Kentucky Web Package

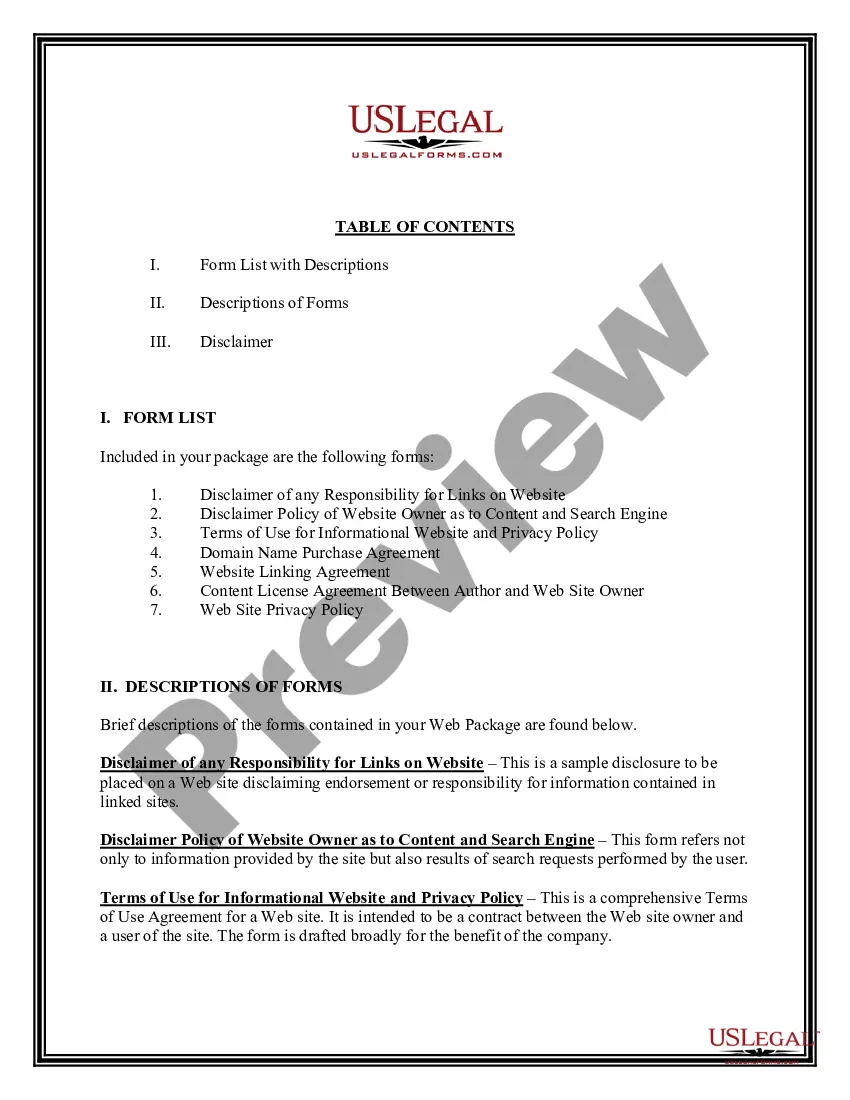

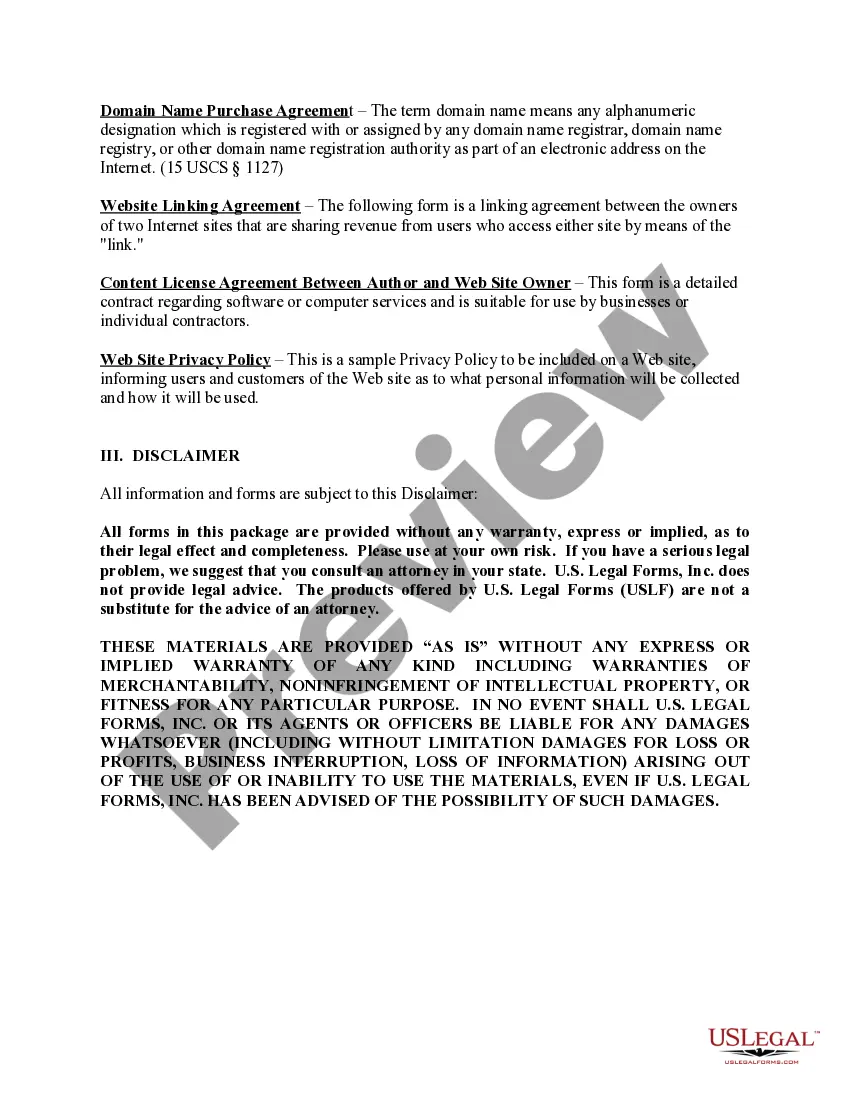

Description

How to fill out Web Package?

US Legal Forms - one of many most significant libraries of authorized varieties in the USA - offers a variety of authorized file themes you are able to down load or print out. Using the web site, you can find thousands of varieties for company and personal reasons, sorted by classes, says, or search phrases.You can find the newest types of varieties like the Kentucky Web Package within minutes.

If you currently have a registration, log in and down load Kentucky Web Package from your US Legal Forms collection. The Down load option can look on each form you perspective. You have accessibility to all earlier acquired varieties within the My Forms tab of your own accounts.

In order to use US Legal Forms the first time, here are basic instructions to get you started out:

- Be sure to have chosen the right form for your personal metropolis/state. Click the Review option to analyze the form`s information. Browse the form information to ensure that you have selected the proper form.

- When the form does not satisfy your specifications, use the Research industry towards the top of the display to discover the one who does.

- If you are content with the form, confirm your selection by clicking on the Get now option. Then, choose the prices plan you want and offer your qualifications to register on an accounts.

- Process the deal. Make use of charge card or PayPal accounts to accomplish the deal.

- Choose the format and down load the form in your system.

- Make alterations. Complete, revise and print out and signal the acquired Kentucky Web Package.

Every format you included in your account lacks an expiration date which is the one you have for a long time. So, in order to down load or print out an additional copy, just go to the My Forms area and then click in the form you want.

Obtain access to the Kentucky Web Package with US Legal Forms, by far the most extensive collection of authorized file themes. Use thousands of skilled and condition-particular themes that meet up with your company or personal needs and specifications.

Form popularity

FAQ

Commonwealth Business Identifier (CBI): A unique, ten-digit, number assigned to all Kentucky businesses. The CBI allows the business to be easily identified by all state agencies that utilize the Kentucky OneStop Portal. Complete the online registration via the Kentucky Business OneStop portal.

The Kentucky Tax Registration Application, Form 10A100, is to be used to apply for tax registration of the major business taxes administered by the Revenue Cabinet which are: (1) employer's Kentucky withholding, (2) corporation income and license, (3) coal severance and processing and (4) sales and use.

Where can I get an EIN in Kentucky? All EINs are issued by the federal government through the IRS, regardless of your state. You can apply for a federal employer identification number on the IRS website. Keep in mind that you will also have to get a state tax ID number from the Kentucky Department of Revenue.

?Free federal and Kentucky filing if: Federal Adjusted Gross Income of $41,000 or less, or. Active duty military with a Federal Adjusted Gross Income of $73,000 or less?

This stands for Commonwealth Business Identifier number, and is another name for your Kentucky state tax ID number. Note that this is distinct from your federal tax ID number, which is sometimes simply called a ?tax ID,? and is sometimes called an employer identification number, or EIN.

The best way to apply for your CBI is to apply online. It's faster, more convenient, and more accessible. However, be aware that it may take up to 4 to 6 weeks to receive your Kentucky CBI number, since it takes longer to process than your federal tax ID.

Commonwealth Business Identifier (CBI): A unique, ten-digit, number assigned to all Kentucky businesses. The CBI allows the business to be easily identified by all state agencies that utilize the Kentucky OneStop Portal. Complete the online registration via the Kentucky Business OneStop portal.

Register online with the KY Dept of Revenue to receive a Withholding Account Number. Registration may also be completed via the Kentucky Registration Application (10A100). Please visit the Kentucky DOR Tax Registration Information page or additional resources or call the KY DOR at (502) 564-4581.