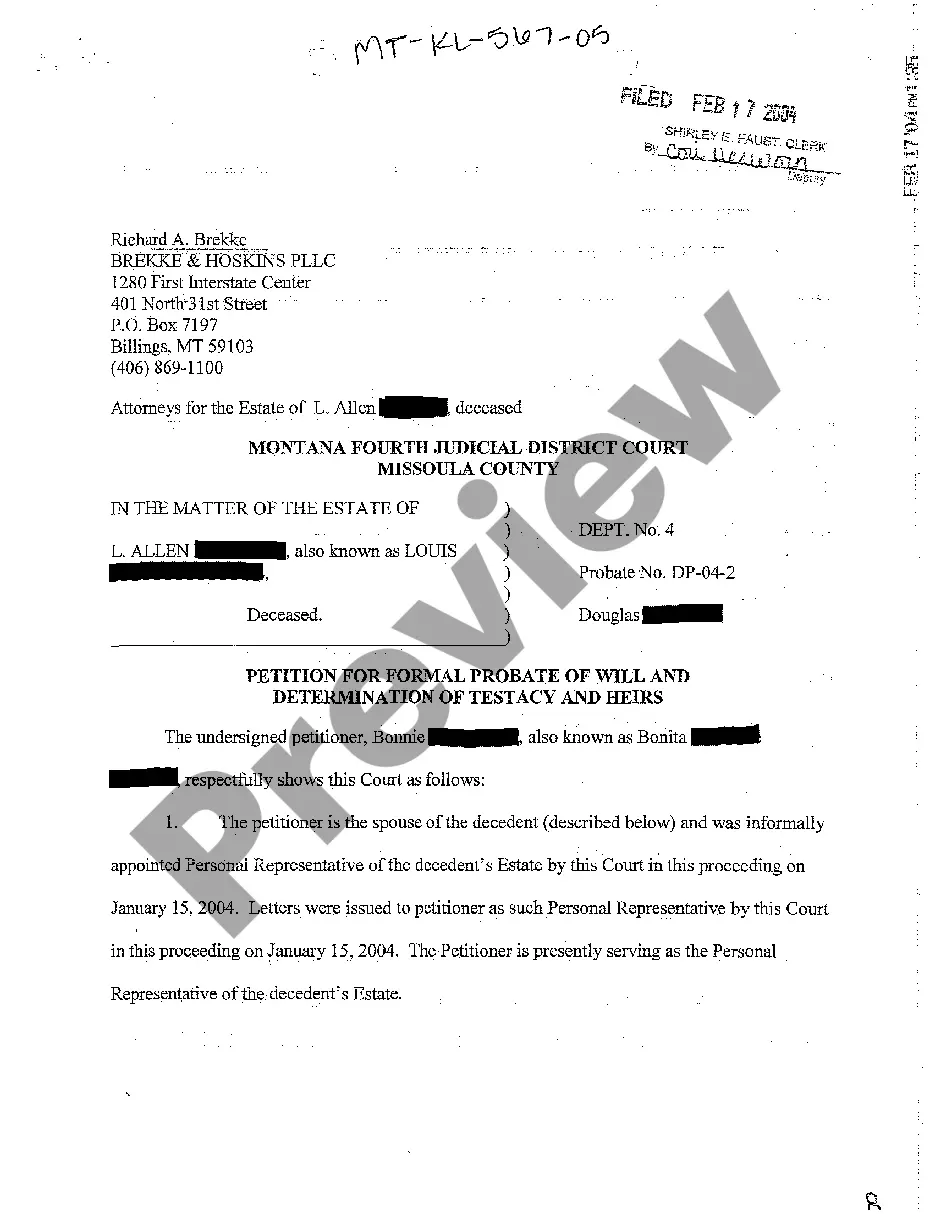

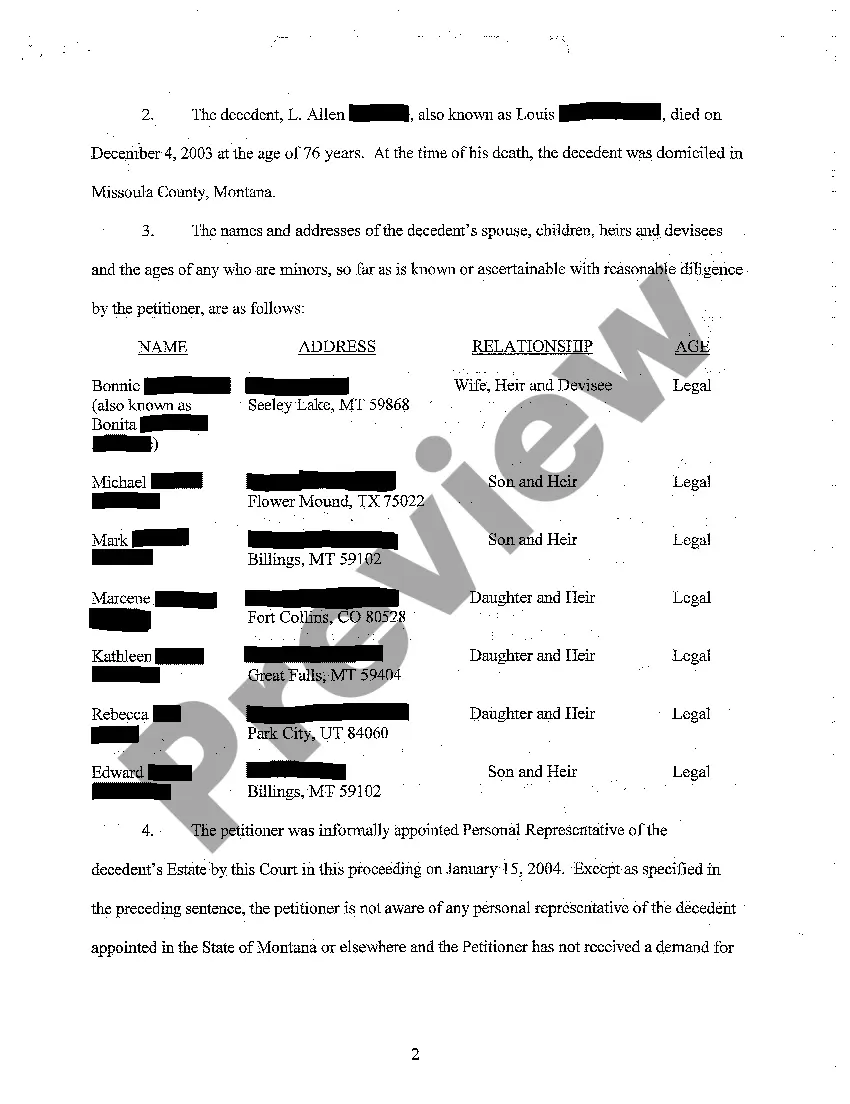

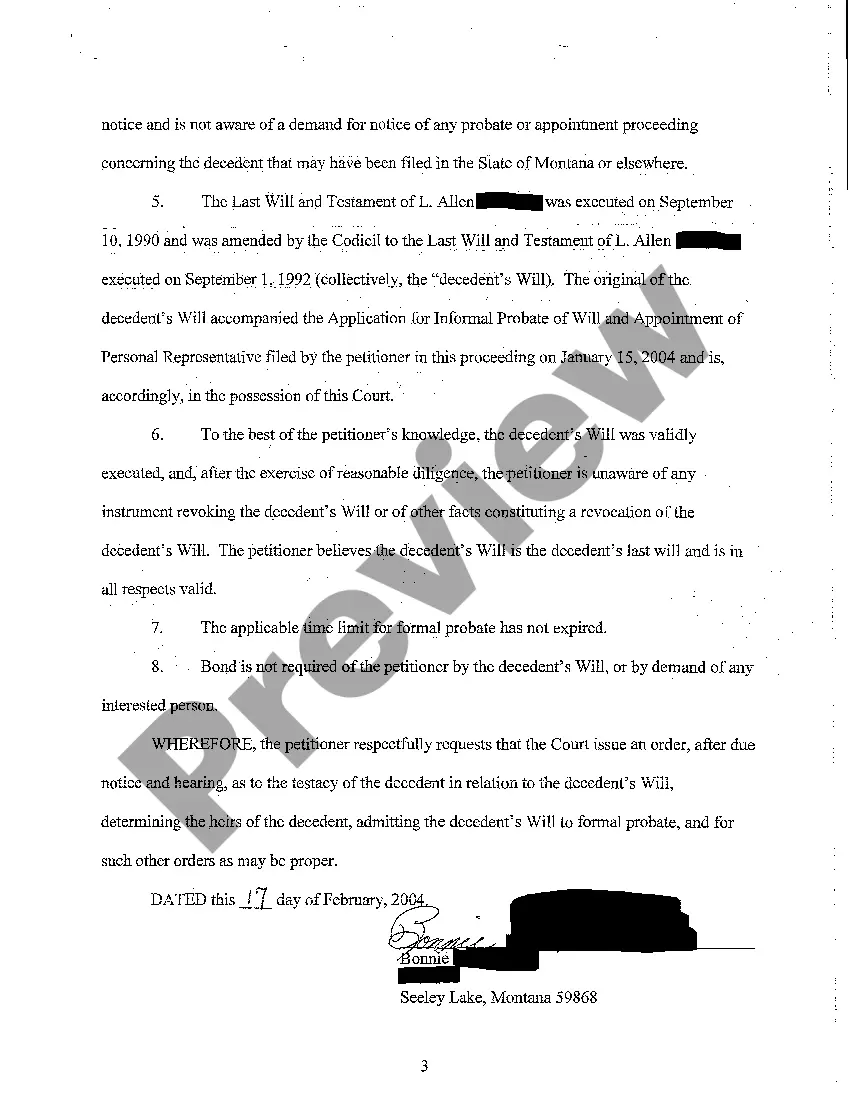

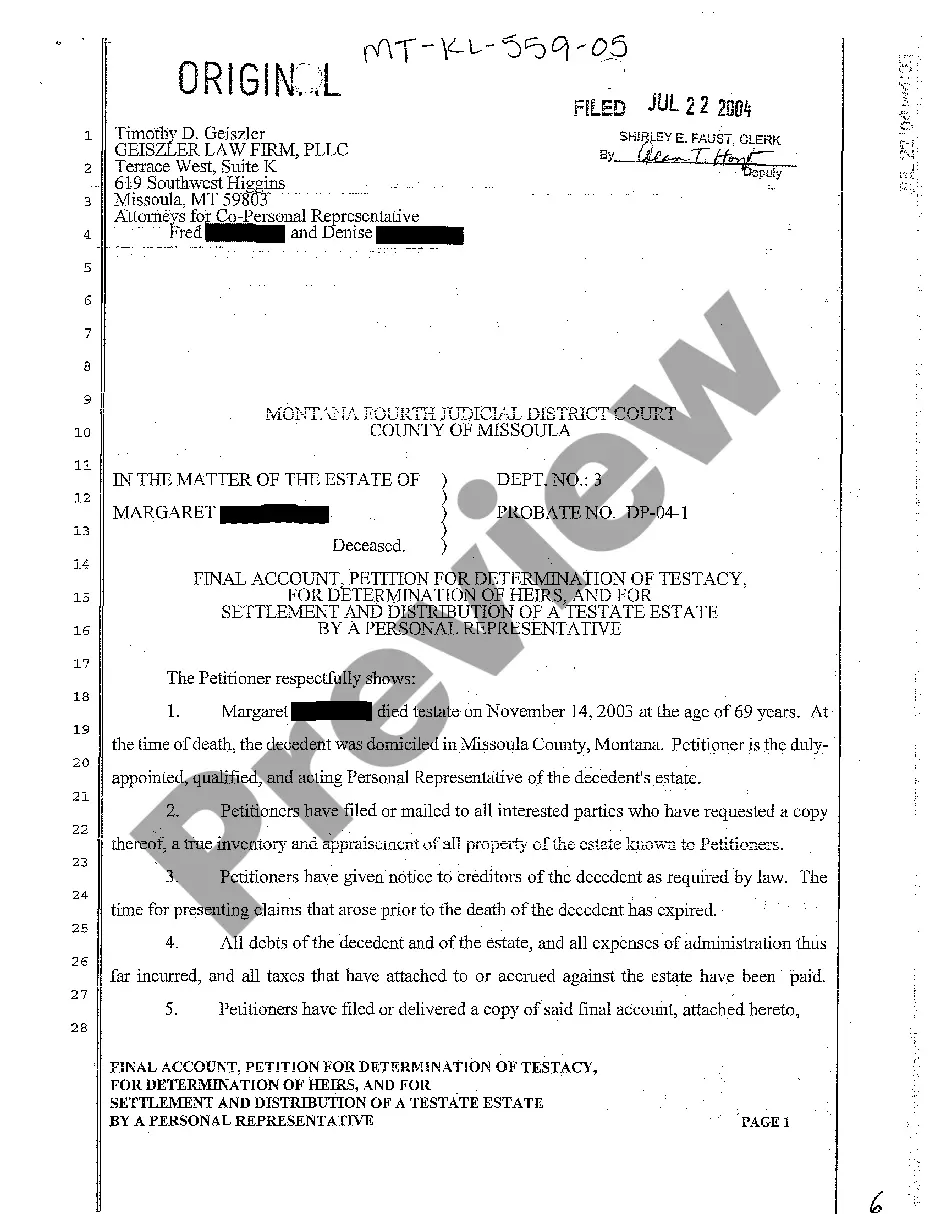

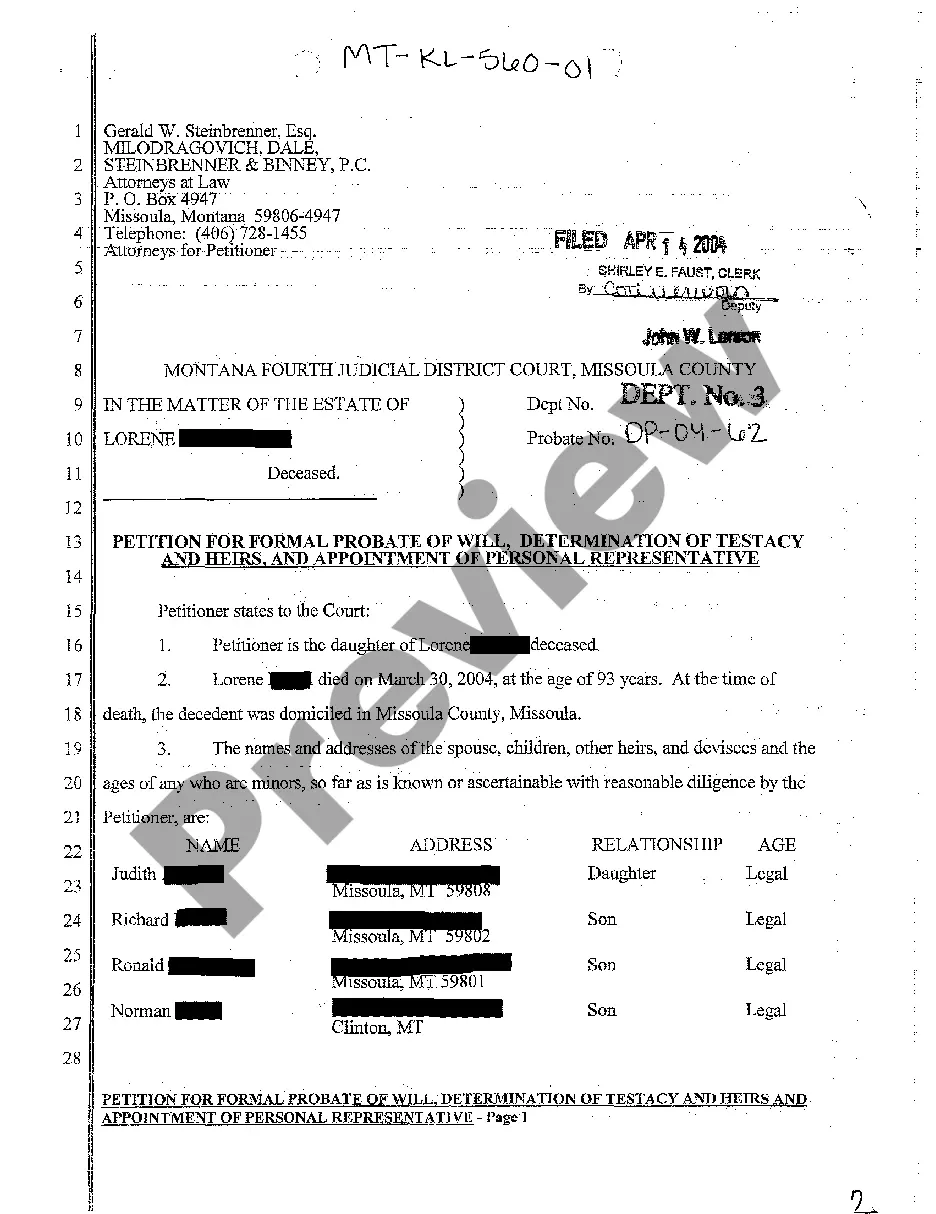

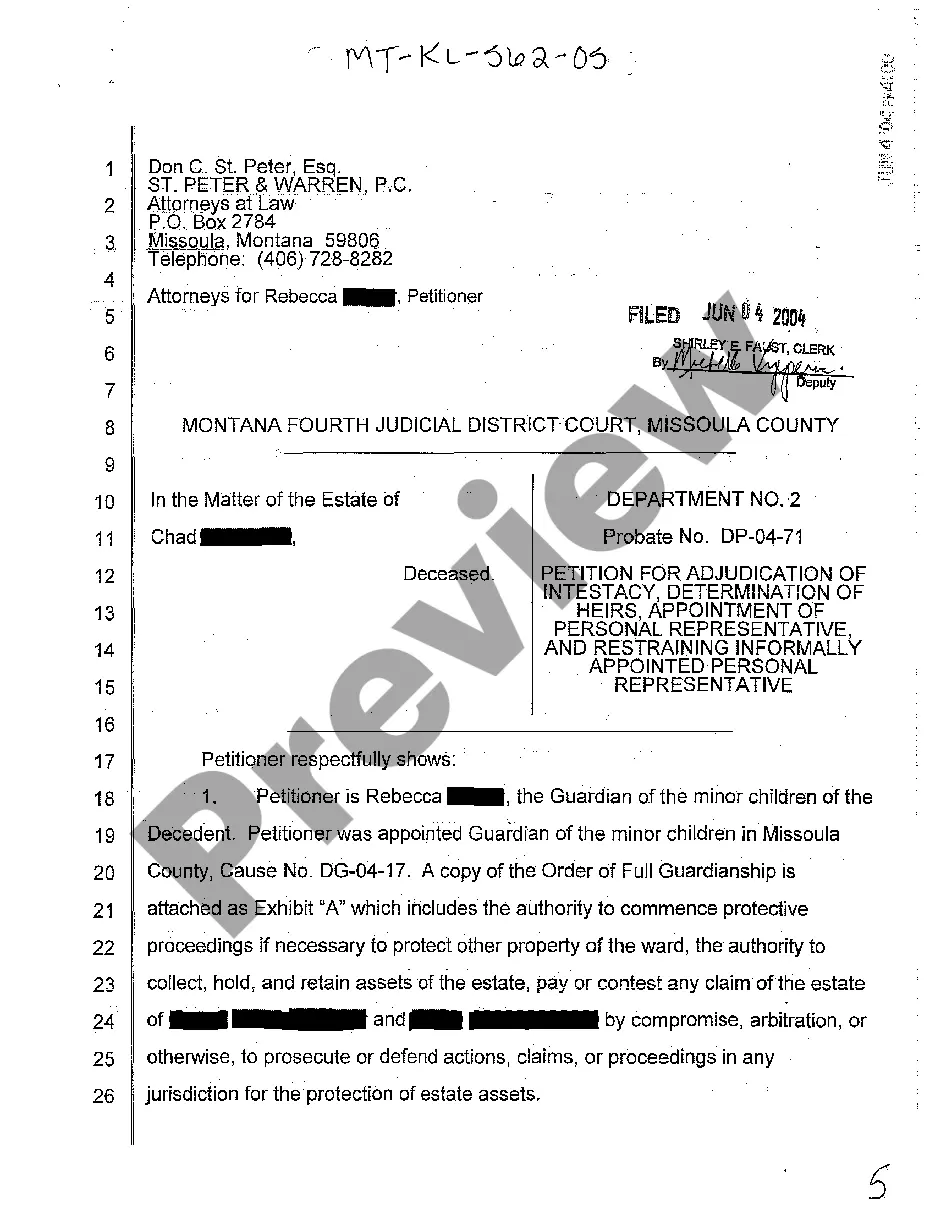

Montana Petition for Formal Probate of Will and Determination of Testacy and Heirs

Description

How to fill out Montana Petition For Formal Probate Of Will And Determination Of Testacy And Heirs?

Obtain a printable Montana Petition for Formal Probate of Will and Determination of Testacy and Heirs within several mouse clicks from the most comprehensive catalogue of legal e-files. Find, download and print professionally drafted and certified samples on the US Legal Forms website. US Legal Forms continues to be the #1 provider of affordable legal and tax forms for US citizens and residents on-line since 1997.

Customers who have already a subscription, need to log in into their US Legal Forms account, download the Montana Petition for Formal Probate of Will and Determination of Testacy and Heirs and find it stored in the My Forms tab. Users who do not have a subscription must follow the steps listed below:

- Make certain your template meets your state’s requirements.

- If available, look through form’s description to find out more.

- If available, preview the form to view more content.

- As soon as you are sure the template meets your requirements, simply click Buy Now.

- Create a personal account.

- Choose a plan.

- Pay out through PayPal or bank card.

- Download the form in Word or PDF format.

As soon as you have downloaded your Montana Petition for Formal Probate of Will and Determination of Testacy and Heirs, you can fill it out in any web-based editor or print it out and complete it manually. Use US Legal Forms to to access 85,000 professionally-drafted, state-specific documents.

Form popularity

FAQ

A personal representative must be 18 or more years of age. A Montana personal representative need not be a resident of the same county or state as the deceased. For example, he or she may be a resident of Glendive and serve as a personal representative in Helena.

How much do probate services cost? Some probate specialists and solicitors charge an hourly rate while others charge a fee that is a percentage of the value of the estate. This fee is usually calculated as between 1% to 5% of the value of the estate, plus VAT.

Every financial institution will have a different threshold as to the amount they will transfer without a Grant of Probate. To provide you some guidance, a balance of somewhere in the vicinity of $20,000.00 $50,000.00 will not require a Grant of Probate.

Application fees for probate are £155 if you apply through a solicitor and A£215 if you're taking the DIY option. Estates worth less than A£5,000 pay no fee.

The will of a decedent must be filed with the Clerk of Court so the personal representative may proceed with the administration of the estate. Montana has both formal (court-directed) and informal probate as well as a simplified probate process for small estates.

Under Montana statute, where as estate is valued at less than $50,000, an interested party may, thirty (30) days after the death of the decedent, issue a small estate affidavit to to demand payment on any debts owed to the decedent.

How much are the attorney's fees for probate proceedings? In Montana, the maximum fees attorneys may charge for probate proceedings are set by statute. Based on the gross value of the estate, without Court approval, the maximum fee cannot exceed 4.5% of the first $40,000, and 3% of the remainder.

In Montana, you can make a living trust to avoid probate for virtually any asset you ownreal estate, bank accounts, vehicles, and so on. You need to create a trust document (it's similar to a will), naming someone to take over as trustee after your death (called a successor trustee).

No, in Montana, you do not need to notarize your will to make it legal. However, Montana allows you to make your will "self-proving" and you'll need to go to a notary if you want to do that. A self-proving will speeds up probate because the court can accept the will without contacting the witnesses who signed it.