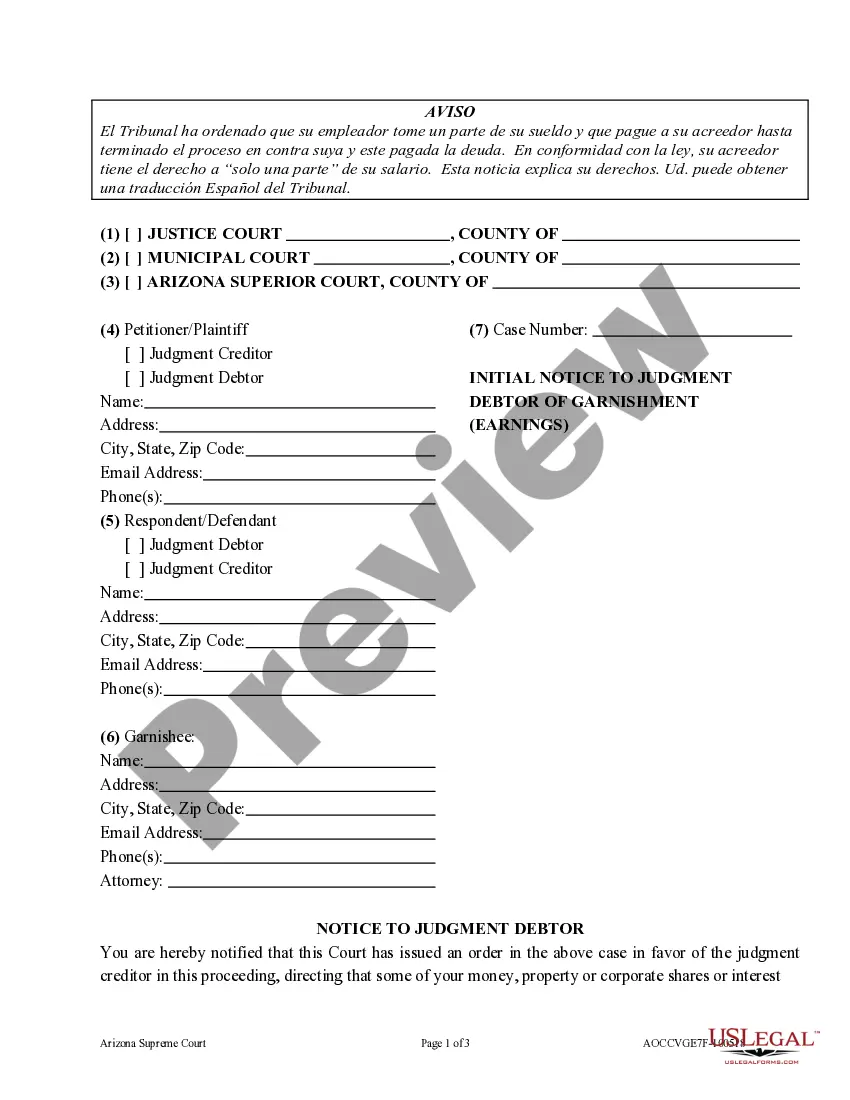

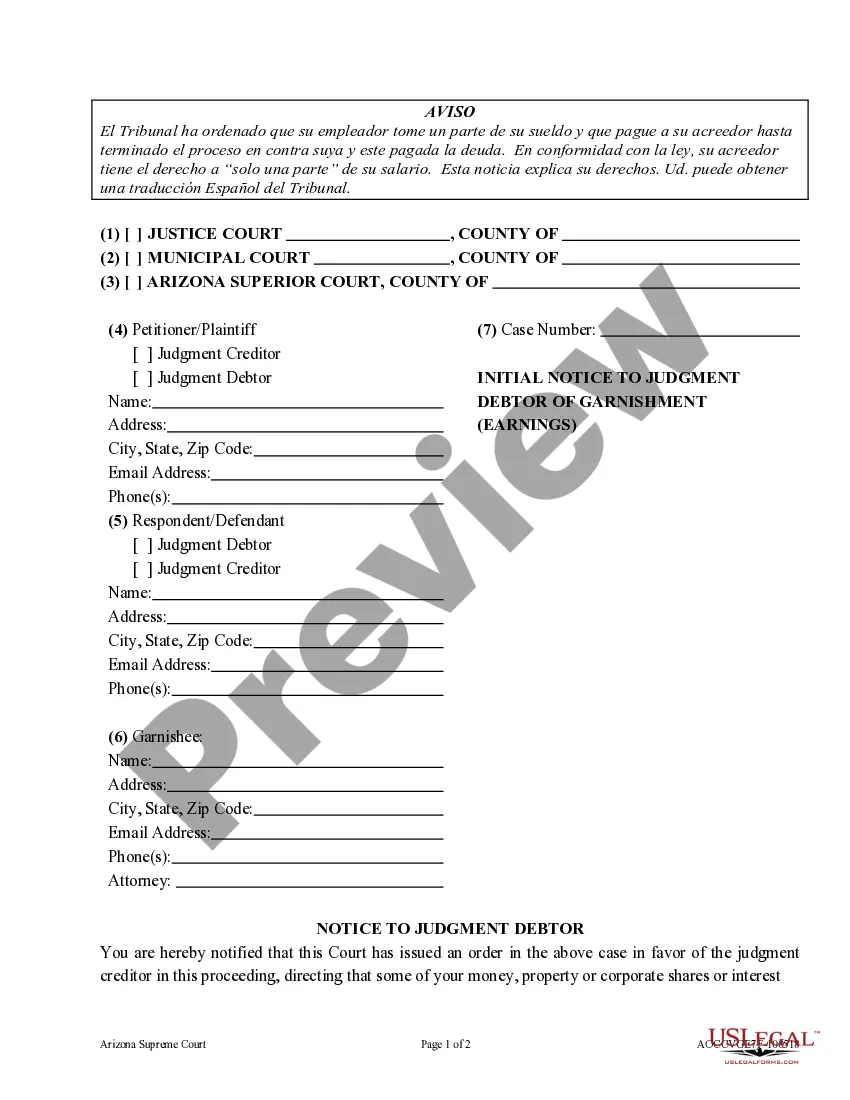

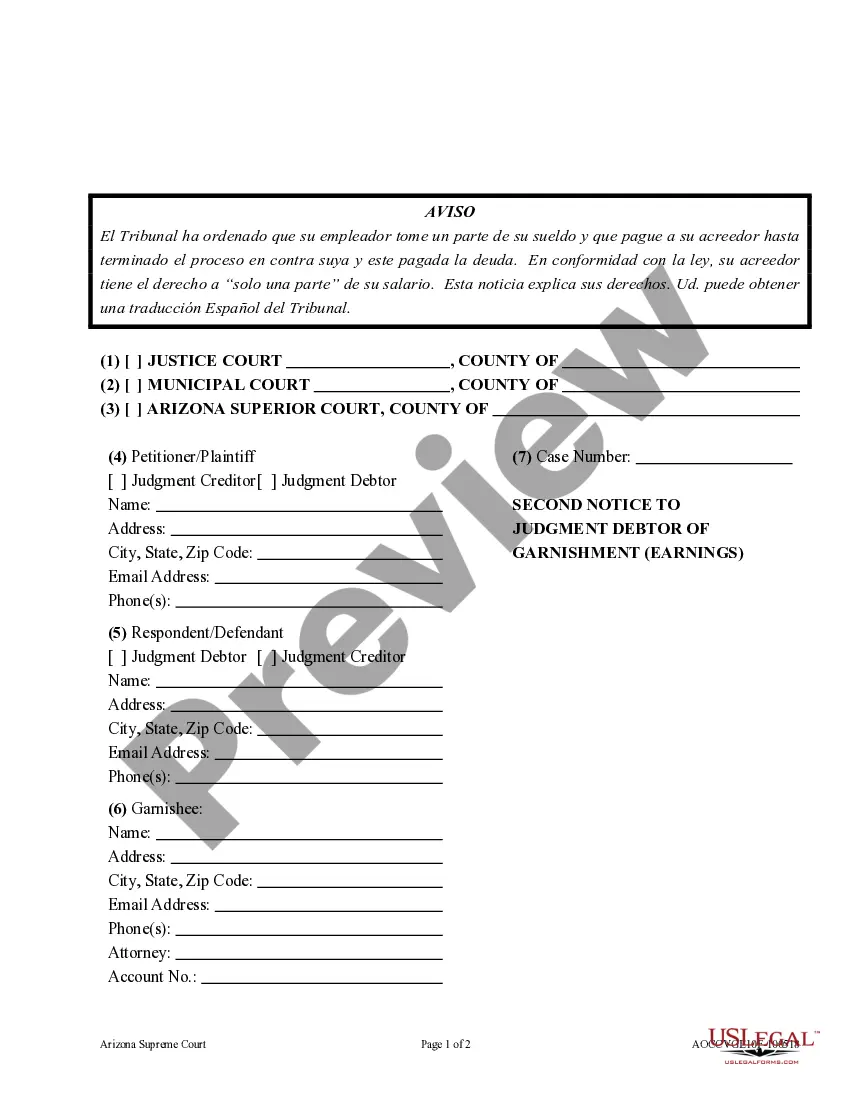

Second Request and Notice of Hearing of Garnishment Earnings: This Notice informs the Judgment Debtor, for a second time, that as a result of his/her non-payment, the Judgment Creditor will now be garnishing his/her wages until such judgment is satisfied. If the Judgment Debtor disagrees with the garnishment proceedings, then he/she is advised to ask for a hearing on the matter. This form is available for download in both Word and Rich Text formats.

Arizona Second Notice to Judgment Debtor of Garnishment

Description

How to fill out Arizona Second Notice To Judgment Debtor Of Garnishment?

If you are in search of accurate Arizona 2nd Request and Notice of Hearing of Garnishment Earnings templates, US Legal Forms is exactly what you require; obtain documents formulated and validated by state-certified attorneys.

Utilizing US Legal Forms not only alleviates your concerns related to legal documents; moreover, it saves you time, effort, and money! Downloading, printing, and completing a professional template is far less expensive than hiring an attorney to do it for you.

And that's it. In just a few simple clicks, you obtain an editable Arizona 2nd Request and Notice of Hearing of Garnishment Earnings. Once you've created your account, all future requests will be processed even more easily. With a US Legal Forms subscription, simply Log In to your account and click the Download button located on the form’s page. Then, when you need this template again, you can always find it in the My documents section. Don't waste your time comparing numerous forms across different websites. Purchase accurate documents from a single, secure service!

- Begin by completing your registration process by providing your email and creating a secure password.

- Follow the instructions below to set up an account and access the Arizona 2nd Request and Notice of Hearing of Garnishment Earnings template to manage your situation.

- Make use of the Preview option or review the document description (if available) to ensure that the template is what you need.

- Verify its validity in your state.

- Click Buy Now to place an order.

- Choose a preferred pricing plan.

- Create an account and pay using your credit card or PayPal.

- Select a suitable format and save the document.

Form popularity

FAQ

Yes, in Arizona, you can have more than one garnishment at the same time. However, each garnishment must adhere to the laws surrounding employee wages and debtor rights. For example, the total withheld from wages cannot exceed a specific percentage of your income. To navigate these legal complexities effectively, consider consulting resources like the Arizona Second Notice to Judgment Debtor of Garnishment through uslegalforms, which can help ensure you understand your options and obligations.

To stop a wage garnishment in Arizona, you must file a motion in the court that issued the garnishment. This motion often requires you to present evidence or documentation that supports your reason for stopping the garnishment. Additionally, you might consider seeking assistance from legal services or platforms like uslegalforms to ensure you're following the correct procedure. The Arizona Second Notice to Judgment Debtor of Garnishment provides vital information for navigating this process.

Yes, a creditor can garnish your bank account in Arizona if they obtain a court order. Once they have this order, they can freeze funds in your account to satisfy a debt. However, there are protections and exemptions available to safeguard certain amounts. The Arizona Second Notice to Judgment Debtor of Garnishment details your rights regarding bank account garnishments.

The amount your check can be garnished in Arizona is generally capped at 25% of your disposable income or a percentage based on federal guidelines. Additionally, specific types of income, such as Social Security or disability benefits, may be exempt from garnishment. Understanding these limits can help you budget better. Referencing the Arizona Second Notice to Judgment Debtor of Garnishment can provide clarity on your situation.

Recent legislation in Arizona has introduced changes to garnishment processes, making them more user-friendly for debtors. This new law includes more transparent rules regarding how garnishments are applied and enforced. It's crucial to stay updated on these changes for better financial management. You can learn more about these modifications in the Arizona Second Notice to Judgment Debtor of Garnishment.

In Arizona, the maximum wage garnishment is generally 25% of your disposable earnings. However, this limit can also depend on the type of debt and the court's determination in some cases. It's essential to check the specifics of your case to ensure compliance with the law. Familiarizing yourself with the Arizona Second Notice to Judgment Debtor of Garnishment can clarify your obligations.

To stop a garnishment in Arizona, you can file a motion with the court that issued the garnishment order. You should present valid reasons why the garnishment should be halted. This process often requires evidence and documentation to support your claims. Remember, understanding the Arizona Second Notice to Judgment Debtor of Garnishment can help you navigate this procedure effectively.

To file a garnishee answer in Arizona, the garnishee must submit a response to the court that issued the garnishment. This answer typically includes details about the debtor's accounts or property that the garnishee holds. Ensure you adhere to the deadlines and legal requirements set forth in the garnishment order. For more information on forms and guidance, US Legal Forms offers comprehensive resources related to Arizona Second Notice to Judgment Debtor of Garnishment.

To stop garnishment in Arizona, you must take action to address the underlying debt or dispute the garnishment in court. You may file a motion to quash the garnishment if it does not comply with legal requirements. Negotiating with your creditor for a possible settlement can also be an effective strategy. For assistance with the necessary legal documents and procedures, consider using US Legal Forms, which specializes in matters like Arizona Second Notice to Judgment Debtor of Garnishment.

In Arizona, the statute governing garnishment procedures is found in the Arizona Revised Statutes, Title 12, Chapter 9. This legislation outlines how creditors can collect debts through garnishment and the rights of debtors. Understanding these laws is crucial to navigate the garnishment process effectively. For detailed insights and templates, visit US Legal Forms, where you can find resources focused on Arizona Second Notice to Judgment Debtor of Garnishment.