Oregon Sample Letter to Foreclosure Attorney - After Foreclosure - Did not Receive Notice

Description

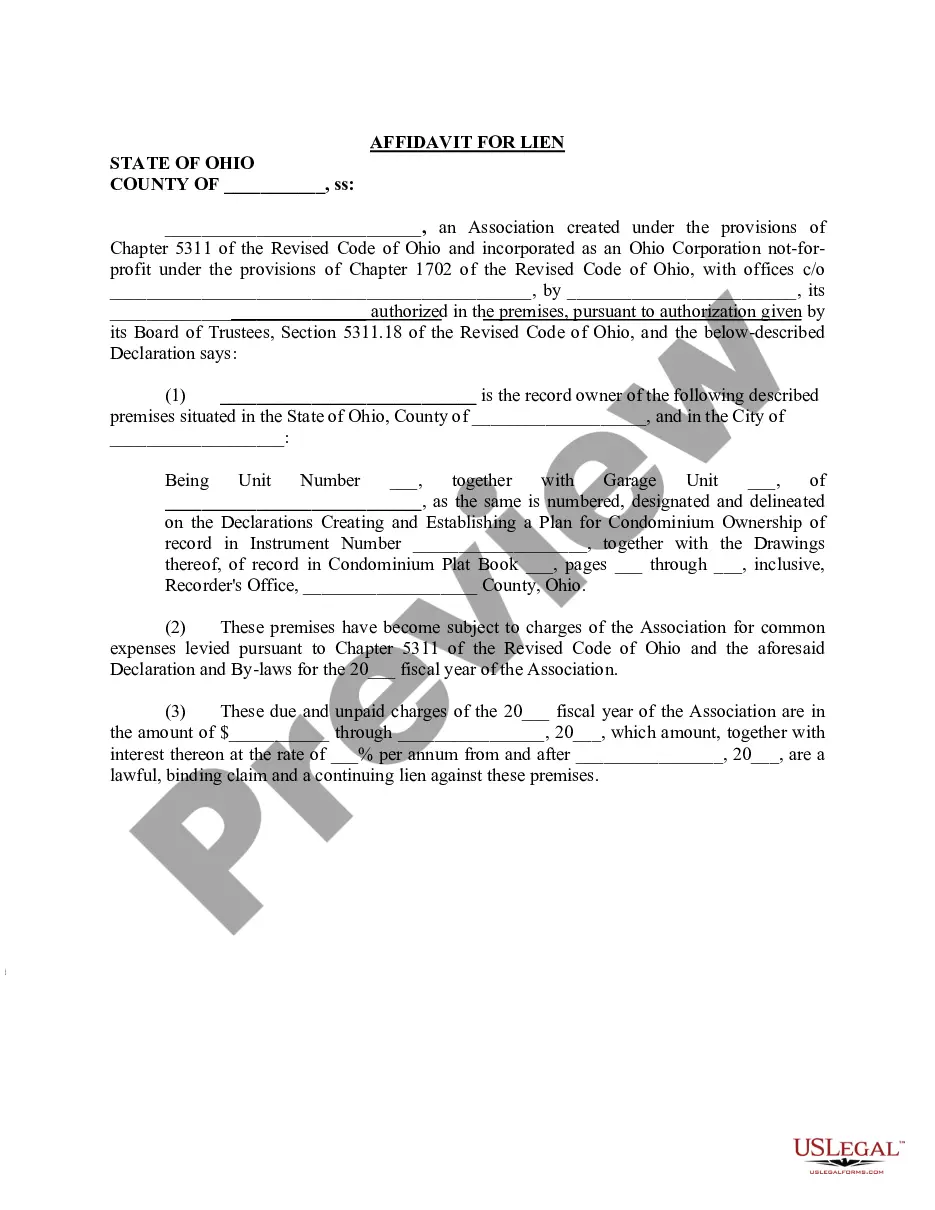

How to fill out Sample Letter To Foreclosure Attorney - After Foreclosure - Did Not Receive Notice?

It is possible to devote time on the Internet attempting to find the lawful document design that meets the state and federal specifications you want. US Legal Forms offers a large number of lawful forms that happen to be examined by pros. It is simple to download or print out the Oregon Sample Letter to Foreclosure Attorney - After Foreclosure - Did not Receive Notice from your assistance.

If you currently have a US Legal Forms bank account, it is possible to log in and then click the Down load button. Afterward, it is possible to total, change, print out, or signal the Oregon Sample Letter to Foreclosure Attorney - After Foreclosure - Did not Receive Notice. Every single lawful document design you get is yours permanently. To get yet another backup associated with a acquired develop, go to the My Forms tab and then click the corresponding button.

If you are using the US Legal Forms website the very first time, keep to the basic recommendations under:

- Very first, ensure that you have chosen the best document design for your area/town of your choice. Look at the develop outline to ensure you have picked out the proper develop. If available, take advantage of the Review button to look through the document design at the same time.

- If you want to discover yet another model of your develop, take advantage of the Lookup area to find the design that meets your requirements and specifications.

- After you have found the design you would like, click on Buy now to move forward.

- Select the pricing prepare you would like, type in your references, and register for an account on US Legal Forms.

- Complete the financial transaction. You may use your charge card or PayPal bank account to cover the lawful develop.

- Select the file format of your document and download it for your product.

- Make changes for your document if possible. It is possible to total, change and signal and print out Oregon Sample Letter to Foreclosure Attorney - After Foreclosure - Did not Receive Notice.

Down load and print out a large number of document web templates while using US Legal Forms Internet site, that provides the most important assortment of lawful forms. Use expert and status-certain web templates to deal with your business or specific demands.

Form popularity

FAQ

Under federal law, the servicer usually can't officially begin a foreclosure until you're more than 120 days past due on payments, subject to a few exceptions. (12 C.F.R. § 1024.41). This 120-day period provides most homeowners ample opportunity to submit a loss mitigation application to the servicer.

Oregon borrowers can expect that the foreclosure process will take approximately six months to complete if everything goes smoothly during the foreclosure. Court delays, borrower objects or a borrower's filing for bankruptcy can delay the process.

Limitations Period: Six years for an action on the Note. Ten years for foreclosure under a deed of trust. [7] It is unsettled in Oregon whether a non-judicial foreclosure is barred if the limitations period on an action under the Note has already expired.

Ways to Stop Foreclosure in Oregon Declare Bankruptcy. Yes, bankruptcy is a way through which foreclosure can be stopped. ... Applying for Loan Modification. ... Reinstating Your Loan. ... Plan for Repayment. ... Refinancing. ... Sell Out Your Home. ... Short Sale. ... Deed In Lieu of Foreclosure.

Put your name, address, phone number, loan number, and date on the top of the letter. List the name and address of your lender. information about any money you have saved for a workout agreement. Tell the lender you are working with a foreclosure counselor and include their name and agency.

Oregon laws allows for both judicial and non judicial foreclosures. If a lender pursues a foreclosure through the judicial system then the borrower has a 180 day right of redemption. There is no right of redemption for non judicial foreclosures.

Oregon allows for two different foreclosure processes: judicial and nonjudicial. Foreclosure can also occur when a homeowner does not pay their property taxes, a court judgment, or other liens on the property. This covers Nonjudicial Foreclosure.