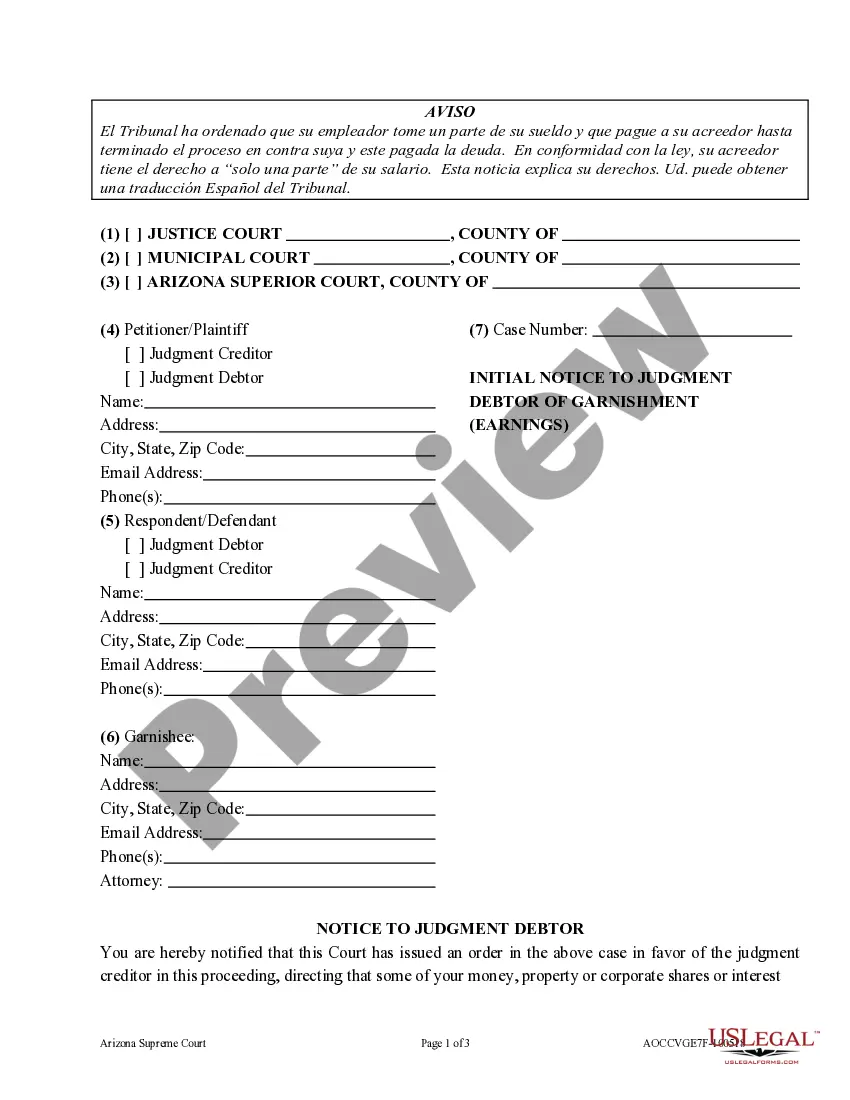

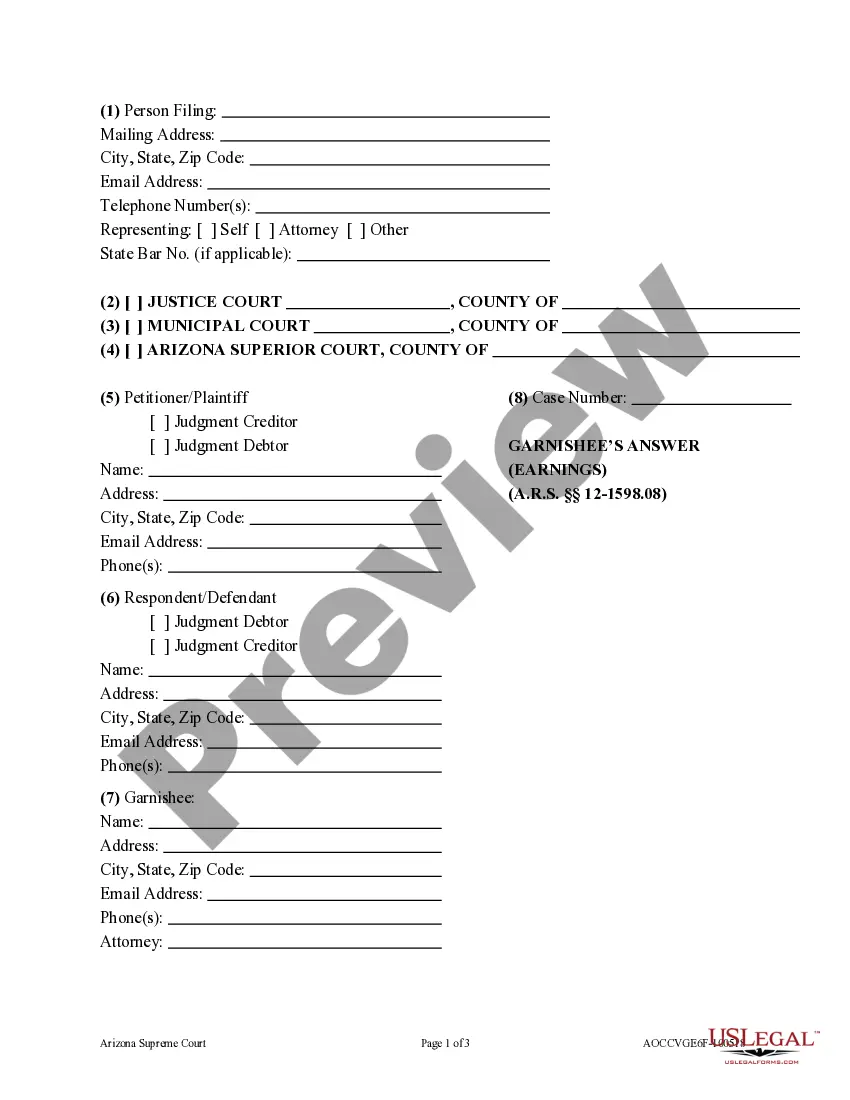

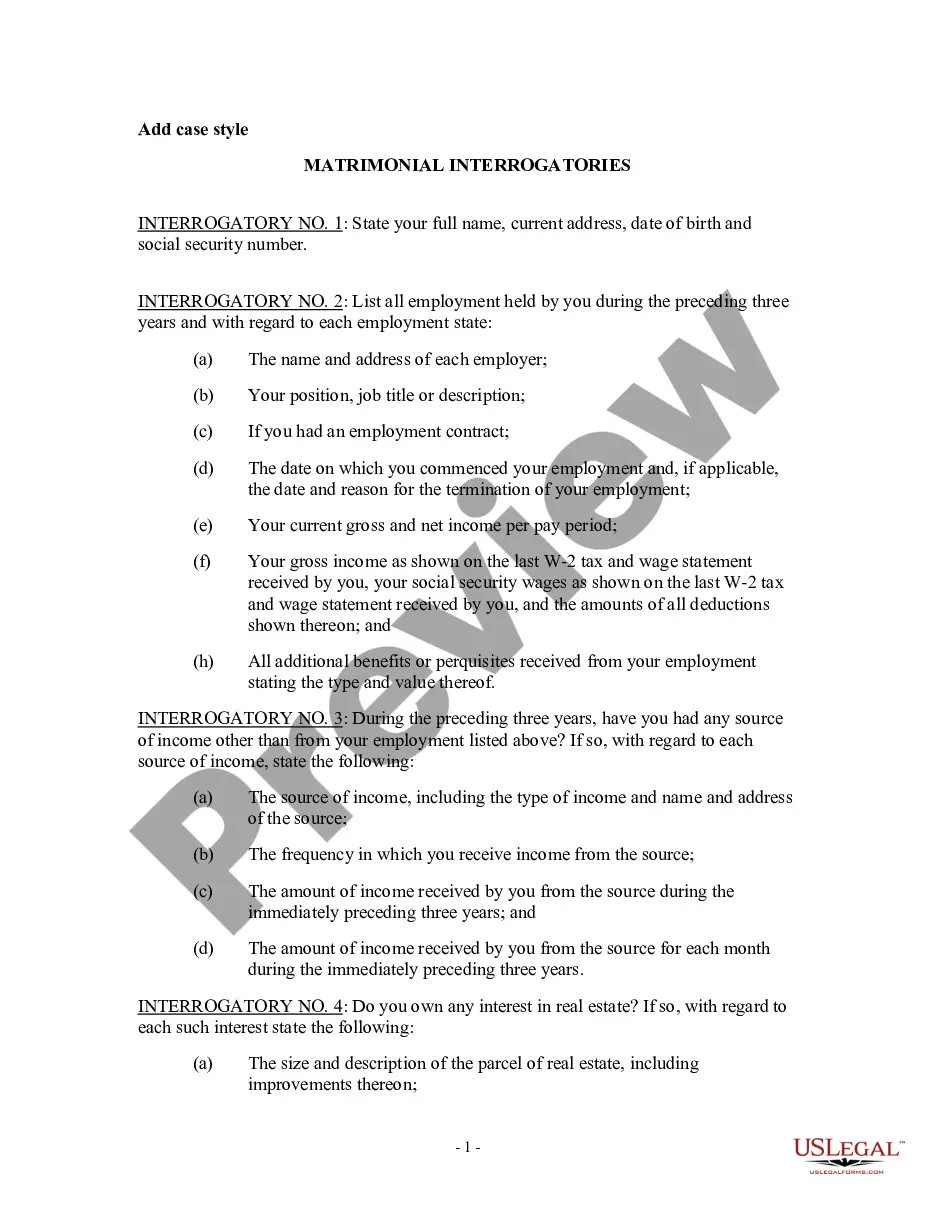

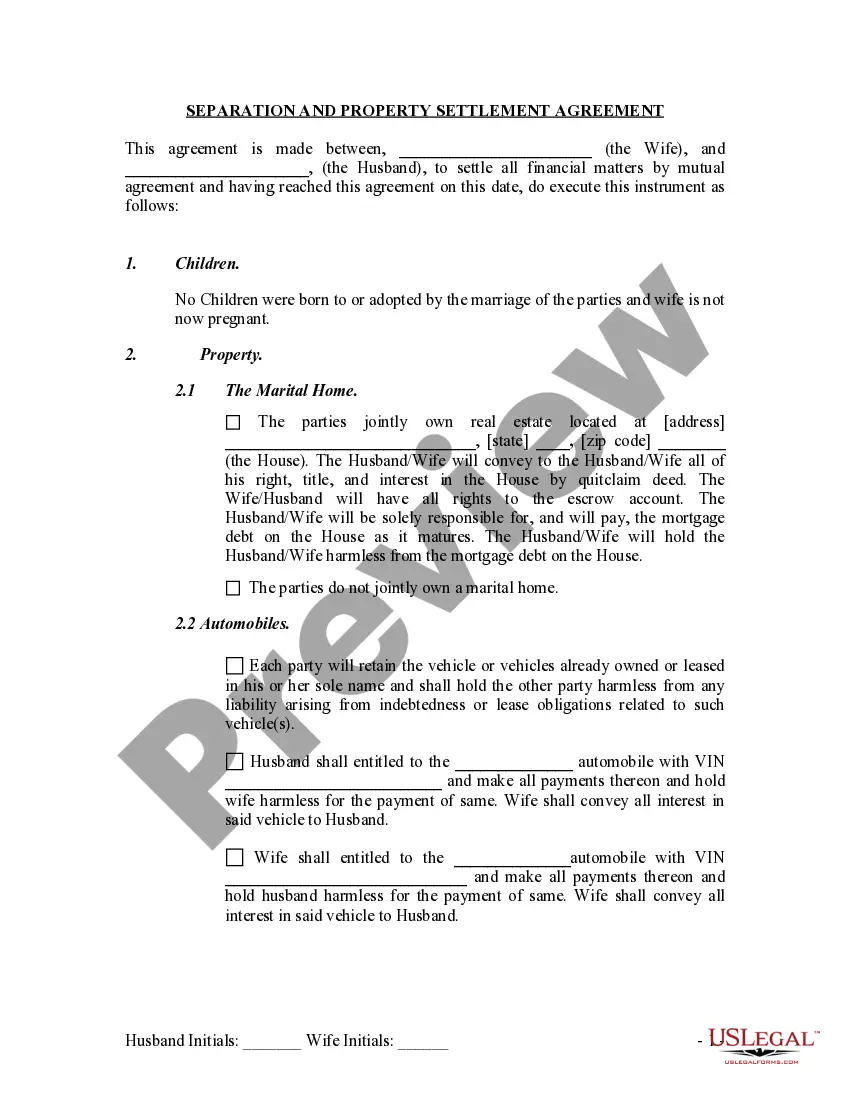

Arizona Introduction to Garnishment is a program designed to provide employers with an overview of the garnishment process in Arizona. It covers the legal requirements of garnishment in the state, including the proper withholding of wages, filing of garnishment documents with the court, and paying the garnishment to the creditor. The program also provides guidance on how to respond to garnishment requests from creditors and debt collectors, and how to protect employees from illegal garnishment practices. There are two types of Arizona Introduction to Garnishment: Garnishment for Child Support and Garnishment for Other Debts. Garnishment for Child Support covers the process of garnishment for child support payments, and Garnishment for Other Debts covers the process for collecting on other types of debts such as credit card debt, student loans, and medical bills.

Arizona Introduction to Garnishment

Description

How to fill out Arizona Introduction To Garnishment?

Creating legal documents can be quite a burden if you lack prepared fillable forms. With the US Legal Forms digital repository of formal documentation, you can be confident in the blanks available, as all comply with national and state standards and are verified by our specialists.

Acquiring your Arizona Introduction to Garnishment from our platform is as simple as 1-2-3. Previously approved users with a valid subscription can just Log In and click the Download button once they find the appropriate template. Furthermore, if necessary, users can retrieve the same document from the My documents section of their account. However, even if you are a newcomer to our platform, signing up with a valid subscription will take only a brief moment. Here’s a quick guide for you.

Haven't you explored US Legal Forms yet? Register for our service today to obtain any official document swiftly and effortlessly every time you require it, and maintain your paperwork systematically!

- Document compliance verification. You should carefully examine the content of the form you wish to use and ensure it meets your requirements and adheres to your state regulations. Previewing your document and reviewing its general description will assist you in doing so.

- Alternative search (optional). If you notice any discrepancies, explore the library through the Search tab located at the top of the webpage until you find a suitable template, and click Buy Now when you discover what you need.

- Account creation and form acquisition. Sign up for an account with US Legal Forms. After your account is verified, Log In and choose your preferred subscription plan. Proceed with payment (PayPal and credit card options are available).

- Template download and subsequent usage. Choose the file format for your Arizona Introduction to Garnishment and click Download to save it to your device. Print it to complete your paperwork manually, or utilize a multi-featured online editor to prepare an electronic version more quickly and efficiently.

Form popularity

FAQ

In Arizona, the statute of limitations for wage claims is generally 2 years. This timeframe applies to unpaid wages and breaches of contract related to employment. Familiarity with the Arizona Introduction to Garnishment can guide you in addressing unpaid wages and any potential garnishment procedures. Therefore, consider consulting with professionals who can assist you in resolving wage issues efficiently.

The Prop 209 lawsuit in Arizona pertains to legal challenges against the initiative that aimed to prohibit the state from considering race, color, or national origin in public employment and contracting. This case holds significant implications for various legal processes, including garnishments. When navigating instances of garnishment, having knowledge of legal changes like Prop 209 helps you understand your rights and options under the Arizona Introduction to Garnishment framework.

In Arizona, the statute of limitations on garnishments typically extends for 5 years. This period begins from the date the judgment is entered. Understanding the Arizona Introduction to Garnishment is crucial, as it affects how long creditors can pursue these actions against your wages or bank accounts. Therefore, if you have a garnishment issue, it's essential to seek advice promptly.

Stopping a garnishment in Arizona may require filing specific legal motions or negotiating with the creditor. You can contest the garnishment by providing evidence that it causes undue hardship, or you can arrange a payment plan. For comprehensive assistance, the Arizona Introduction to Garnishment information on US Legal Forms can guide you through the necessary steps to regain control.

Creditors in Arizona can pursue your home under certain circumstances, typically after obtaining a judgment. However, garnishment does not apply directly to real estate but may lead to a lien, should they pursue repayment through legal channels. Understanding the implications of the Arizona Introduction to Garnishment can help you protect your assets.

The most your check can be garnished in Arizona depends on your specific circumstances and income levels. Generally, the maximum is capped at 25% of your disposable earnings. Familiarizing yourself with the Arizona Introduction to Garnishment can provide insights into how these limits apply to your situation.

In Arizona, the law typically allows creditors to garnish a portion of your disposable earnings to repay debts. The maximum garnishment amount is often set at 25% of your disposable income or the amount by which your income exceeds 30 times the federal minimum wage, whichever is less. This ensures that you retain enough income to support yourself, aligning with the Arizona Introduction to Garnishment framework.

The new garnishment rules in Arizona focus on protecting debtors while ensuring that creditors can collect what's owed. Changes include specific limits on the amount that can be garnished from wages and improvements to the notification process. Understanding the Arizona Introduction to Garnishment will help you navigate these rules effectively.

To stop wage garnishment in Arizona, you can challenge the garnishment in court or negotiate directly with your creditor to reach an agreement. Filing a request to release the garnishment can also be an option under specific circumstances. Taking proactive steps is essential, as it can prevent further financial strain. Utilize resources from the Arizona Introduction to Garnishment to understand the procedures involved.

The statute of garnishments in Arizona outlines the legal framework governing how creditors can collect debts through garnishment. This includes specific procedures that must be followed and limits on the amounts that can be garnished. Familiarizing yourself with these statutes empowers you to protect your rights and address any garnishment challenges. For more detailed information, explore the Arizona Introduction to Garnishment.