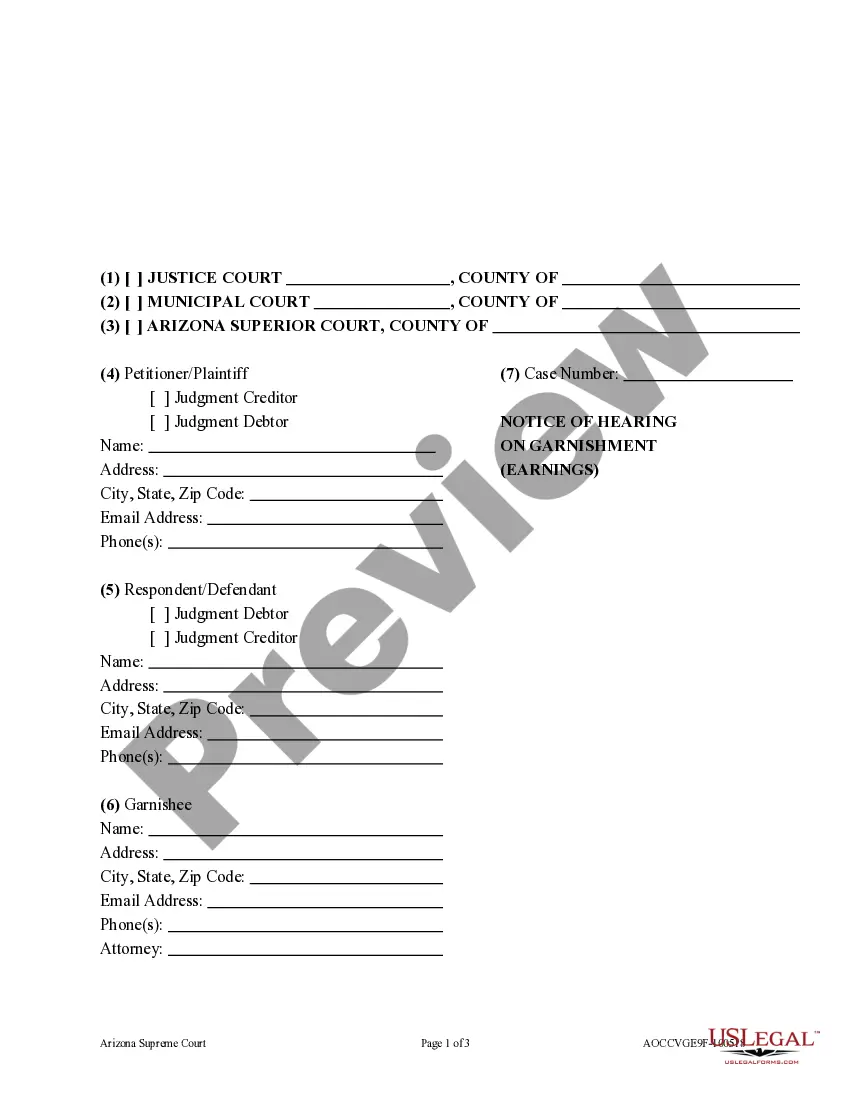

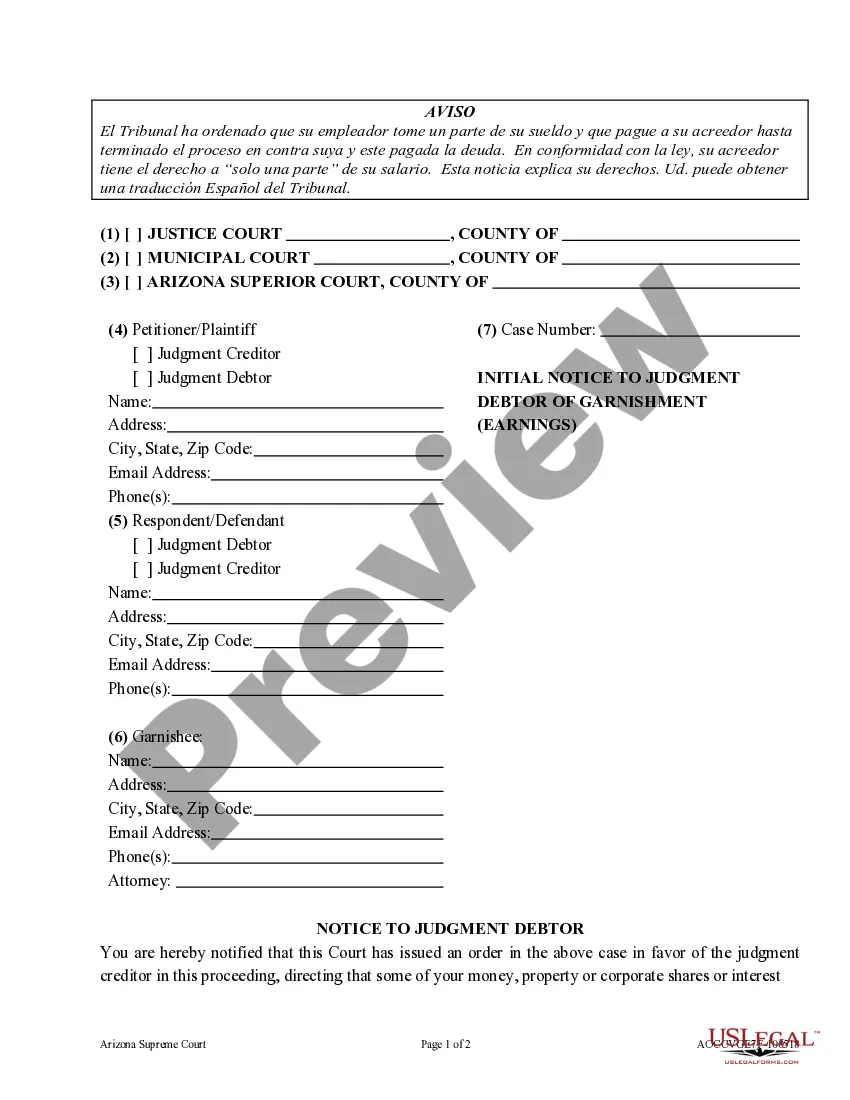

The Arizona Initial Notice to Judgment Debtor of Garnishment is a document that is sent to an individual who has been found liable for a debt in court. This notice informs the debtor that their wages, bank accounts, or other assets may be garnished in order to satisfy the judgment. There are two types of Arizona Initial Notice to Judgment Debtor of Garnishment: one for garnishment of wages and one for garnishment of non-wage property. The notice includes the name of the creditor, the court case number, the date the judgment was entered, and the amount owed. It also includes information about the garnishment procedure, including the rights of the debtor. The notice must be served in accordance with Arizona state law.

Arizona Initial Notice to Judgment Debtor of Garnishment

Description

How to fill out Arizona Initial Notice To Judgment Debtor Of Garnishment?

Drafting legal documents can be quite a hassle unless you have accessible ready-to-use fillable forms. With the US Legal Forms online collection of official paperwork, you can be assured of the blanks you obtain, as they all adhere to federal and state regulations and are validated by our specialists.

Therefore, if you require to complete the Arizona Initial Notice to Judgment Debtor of Garnishment, our platform is the ideal location to obtain it.

Here’s a short guide for you: Document compliance check. You should carefully scrutinize the form's content you wish to ensure that it meets your requirements and complies with your state laws. Reviewing your document and exploring its general overview will assist you in doing just that.

- Acquiring your Arizona Initial Notice to Judgment Debtor of Garnishment from our library is as easy as pie.

- Existing users with an active subscription just need to Log In and hit the Download button after they find the appropriate form.

- Subsequently, if necessary, users can choose the same document from the My documents section of their account.

- However, even if you are new to our service, creating an account with a valid subscription will only take a few moments.

Form popularity

FAQ

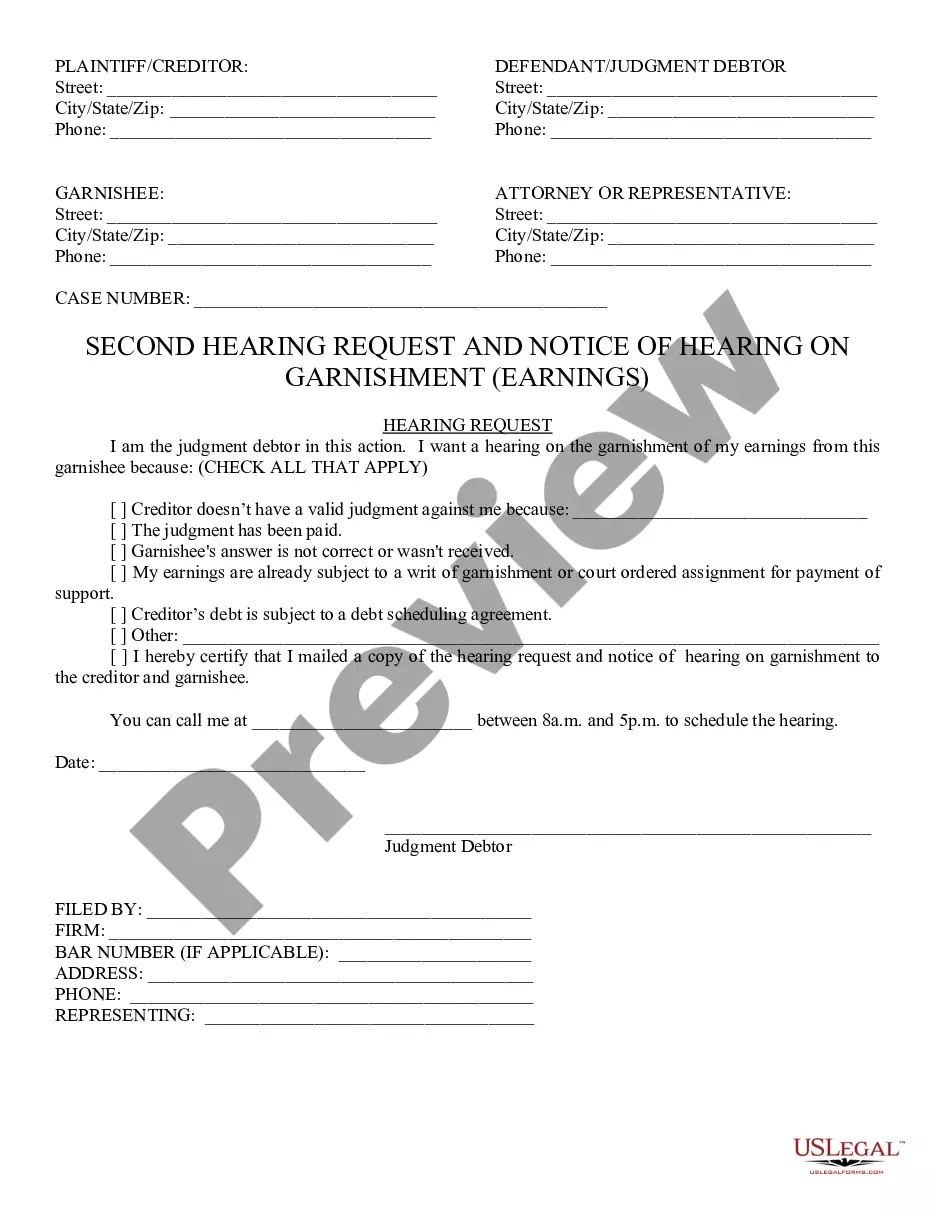

To stop a garnishment in Arizona, debtors often have to file a motion with the court to contest the garnishment or negotiate a settlement with the creditor. It is essential to act quickly upon receiving the Arizona Initial Notice to Judgment Debtor of Garnishment because every day counts in legal processes. Exploring options through platforms like US Legal Forms can provide vital resources and documentation to navigate this situation effectively.

Certain property is exempt from seizure under Arizona law, including primary residences, specific personal items, and some retirement accounts. Understanding these exemptions can provide debtors peace of mind when facing garnishment actions. The Arizona Initial Notice to Judgment Debtor of Garnishment will outline relevant information regarding exemptions to help you protect your assets.

In Arizona, judgments must be filed with the court and are enforceable for a specified period. Parties involved have the right to appeal the judgment or negotiate settlements before enforcement actions, such as garnishments, begin. Awareness of the Arizona Initial Notice to Judgment Debtor of Garnishment aids judgment debtors in understanding their obligations and rights under the law.

If a defendant does not respond to a lawsuit within the specified time, the court may issue a default judgment against them. This ruling means the plaintiff wins without a trial, and they can pursue actions such as garnishment. An early awareness of the Arizona Initial Notice to Judgment Debtor of Garnishment can help you address any potential default scenarios effectively.

In Arizona, the court can order the seizure of various types of personal property if a judgment is entered against you. This property may include bank accounts, vehicles, and other assets. It is crucial to receive the Arizona Initial Notice to Judgment Debtor of Garnishment to understand what can be seized and what your rights are during this process.

In Arizona, a creditor can garnish up to 25% of your disposable earnings, but the specific amount may vary based on your overall financial situation. The law protects a portion of your earnings to ensure you can meet your basic living expenses. Prior to garnishment, creditors must send an Arizona Initial Notice to Judgment Debtor of Garnishment. Understanding these limits can empower you to manage your financial obligations.

In Arizona, a writ of garnishment typically remains valid for up to 90 days from the date it is issued. Creditors must act within this timeframe to collect the owed amount. If the debt remains unpaid, creditors may apply for a renewal of the writ for an additional period. It’s important to respond promptly after receiving the Arizona Initial Notice to Judgment Debtor of Garnishment to protect your rights.

Garnishment in Arizona allows creditors to collect debts by withholding a portion of your wages directly from your paycheck. After receiving an Arizona Initial Notice to Judgment Debtor of Garnishment, your employer must comply with the court's order. Generally, creditors must follow specific legal procedures, including obtaining a court judgment before garnishment can occur. Understanding this process can help you manage your financial situation more effectively.

To stop wage garnishment in Arizona, you can file a motion with the court to challenge the garnishment. This process often involves providing evidence to justify your request. You may also negotiate a payment plan with your creditor or seek assistance from legal aid services. Knowing your rights in relation to the Arizona Initial Notice to Judgment Debtor of Garnishment is critical.

The maximum wage garnishment in Arizona is capped at 25% of your disposable earnings. This regulation aims to ensure that you retain enough income to support your living expenses. When you receive an Arizona Initial Notice to Judgment Debtor of Garnishment, it is important to understand how this amount is calculated. If you find yourself overwhelmed by the garnishment process, uslegalforms offers valuable tools and information to help you manage and respond effectively.