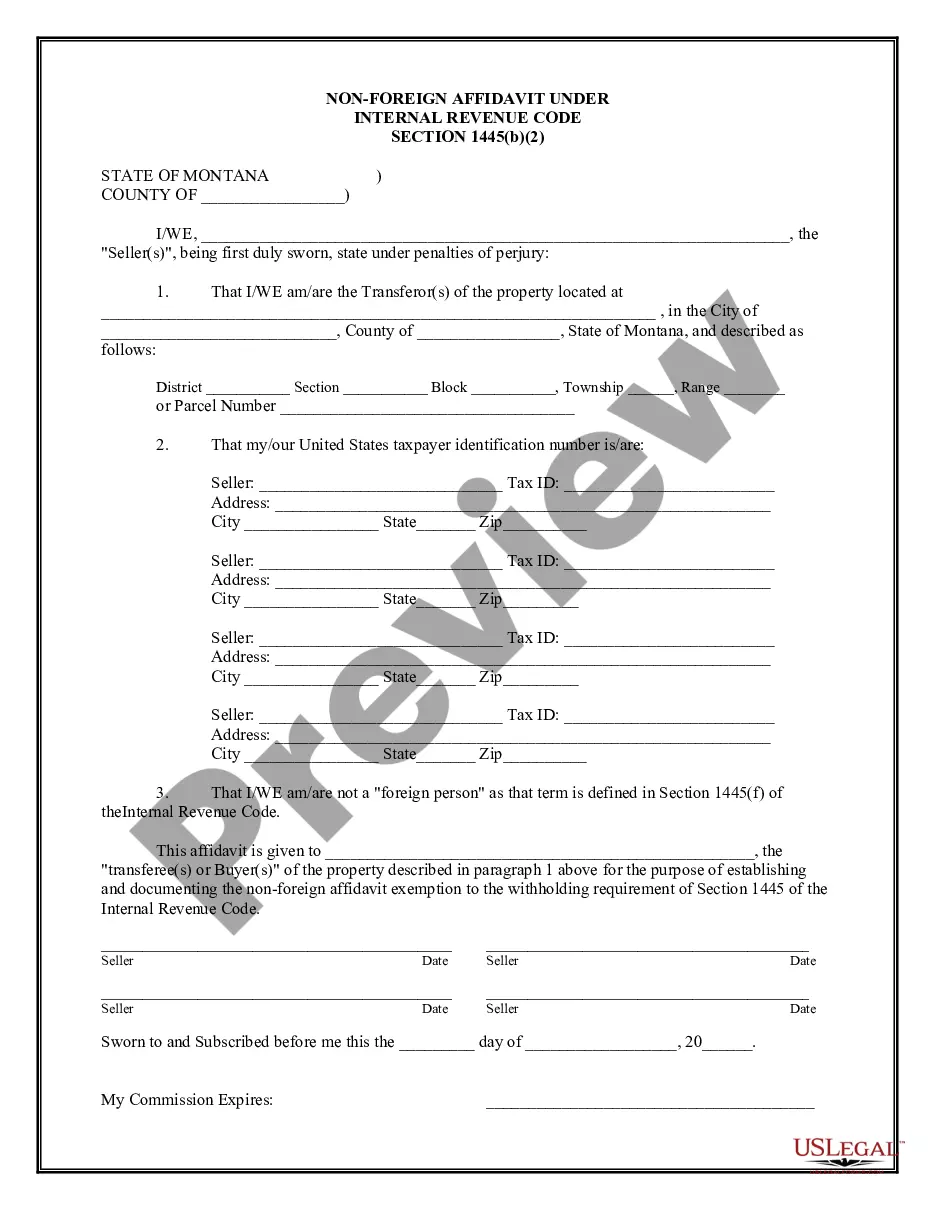

This Non-Foreign Affidavit Under Internal Revenue Code 1445 is for a seller of real property to sign stating that he or she is not a foreign person as defined by the Internal Revenue Code Section 26 USC 1445. This document must be signed and notarized.

Montana Non-Foreign Affidavit Under IRC 1445

Description

Get your form ready online

Our built-in tools help you complete, sign, share, and store your documents in one place.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Looking for another form?

How to fill out Montana Non-Foreign Affidavit Under IRC 1445?

Obtain a printable Montana Non-Foreign Affidavit Under IRC 1445 in just a few clicks from the largest collection of legal e-forms.

Search, download and print expertly created and verified samples on the US Legal Forms site. US Legal Forms has been the leading provider of affordable legal and tax documents for US citizens and residents online since 1997.

After you have downloaded your Montana Non-Foreign Affidavit Under IRC 1445, you can fill it out in any online editor or print it and complete it by hand. Utilize US Legal Forms to access 85,000 professionally drafted, state-specific forms.

- Clients who already possess a subscription must sign in to their US Legal Forms account, download the Montana Non-Foreign Affidavit Under IRC 1445, and find it saved in the My documents section.

- Clients without a subscription are required to follow the instructions listed below.

- Ensure your document aligns with your state's regulations.

- If available, review the form's details for additional information.

- If provided, view a preview of the form to see more content.

- Once you are certain the document is suitable for you, simply click Buy Now.

- Create a personal account.

- Choose a subscription plan.

- Make a payment via PayPal or credit card.

- Download the document in Word or PDF format.

Form popularity

FAQ

FIRPTA is a federal tax law that ensures that foreign sellers pay income tax on the sale of real property in the United States.

FIRPTA Exemptions The sales price is $300,000 or less, and. The buyer signs affidavit at or before closing stating they intend to use property for personal purposes for at least 50% of time property occupied for the each of the first two 12 month periods immediately after closing.

What Is a Certification of Non-Foreign Status? With a Certification of Non-Foreign Status, the seller of real estate is certifying under penalty of perjury, that the seller is not foreign. Therefore, the seller and the transaction will not have the withholding requirements.

A: The buyer must agree to sign an affidavit stating that the purchase price is under $300,000 and the buyer intends to occupy. The buyer may choose not to sign the form, in which case withholding must be done.

A: The buyer must agree to sign an affidavit stating that the purchase price is under $300,000 and the buyer intends to occupy. The buyer may choose not to sign the form, in which case withholding must be done.

The Foreign Investment in Real Property Transfer Act (FIRPTA) requires any buyer of a U.S. real property interest to withhold ten percent of the amount realized by a foreign seller. 26 USC § 1445(a).

The only other way to avoid FIRPTA is via a withholding certificate. If FIRPTA withholding exceeds the maximum tax liability realized on the sale of the real property, sellers can appeal to the IRS for a lower withholding amount.

The disposition of a U.S. real property interest by a foreign person (the transferor) is subject to income tax withholding (IRC section 1445).Withholding is required on certain distributions and other transactions by domestic or foreign corporations, partnerships, trusts, and estates.

CERTIFICATE OF NON FOREIGN STATUS. Section 1445 of the Internal Revenue Code provides that a transferee (buyer) of a U.S. real property interest must withhold tax if the transferor (seller) is a foreign person.