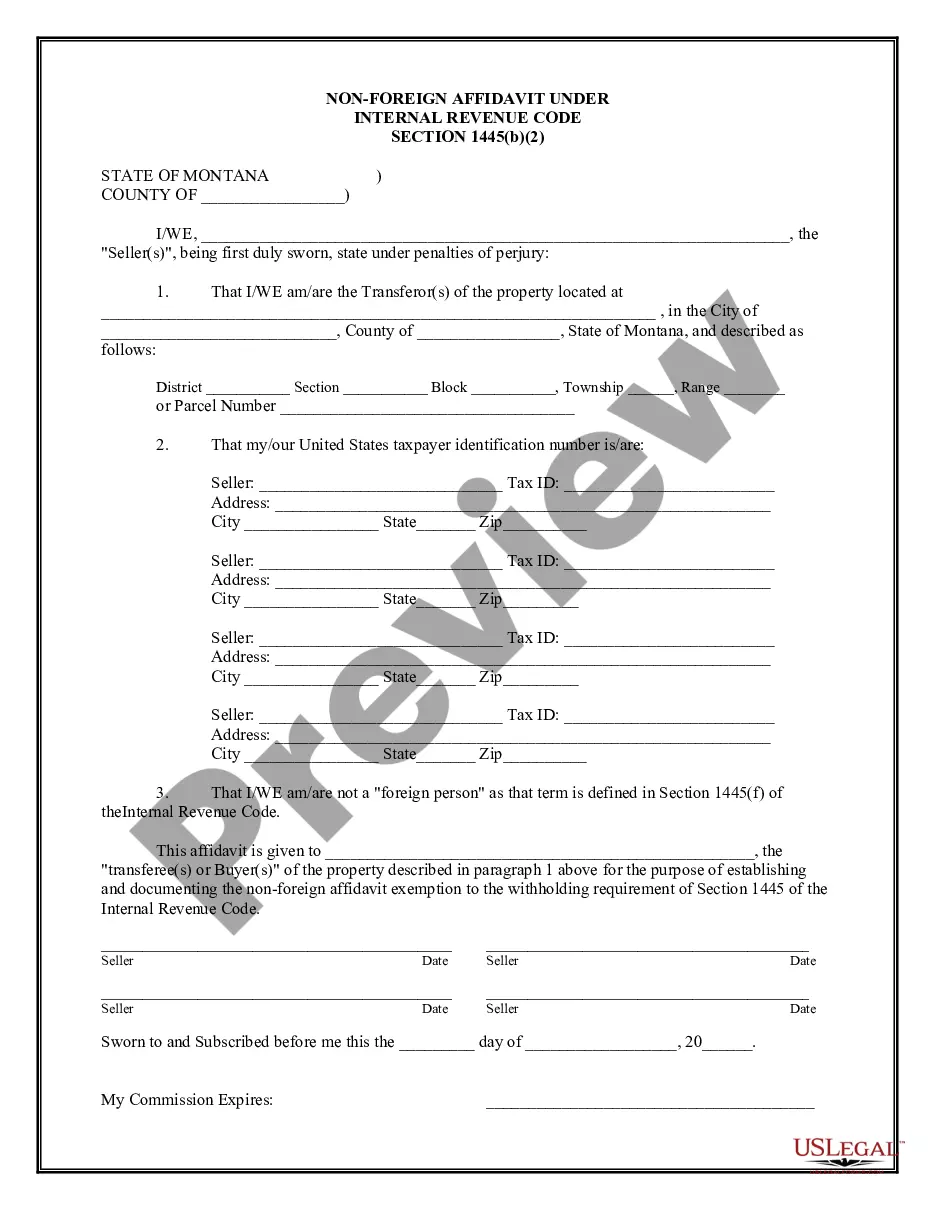

Montana Non-Foreign Affidavit Under IRC 1445

What is this form?

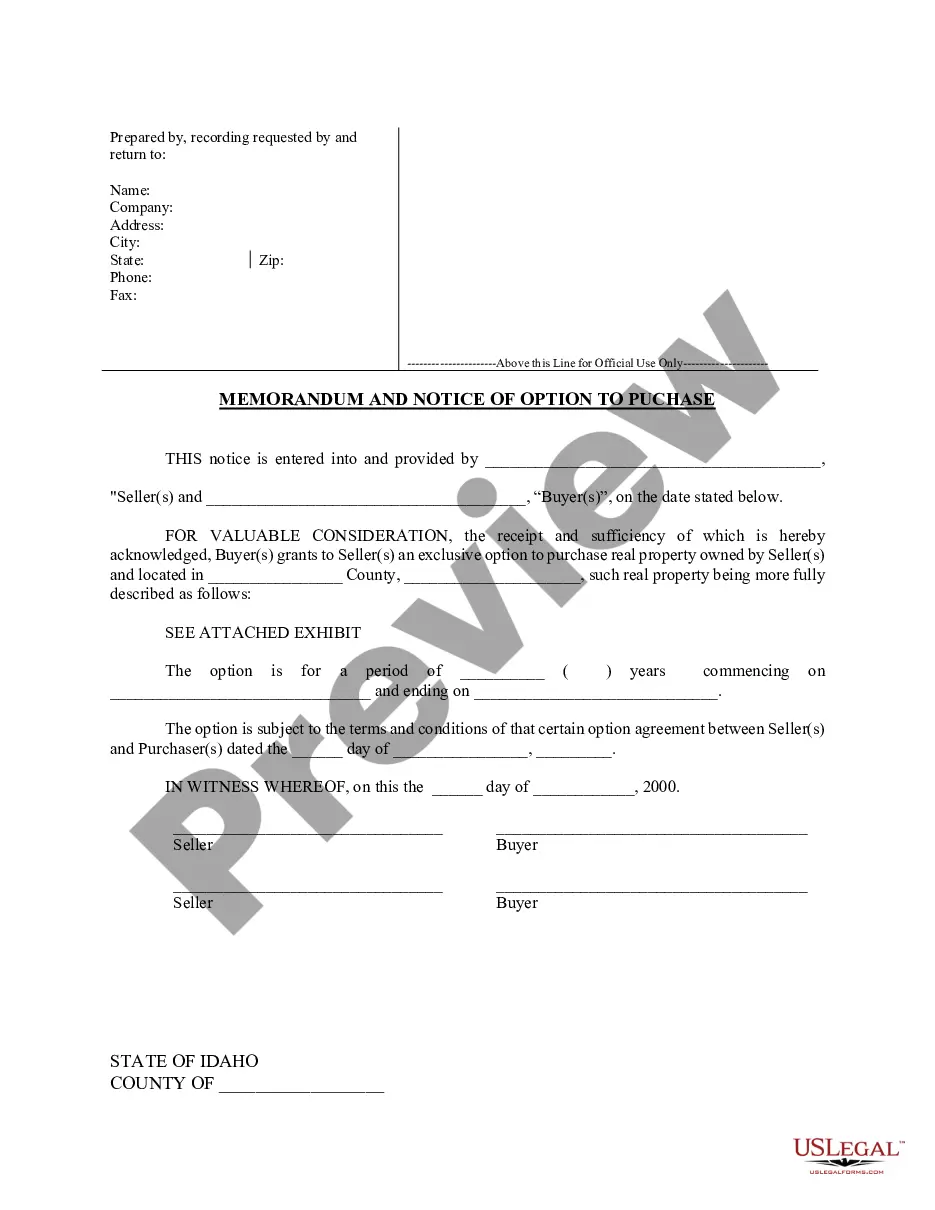

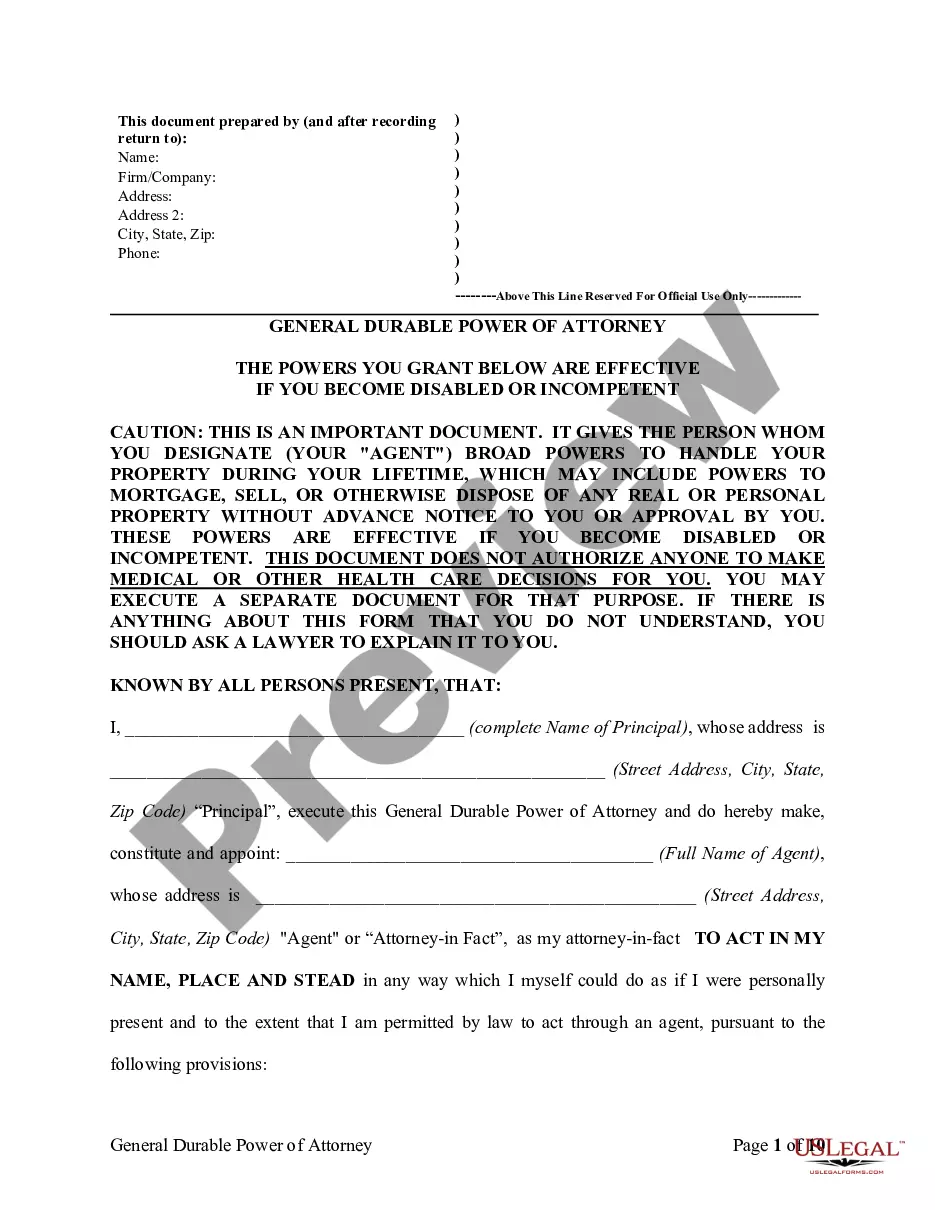

The Non-Foreign Affidavit Under IRC 1445 is a legal document used by sellers of real property to declare that they are not foreign persons as defined by the Internal Revenue Code Section 26 USC 1445. This affidavit helps sellers avoid the withholding tax that may apply to foreign sellers when selling U.S. real estate. Unlike similar forms, this affidavit explicitly addresses the foreign status of the seller to comply with tax regulations.

Key parts of this document

- Seller's identification including taxpayer identification numbers.

- Property details including location and legal description.

- Declaration of non-foreign status under Section 1445(f) of the Internal Revenue Code.

- Notarization section confirming the seller's sworn statement.

- Signature lines for all sellers involved in the transaction.

When to use this form

This form should be used when a seller of real estate is conducting a transaction and needs to affirm their non-foreign status to the buyer. It is particularly important when the buyer is required to withhold a percentage of the sales price due to potential foreign sellers, helping to exempt the seller from this withholding requirement.

Who needs this form

- Individuals or entities selling real estate in the United States.

- U.S. citizens or residents who must confirm their non-foreign status.

- Any seller involved in a real estate transaction where withholding may apply.

How to complete this form

- Identify the sellers by entering their names and taxpayer identification numbers.

- Specify the property by entering the address and legal description.

- Declare non-foreign status by ensuring all sellers confirm they are not foreign persons.

- Include the date and signatures of all sellers at the bottom of the affidavit.

- Have the affidavit notarized to validate the signatures and declarations made.

Notarization guidance

This form must be notarized to be legally valid. US Legal Forms provides secure online notarization powered by Notarize, allowing you to complete the process through a verified video call.

Get your form ready online

Our built-in tools help you complete, sign, share, and store your documents in one place.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Avoid these common issues

- Failing to provide accurate taxpayer identification numbers.

- Leaving out the property's legal description or address.

- Not having the document notarized.

- Omitting signature(s) of all sellers involved in the transaction.

Benefits of using this form online

- Convenient access to professional-grade legal documents anytime, anywhere.

- Edit and customize the form to suit your specific transaction needs.

- Reliable templates created by licensed attorneys, ensuring legal compliance.

Looking for another form?

Form popularity

FAQ

FIRPTA is a federal tax law that ensures that foreign sellers pay income tax on the sale of real property in the United States.

FIRPTA Exemptions The sales price is $300,000 or less, and. The buyer signs affidavit at or before closing stating they intend to use property for personal purposes for at least 50% of time property occupied for the each of the first two 12 month periods immediately after closing.

What Is a Certification of Non-Foreign Status? With a Certification of Non-Foreign Status, the seller of real estate is certifying under penalty of perjury, that the seller is not foreign. Therefore, the seller and the transaction will not have the withholding requirements.

A: The buyer must agree to sign an affidavit stating that the purchase price is under $300,000 and the buyer intends to occupy. The buyer may choose not to sign the form, in which case withholding must be done.

A: The buyer must agree to sign an affidavit stating that the purchase price is under $300,000 and the buyer intends to occupy. The buyer may choose not to sign the form, in which case withholding must be done.

The Foreign Investment in Real Property Transfer Act (FIRPTA) requires any buyer of a U.S. real property interest to withhold ten percent of the amount realized by a foreign seller. 26 USC § 1445(a).

The only other way to avoid FIRPTA is via a withholding certificate. If FIRPTA withholding exceeds the maximum tax liability realized on the sale of the real property, sellers can appeal to the IRS for a lower withholding amount.

The disposition of a U.S. real property interest by a foreign person (the transferor) is subject to income tax withholding (IRC section 1445).Withholding is required on certain distributions and other transactions by domestic or foreign corporations, partnerships, trusts, and estates.

CERTIFICATE OF NON FOREIGN STATUS. Section 1445 of the Internal Revenue Code provides that a transferee (buyer) of a U.S. real property interest must withhold tax if the transferor (seller) is a foreign person.