Kentucky Assignment of Website Creator

Description

How to fill out Assignment Of Website Creator?

You may dedicate time online looking for the legal document template that aligns with the state and federal requirements you desire.

US Legal Forms provides thousands of legal documents that are evaluated by experts.

You can conveniently download or print the Kentucky Assignment of Website Creator from the service.

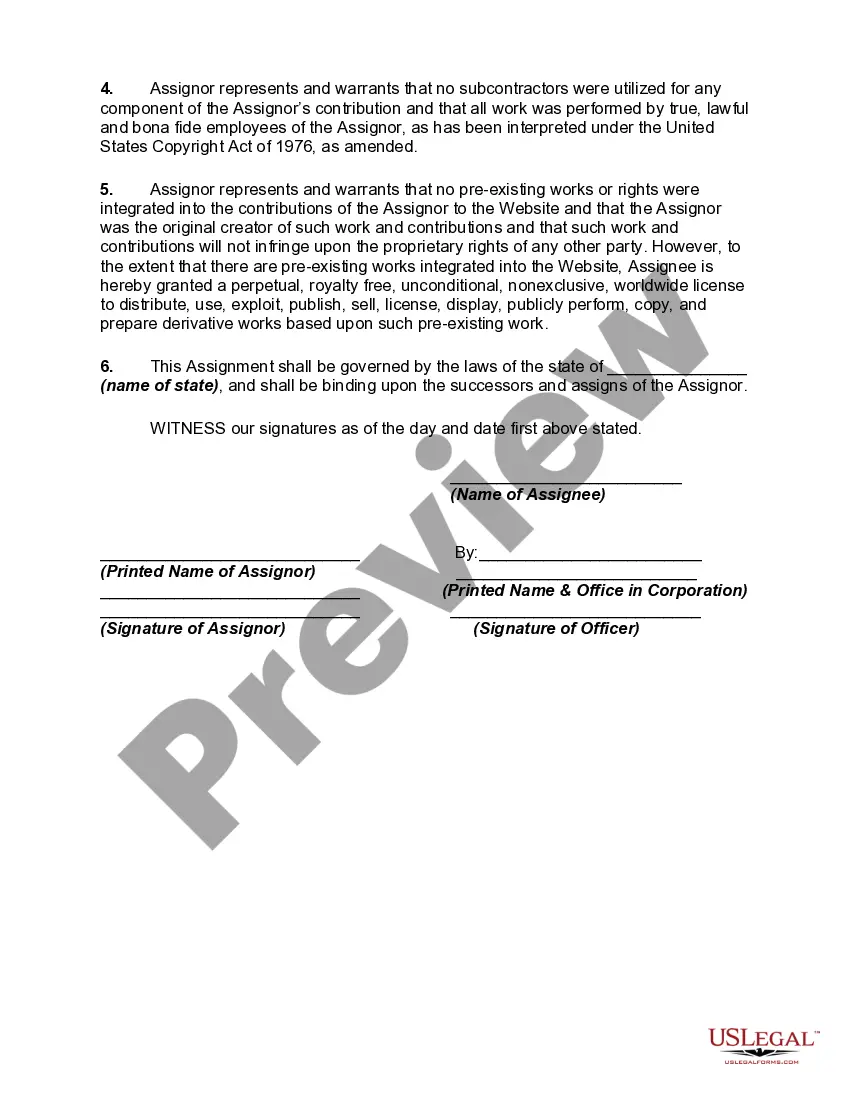

If available, utilize the Preview option to review the document template as well.

- If you already possess a US Legal Forms account, you can Log In and select the Download option.

- Afterward, you may fill out, edit, print, or sign the Kentucky Assignment of Website Creator.

- Every legal document template you obtain is yours forever.

- To obtain another copy of the purchased document, navigate to the My documents section and choose the appropriate option.

- If you are using the US Legal Forms site for the first time, follow the straightforward instructions below.

- First, ensure that you have selected the correct document template for the state/city you choose.

- Review the document details to confirm you have selected the right form.

Form popularity

FAQ

The hospital tax in Kentucky is a specific tax imposed on hospitals, assessed based on their gross patient revenues. This tax supports healthcare funding within the state. For healthcare-related businesses, resources from US Legal Forms can provide clarity and assistance, especially when linked to your Kentucky Assignment of Website Creator.

You can obtain a Kentucky withholding account number by registering your business with the Kentucky Department of Revenue. This is a crucial step for employers to properly manage state income tax withholding. If you're focused on your Kentucky Assignment of Website Creator, US Legal Forms can help you navigate this registration.

Acquiring a llet number in Kentucky requires registering with the Kentucky Department of Revenue, usually through an online application. Ensure you have all necessary business information at hand for this process. US Legal Forms can help streamline this process, particularly for your Kentucky Assignment of Website Creator.

To get a Kentucky Employer Identification Number (EIN), you must apply through the IRS or via the online application on their website. An EIN is vital for tax administration and employee hiring. For further assistance, especially regarding your Kentucky Assignment of Website Creator, consider support from US Legal Forms.

Yes, KY Form 725 can be filed electronically through the Kentucky Department of Revenue's online portal. This option simplifies the filing process for businesses. By leveraging resources such as US Legal Forms, you can efficiently manage these forms in the context of your Kentucky Assignment of Website Creator.

To obtain a llet number in Kentucky, register your business with the state using the appropriate application. This process involves providing details about your business structure and purpose. Utilizing services like US Legal Forms can significantly ease this process for creators focused on their Kentucky Assignment of Website Creator.

The Llet tax in Kentucky generally ranges from 4 to 6 percent, depending on the income level and specific business activities. It's crucial for business owners to stay updated on any changes to this rate. For simple compliance and understanding, consider using tools from US Legal Forms that relate to your Kentucky Assignment of Website Creator.

Form 720 is a tax form used in Kentucky to report sales and use tax. This form is essential for businesses that need to collect and remit sales taxes. If you're navigating Kentucky tax forms as part of your Kentucky Assignment of Website Creator, platforms like US Legal Forms can guide you through the required paperwork.

Property tax in Kentucky is calculated using the assessed value of the property and the local tax rate. The assessed value typically reflects a percentage of the property's fair market value. For property owners, resources from US Legal Forms can help clarify how to manage these calculations correctly in relation to your Kentucky Assignment of Website Creator.

Kentucky state tax withholding is calculated based on your employee's wages and the state's withholding tables. Employers must consider personal exemptions and allowable deductions. If you're unsure about these calculations, US Legal Forms offers guidance that can assist you in managing your Kentucky Assignment of Website Creator efficiently.