Mississippi Executive Employee Stock Incentive Plan

Description

How to fill out Executive Employee Stock Incentive Plan?

Should you need to finalize, download, or print sanctioned document templates, utilize US Legal Forms, the largest variety of legal forms accessible online.

Make use of the site's straightforward and convenient search feature to find the documents you require.

Various templates for business and personal purposes are organized by categories and states, or keywords.

Step 4. Once you have found the form you need, click the Get now button. Select your preferred pricing plan and provide your details to register for the account.

Step 5. Complete the payment process. You may use your credit card or PayPal account to finalize the transaction.

- Employ US Legal Forms to locate the Mississippi Executive Employee Stock Incentive Plan with just a few clicks.

- If you are already a customer of US Legal Forms, sign in to your account and click the Download button to retrieve the Mississippi Executive Employee Stock Incentive Plan.

- Additionally, you can access forms you previously downloaded from the My documents tab of your account.

- In case you are using US Legal Forms for the first time, follow the steps outlined below.

- Step 1. Ensure you have selected the form for the correct region/state.

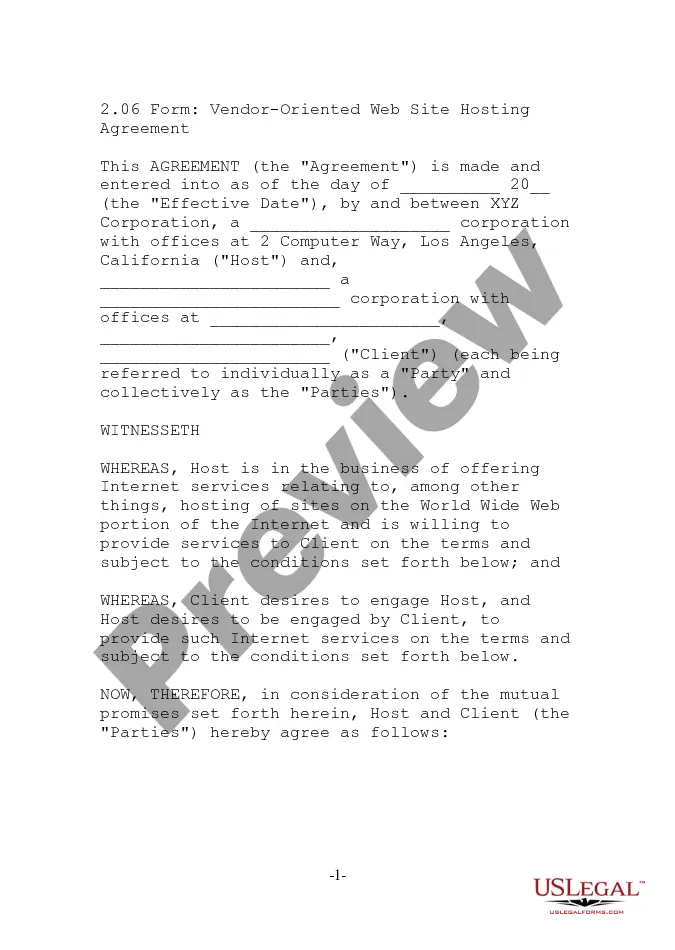

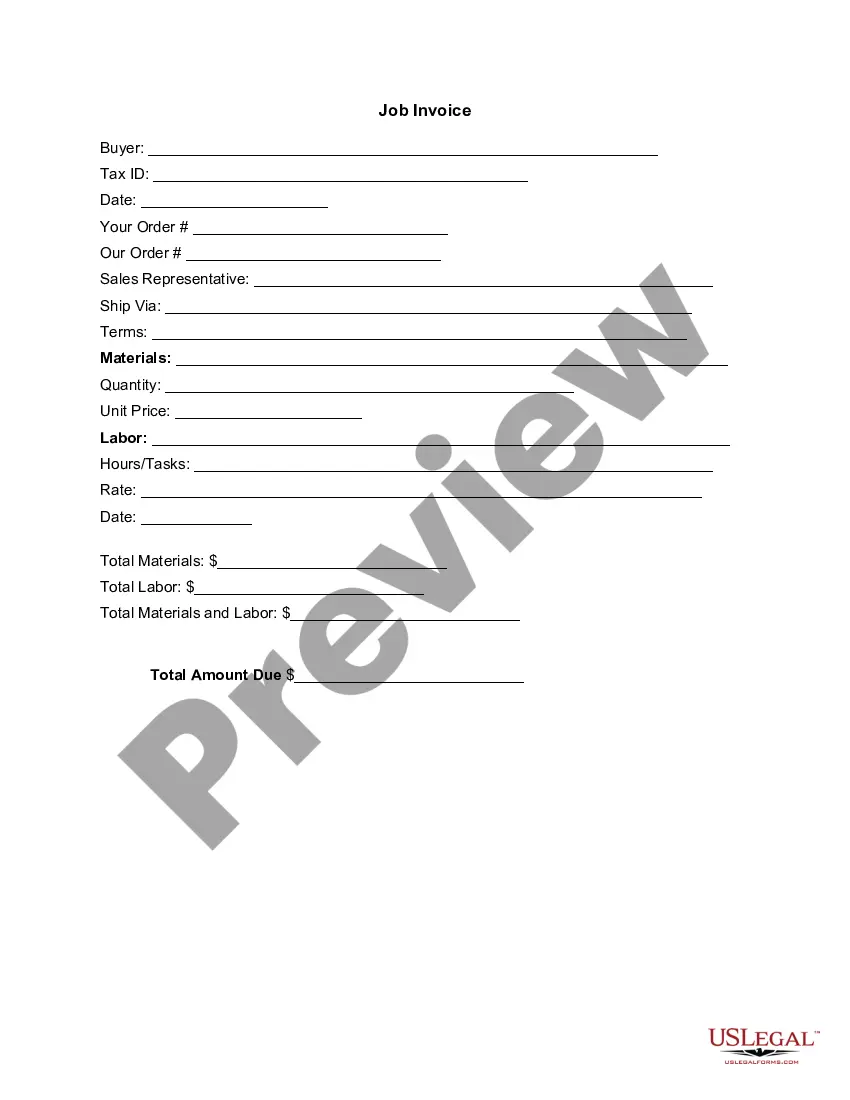

- Step 2. Use the Review feature to check the form's contents. Don't forget to read the description.

- Step 3. If you are not satisfied with the form, utilize the Search field at the top of the screen to find other variations of your legal form template.

Form popularity

FAQ

As a new business, you may qualify for several tax incentives that promote growth and investment. These may include benefits from the Mississippi Executive Employee Stock Incentive Plan, which allows you to attract and retain top talent through stock options. Additionally, leveraging local credits and grants can further enhance your financial position, making it crucial to explore all available options as you establish your presence in Mississippi.

The New Market Tax Credit in Mississippi aims to encourage investments in low-income communities. It provides tax incentives to investors who invest in qualified projects, enhancing the local economic landscape. For businesses looking to benefit, understanding the Mississippi Executive Employee Stock Incentive Plan can complement these investments, as it allows companies to incentivize key employees, driving growth and success.

The Advantage Jobs incentive program in Mississippi focuses on providing financial incentives to create and retain quality jobs in the state. This program promotes workforce development and economic growth, aligning closely with the goals of the Mississippi Executive Employee Stock Incentive Plan. If you're a business leader, leveraging such programs can help you build a stronger company culture and attract top talent.

The employee stock incentive program enables employees to acquire company shares, often at a discount or through stock options. This program fosters employee ownership and motivation, as employees benefit from the company's success. Implementing a robust program, like the Mississippi Executive Employee Stock Incentive Plan, can significantly enhance employee loyalty and satisfaction.

Tax abatement in Mississippi is a financial incentive that reduces or eliminates certain taxes for businesses meeting specific criteria. This initiative encourages business investment and expansion in the state, making it an attractive option for companies. Combining tax abatement with the Mississippi Executive Employee Stock Incentive Plan can provide substantial advantages for both employers and employees.

The growth and prosperity program in Mississippi is designed to promote economic development through funding and support for businesses. By providing assistance, this program can facilitate job creation and business expansion, aligning well with the objectives of the Mississippi Executive Employee Stock Incentive Plan. It's an excellent resource for companies seeking to develop their workforce and enhance employee benefits.

The motion picture incentive program in Mississippi aims to attract filmmakers by offering tax credits and incentives for film productions in the state. This program not only boosts the local economy but also generates potential job opportunities for residents. If you're in the film industry, understanding this program can complement the benefits of the Mississippi Executive Employee Stock Incentive Plan.

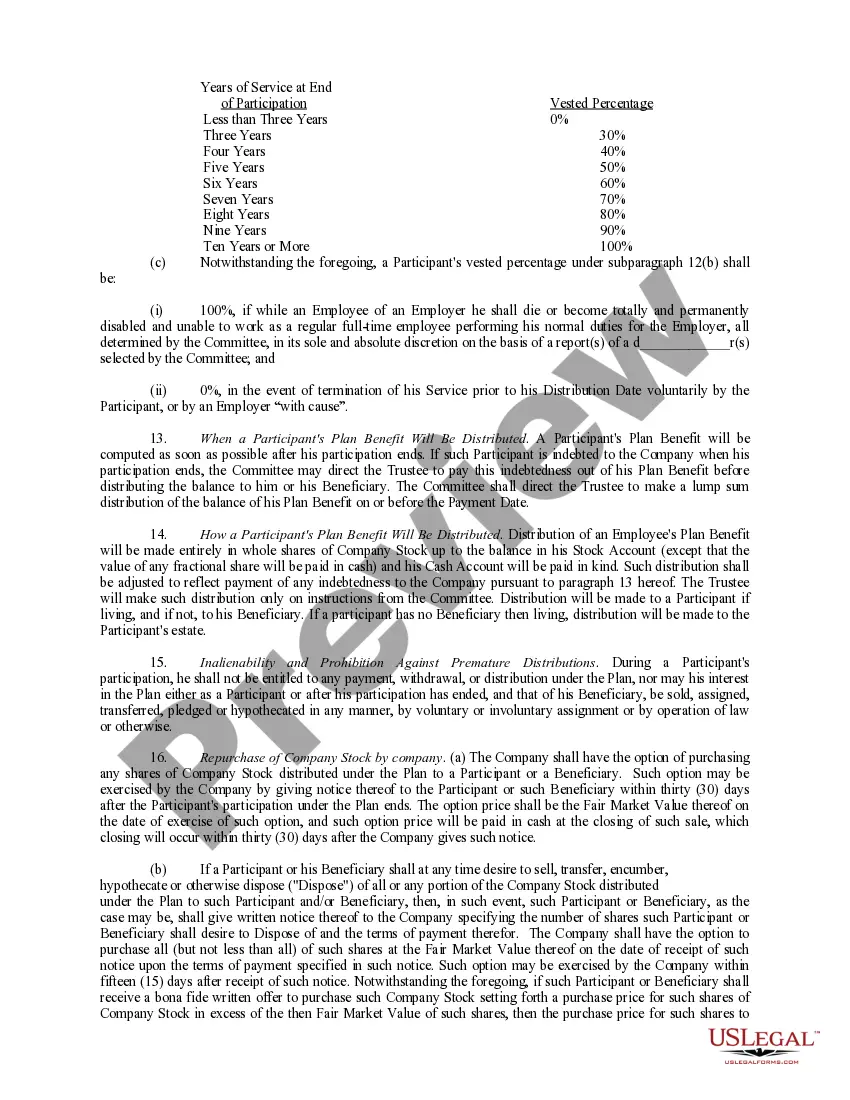

To qualify for incentive stock options under the Mississippi Executive Employee Stock Incentive Plan, you typically need to be an employee of the company offering the options. Key roles might include executives or other key employees who have a significant impact on the company's success. It's essential to review specific eligibility criteria set by your employer, as these can vary.

Mississippi features various tax benefits that can positively impact individuals and businesses alike. It offers low sales tax rates, which can make everyday purchases more affordable. For businesses, implementing a Mississippi Executive Employee Stock Incentive Plan can lead to significant tax advantages while enhancing employee engagement. These benefits collectively foster a thriving economy and support community growth.

Living in Mississippi offers several tax benefits, including lower property tax rates compared to the national average. The state provides incentives for small businesses, such as the Mississippi Executive Employee Stock Incentive Plan, which can help individuals receive favorable stock options. These factors contribute to a more stable financial environment, encouraging growth and investment. By leveraging such benefits, residents can enhance their overall quality of life.