Mississippi Proposal to approve annual incentive compensation plan

Description

How to fill out Proposal To Approve Annual Incentive Compensation Plan?

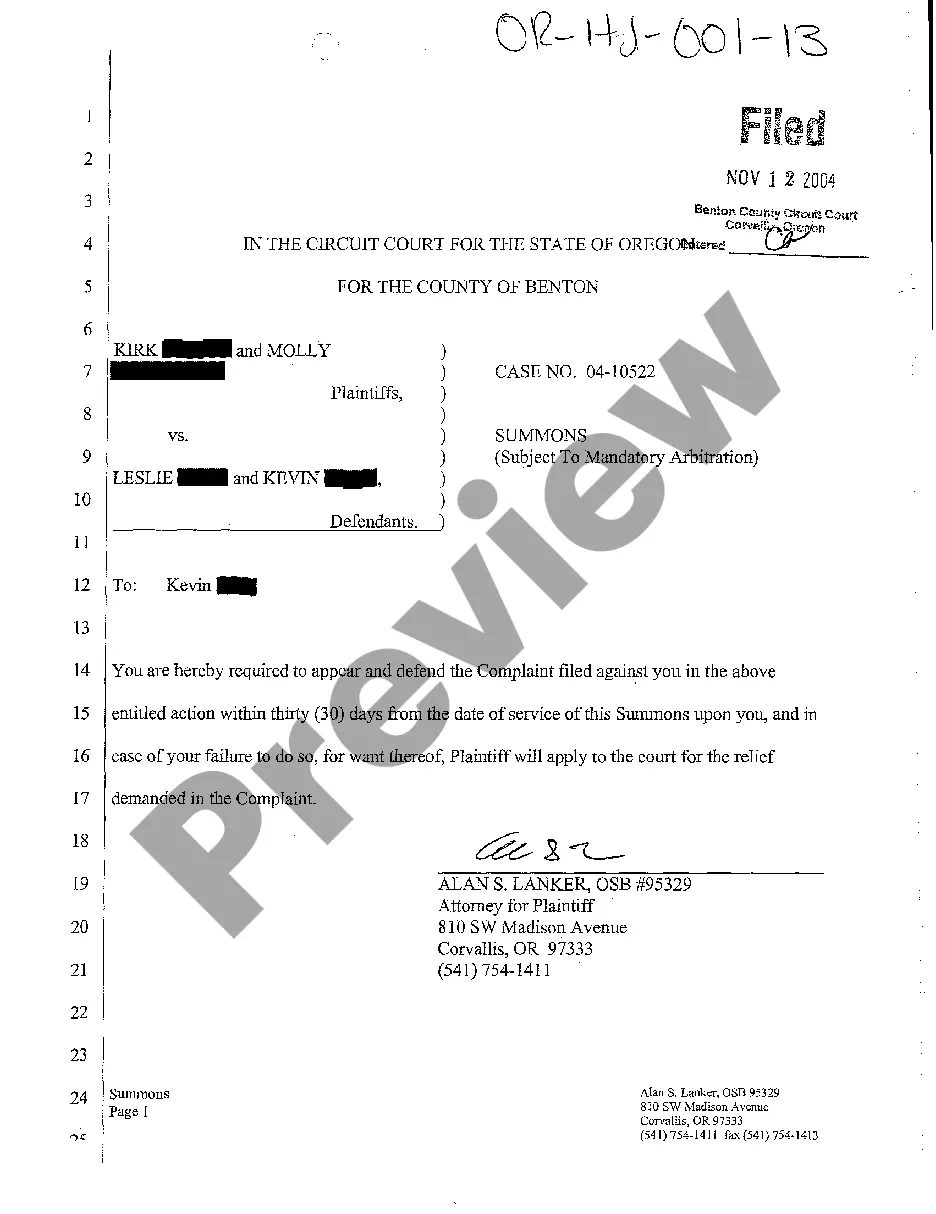

You can devote time on-line trying to find the legal papers design that suits the federal and state demands you want. US Legal Forms gives 1000s of legal forms that happen to be analyzed by experts. You can easily download or print out the Mississippi Proposal to approve annual incentive compensation plan from your assistance.

If you already have a US Legal Forms bank account, you may log in and then click the Obtain key. Afterward, you may full, edit, print out, or signal the Mississippi Proposal to approve annual incentive compensation plan. Each and every legal papers design you purchase is your own property forever. To have yet another backup of the obtained form, go to the My Forms tab and then click the related key.

If you are using the US Legal Forms internet site the first time, keep to the easy directions under:

- Initially, make sure that you have selected the correct papers design for the state/metropolis that you pick. Look at the form description to make sure you have picked out the appropriate form. If accessible, use the Review key to check through the papers design too.

- If you would like find yet another variation of the form, use the Research industry to get the design that fits your needs and demands.

- Once you have identified the design you would like, click on Purchase now to proceed.

- Pick the rates program you would like, key in your references, and sign up for your account on US Legal Forms.

- Comprehensive the financial transaction. You can use your credit card or PayPal bank account to purchase the legal form.

- Pick the format of the papers and download it in your product.

- Make alterations in your papers if possible. You can full, edit and signal and print out Mississippi Proposal to approve annual incentive compensation plan.

Obtain and print out 1000s of papers web templates while using US Legal Forms web site, that provides the greatest variety of legal forms. Use specialist and condition-distinct web templates to take on your company or specific demands.

Form popularity

FAQ

PROGRAM FACTS The amount of the Advantage Jobs rebate is 90 percent of the amount of income tax withheld for employees with new, direct jobs. However, the rebate cannot exceed 4 percent of the new employees' total annual salaries, which exclude benefits not subject to Mississippi income taxes.

The Mississippi Major Economic Impact Act, jointly administered by MDA and the State Bond Commission, was created by the Legislature to provide incentives to aid local communities in the development requirements of large capital projects.

The Mississippi River plays a major role in local, regional, state and national economies, both directly and indirectly, by supporting freight and passenger transportation, manufacturing, agriculture, tourism and outdoor recreation as well as a number of other related industrial sectors.

To qualify, a business must invest at least $1 million in buildings and/or equipment. A corporate income tax credit equal to 5% of eligible investment may be awarded to qualifying manufacturers with a maximum available credit of $1 million per project.

The New Markets Credit allows a credit for income, insurance premium, or premium retaliatory taxes to investors in eligible equity securities issued by a Qualified Community Development Entity that has entered into an allocation agreement with the Community Development Financial Institutions Fund of the U.S. Treasury ...