Mississippi Guaranty by Individual - Complex

Description

How to fill out Guaranty By Individual - Complex?

If you want to full, down load, or printing authorized file templates, use US Legal Forms, the biggest variety of authorized varieties, that can be found on the web. Take advantage of the site`s basic and convenient search to get the paperwork you will need. A variety of templates for business and person reasons are categorized by categories and suggests, or key phrases. Use US Legal Forms to get the Mississippi Guaranty by Individual - Complex in just a handful of clicks.

If you are presently a US Legal Forms buyer, log in to the profile and click the Down load switch to obtain the Mississippi Guaranty by Individual - Complex. You can even entry varieties you previously acquired in the My Forms tab of the profile.

If you use US Legal Forms the very first time, follow the instructions beneath:

- Step 1. Ensure you have selected the form for the appropriate city/region.

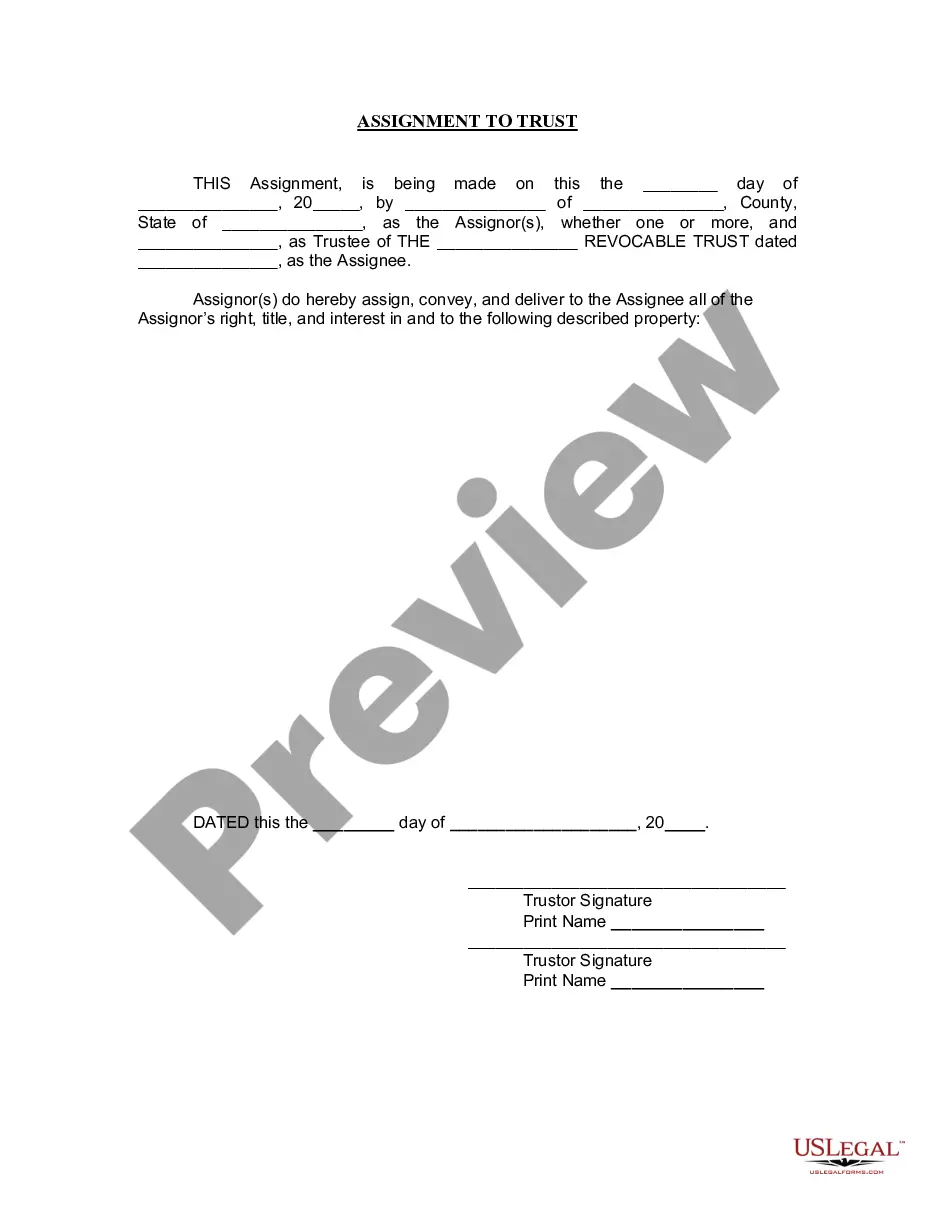

- Step 2. Make use of the Review method to look over the form`s content material. Do not neglect to learn the description.

- Step 3. If you are unhappy together with the develop, utilize the Research industry towards the top of the display screen to find other models of your authorized develop web template.

- Step 4. Once you have identified the form you will need, go through the Get now switch. Choose the rates plan you prefer and put your references to sign up for an profile.

- Step 5. Process the purchase. You can utilize your credit card or PayPal profile to complete the purchase.

- Step 6. Choose the file format of your authorized develop and down load it in your system.

- Step 7. Comprehensive, modify and printing or sign the Mississippi Guaranty by Individual - Complex.

Each and every authorized file web template you purchase is the one you have permanently. You have acces to each and every develop you acquired inside your acccount. Click the My Forms segment and select a develop to printing or down load again.

Remain competitive and down load, and printing the Mississippi Guaranty by Individual - Complex with US Legal Forms. There are many skilled and state-distinct varieties you can use to your business or person requirements.

Form popularity

FAQ

The guaranty associations are established by state law and are comprised of membership of companies licensed to do business in Mississippi. Guaranty associations pay the claims of policyholders of an insolvent company when that company's assets become insufficient to meet their obligations to policyholders.

LIMITS ON AMOUNTS OF COVERAGE Also, for any one insured life, the Guaranty Association will pay a maximum of $300,000 in life and annuity benefits and $500,000 in health insurance benefits? no matter how many policies and contracts there were with the same company, even if they provided different types of coverages.

State guaranty funds guarantee payment for insurance policyholders should the insurance company default. The fund only covers beneficiaries of insurance companies where the insurer is licensed to sell products in that state.

The health insurance protection for which the Guarantee Association may become liable shall be the contractual obligations for which the insurer is liable or would have been liable if it were not an insolvent insurer, up to a maximum benefit of $200,000.

Most states provide the following amounts of coverage (or more), which are specified in the National Association of Insurance Commissioners' (NAIC) Life and Health Insurance Guaranty Association Model Law: $300,000 in life insurance death benefits. $100,000 in net cash surrender or withdrawal values for life insurance.

The maximum amount of protection for each individual, regardless of the number of policies or contracts, is $300,000. Special rules may apply with regard to health benefit plans.

StateMax liability for present value of an annuity contractMax aggregate benefits for all lines of insuranceCalifornia80% not to exceed $250,00080% not to exceed $300,000Colorado$250,000$300,000Connecticut$500,000$500,000Delaware$250,000$300,00047 more rows

Most of these organizations are funded with the money they collect from conducting assessments of member insurers. The total payout in most states is capped at $300,000 per individual.