Montana Dissolution Package to Dissolve Corporation

What this document covers

The Montana Dissolution Package to Dissolve Corporation is a comprehensive set of legal forms designed to facilitate the voluntary dissolution of a corporation in Montana. This package includes step-by-step instructions, relevant addresses, transmittal letters, and necessary documents. It is specifically tailored for corporations that wish to cease their business operations and legally dissolve without going through a judicial process, differentiating it from other dissolution methods, such as involuntary dissolution or bankruptcy filings.

Key components of this form

- Form 1: Used for corporations that have not issued shares or commenced business.

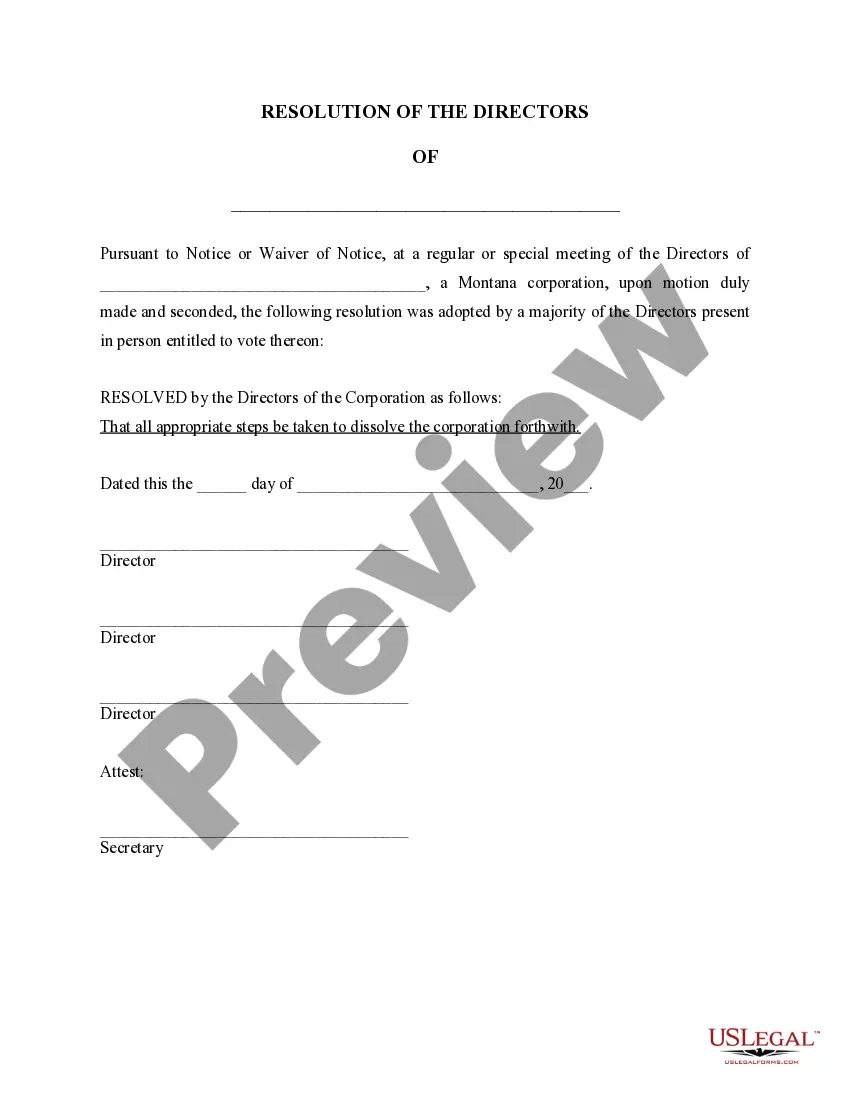

- Form A: Resolution of Directors, which proposes the dissolution to shareholders.

- Form B: Notice of Special Meeting that informs shareholders of the proposal to dissolve.

- Form 2: Articles of Dissolution for corporations that have issued shares and started business.

- Form 3: Notice of Dissolution and Request for Claims, sent to known claimants post-dissolution.

- Form 4: Notice of Rejection of Claim, used if claims against the corporation are denied.

Common use cases

This form package is utilized when a corporation in Montana wants to legally dissolve its business operations. Common scenarios include situations where the corporation has completed its intended business activities, faced financial difficulties, or the shareholders have collectively decided to terminate the corporation. It is important for corporations with outstanding debts or ongoing obligations to follow the necessary procedures outlined in this package to mitigate legal liabilities.

Who can use this document

- Corporation owners and shareholders looking to voluntarily dissolve their corporation.

- Corporations that have not issued any shares or commenced business operations.

- Corporations with outstanding shares that need shareholder approval for dissolution.

- Directors proposing the dissolution to shareholders due to business cessation.

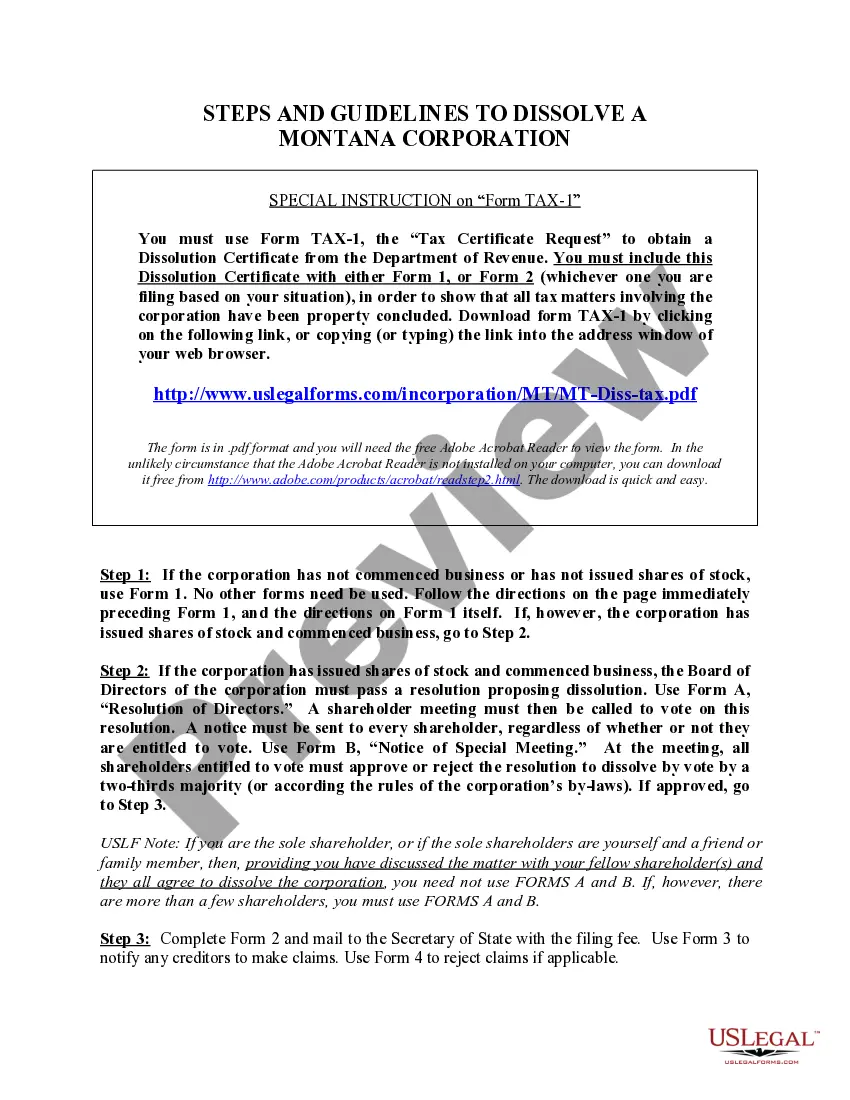

Completing this form step by step

- Identify whether your corporation has issued shares or commenced business to determine the appropriate form to use.

- If applicable, have the Board of Directors adopt a resolution to propose dissolution (use Form A).

- Notify all shareholders about the proposed meeting to vote on the dissolution resolution using Form B.

- Complete the Articles of Dissolution (Form 2) if shares were issued, including the necessary filing fee.

- Send a Notice of Dissolution (Form 3) to known claimants after dissolution approval.

- If applicable, use Form 4 to formally reject any claims that cannot be honored.

Notarization guidance

This form does not typically require notarization unless specified by local law. Ensure all forms are completed accurately before submission.

Get your form ready online

Our built-in tools help you complete, sign, share, and store your documents in one place.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Typical mistakes to avoid

- Failing to notify all shareholders if required, especially if there are multiple shareholders.

- Not including the Dissolution Certificate with the Articles of Dissolution.

- Using the wrong form based on whether or not shares have been issued.

- Overlooking the deadline to notify claimants about the dissolution.

Why use this form online

- Convenience of downloading and completing documents at your own pace.

- Editability allows for customization as needed before submission.

- Reliable templates drafted by licensed attorneys to ensure compliance with state laws.

Legal use & context

- The forms provided in the dissolution package are designed to comply fully with Montana state law.

- Using these forms correctly can help avoid legal issues that may arise from improper dissolution procedures.

- Once the dissolution is filed, the corporation retains limited rights to address outstanding claims or debts.

Key takeaways

- The Montana Dissolution Package is essential for anyone looking to dissolve a corporation in Montana.

- Understanding which forms to use based on corporate activity is crucial for compliance.

- Proper notification to shareholders and creditors is required to protect against claims.

- Using this package simplifies the legal process and ensures adherence to Montana statutes.

Looking for another form?

Form popularity

FAQ

In most states, to keep a corporation active, the owners must file annual reports and income tax returns. They may have to pay annual fees as well. Failure to do these things can render the corporation inactive. A corporation may also voluntarily become inactive by ceasing to do business.

After a company is dissolved, it must liquidate its assets. Liquidation refers to the process of sale or auction of the company's non-cash assets.Assets used as security for loans must be given to the bank or creditor that extended the loan, or you must pay off the loan before selling such assets.

An inactive business is a business that still exists but has no activity, which means no business transactions during a specific year.Even if the business has no income, it may still be considered active for tax purposes. There are many reasons a business may become inactive.

Hold a Board of Directors meeting and record a resolution to Dissolve the Montana Corporation. Hold a Shareholder meeting to approve Dissolution of the Montana Corporation. File all required Annual Reports with the Montana Secretary of State. File all required tax returns with the Montana Department of Revenue.

Dissolve the Legal Entity (LLC or Corporation) with the State. An LLC or Corporation needs to be officially dissolved. Pay Any Outstanding Bills. You need to satisfy any company debts before closing the business. Cancel Any Business Licenses or Permits. File Your Final Federal and State Tax Returns.

Step 1: Corporation or LLC action. Step 2: Filing the Certificate of Dissolution with the state. Step 3: Filing federal, state, and local tax forms. Step 4: Notifying creditors your business is ending. Step 5: Settling creditors' claims.

When a corporation is dissolved, it no longer legally exists and, in most cases, its debts disappear as well. State laws usually give additional time beyond the dissolution for creditors to file suits for failure to pay any corporate debts or for the wrongful distribution of corporate assets.

Failing to dissolve the corporation allows third parties to continue to sue the corporation as if it is still in operation. A judgment might mean that shareholders use the money received from distributed assets when the corporation closed down to satisfy judgments against the corporation.