Mississippi Demand for Collateral by Creditor

Description

How to fill out Demand For Collateral By Creditor?

US Legal Forms - one of the largest repositories of legal documents in the United States - offers a broad selection of legal document templates that you can download or print.

By utilizing the site, you will access countless forms for business and personal purposes, organized by categories, states, or keywords. You can find the latest forms such as the Mississippi Demand for Collateral by Creditor within moments.

If you already have a subscription, Log In and download the Mississippi Demand for Collateral by Creditor from the US Legal Forms library. The Download button will appear on every document you view. You can access all previously downloaded forms in the My documents section of your account.

Process the transaction. Use your credit card or PayPal account to complete the transaction.

Download the form to your device in the chosen format. Edit. Fill out, modify, print, and sign the downloaded Mississippi Demand for Collateral by Creditor. Every template you added to your account has no expiration date and is yours indefinitely. Thus, to download or print another copy, simply navigate to the My documents section and click on the document you need. Access the Mississippi Demand for Collateral by Creditor with US Legal Forms, the most extensive collection of legal document templates. Utilize a vast number of professional and state-specific templates that meet your business or personal needs and requirements.

- Ensure you have selected the correct document for your city/state.

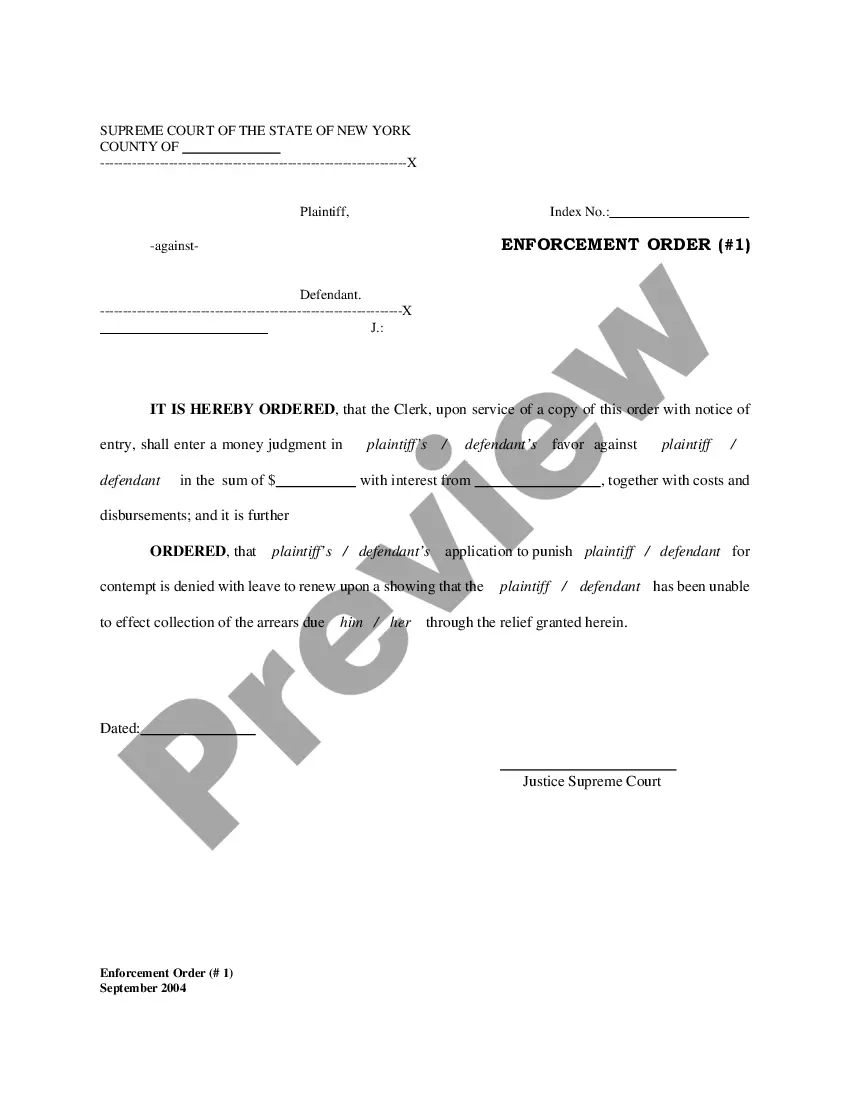

- Click the Preview button to review the form's content.

- Read the form description to confirm that you have chosen the correct document.

- If the document does not meet your requirements, use the Search field at the top of the page to find one that does.

- If you are satisfied with the form, confirm your choice by clicking the Buy now button.

- Then, choose your preferred payment plan and provide your details to register for an account.

Form popularity

FAQ

Filling out a UCC-1 form correctly involves providing accurate information about the debtor, the secured party, and the collateral involved. Be sure to include the debtor's legal name and address, as well as a detailed description of the collateral. Take your time to avoid mistakes, as inaccuracies can lead to disputes. Utilizing resources like uslegalforms can simplify the process, especially when dealing with Mississippi Demand for Collateral by Creditor.

A creditor is deemed secured when they possess a legally enforceable interest in collateral offered by the debtor. This status is contingent on having filed a financing statement that clearly outlines their claim. The collateral may take various forms, such as equipment or receivables, which grants the creditor additional protection in case of default. Understanding how this relates to the Mississippi Demand for Collateral by Creditor is vital for securing your investment.

To become a secured creditor, you need to create a binding security agreement with the borrower, ensuring they grant you a security interest in specified collateral. After this, it is crucial to file the appropriate UCC-1 financing statement to make the security interest public. This process helps protect your interests and is particularly important when dealing with Mississippi Demand for Collateral by Creditor.

Responding to a UCC lien notice involves reviewing the notice carefully to understand its implications. Start by confirming the validity of the lien and the specific claims being made. If you believe the lien is incorrect or unjustified, you may challenge it by filing a UCC-3 form. Understanding your rights and options following a Mississippi Demand for Collateral by Creditor can help you take appropriate steps.

A creditor becomes a secured party by establishing a legal relationship with the debtor that includes a security agreement. This agreement must clearly identify the collateral and must be signed by the debtor. To further secure their interest, creditors should file a UCC-1 financing statement. By doing so, they can assert their rights in relation to the Mississippi Demand for Collateral by Creditor.

To become a secured party under Mississippi law, a creditor must first ensure that they have a security interest in the collateral. This means that the creditor needs a valid security agreement with the debtor. Additionally, they should file a financing statement with the Mississippi Secretary of State to establish their priority over other claims. Effectively, understanding the Mississippi Demand for Collateral by Creditor is essential in this process.

The process of a creditor taking possession of collateral to satisfy an unpaid debt is known as foreclosure or repossession. This action typically occurs after the debtor has defaulted on their payment obligations. In the context of Mississippi Demand for Collateral by Creditor, understanding this process can facilitate better communication between creditors and debtors. Legal resources, such as US Legal Forms, provide valuable templates and guidelines that can assist in navigating this complex process.

An interest in property given by a debtor to a creditor is generally defined as a security interest. This agreement legally binds the asset to the debt, ensuring that the creditor has a claim if the debtor defaults. When you encounter a situation involving Mississippi Demand for Collateral by Creditor, recognizing this concept becomes vital for both parties involved. It establishes a clear pathway for resolving debts and expectations.

An interest in property that secures the repayment of a debt is referred to as a security interest. This arrangement provides reassurance to creditors, as it establishes a claim to the property if the debtor fails to meet their obligations. In scenarios involving Mississippi Demand for Collateral by Creditor, identifying the security interest helps both parties understand their positions. This clarity can lead to more effective negotiations and resolutions.

Yes, debtors maintain certain rights in the collateral even after it has been pledged. These rights typically include the ability to use the collateral as per their original agreement. It's important to refer to the terms specified in the Mississippi Demand for Collateral by Creditor, as they outline the extent of these rights. Always consult a legal professional to understand your individual situation.