees with workers' compensation insurance.

Form ERD-991 First Report of Injury or Occupational Disease (FROI). (click link above) Employees must submit a written and signed First Report of Injury (FROI) within 12 months from the date of their accident or occupational disease. They can submit this form to you, EMPLOYERS or the Department of Labor and Industry.