Missouri Demand for Collateral by Creditor

Description

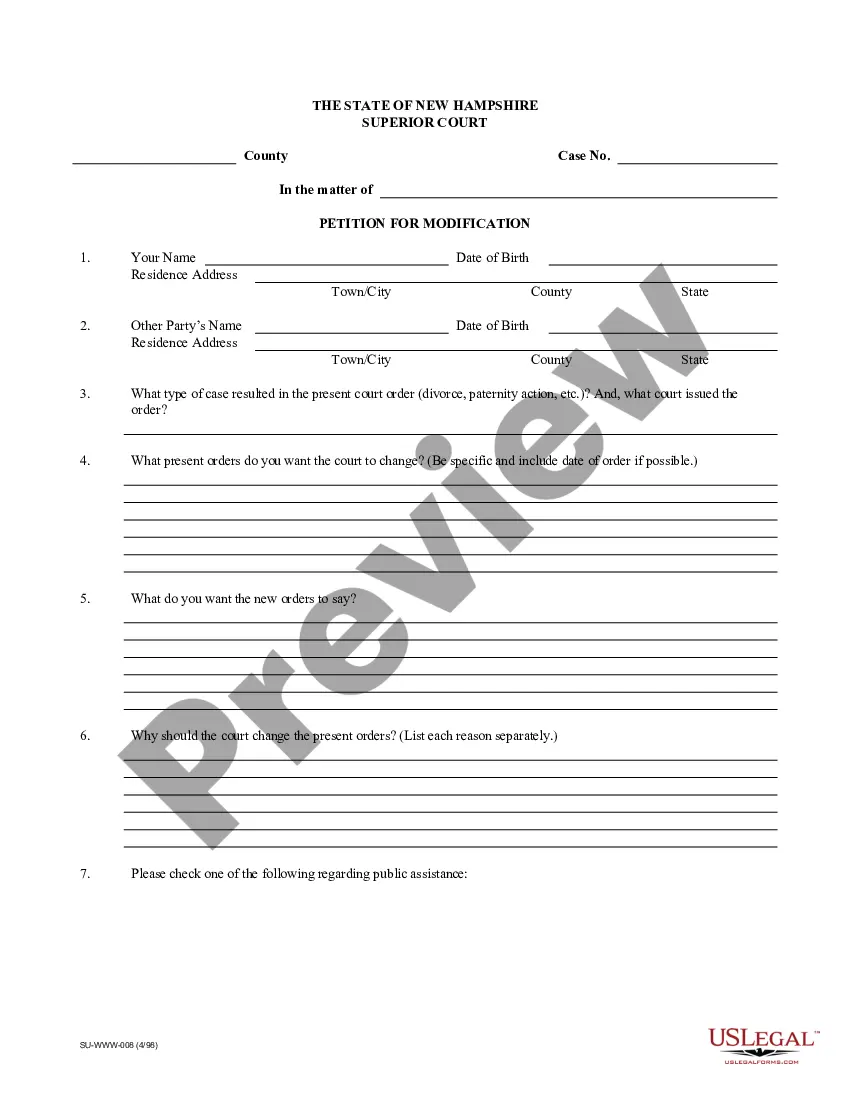

How to fill out Demand For Collateral By Creditor?

Are you now situated in a location where you require documentation for occasional business or personal purposes almost every day.

There are numerous authentic document templates available online, but finding reliable ones is challenging.

US Legal Forms provides a vast array of form templates, such as the Missouri Demand for Collateral by Creditor, designed to comply with state and federal requirements.

Upon finding the correct form, click Buy now.

Select the pricing plan you want, enter the required information to create your account, and pay for the order using your PayPal or credit card.

- If you are already familiar with the US Legal Forms website and have an account, simply Log In.

- Then you can download the Missouri Demand for Collateral by Creditor template.

- If you do not have an account and would like to begin using US Legal Forms, follow these instructions.

- Locate the form you need and ensure it is for the correct city/region.

- Utilize the Preview button to review the template.

- Check the details to confirm you have selected the correct document.

- If the form does not meet your needs, use the Search field to find a form that suits your requirements.

Form popularity

FAQ

The collateral source rule in Missouri maintains that a plaintiff's recovery should not be diminished by benefits received from third parties. This rule is particularly relevant in cases of a Missouri Demand for Collateral by Creditor, as it allows creditors to pursue the full value of their claims without deductions for payments made from other sources. This promotes fairness in the legal process and protects the rights of creditors. For further insights and legal documentation, visit USLegalForms.

The collateral source doctrine is a legal concept that allows plaintiffs to recover full damages from the defendant, regardless of any compensation received from other sources. This ensures that the defendant remains fully liable and does not benefit from the plaintiff's independent support. In cases involving a Missouri Demand for Collateral by Creditor, this doctrine emphasizes the importance of the original debt. For a structured understanding, USLegalForms offers comprehensive guidance.

The collateral source doctrine in Missouri refers to a legal principle that prevents defendants from reducing their liability by the amount the plaintiff has received from other sources. In the context of a Missouri Demand for Collateral by Creditor, this doctrine ensures that any compensation received by the creditor does not lessen their claim against the debtor. Understanding this principle is essential for creditors navigating collections. For a deeper exploration, consider resources available at USLegalForms.

A right to cure letter in Missouri is similar to a right to cure notice, but it serves as a detailed account of the borrower’s options to address a default. This letter outlines the specific actions the borrower can take to remedy the default, often providing a clear timeline. If you receive this letter, it’s crucial to respond promptly to avoid complications related to Missouri Demand for Collateral by Creditor.

A right to sue letter in Missouri is an official document that grants a borrower the ability to initiate a lawsuit against a creditor. This letter often follows a mediation or other attempts to resolve a dispute without litigation. It’s vital to understand its implications, as it could relate to situations where a borrower faces actions such as a Missouri Demand for Collateral by Creditor.

The three requirements for a creditor to have an enforceable security interest typically involve a written agreement, attachment of the security interest, and the creditor's rights to the collateral. Fulfilling these criteria ensures that the creditor has a legitimate claim in case of default. A clear understanding of these requirements is essential when addressing a Missouri Demand for Collateral by Creditor.

The process by which a security interest in collateral becomes enforceable is called attachment. This occurs when specific conditions are met, ensuring that the creditor's claim on the collateral is legally recognized. Navigating this process is crucial for creditors, especially when making a Missouri Demand for Collateral by Creditor.

The right to take possession of collateral until a debt is repaid is known as a retention right. This allows creditors to hold onto the collateral until the debtor fulfills their repayment obligations fully. In the setting of a Missouri Demand for Collateral by Creditor, this right safeguards the creditor’s financial stake and encourages timely repayment.

A creditor’s right to use collateral to recover unpaid debts is termed a right of recourse. This right allows creditors to pursue the collateral if the debtor does not fulfill their obligations. Within the framework of a Missouri Demand for Collateral by Creditor, this right is a fundamental tool for creditors to stabilize their financial interests.

The process by which a creditor takes possession of collateral to satisfy an unpaid debt is called repossession. When a debtor defaults, creditors may initiate this process to reclaim assets and recover the outstanding amounts. Understanding repossession is crucial for both creditors and debtors involved in a Missouri Demand for Collateral by Creditor.