Mississippi Rental Application for House

Description

How to fill out Rental Application For House?

If you wish to accumulate, obtain, or print authentic document templates, utilize US Legal Forms, the premier collection of legal documents, which are available online.

Take advantage of the site’s straightforward and user-friendly search to locate the documents you require.

A selection of templates for business and personal purposes is categorized by types and states, or keywords.

Step 5. Complete the transaction. You can use your credit card or PayPal account to finalize the transaction.

Step 6. Select the format of the legal document and download it to your device. Step 7. Fill out, edit, and print or sign the Mississippi Rental Application for Residence.

- Utilize US Legal Forms to acquire the Mississippi Rental Application for Residence in just a few clicks.

- If you are already a US Legal Forms user, sign in to your account and click the Download button to access the Mississippi Rental Application for Residence.

- You can also retrieve forms you previously downloaded in the My documents section of your account.

- If you are using US Legal Forms for the first time, follow the guidelines below.

- Step 1. Ensure you have selected the form for the correct city/state.

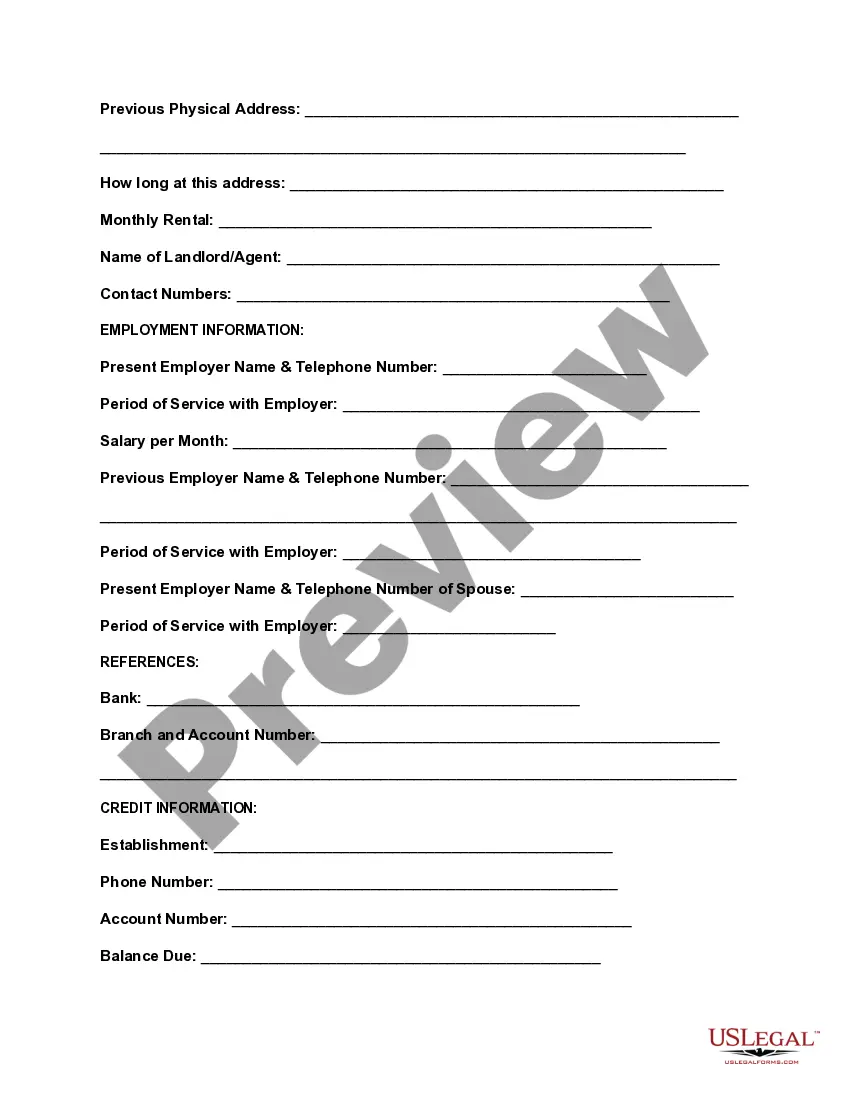

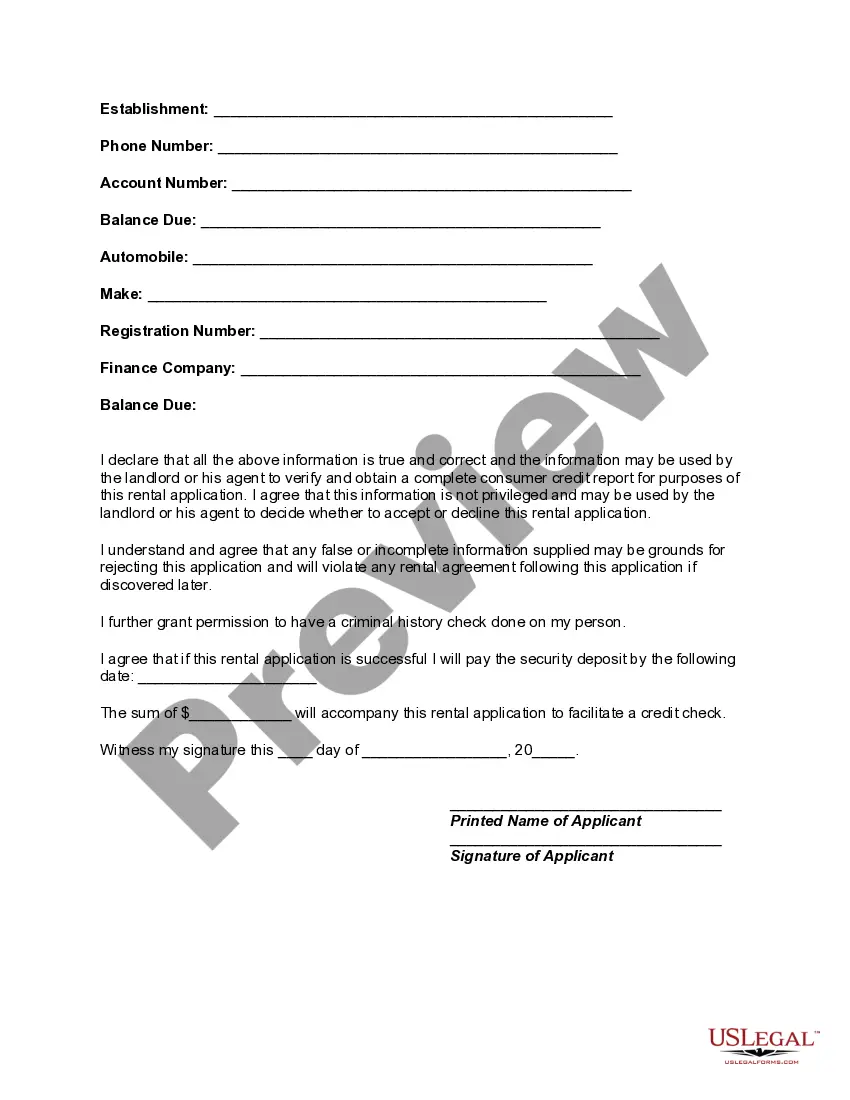

- Step 2. Make use of the Preview option to review the form’s content. Don’t forget to examine the details.

- Step 3. If you are dissatisfied with the form, employ the Search field at the top of the page to discover other documents in the legal form template.

- Step 4. After locating the form you want, click the Purchase now button. Choose the pricing plan you prefer and input your credentials to create an account.

Form popularity

FAQ

Approval for a rental often depends on the criteria set by the landlord and your personal qualifications. While some may find the process challenging due to strict requirements, a well-prepared Mississippi Rental Application for House can significantly ease potential hurdles. Providing thorough and accurate information enhances your potential for approval.

Creating a rental application form begins with gathering essential tenant information, such as income, rental history, and references. Utilize templates available online to ensure you include all necessary sections. By employing a well-structured Mississippi Rental Application for House, you simplify the tenant screening process and maintain consistency in your evaluations.

To comfortably afford $1500 rent, a general rule is to aim for a monthly income of three times that amount, totaling around $4500. This ensures you can cover rent, utilities, and other expenses without financial strain. Always assess your personal financial situation when completing a Mississippi Rental Application for House to ensure you meet these thresholds.

Typically, a credit score of 620 or higher is recommended for rental applications. This score indicates a reliable payment history and financial responsibility. When you use a Mississippi Rental Application for House, consider setting clear guidelines that align with this standard to facilitate smoother rental transactions.

To attract more rental applications, focus on enhancing your property’s online visibility. Use clear, appealing photos, and include specific details in your listing. Promoting a simple Mississippi Rental Application for House can also help; streamline the process, making it easier for potential renters to apply.

The frequency of rental application denials varies based on the applicant pool and landlord requirements. On average, around 30% of applications may face rejection, often due to insufficient income or bad credit history. By presenting a solid Mississippi Rental Application for House with supporting documents, you can improve your chances of approval.

Getting approved for a rental can be straightforward if you meet the landlord's criteria. Many landlords look for a steady income, a good rental history, and acceptable credit scores. When you complete your Mississippi Rental Application for House, ensuring all information is accurate and complete can make a significant difference in the approval process.

If you have no rental history, focus on your financial stability instead. Provide proof of income, a letter of recommendation from an employer or personal reference, and any other financial documentation that showcases your reliability. Many landlords consider overall financial health, so presenting a strong case in your Mississippi Rental Application for House is essential.

For proof of rental income, you can use a Rental Income Statement or any standardized form widely accepted by landlords. This document should detail the amount received, tenant information, and lease terms. Having a well-structured document makes it easier to complete your Mississippi Rental Application for House and strengthens your rental profile.

To document rental income for your Mississippi Rental Application for House, you will need to provide copies of your lease agreements, bank statements showing rental deposits, or tax returns reflecting your rental income. Ensure you gather all necessary financial records to present a complete picture of your income. This documentation helps landlords ascertain your financial stability.