Mississippi Bill of Sale of Personal Property - Reservation of Life Estate in Seller

Description

How to fill out Bill Of Sale Of Personal Property - Reservation Of Life Estate In Seller?

Are you in a location where you frequently require documents for organizational or personal purposes.

There are numerous legal document templates accessible online, but finding ones you can trust isn't easy.

US Legal Forms offers a vast array of form templates, such as the Mississippi Bill of Sale of Personal Property - Reservation of Life Estate in Seller, which are designed to comply with federal and state regulations.

Select the pricing plan you want, fill out the required information to create your account, and pay for the transaction using PayPal or a credit card.

Choose a convenient file format and download your copy.

- If you are already familiar with the US Legal Forms website and have an account, simply Log In.

- Afterward, you can download the Mississippi Bill of Sale of Personal Property - Reservation of Life Estate in Seller template.

- If you do not have an account and wish to start using US Legal Forms, follow these steps.

- Look for the form you need and ensure it is for the correct city/county.

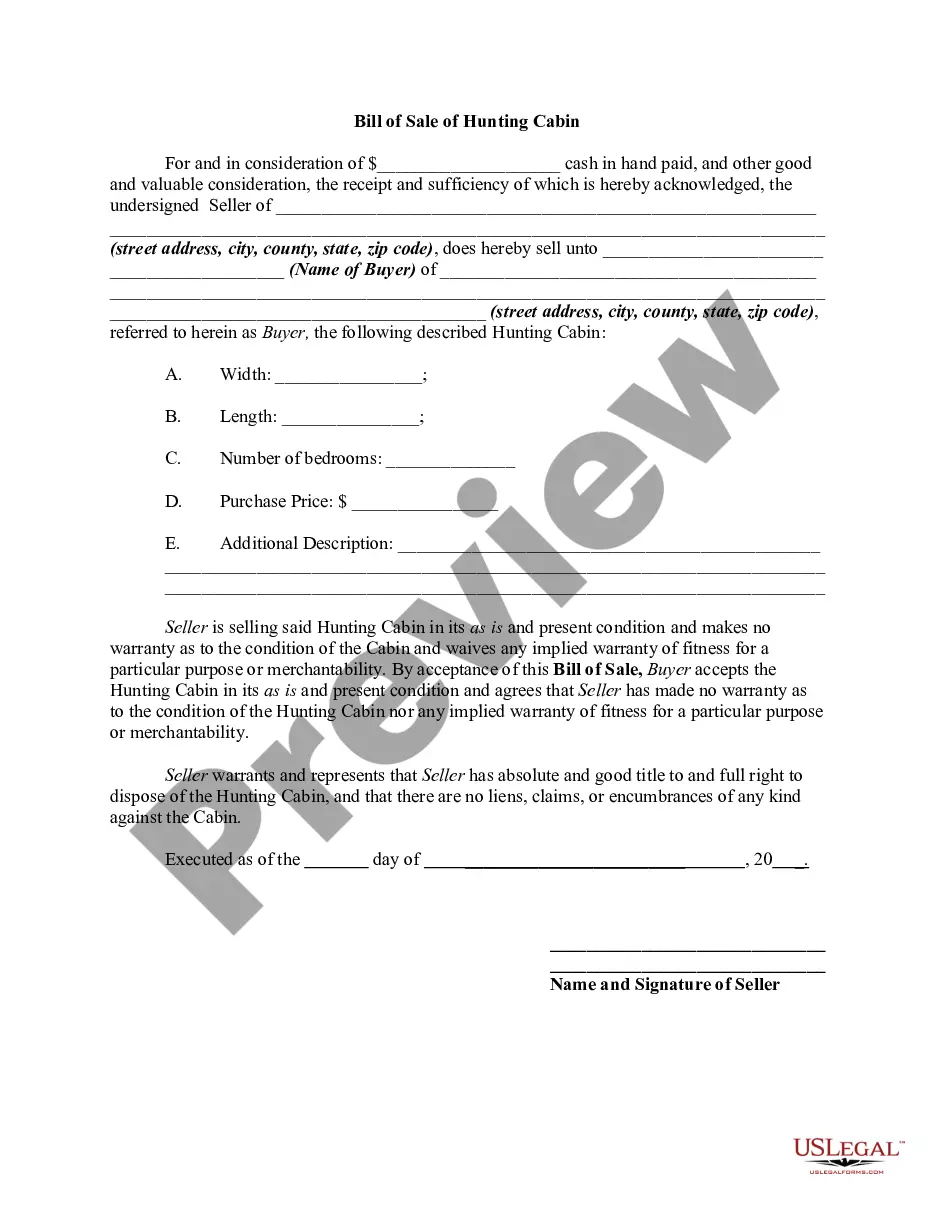

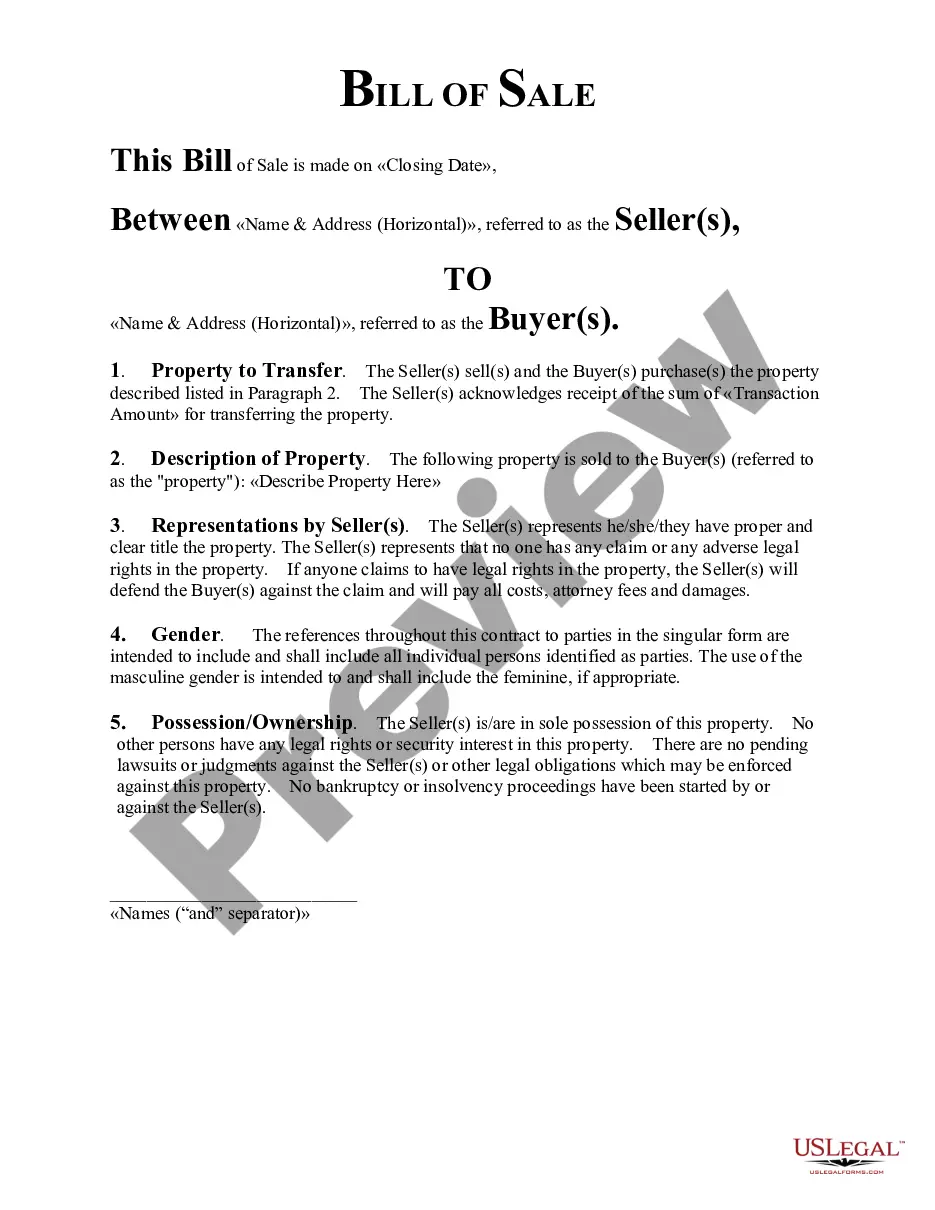

- Use the Review button to view the form.

- Check the description to confirm that you have chosen the correct form.

- If the form is not what you are looking for, use the Search field to find the form that fits your needs and requirements.

- Once you have the right form, click Get now.

Form popularity

FAQ

Life estate consThe life tenant cannot change the remainder beneficiary without their consent.If the life tenant applies for any loans, they cannot use the life estate property as collateral.There's no creditor protection for the remainderman.You can't minimize estate tax.More items...

If an object is physically and permanently attached or fastened to the property, it's considered a fixture. This includes items that have been bolted, screwed, nailed, glued or cemented onto the walls, floors, ceilings or any other part of the home. A classic example of this is a window treatment.

If a couple has a life estate and one spouse dies, the remaining spouse is the sole owner of the life estate. When the remaining spouse dies, the person holding the remainder interest then has the right to possess and use the property. 2022 It is possible to have a life estate interest in a.

A life estate helps avoid the probate process upon the life tenant's death. The property will automatically transfer to the remainderman, making the process simple and easy a will isn't needed for the transfer to happen.

What are the pros and cons of life estates?Possible tax breaks for the life tenant.Reduced capital gains taxes for remainderman after death of life tenant.Capital gains taxes for remainderman if property sold while life tenant still alive.Remainderman's financial problems can affect the life tenant.More items...?

Everything you own, aside from real property, is considered personal property. This includes material goods such as all of your clothing, any jewelry, all of your household goods and furnishings, and anything else that is movable and not permanently attached to a fixed location such as your home.

In a nutshell, real property is anything that's immovable and attached to the house - walls, windows, blinds, light fixtures, doors, and (most) appliances. Personal property is anything that can be moved or taken from the house - furniture, artwork, above-ground hot tubs, and more.

Personal property may not be included as additional security for any mortgage on a one-unit property unless otherwise specified by Fannie Mae. For example, certain personal property is pledged when the Multistate Rider and Addenda (Form 3170) is used.

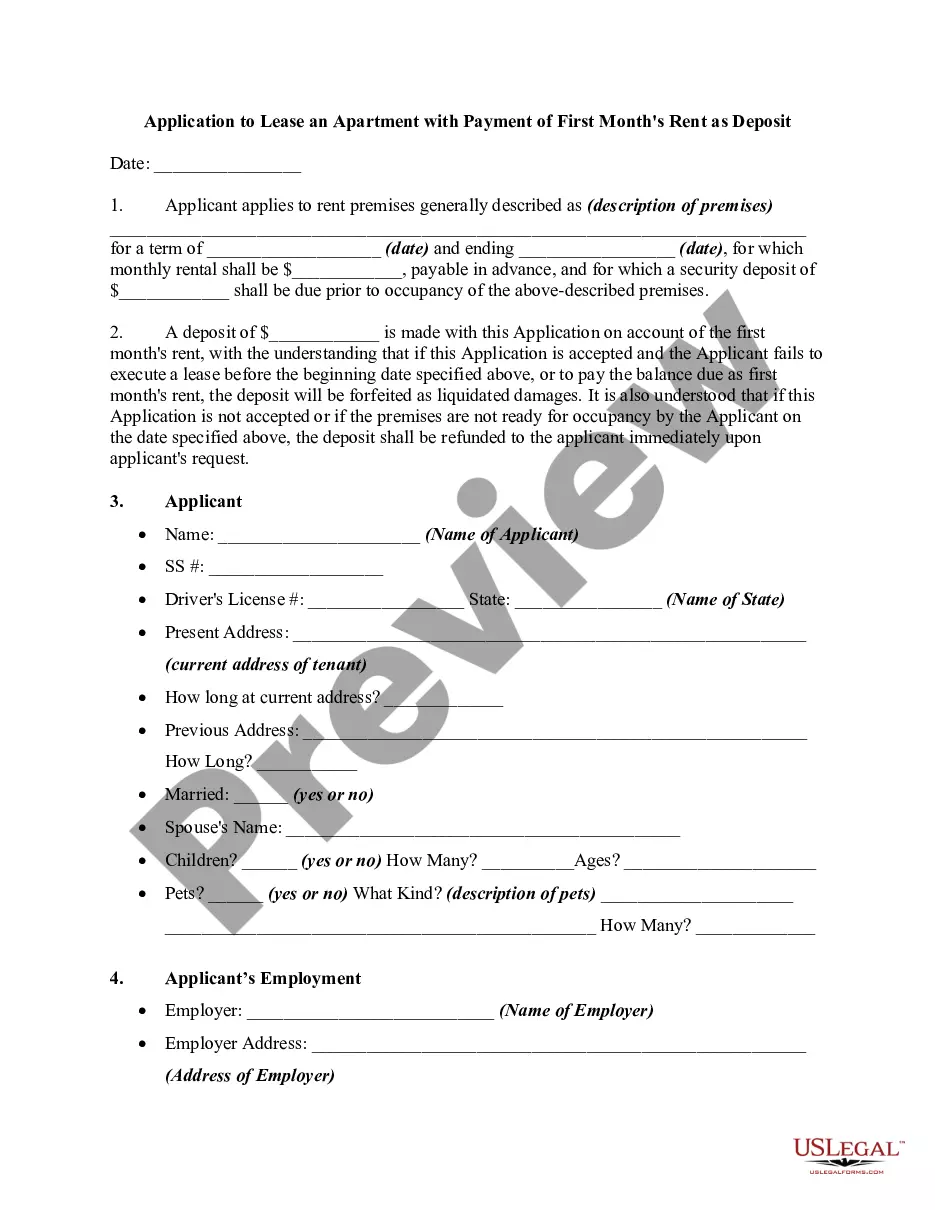

You should include:Land or real estate location.Property description.Sale date.Sale price for the land or real estate.Contact information for the buyer and seller.Terms and conditions of the sale (for example, the buyer accepts property as is)

Legally, the items you listed are personal property because they are not permanently attached to the house. Unless specifically itemized, such personal property is not included in the home sale.