Mississippi Agreement to Extend Closing or Completion Date

Description

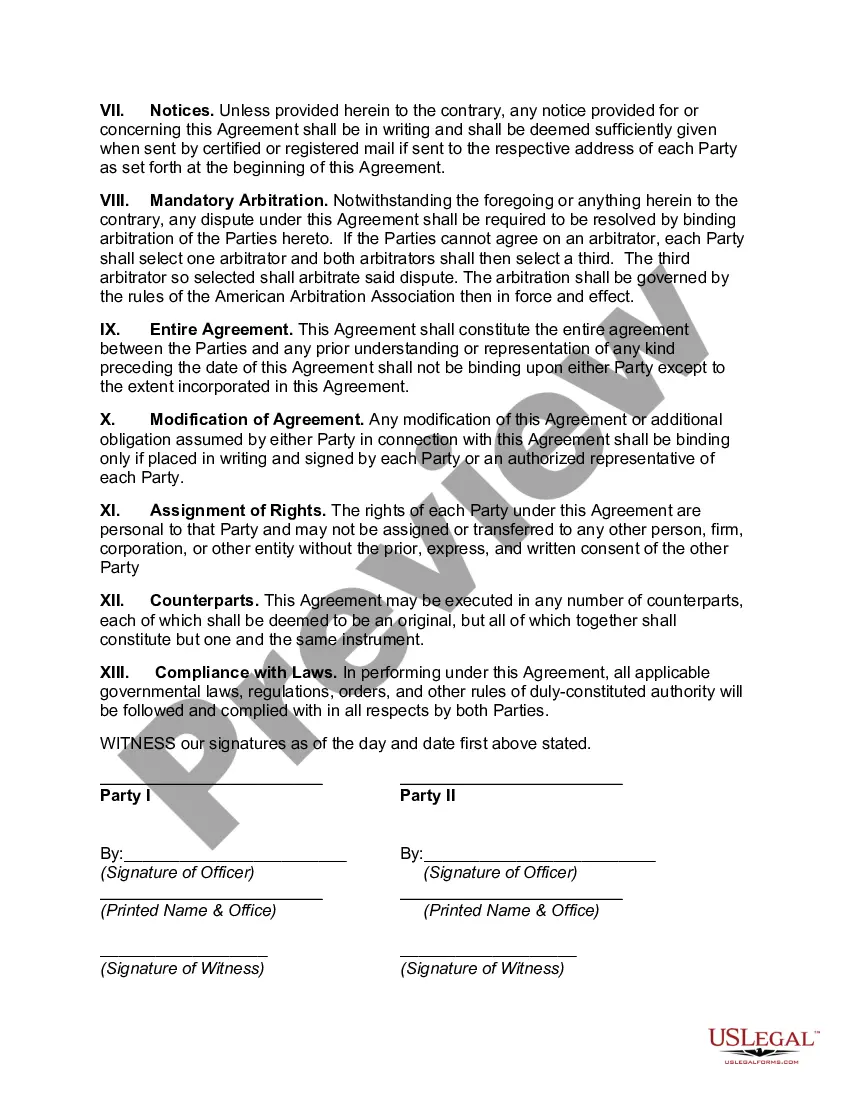

How to fill out Agreement To Extend Closing Or Completion Date?

US Legal Forms - one of the largest collections of legal templates in the United States - offers a variety of legal document samples that you can download or print.

By utilizing the website, you can discover thousands of forms for both business and personal needs, organized by categories, states, or keywords.

You can access the latest editions of forms such as the Mississippi Agreement to Extend Closing or Completion Date in just seconds.

Review the form details to confirm you have selected the appropriate form.

If the form does not meet your needs, utilize the Search box at the top of the screen to find one that does.

- If you have an account, Log In and download the Mississippi Agreement to Extend Closing or Completion Date from the US Legal Forms collection.

- The Download button appears on every form you view.

- You can access all previously saved forms in the My documents section of your profile.

- To begin using US Legal Forms for the first time, here are some straightforward instructions.

- Ensure you have selected the correct form for your region/county.

- Click on the Preview button to review the form's details.

Form popularity

FAQ

If you cannot close by the closing date, the Mississippi Agreement to Extend Closing or Completion Date serves as a vital tool. Typically, the parties involved may negotiate an extension to avoid potential penalties or loss of deposit. Failing to close on time may lead to legal consequences or the possibility of losing the property. Therefore, discussing options with your agent or legal representative is crucial to ensure a smooth resolution.

If a house doesn't close by the closing date, several implications arise for both buyers and sellers. Typically, parties may need to sign a Mississippi Agreement to Extend Closing or Completion Date to continue the transaction. This extension provides time for issues to be resolved, which could include financing delays or inspection concerns. Understanding the terms of your agreement can help you navigate this process smoothly and avoid potential penalties.

An extension of an existing agreement refers to modifying the original terms to prolong its duration. This can involve revising deadlines or completion dates, such as in a Mississippi Agreement to Extend Closing or Completion Date. The extension should be documented formally to maintain clarity and legal validity.

One action you can take is relatively simple: grant the buyer an extension, no strings attached. Your real estate agent can negotiate a new closing date that generally will add an additional 10 to 30 days to the closing date, giving the buyer more time to tie up their loose ends.

Reasons for an Extension to CloseUnexpected causes such as low appraisals, lender issues, or even a divorce can make an extended closing date necessary. Many times, the delays are due to poor communication between the lender and closing agent or Title Company.

One action you can take is relatively simple: grant the buyer an extension, no strings attached. Your real estate agent can negotiate a new closing date that generally will add an additional 10 to 30 days to the closing date, giving the buyer more time to tie up their loose ends.

What happens if the lender misses the closing date? If the lender doesn't approve your loan by the closing date, then the purchase contract may expire. The seller might agree to push back the closing date to allow you more time to get your loan, but they don't have to.

A closing date is like a term paper deadline: you need to meet it. But life happens, and sometimes you need an extension. In fact, about 1 in 4 closings experience delays, according to the National Association of Realtors (NAR).

If the buyer uncovers issues but still wants to buy the house, the buyer can request the seller address the issues. If the seller agrees, both parties may agree to extend the closing date to provide the needed time for the seller to correct the issues.