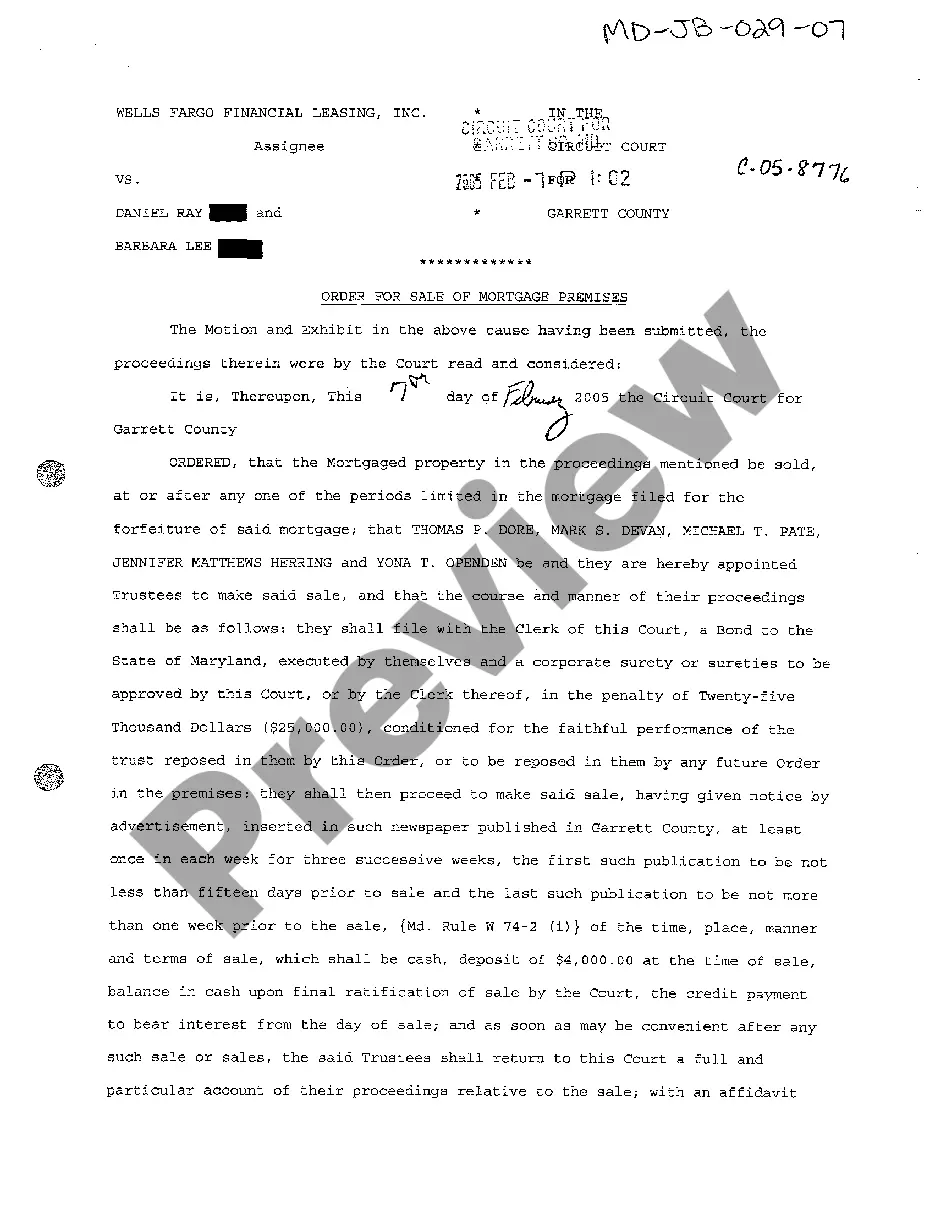

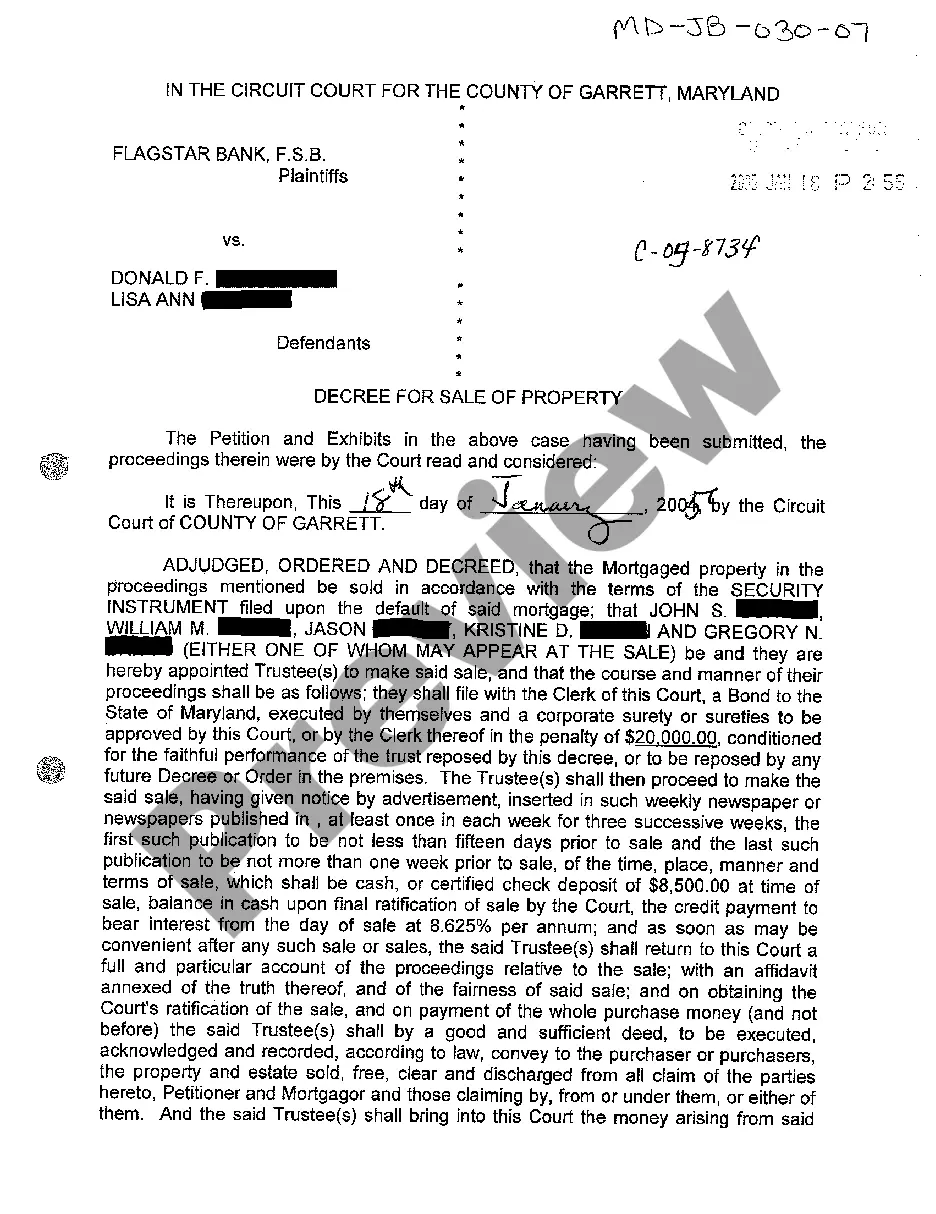

Maryland Order for Sale of Mortgage Premises

Description

How to fill out Maryland Order For Sale Of Mortgage Premises?

You are invited to the finest legal document library, US Legal Forms.

Here you can find any template including Maryland Order for Sale of Mortgage Premises forms and download as many as you desire.

Prepare official paperwork in a few hours instead of days or even weeks, without breaking the bank on a lawyer or attorney.

To create an account, select a pricing plan. Use a credit card or PayPal account to register. Save the template in your required format (Word or PDF). Print the document and fill it out with your or your business’s information. Once you’ve completed the Maryland Order for Sale of Mortgage Premises, forward it to your lawyer for verification. It’s an additional step but a crucial one for ensuring you’re fully protected. Join US Legal Forms today and gain access to a multitude of reusable samples.

- If you are already a registered user, just Log In to your account and then click Download next to the Maryland Order for Sale of Mortgage Premises you need.

- Since US Legal Forms is an online service, you’ll always have access to your saved templates, no matter the device you are using.

- View them in the My documents section.

- If you haven't created an account yet, what are you waiting for.

- Verify the validity of this state-specific form in your residing state.

- Check the description (if provided) to ensure it’s the correct template.

- Explore more details with the Preview feature.

- If the sample meets all your needs, just click Buy Now.

Form popularity

FAQ

The 14-day eviction notice in Maryland is a legal document that a landlord must provide to a tenant before beginning the eviction process for nonpayment of rent or lease violations. This notice serves as a warning and gives tenants a chance to rectify the issue before further action is taken. In cases related to the Maryland Order for Sale of Mortgage Premises, understanding this notice is important for both homeowners and renters facing housing instability. Staying informed can improve your chances of resolving disputes amicably.

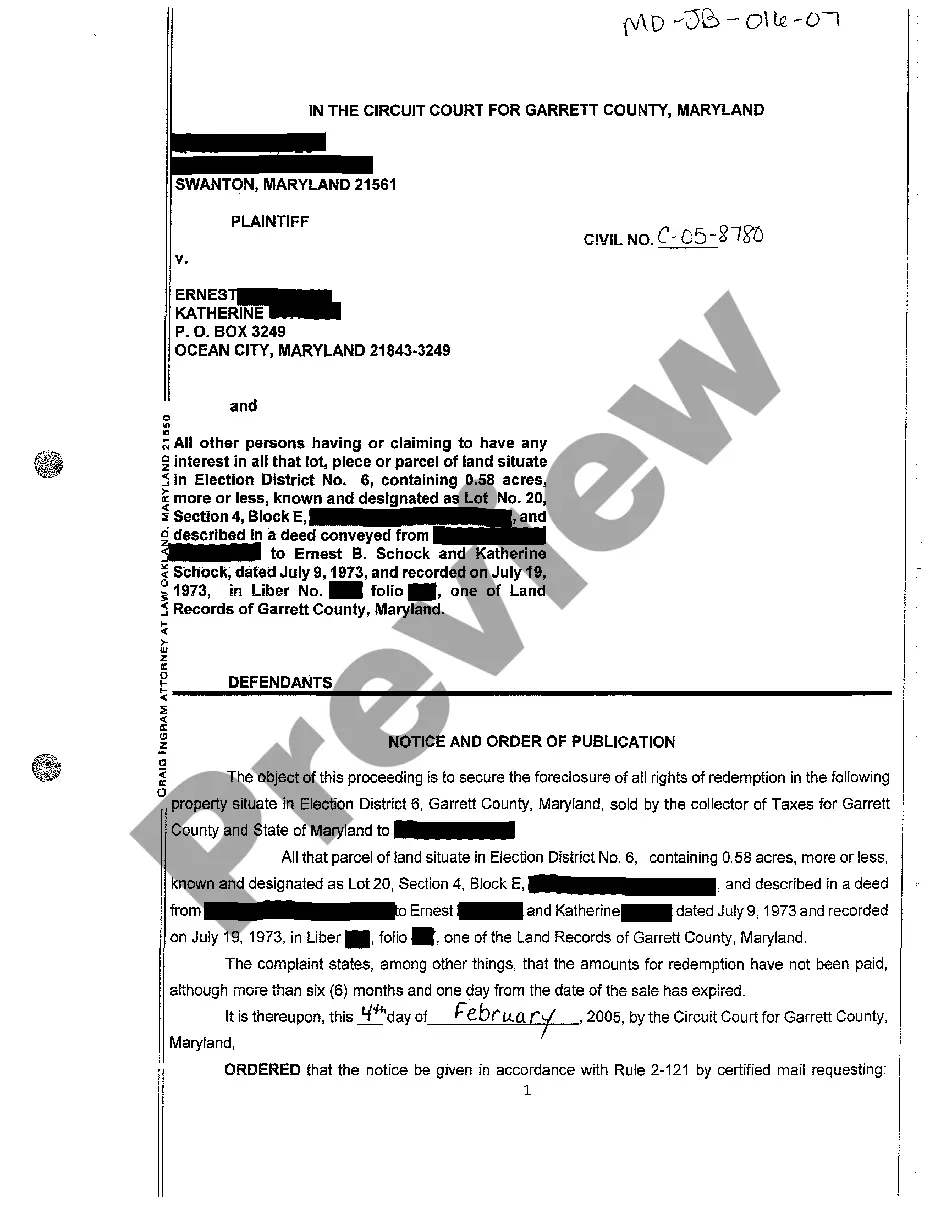

Maryland Foreclosures: A Quasi-Judicial Process. Most foreclosures in Maryland are what's called nonjudicial or quasi-judicial. With a nonjudicial foreclosure, the lender must complete specific out-of-court steps detailed in state law before selling the property.

While you can't redeem your home after the foreclosure sale in Maryland, you do get what is called an "equitable right of redemption" before the sale is finalized.Ratification typically takes place 30 to 45 days after the sale, though this varies from county to county.

States that allow for statutory redemption include California, Illinois, Florida, and Texas.

Maryland is a recourse (deficiency) state. The lender can pursue you for the deficiency. If you can't afford it, you can file bankruptcy to discharge it, or try to work out a deal for a deed in lieu, to surrender the property in satisfaction of the debt.

(Md. Code Ann., Tax-Prop. § 14-833). These six months are called a "redemption period." (In Baltimore City, the redemption period is nine months from the date of sale for owner-occupied residential properties.

Foreclosure auctions are usually held at the courthouse in the county where the property is located. After a sale has taken place, it usually takes approximately 30-45 days for the sale to be ratified, however the ratification time can vary significantly from county to county.

Some states allow foreclosed homeowners to repurchase their property after the foreclosure sale during a post-sale redemption period, but Maryland isn't one of them.

Maryland is a recourse (deficiency) state. The lender can pursue you for the deficiency. If you can't afford it, you can file bankruptcy to discharge it, or try to work out a deal for a deed in lieu, to surrender the property in satisfaction of the debt.