Colorado Credit Application

Description

How to fill out Credit Application?

If you need to finalize, obtain, or create legal document templates, utilize US Legal Forms, the leading source of legal forms available online.

Take advantage of the website's straightforward and user-friendly search feature to locate the documents you require.

Numerous templates for business and personal applications are categorized by groups and states, or keywords. Use US Legal Forms to find the Colorado Credit Application in just a few clicks.

Step 5. Process the payment. You can use your credit card or PayPal account to complete the transaction.

Step 6. Select the format of the legal form and download it to your device.

- If you are already a US Legal Forms user, Log In to your account and click the Download button to access the Colorado Credit Application.

- You can also retrieve forms you previously obtained from the My documents section of your account.

- If you are using US Legal Forms for the first time, follow the instructions below.

- Step 1. Ensure you have selected the template for the correct city/state.

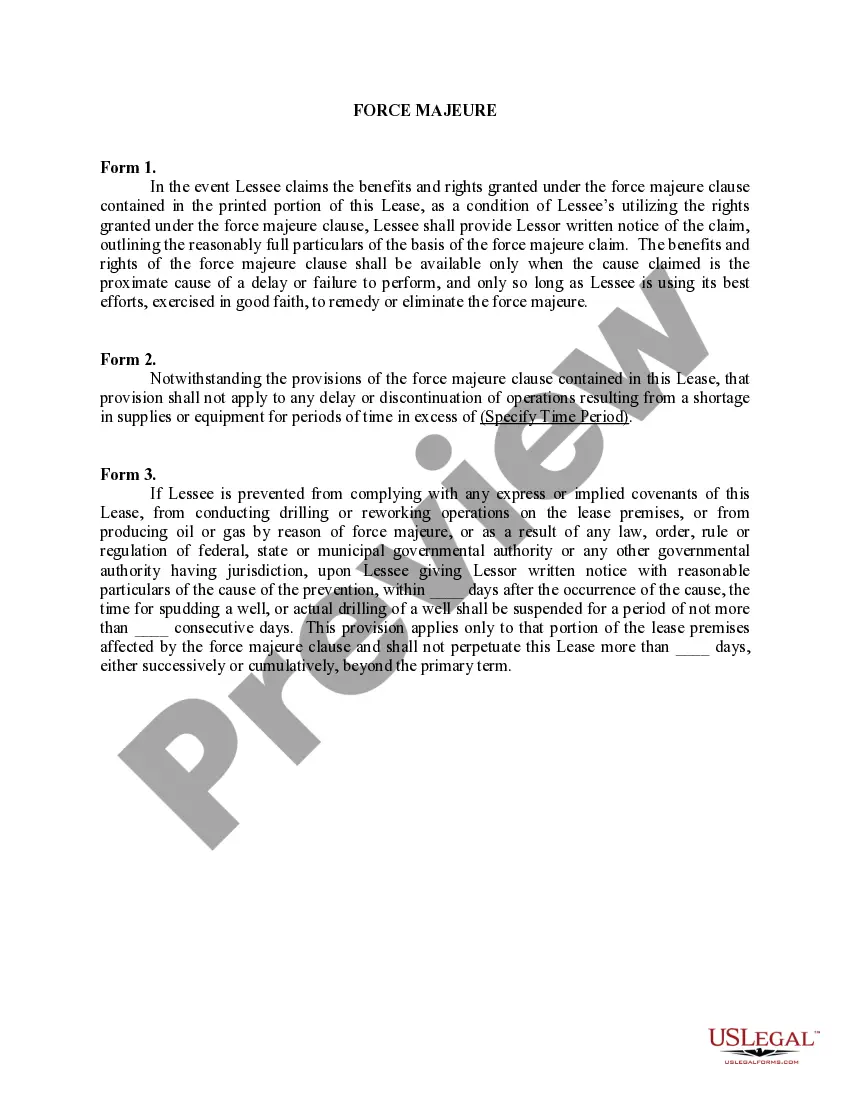

- Step 2. Utilize the Preview option to review the content of the form. Be sure to read the details.

- Step 3. If you are not satisfied with the form, use the Search box at the top of the screen to find other versions of the legal form template.

- Step 4. Once you have located the form you need, click the Acquire now button. Choose your pricing plan and enter your information to sign up for an account.

Form popularity

FAQ

To determine if you qualify for the Colorado rebate, check your income level, age, and residency status. Generally, Colorado residents who file their income taxes and meet specific criteria can receive a rebate. Completing the Colorado Credit Application accurately can simplify the process of identifying your eligibility and help secure your rebate.

To qualify for the Colorado earned income tax credit, you must have earned income from working, including self-employment. Additionally, you must have a valid Social Security number, meet specific income limits, and have qualifying children. If you apply for the Colorado Credit Application, this credit can significantly reduce your tax liability and help boost your refund.

Property Tax, Rent, Heat (PTC) Rebate is now available to Colorado residents based on income including people with disabilities and older adults to help with their property tax, rent, and/or heat expenses this winter and beyond. The rebate amount can be up to $976 a year for applicants.

Under the Section 80 GG, the self-employed or the salaried person can claim a HRA tax exemption or the rent paid by him or her, in excess of 10% of his/her income or salary respectively.

To qualify for the EITC, you must: Have worked and earned income under $57,414. Have investment income below $10,000 in the tax year 2021. Have a valid Social Security number by the due date of your 2021 return (including extensions)

The PTC Rebate is available to qualifying Colorado residents who have very low income and who have paid property tax and/or heat expenses during the year (these expenses may have been included in rent payments). The maximum PTC Rebate amount is $792, which is the sum of $600 property tax and $192 heat.

Colorado taxpayers who qualify for the Federal Earned Income Tax Credit (EITC) can claim a percent of the amount they claim on their federal tax return on their state tax return.

To claim the Expanded COEITC you must be a Colorado resident. This means that you were domiciled in Colorado or had a permanent home in Colorado where you spent more than six months of the tax year. Other requirements and limits apply to the Expanded COEITC.

Colorado Minimum Tax Credit Credit equal to 12% of the prior tax year's federal minimum tax credit claimed on the current year's federal income tax return.

Families can receive up to $3,600 per child through the child tax credit (CTC). Workers can receive up to $6,700 through the federal earned income tax credit (EITC), and up to another $670 through the Colorado EITC.