Mississippi Sample Letter for Information regarding Corporation

Description

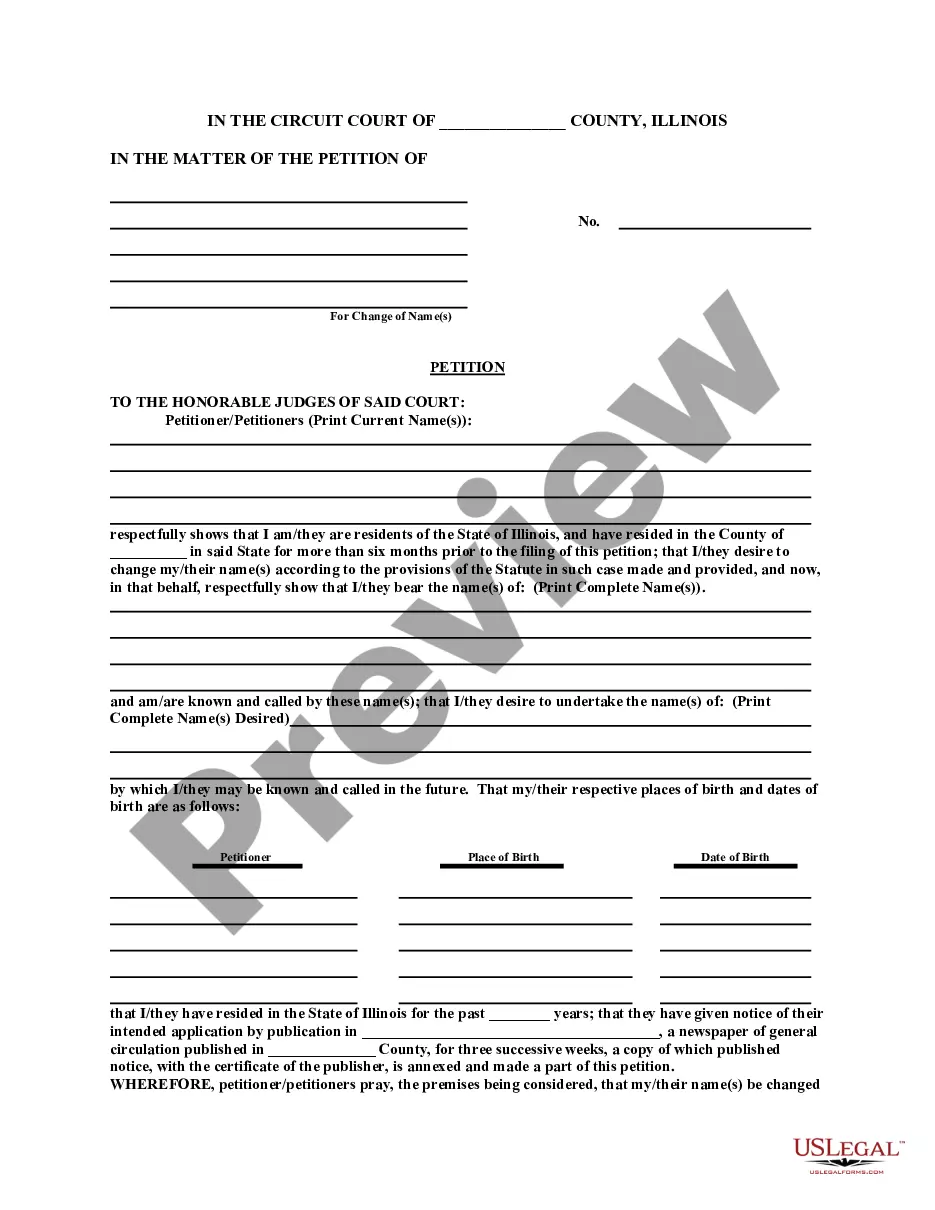

How to fill out Sample Letter For Information Regarding Corporation?

If you want to complete, acquire, or print lawful record themes, use US Legal Forms, the most important collection of lawful forms, that can be found on-line. Use the site`s basic and hassle-free look for to discover the paperwork you want. A variety of themes for business and specific reasons are categorized by groups and says, or key phrases. Use US Legal Forms to discover the Mississippi Sample Letter for Information regarding Corporation within a handful of mouse clicks.

If you are already a US Legal Forms customer, log in for your account and click on the Acquire switch to find the Mississippi Sample Letter for Information regarding Corporation. Also you can entry forms you previously acquired in the My Forms tab of your own account.

Should you use US Legal Forms for the first time, follow the instructions beneath:

- Step 1. Ensure you have chosen the shape for that right metropolis/nation.

- Step 2. Make use of the Preview solution to check out the form`s content. Never forget to read through the description.

- Step 3. If you are unsatisfied with the form, take advantage of the Lookup area on top of the display screen to get other variations in the lawful form format.

- Step 4. After you have identified the shape you want, go through the Get now switch. Choose the prices program you like and put your accreditations to sign up on an account.

- Step 5. Process the purchase. You can use your charge card or PayPal account to complete the purchase.

- Step 6. Select the formatting in the lawful form and acquire it on your device.

- Step 7. Comprehensive, revise and print or indication the Mississippi Sample Letter for Information regarding Corporation.

Every lawful record format you get is yours for a long time. You may have acces to every form you acquired with your acccount. Click the My Forms area and pick a form to print or acquire once more.

Be competitive and acquire, and print the Mississippi Sample Letter for Information regarding Corporation with US Legal Forms. There are millions of expert and condition-particular forms you can utilize for the business or specific requirements.

Form popularity

FAQ

To form a Mississippi S corp, you'll need to ensure your company has a Mississippi formal business structure (LLC or corporation), and then you can elect S corp tax designation. If you've already formed an LLC or corporation, file Form 2553 with the Internal Revenue Service (IRS) to designate S corp taxation status.

How to change from LLC to S corp. To make an LLC to S corp. election with the IRS, you need to file form 2553 Election by a Small Business Corporation.

You will be required to obtain a new EIN if any of the following statements are true. A new LLC with more than one owner (Multi-member LLC) is formed under state law. A new LLC with one owner (Single Member LLC) is formed under state law and chooses to be taxed as a corporation or an S corporation.

To form a Mississippi S corp, you'll need to ensure your company has a Mississippi formal business structure (LLC or corporation), and then you can elect S corp tax designation. If you've already formed an LLC or corporation, file Form 2553 with the Internal Revenue Service (IRS) to designate S corp taxation status.

File Articles of Organization ? Conversion (Form LLC-1A (PDF)) online at bizfileOnline.sos.ca.gov, by mail, or in person. The filing fee is $150 if a California Corp is involved; and $70 for all others.