Mississippi Franchisee Closing Questionnaire

Description

How to fill out Franchisee Closing Questionnaire?

Are you inside a situation that you need to have paperwork for sometimes organization or person purposes almost every time? There are a variety of authorized document themes accessible on the Internet, but getting kinds you can depend on isn`t simple. US Legal Forms provides 1000s of kind themes, such as the Mississippi Franchisee Closing Questionnaire, which are written to satisfy state and federal requirements.

Should you be presently acquainted with US Legal Forms web site and get a merchant account, simply log in. Afterward, you can obtain the Mississippi Franchisee Closing Questionnaire design.

Unless you come with an accounts and want to begin using US Legal Forms, follow these steps:

- Find the kind you will need and ensure it is to the correct town/area.

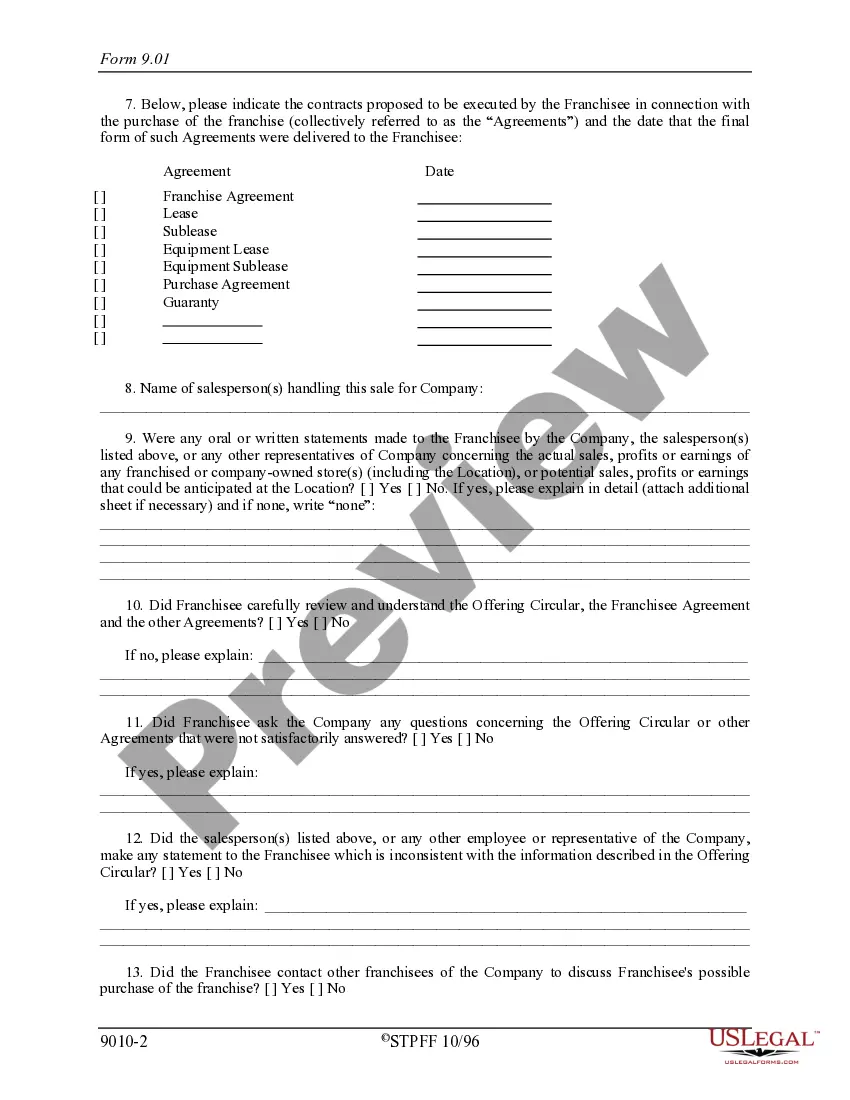

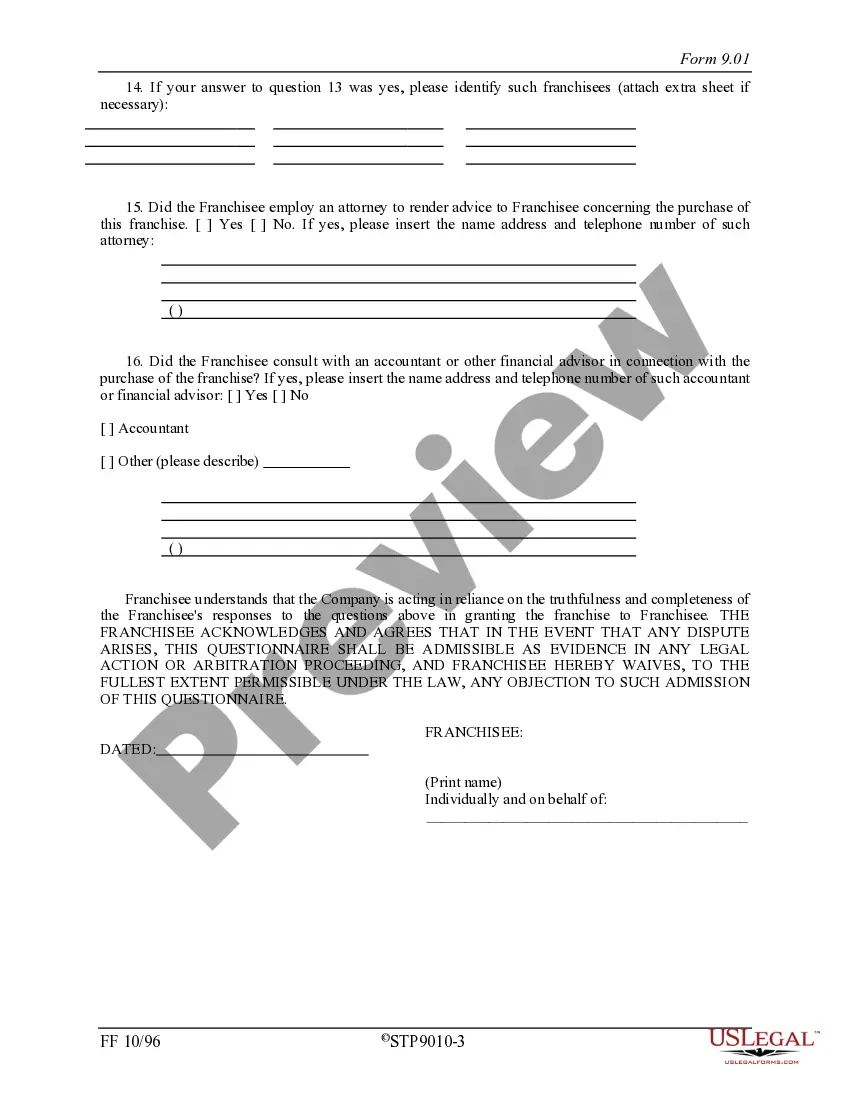

- Use the Review key to check the shape.

- See the outline to ensure that you have selected the correct kind.

- When the kind isn`t what you are trying to find, make use of the Lookup discipline to get the kind that meets your needs and requirements.

- When you get the correct kind, click on Acquire now.

- Opt for the pricing prepare you want, fill in the necessary info to generate your money, and buy the order with your PayPal or Visa or Mastercard.

- Select a hassle-free file structure and obtain your backup.

Find each of the document themes you may have purchased in the My Forms menu. You can obtain a additional backup of Mississippi Franchisee Closing Questionnaire whenever, if needed. Just click the necessary kind to obtain or print the document design.

Use US Legal Forms, one of the most comprehensive variety of authorized types, in order to save time as well as avoid mistakes. The service provides skillfully made authorized document themes which you can use for a variety of purposes. Produce a merchant account on US Legal Forms and begin making your daily life a little easier.

Form popularity

FAQ

Public Law 86-272 potentially applies to companies located outside of California whose only in-state activity is the solicitation of sale of tangible personal property to California customers. Businesses that qualify for the protections of Public Law 86-272 are exempt from state taxes that are based on your net income.

86-272 prohibits states from imposing income taxes, such as corporate or franchise tax, under specific conditions. Out-of-state businesses whose activities in California are limited to selling tangible personal property and soliciting sales may be exempt from state income tax.

Hear this out loud Pause¶16-310, Subtractions--Net Operating Loss Mississippi allows a subtraction from the taxable income base for net operating losses. NOLs may be carried back two years and carried forward 20 years.

Hear this out loud PausePublic Law 86-272 (15 USC Section 381) prevents States from asserting their right to impose a tax based on net income, such as the corporate income tax or franchise tax. Public Law 86-272 protection is available to out-of-state business entities that: Sell tangible personal property in this state.

PL 86-272 or the Interstate Income Act of 1959 does provide limited protection from a state's net income tax. In order to qualify for this protection, a company can only be selling tangible personal property (TPP) in the state. It can not be offering any additional services or intangibles.

PL 86-272 prohibits a state from imposing a net income tax on the income of a person derived within the state from interstate commerce if the only business activities within the state conducted by or on behalf of the person consist of the solicitation of orders for sales of tangible personal property.

Hear this out loud PauseMississippi Business Taxes This tax is imposed on corporations or associations doing business in Mississippi. The Franchise tax is calculated at $2.50 per $1,000 of the value of the capital employed or the assessed property values in Mississippi, whichever is greater. The minimum franchise tax payment due is $25.

Hear this out loud PauseYou must also submit an account closure request by logging on to TAP and selecting "Close This Account" under "I Want To" and then select the "More" tab. If you are not able to submit a request online, you may fax a signed written request to the Withholding Division at (601) 923-7188.