Mississippi Management Stock Purchase Plan

Description

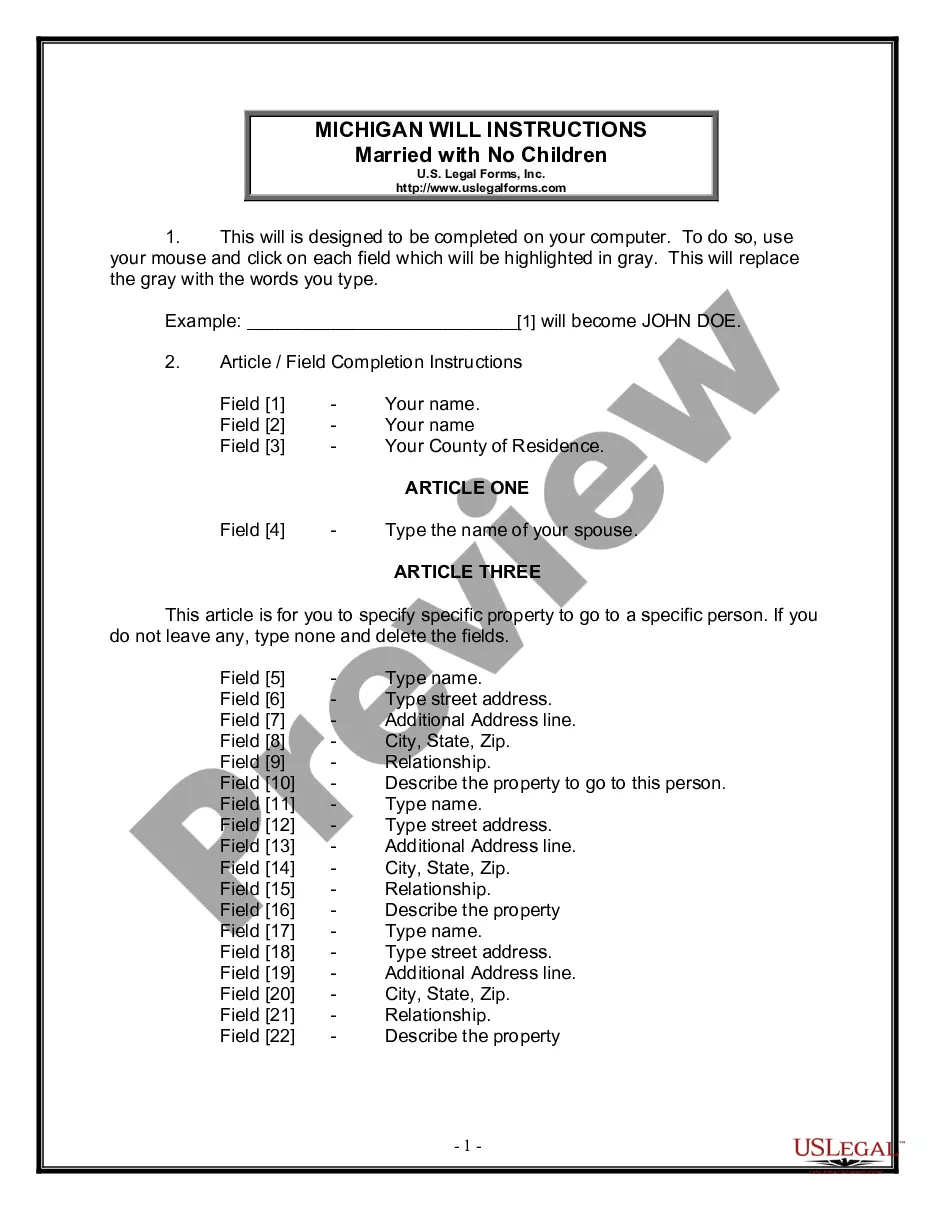

How to fill out Management Stock Purchase Plan?

US Legal Forms - one of several largest libraries of legitimate types in America - delivers a variety of legitimate file templates it is possible to acquire or printing. While using website, you can find thousands of types for enterprise and specific reasons, categorized by types, says, or keywords and phrases.You will discover the latest types of types just like the Mississippi Management Stock Purchase Plan within minutes.

If you already have a subscription, log in and acquire Mississippi Management Stock Purchase Plan from the US Legal Forms library. The Down load key will show up on every kind you see. You have access to all in the past acquired types in the My Forms tab of your own accounts.

If you want to use US Legal Forms for the first time, listed here are basic guidelines to obtain started off:

- Make sure you have picked out the best kind to your metropolis/state. Click the Review key to review the form`s articles. See the kind description to actually have selected the appropriate kind.

- In the event the kind does not satisfy your specifications, use the Lookup industry on top of the display to get the the one that does.

- In case you are content with the shape, affirm your decision by simply clicking the Acquire now key. Then, pick the costs program you want and provide your references to sign up to have an accounts.

- Method the transaction. Utilize your Visa or Mastercard or PayPal accounts to complete the transaction.

- Find the structure and acquire the shape on the device.

- Make alterations. Complete, change and printing and indicator the acquired Mississippi Management Stock Purchase Plan.

Every single design you included with your account does not have an expiration particular date and is the one you have for a long time. So, in order to acquire or printing another duplicate, just proceed to the My Forms section and click in the kind you require.

Obtain access to the Mississippi Management Stock Purchase Plan with US Legal Forms, the most substantial library of legitimate file templates. Use thousands of professional and express-distinct templates that meet your business or specific requirements and specifications.

Form popularity

FAQ

Marsh & Mclennan Companies's analyst rating consensus is a Moderate Buy. This is based on the ratings of 12 Wall Streets Analysts.

Microsoft's Employee Stock Purchase Plan (ESPP) The ESPP allows Microsoft employees to set aside some of their after-tax paychecks to purchase Microsoft stock. Microsoft allows their employees to contribute up to 15% of their salary into the ESPP annually.

Companies usually tie earning equity to tenure (a process called vesting). In most cases, you have to stay for at least a year to vest any equity (your grant may call this a ?one-year cliff?). When you leave, you are only entitled to the portion of that equity that has vested as of the date of your departure.

Yes. The payroll deductions you have set aside for an ESPP are yours if you have not yet used them to purchase stock. You will need to notify your plan administrator and fill out any paperwork required to make a withdrawal. If you have already purchased stock, you will need to sell your shares.

Stock Price Target MMC High$226.00Median$205.00Low$190.00Average$205.58Current Price$197.89

Through this Plan, you can participate in Marsh & McLennan Companies, Inc. ownership by purchasing shares of Company common stock for 95% of its market value on the day of each quarterly purchase.

An employee stock purchase plan (or ESPP) can be a very valuable benefit. In general, if your employer offers an ESPP, we think you should participate at the level you can comfortably afford and then sell the shares as soon as you can.