Montana Installments Fixed Rate Promissory Note Secured by Commercial Real Estate

What is this form?

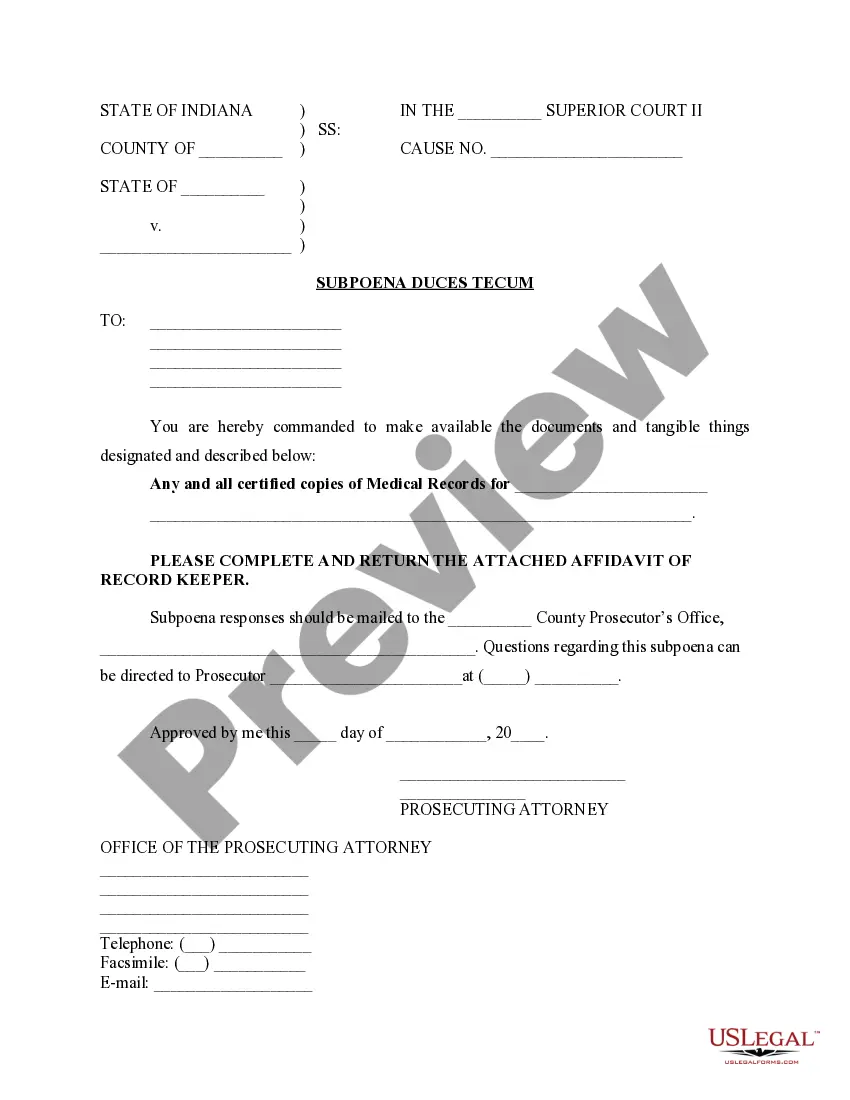

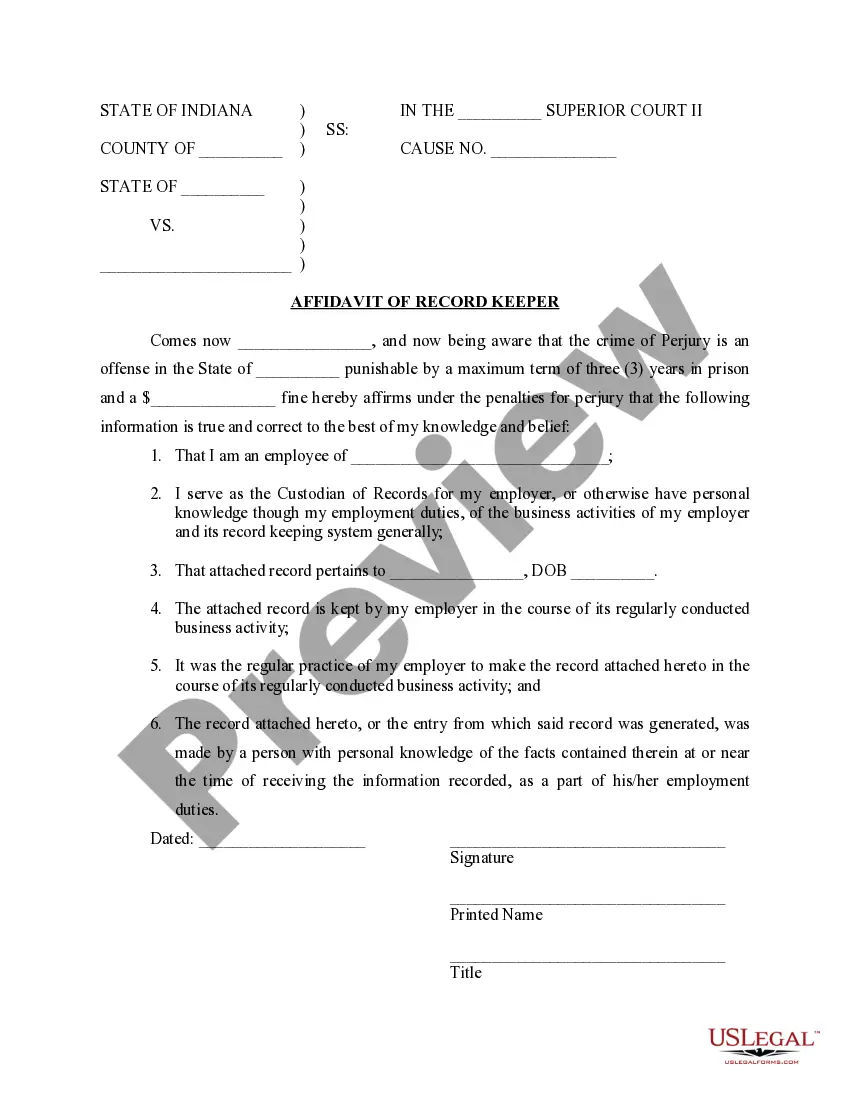

The Montana Installments Fixed Rate Promissory Note Secured by Commercial Real Estate is a legal document that outlines the borrower's promise to repay a loan with fixed interest rates and installment payments. This type of promissory note secures the loan with commercial real estate, distinguishing it from unsecured loans or consumer-focused promissory notes.

What’s included in this form

- Borrower's promise to pay the principal amount and interest to the lender.

- Specification of the interest rate applicable to the loan.

- Details on payment schedules, including the amount and due dates for monthly payments.

- Rights regarding prepayment options, including potential penalties.

- Consequences of failing to make payments, including default notice procedures.

- Secured nature of the note, reinforced by a mortgage or deed of trust on the commercial property.

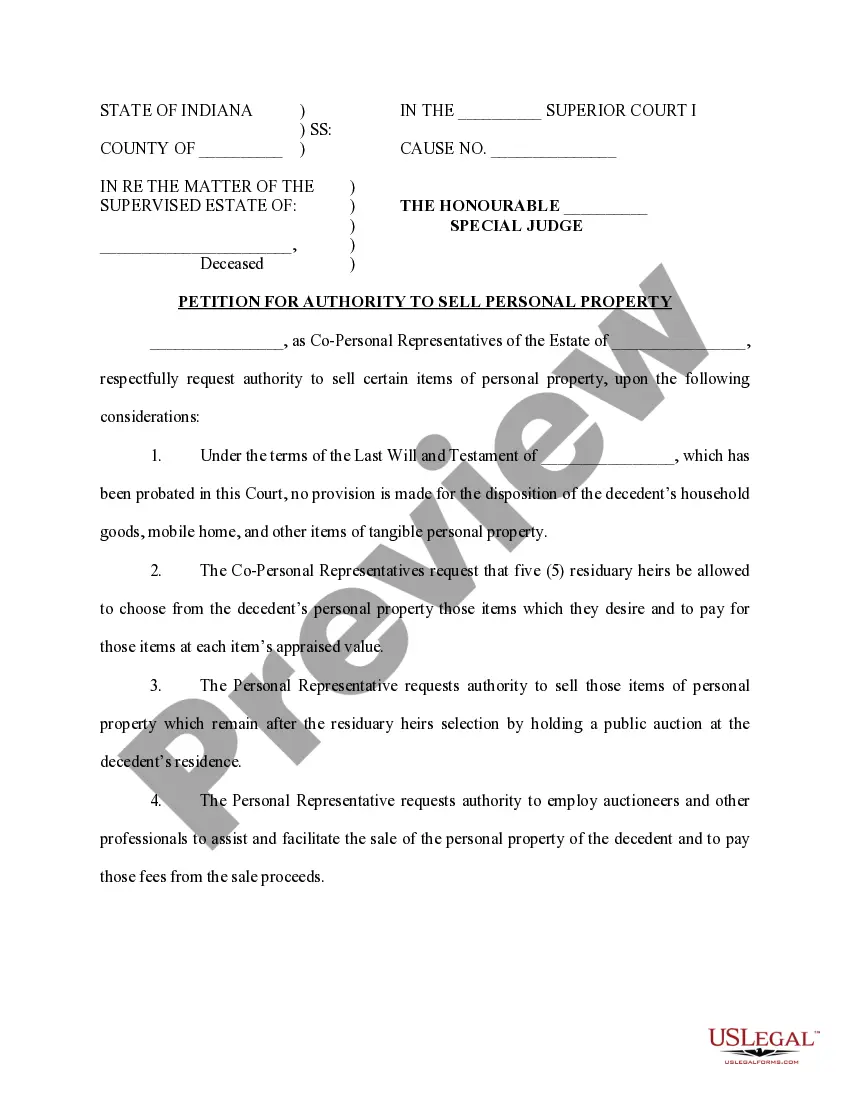

When this form is needed

This form is typically used when a borrower seeks a loan secured by commercial real estate. It is essential in transactions where both the lender and borrower require a clear and enforceable agreement detailing the loan's terms, repayment obligations, and the security interest in the property. It is particularly relevant for business owners looking to finance property purchases or improvements.

Intended users of this form

- Borrowers who are obtaining a loan from a lender backed by commercial real estate as collateral.

- Lenders providing loans that require security and clear repayment terms.

- Corporations or individuals involved in real estate transactions that necessitate a formal loan agreement.

- Legal professionals drafting or reviewing loan agreements to ensure compliance with state laws.

How to prepare this document

- Identify the parties involved: Clearly specify the borrower(s) and lender's full names and addresses.

- Enter loan details: Fill in the principal amount, interest rate, and payment schedule with specific dates.

- Outline payment specifics: State the amount of monthly payments and the due dates.

- Detail prepayment rights: Indicate if there are any penalties for early repayment and how they apply.

- Sign and date: Ensure all parties sign the document where indicated to make it legally binding.

Does this document require notarization?

This document requires notarization to meet legal standards. US Legal Forms provides secure online notarization powered by Notarize, allowing you to complete the process through a verified video call, available 24/7.

Get your form ready online

Our built-in tools help you complete, sign, share, and store your documents in one place.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Mistakes to watch out for

- Leaving sections incomplete, particularly regarding payment amounts and interest rates.

- Failing to provide signatures from all borrowers, making the note potentially unenforceable.

- Not specifying the consequences of default, which can lead to confusion in enforcement.

- Overlooking the requirement for a separate mortgage or deed of trust, which is crucial for securing the loan.

Advantages of online completion

- Convenient access to a professionally drafted legal document from anywhere at any time.

- Editability to customize the form according to specific loan terms and conditions.

- Reliable formats developed by licensed attorneys to ensure compliance and enforceability.

Legal use & context

- This promissory note serves as a legally binding contract between borrower and lender.

- Enforcement of the note is supported by secured interests in commercial real estate.

- Potential default by the borrower may allow the lender to take legal action to recover the owed amounts.

Summary of main points

- The Montana Installments Fixed Rate Promissory Note secures a loan with commercial real estate.

- Clear repayment terms and conditions are essential for legal enforceability.

- Both borrowers and lenders must understand their rights and responsibilities outlined in the document.

Looking for another form?

Form popularity

FAQ

Step 1 Agree to Terms. Step 2 Run a Credit Report. Step 3 Security and Co-Signer(s) Step 4 Writing the Promissory Note. Step 5 Paying Back the Borrowed Money. Calculating Total Interest Owed. Calculating the Final Payment Amount. Calculating the Monthly Payment Amount.

Writing the Promissory Note Terms You can use a template or create a promissory note online. But before you begin, you'll need to gather some information and make decisions about the way the loan will be structured. First, you'll need the names and addresses of both the lender (or "payee") and the borrower.

Full names of parties (borrower and lender) Repayment amount (principal and interest) Payment plan. Consequences of non-payment (default and collection) Notarization (if necessary) Other common details.

Navigate to the website: www.studentloans.gov. Click "Log In." Enter your FSA ID and Password. Click "Complete Master Promissory Note." Select the appropriate loan type. Enter Your Personal Information.

A simple promissory note might be for a lump sum repayment on a certain date. For example, you lend your friend $1,000 and he agrees to repay you by December 1. The full amount is due on that date, and there is no payment schedule involved.

Write the date of the writing of the promissory note at the top of the page. Write the amount of the note. Describe the note terms. Write the interest rate. State if the note is secured or unsecured. Include the names of both the lender and the borrower on the note, indicating which person is which.

The lender holds the promissory note while the loan is being repaid, then the note is marked as paid and returned to the borrower when the loan is satisfied. Promissory notes aren't the same as mortgages, but the two often go hand in hand when someone is buying a home.

In order for a promissory note to be valid, both the lender and the borrower must sign the documentation. If you are a co-signer for the loan, you are required to sign the promissory note. Being a co-signer requires you to repay the loan amount in the instance that the borrower defaults on payment.