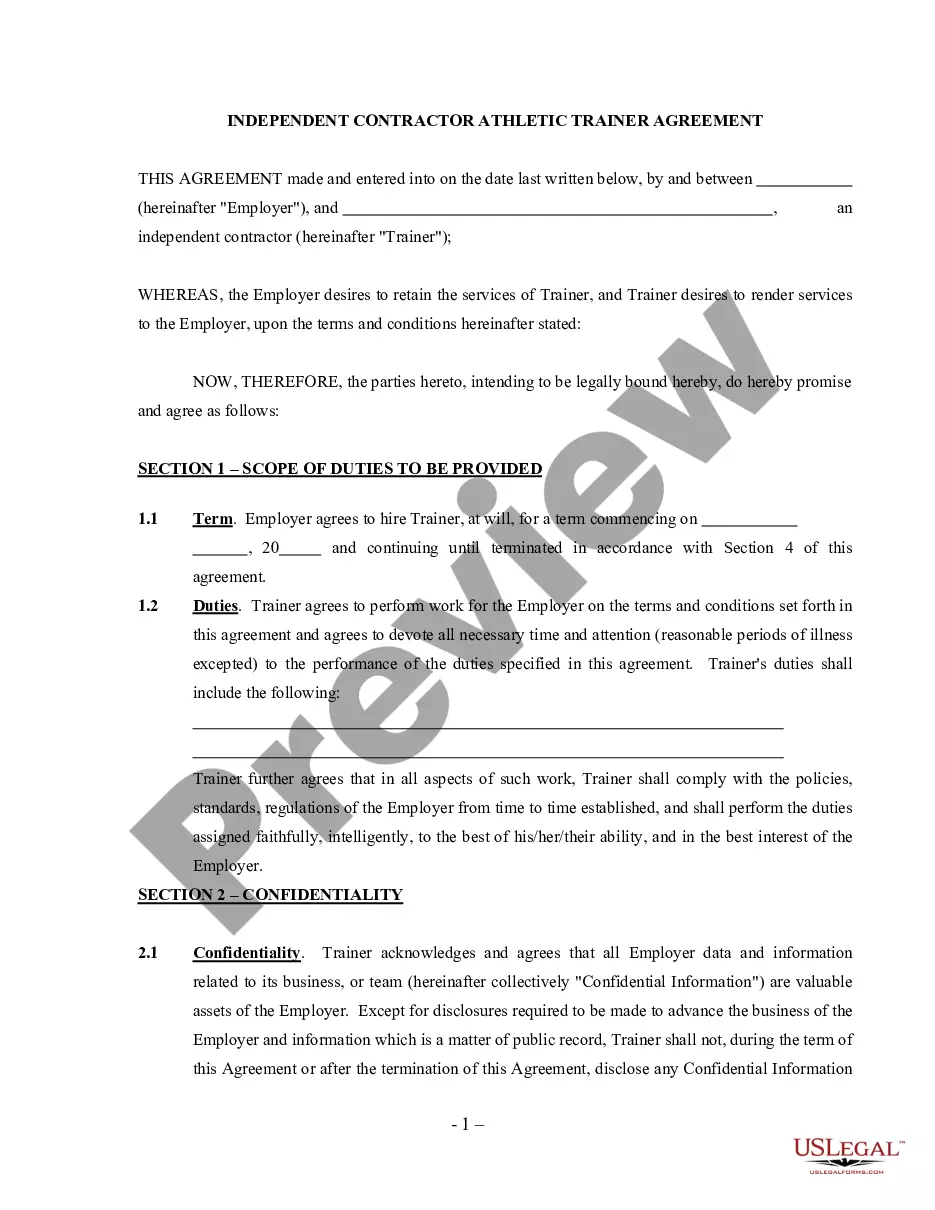

Mississippi Self-Employed Personal Trainer or Training Services Contract

Description

How to fill out Self-Employed Personal Trainer Or Training Services Contract?

Selecting the appropriate lawful document template can be a challenge. Clearly, there are numerous formats available online, but how do you locate the correct type you need? Utilize the US Legal Forms website. The service offers thousands of templates, including the Mississippi Self-Employed Personal Trainer or Training Services Agreement, which you can utilize for business and personal purposes. All of the forms are reviewed by experts and comply with state and federal regulations.

If you are already registered, Log In to your account and then click the Acquire button to download the Mississippi Self-Employed Personal Trainer or Training Services Agreement. Use your account to browse through the legal forms you have purchased previously. Go to the My documents section of your account and retrieve another copy of the document you need.

If you are a new user of US Legal Forms, here are simple instructions that you can follow: First, ensure you have selected the correct template for your area/county. You can review the form using the Review button and examine the form details to confirm it is the right one for you. If the template does not meet your expectations, use the Search field to find the appropriate template. When you are confident that the form is suitable, click on the Buy now button to acquire the template. Choose the pricing plan you prefer and enter the required information. Create your account and complete the order using your PayPal account or Visa or Mastercard. Choose the file format and download the legal document template to your device. Finally, complete, revise, print, and sign the obtained Mississippi Self-Employed Personal Trainer or Training Services Agreement. US Legal Forms is the largest collection of legal templates where you can explore various document formats. Utilize the service to download well-crafted documents that meet state requirements.

US Legal Forms is the largest collection of legal templates where you can explore various document formats.

- Selecting the appropriate lawful document template can be a challenge.

- Clearly, there are numerous formats available online.

- All of the forms are reviewed by experts.

- If you are already registered.

- If you are a new user of US Legal Forms.

- Finally, complete, revise, print, and sign the obtained document.

Form popularity

FAQ

You can take payments as a personal trainer through various methods, including credit cards, online payment platforms, or checks. Offering multiple payment options can enhance customer convenience and satisfaction. Ensure your payment process aligns with the terms laid out in your Mississippi Self-Employed Personal Trainer or Training Services Contract.

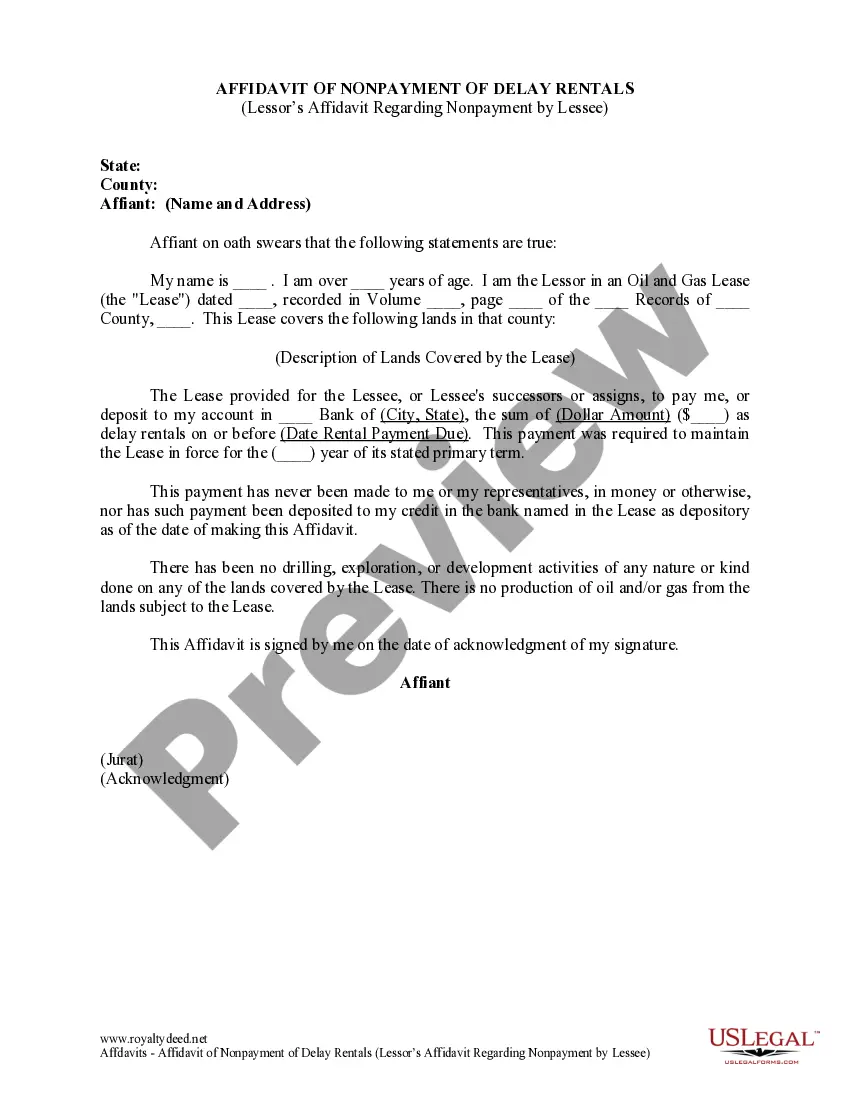

To create a personal training contract, start by outlining the services you offer, payment details, and cancellation policies. Ensure that both you and the client agree on the terms to avoid misunderstandings. Using a template from uslegalforms can make this process simpler and ensure your contract meets the standards for a Mississippi Self-Employed Personal Trainer or Training Services Contract.

In Mississippi, there are no state laws requiring certification to call yourself a personal trainer; however, having certification enhances your credibility. Clients often seek trainers with proven qualifications to ensure they receive safe and effective training. Certification can also be a key aspect of a Mississippi Self-Employed Personal Trainer or Training Services Contract.

Creating a contract as a personal trainer involves outlining the scope of services, payment terms, and client responsibilities. It is essential to include clauses that protect both you and your clients. You can streamline this process by utilizing templates available on platforms like uslegalforms, specifically tailored for a Mississippi Self-Employed Personal Trainer or Training Services Contract.

Yes, a personal trainer can absolutely be self-employed, allowing greater flexibility in setting their own hours and rates. This setup enables you to build your brand and cultivate direct relationships with clients. With a solid Mississippi Self-Employed Personal Trainer or Training Services Contract, you can outline the terms of your services clearly.

Setting up an LLC can offer personal trainers in Mississippi valuable legal protection and help separate personal assets from business liabilities. This structure makes it easier to manage taxes and can enhance your professional image. Additionally, it may simplify the process of obtaining a Mississippi Self-Employed Personal Trainer or Training Services Contract.

To register as a self-employed personal trainer in Mississippi, you need to obtain the necessary licenses and permits based on your location. You should also consider registering your business name if you plan to operate under a specific brand. Having a Mississippi Self-Employed Personal Trainer or Training Services Contract can provide a professional structure for your business and help establish your brand in the fitness industry.

To show proof of income as a personal trainer in Mississippi, you can provide tax returns, bank statements, or payment records from your clients. Keeping organized and up-to-date financial documents is crucial for transparency and trust. Additionally, using a Mississippi Self-Employed Personal Trainer or Training Services Contract can help you maintain proper records of your earnings and client payments.

The income of a self-employed personal trainer in Mississippi can vary widely based on factors such as experience, clientele, and location. On average, personal trainers can earn anywhere from $30,000 to $70,000 annually, with potential for higher earnings as you build your reputation. Offering specialized training sessions or group classes can also increase your revenue. A Mississippi Self-Employed Personal Trainer or Training Services Contract can help you set fair rates and manage your finances.

Personal trainers in Mississippi typically file taxes as self-employed individuals. You will need to report your income and expenses using Schedule C when filing your federal tax return. It's important to keep detailed records of your earnings and any business-related expenses to maximize deductions. A Mississippi Self-Employed Personal Trainer or Training Services Contract can help you track your services and income accurately.