Mississippi Waiver of the Right to be Spouse's Beneficiary

Description

How to fill out Waiver Of The Right To Be Spouse's Beneficiary?

If you need to obtain, download, or print legal document templates, utilize US Legal Forms, the largest collection of legal forms available online.

Take advantage of the site's straightforward and user-friendly search feature to find the documents you require.

Various templates for business and personal use are organized by categories and states, or keywords.

Step 4. Once you have located the form you wish to use, click the Purchase now button. Select the payment plan you prefer and enter your information to register for an account.

Step 5. Complete the transaction. You can use your credit card or PayPal account to finish the payment.

- Utilize US Legal Forms to access the Mississippi Waiver of the Right to be Spouse's Beneficiary in just a few clicks.

- If you are already a US Legal Forms user, Log Into your account and then click the Download button to obtain the Mississippi Waiver of the Right to be Spouse's Beneficiary.

- You can also access forms you have previously downloaded in the My documents section of your account.

- If this is your first time using US Legal Forms, follow the instructions below.

- Step 1. Confirm that you have selected the form for the correct state/region.

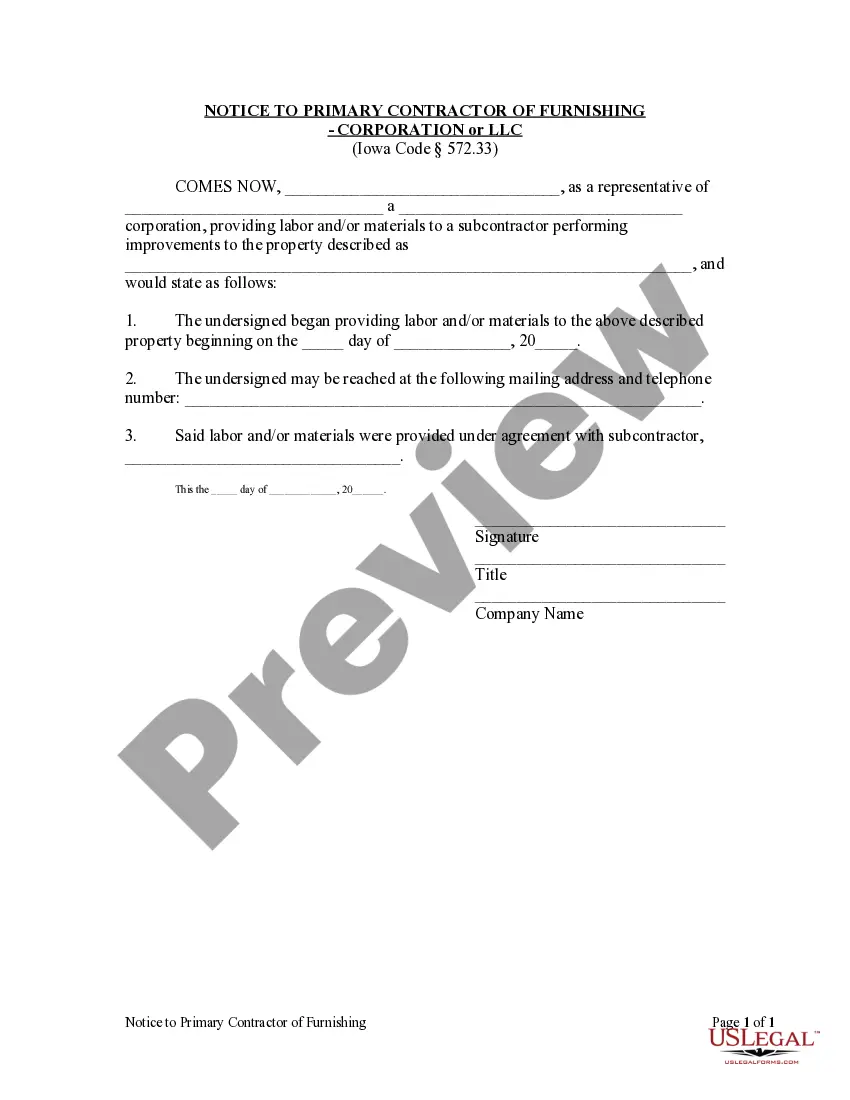

- Step 2. Use the Preview option to review the form’s details. Remember to read the description.

- Step 3. If you are not satisfied with the form, utilize the Search field at the top of the screen to find other forms in the legal form format.

Form popularity

FAQ

ANSWER: Spousal consent is required if a married participant designates a nonspouse primary beneficiary and may be necessary if a 401(k) plan offers one or more annuity forms of distribution. Here is a summary of these rules and the way many 401(k) plans avoid spousal consents.

If this plan is subject to ERISA, the spousal waiver section is only valid for 180 days from the date the Notary Public validates it. The signature on the withdrawal form is valid for 365 days.

Medicaid does not take title or assert ownership to your home. It also includes the value of personal property such as cash, stocks, bonds, automobiles and mobile homes. WHAT IS MEDICAID? Medicaid provides health coverage for eligible, low income populations in Mississippi.

Overview. CalPERS members are eligible for various death benefits. Death benefits range from a simple return of contributions (plus interest) to a monthly allowance. Each member's death benefits can vary significantly, depending on circumstances, data, and employer contract.

Spousal Waiver Form means that form established by the Plan Administrator, in its sole discretion, for use by a spouse to consent to the designation of another person as the Beneficiary or Beneficiaries under a Participant's Account.

The answer is that your home is not considered a countable asset when applying for Medicaid. As a result, in order to collect costs from the deceased persons estate, Medicaid can take your home after death. This is referred to as estate recovery.

Mississippi Health Benefits for Children Health benefits for children from birth to age 19 are provided through Medicaid.

Form of spousal consent to be used to enforce transfer and voting restrictions contained in a shareholders' agreement, voting agreement, operating agreement, or similar document against the spouse or domestic partner of a shareholder or member in California.

Form 4 is used when the spouse of a member/former member of a pension plan agrees to waive or give up his or her right to receive survivor's benefits to permit the member/former member to designate a beneficiary other than the spouse for benefits in 2022 a pension plan, if pension payments have not started, 2022 a locked-in

Monthly Payments The 1957 Survivor Benefit is a monthly allowance to an eligible surviving spouse, registered domestic partner, or minor child equal to half of the highest service retirement benefit payable had the member retired on the date of death.