Mississippi Sample Letter regarding Information for Foreclosures and Bankruptcies

Description

How to fill out Sample Letter Regarding Information For Foreclosures And Bankruptcies?

Finding the right legal papers web template could be a battle. Obviously, there are a variety of layouts available on the net, but how will you discover the legal form you need? Take advantage of the US Legal Forms web site. The services gives 1000s of layouts, such as the Mississippi Sample Letter regarding Information for Foreclosures and Bankruptcies, which can be used for business and personal needs. Every one of the types are inspected by experts and meet state and federal specifications.

When you are presently registered, log in for your account and click on the Down load button to obtain the Mississippi Sample Letter regarding Information for Foreclosures and Bankruptcies. Make use of your account to check throughout the legal types you may have bought earlier. Visit the My Forms tab of the account and acquire yet another copy of your papers you need.

When you are a whole new customer of US Legal Forms, listed below are basic directions that you should follow:

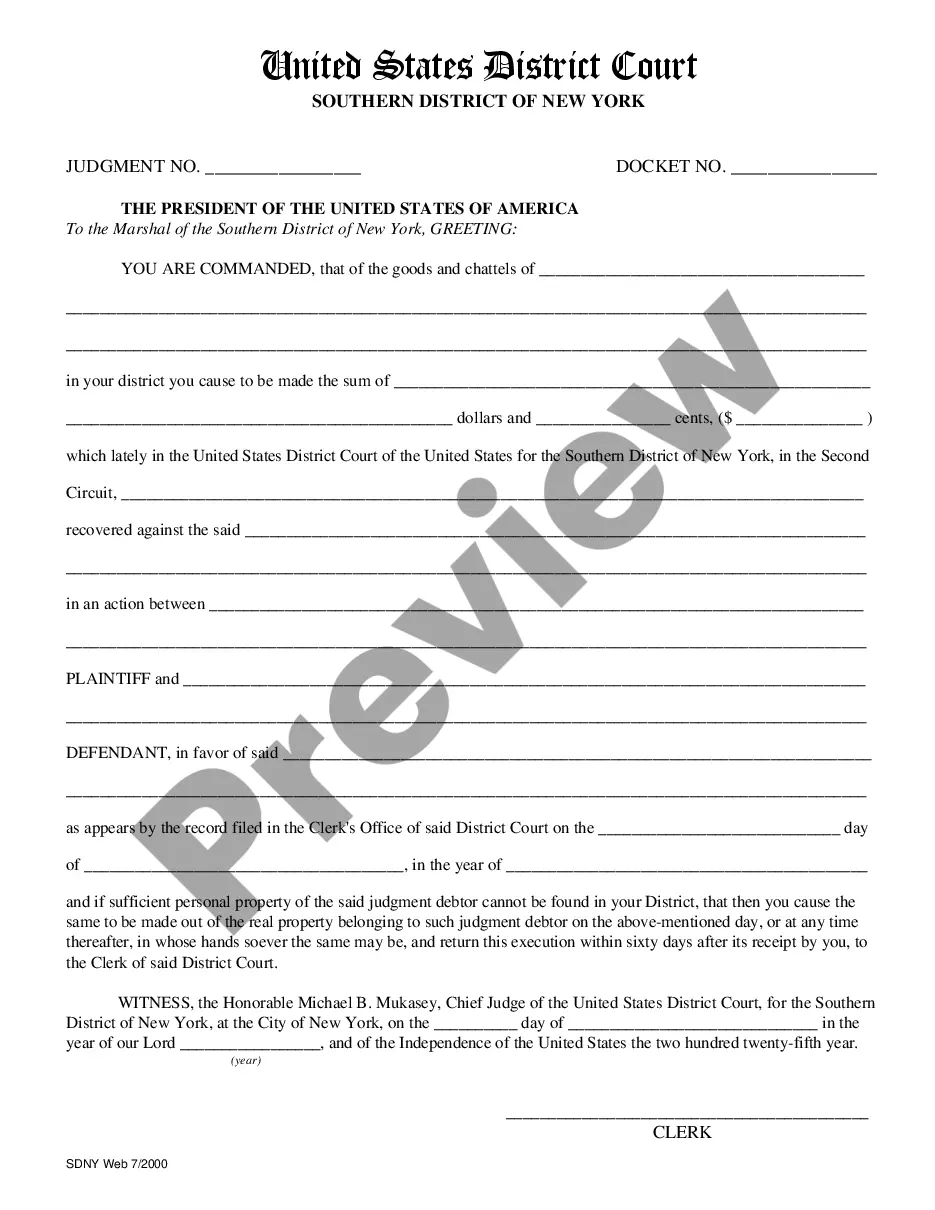

- Initially, ensure you have selected the right form for your personal metropolis/state. You may examine the form utilizing the Review button and browse the form explanation to ensure it will be the best for you.

- In the event the form fails to meet your needs, utilize the Seach discipline to get the appropriate form.

- When you are certain the form would work, select the Get now button to obtain the form.

- Pick the pricing program you desire and enter the required info. Build your account and buy the order using your PayPal account or Visa or Mastercard.

- Opt for the submit structure and obtain the legal papers web template for your gadget.

- Full, change and produce and indication the acquired Mississippi Sample Letter regarding Information for Foreclosures and Bankruptcies.

US Legal Forms will be the biggest collection of legal types where you will find various papers layouts. Take advantage of the service to obtain expertly-produced files that follow express specifications.

Form popularity

FAQ

This can be done after the non-judicial foreclosure through a lawsuit to be filed against the borrower within one year from the sale date. In other states, the borrowers are given a certain time to redeem a foreclosed property. On the contrary, Mississippi laws do not give the right of redemption after the foreclosure.

Again, most residential foreclosures in Mississippi are nonjudicial. Once the 120-day waiting period that federal law generally requires ends, the lender will start a foreclosure using the process described in the Mississippi statutes.

Technically speaking, a notice of default is not a foreclosure. Instead, it serves as notice that you are behind in your payments and that your property may be sold as a result of foreclosure if you don't act soon.

Foreclosure information generally remains in your credit report for seven years from the date of the foreclosure. Even if you have a bad credit history or a low credit score, you may qualify for an Federal Housing Administration (FHA) loan.

What is a payment default? A payment default usually happens after multiple payments on a loan or other debt are missed. The default happens when the lender decides to cut their losses and close the borrower's account because of missed payments.

Judicial Foreclosure This is the most common type of foreclosure. It is allowed in every state and in some states it is required. It involves the sale of the mortgaged property on which the borrower has defaulted on his loan repayment obligations. The sale occurs under judicial supervision.

Mississippi is a state where mortgage holders may foreclose on mortgages or deeds of trusts that are in default by either judicial or non-judicial foreclosure processes. If the deed of trust or the mortgage contains no power of sale clause, the lender must seek an order to foreclose from the civil courts.

Your Home Goes Into Foreclosure If you're unable to pay the outstanding balance, the lender's next step is foreclosing on the home. This process usually isn't instantaneous ? federal law requires lenders to wait 120 days before beginning the foreclosure process (though the process varies from state to state).