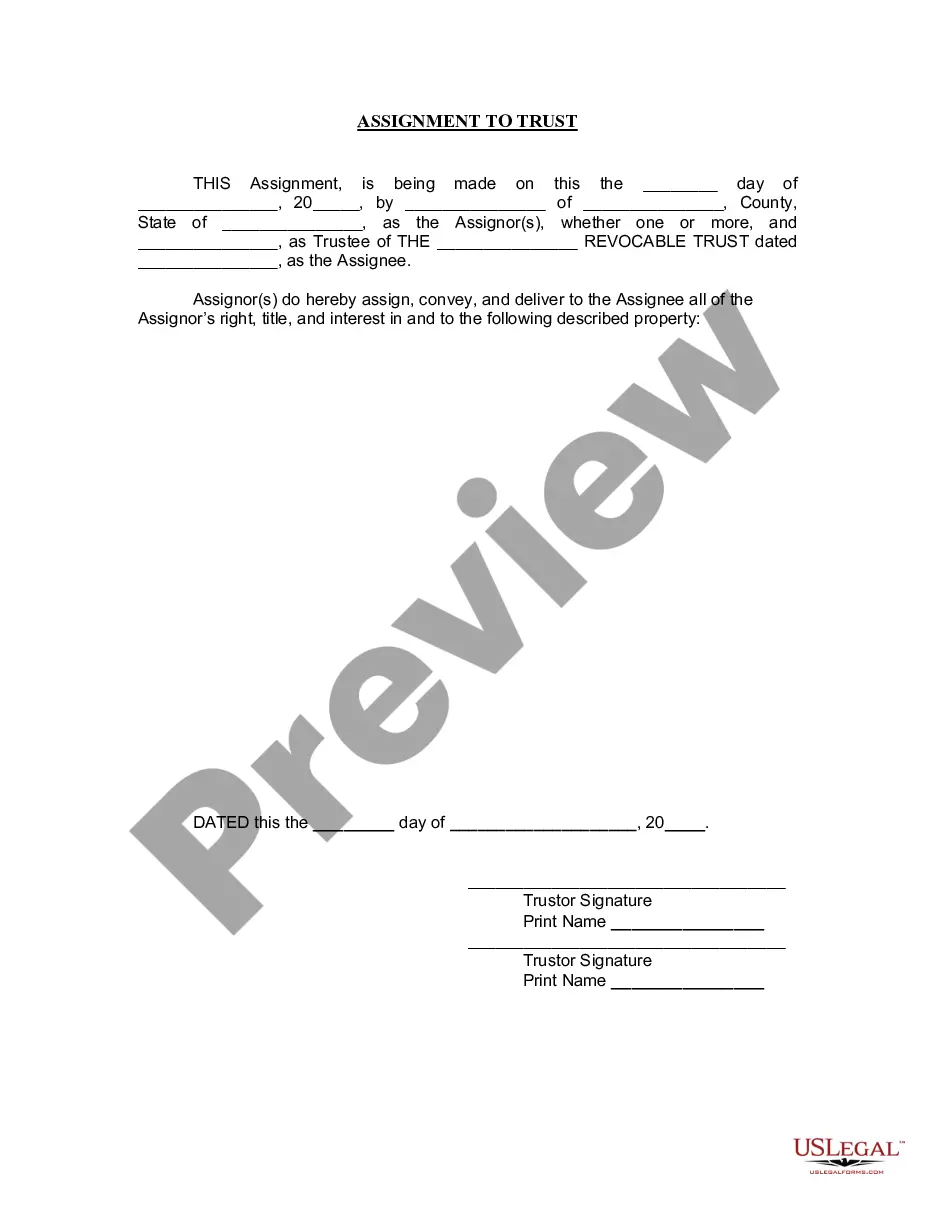

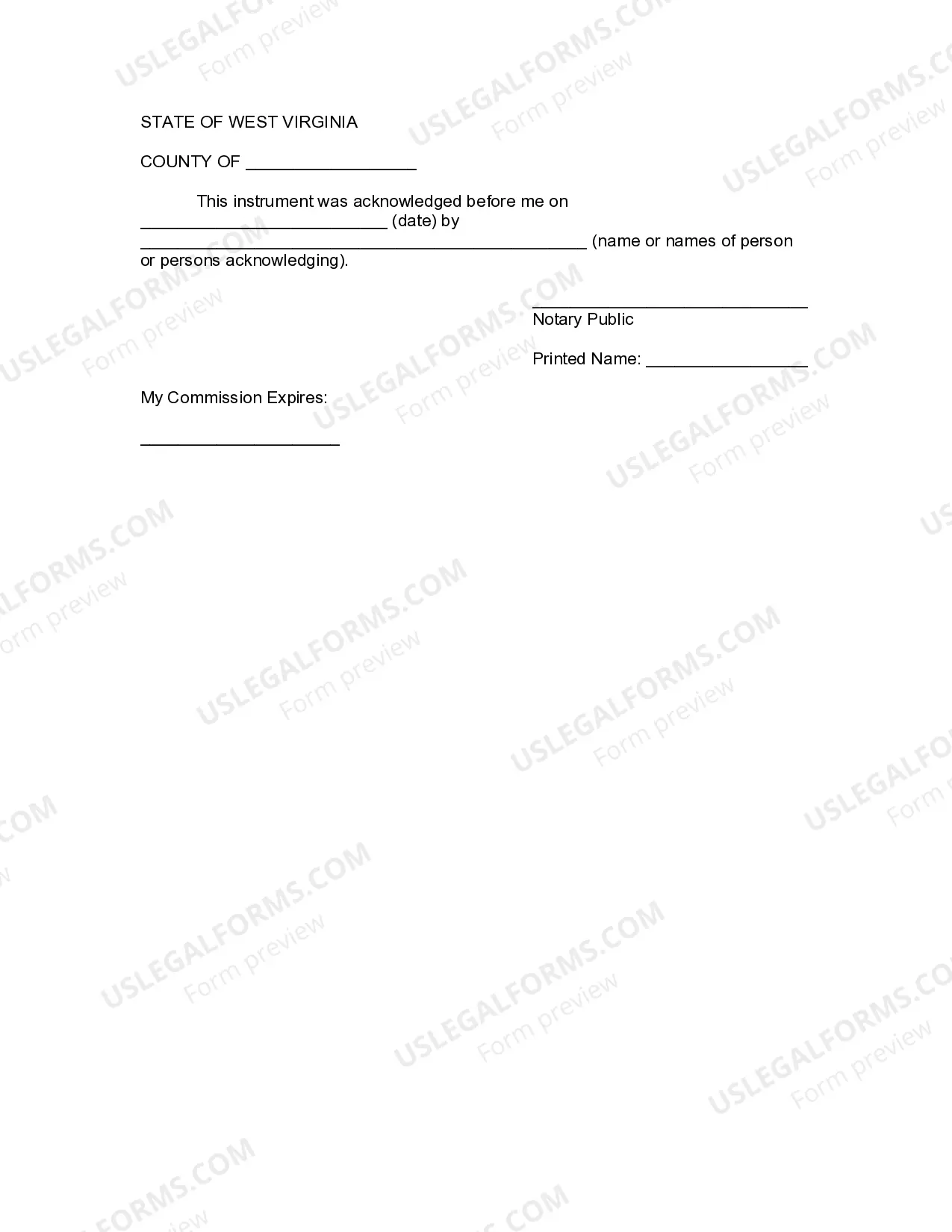

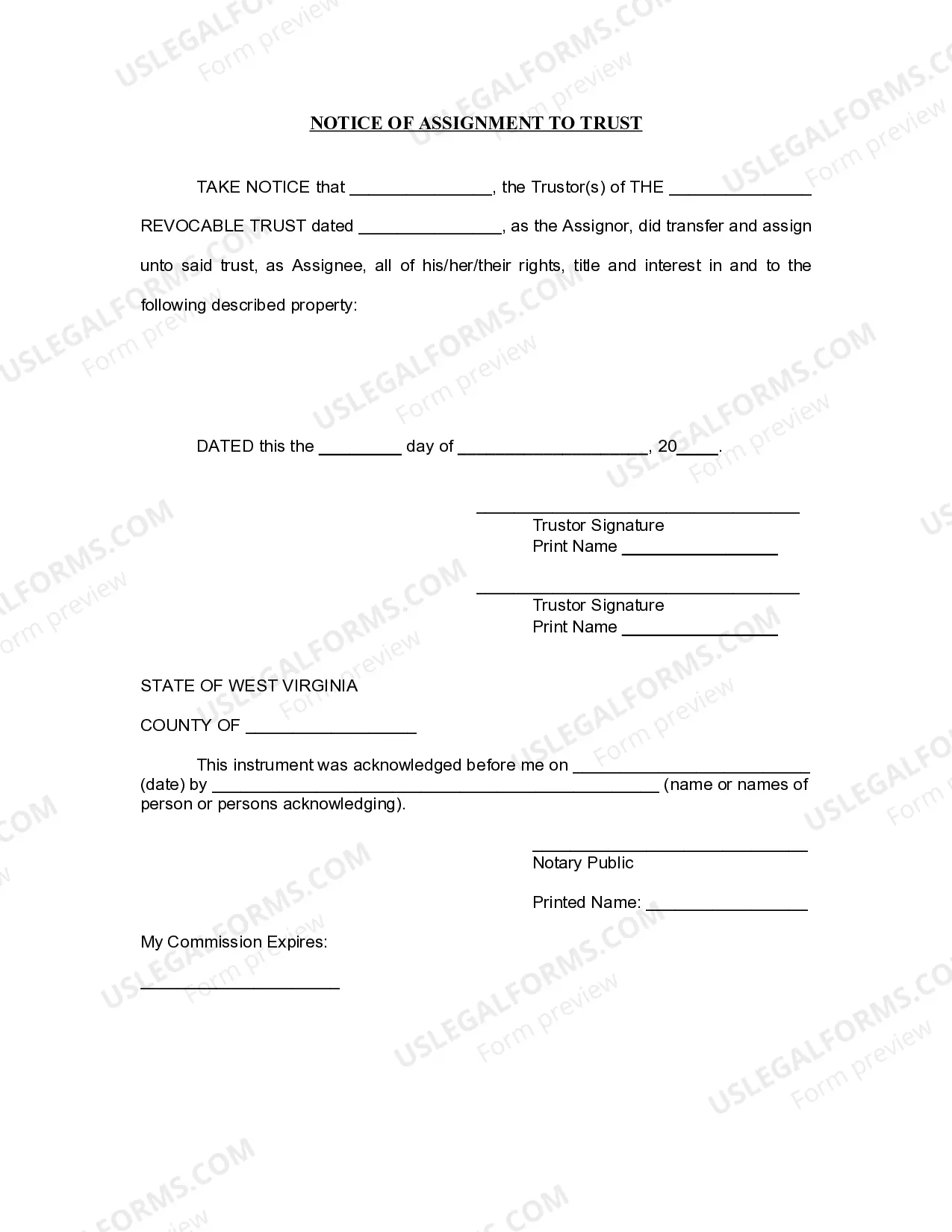

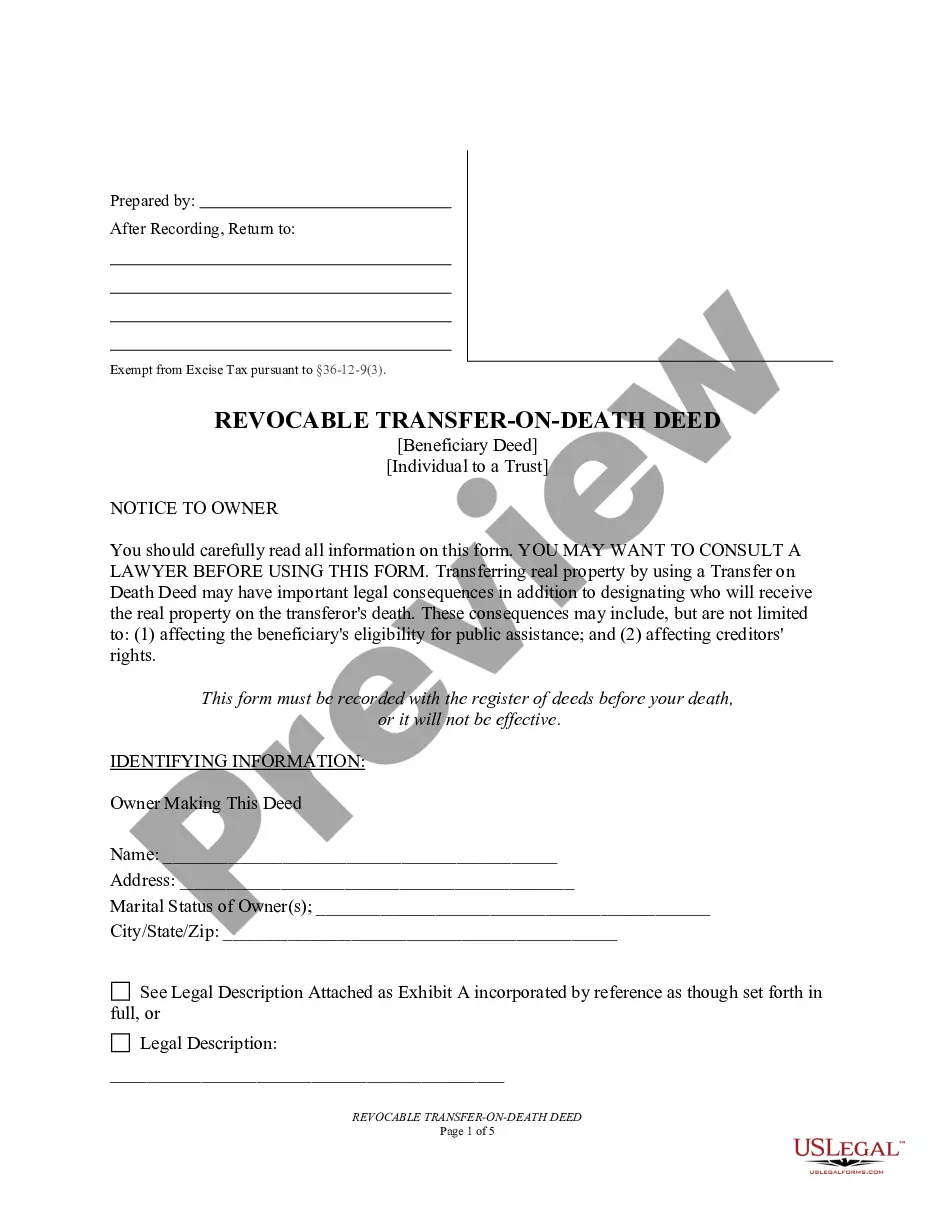

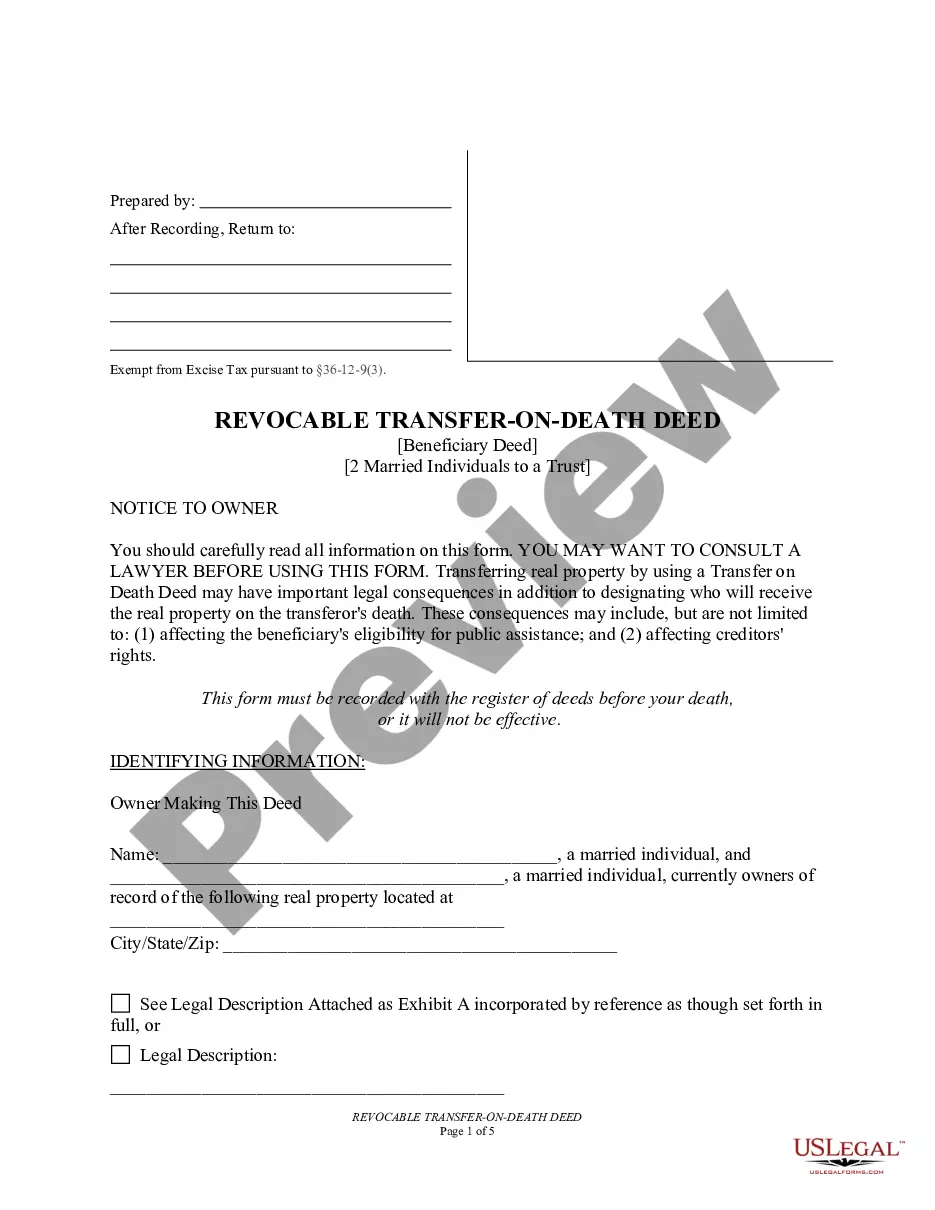

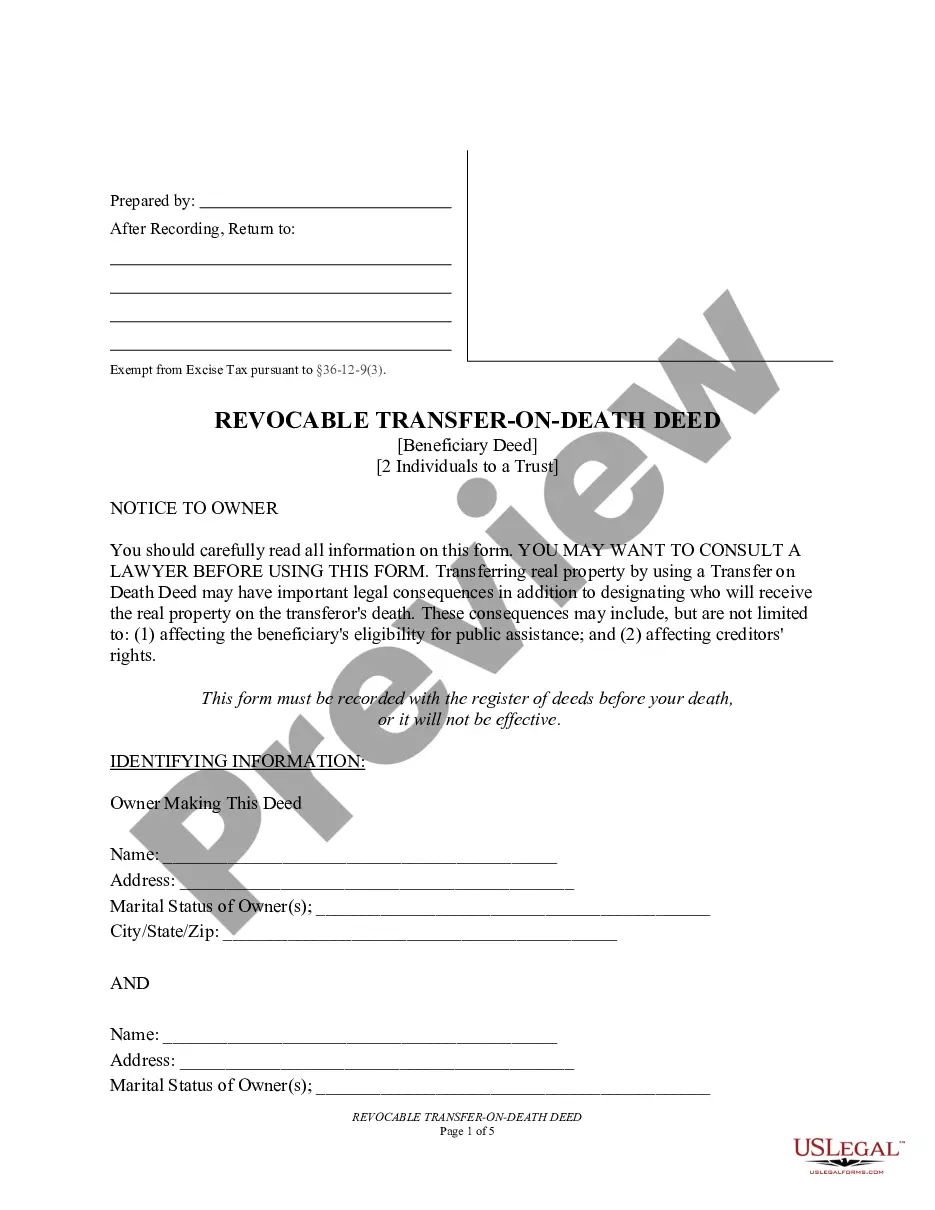

This Assignment to Living Trust form is used to assign all right, title and interest in specific property to a Living Trust. A living trust is a trust established during a person's lifetime in which a person's assets and property are placed within the trust, usually for the purpose of estate planning. This form must be signed by the Assignor before a notary public.

West Virginia Assignment to Living Trust

Description

Get your form ready online

Our built-in tools help you complete, sign, share, and store your documents in one place.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Looking for another form?

How to fill out West Virginia Assignment To Living Trust?

Out of the great number of platforms that provide legal samples, US Legal Forms provides the most user-friendly experience and customer journey when previewing forms prior to buying them. Its complete library of 85,000 samples is categorized by state and use for efficiency. All of the forms available on the service have already been drafted to meet individual state requirements by accredited legal professionals.

If you have a US Legal Forms subscription, just log in, look for the form, hit Download and get access to your Form name in the My Forms; the My Forms tab holds all your downloaded forms.

Stick to the guidelines listed below to obtain the document:

- Once you see a Form name, make sure it’s the one for the state you really need it to file in.

- Preview the template and read the document description before downloading the sample.

- Search for a new template through the Search engine in case the one you’ve already found is not appropriate.

- Simply click Buy Now and choose a subscription plan.

- Create your own account.

- Pay using a card or PayPal and download the template.

Once you have downloaded your Form name, you may edit it, fill it out and sign it with an online editor that you pick. Any document you add to your My Forms tab might be reused many times, or for as long as it remains the most updated version in your state. Our service provides fast and easy access to templates that fit both attorneys as well as their customers.

Form popularity

FAQ

To transfer assets such as investments, bank accounts, or stock to your real living trust, you will need to contact the institution and complete a form. You will likely need to provide a certificate of trust as well. You may want to keep your personal checking and savings account out of the trust for ease of use.

Sure you can write your own revocable living trust.The discussion of your need for a revocable living trust is in another of my articles, but it is safe to say that if you own real property and have a significant estate (over about $50,000), then you could use a trust and it would help your loved ones.

Assuming you decide you want a revocable living trust, how much should you expect to pay? If you are willing to do it yourself, it will cost you about $30 for a book, or $70 for living trust software. If you hire a lawyer to do the job for you, get ready to pay between $1,200 and $2,000.

A living trust is an important part of your estate plan. Most people can create a living trust without an attorney using software or an online service.

No, you don't need a lawyer to set up a trust, but it might be a good idea to seek legal advice to ensure the trust is set up correctly and that you have considered all long-term financial and estate planning aspects of the trust.Some living trusts are revocable, which means the trust can be changed at any time.

You should still have a durable power of attorney for finances.You may even want to empower your attorney-in-fact to transfer into your living trust any property that becomes yours after you become incapacitated. Only a durable power of attorney for finances can grant that authority.

Pick a type of living trust. If you're married, you'll first need to decide whether you want a single or joint trust. Take stock of your property. Choose a trustee. Draw up the trust document. Sign the trust. Transfer your property to the trust.

Qualified retirement accounts 401ks, IRAs, 403(b)s, qualified annuities. Health saving accounts (HSAs) Medical saving accounts (MSAs) Uniform Transfers to Minors (UTMAs) Uniform Gifts to Minors (UGMAs) Life insurance. Motor vehicles.

When you create a DIY living trust, there are no attorneys involved in the process. You will need to choose a trustee who will be in charge of managing the trust assets and distributing them.You'll also need to choose your beneficiary or beneficiaries, the person or people who will receive the assets in your trust.