Mississippi Owner Financing Contract for Home

Description

How to fill out Owner Financing Contract For Home?

Are you presently in a situation where you need documents for either business or personal motives almost daily.

There are many legitimate document templates available online, but locating ones you can trust is challenging.

US Legal Forms offers an extensive collection of form templates, such as the Mississippi Owner Financing Contract for Home, designed to meet state and federal requirements.

Once you locate the correct form, click on Purchase now.

Select the pricing plan you desire, enter the necessary information to create your account, and finalize your order using PayPal or a credit card.

- If you're familiar with the US Legal Forms site and have an account, simply Log In.

- Then, you may download the Mississippi Owner Financing Contract for Home template.

- If you do not possess an account and wish to use US Legal Forms, follow these steps.

- Identify the form you need and ensure it is for your specific city/state.

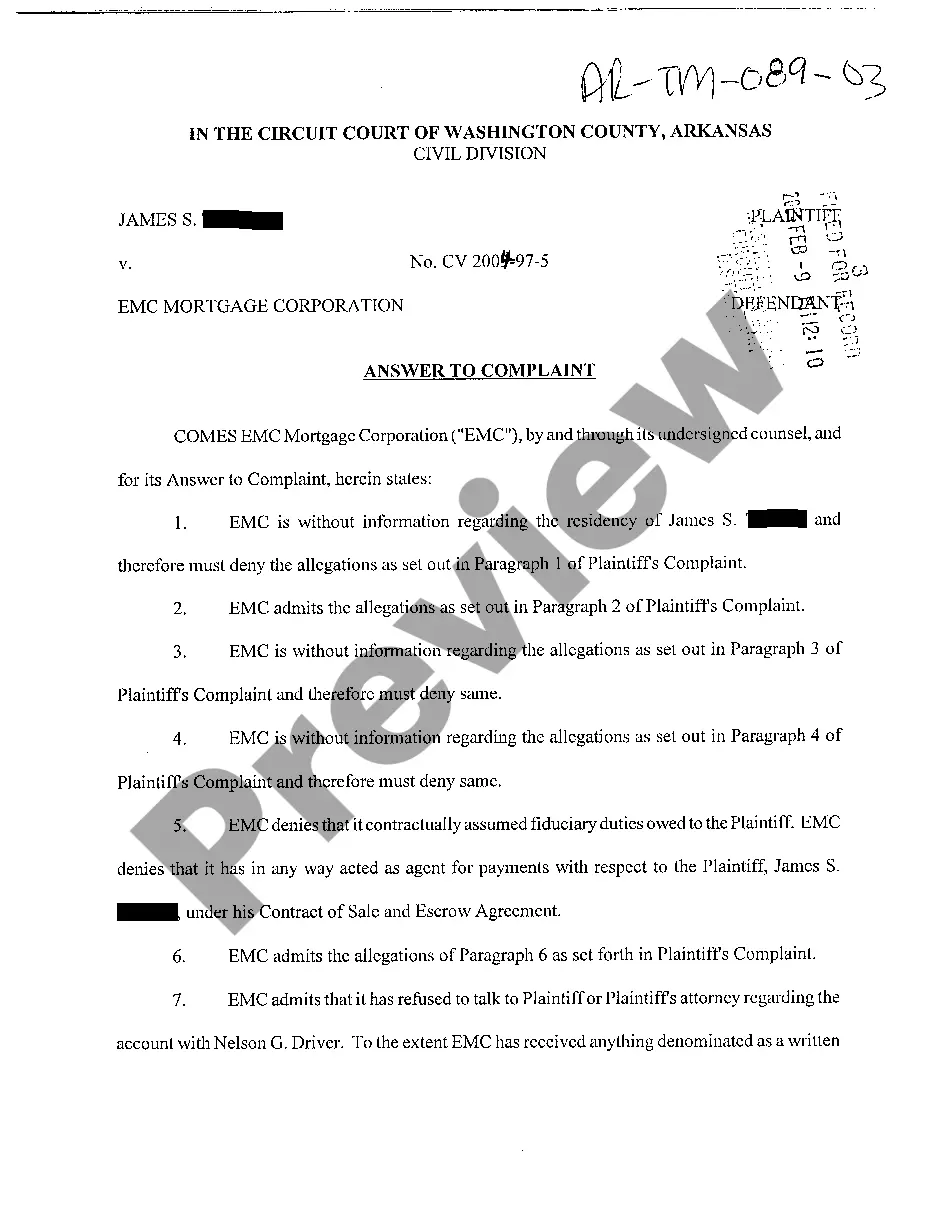

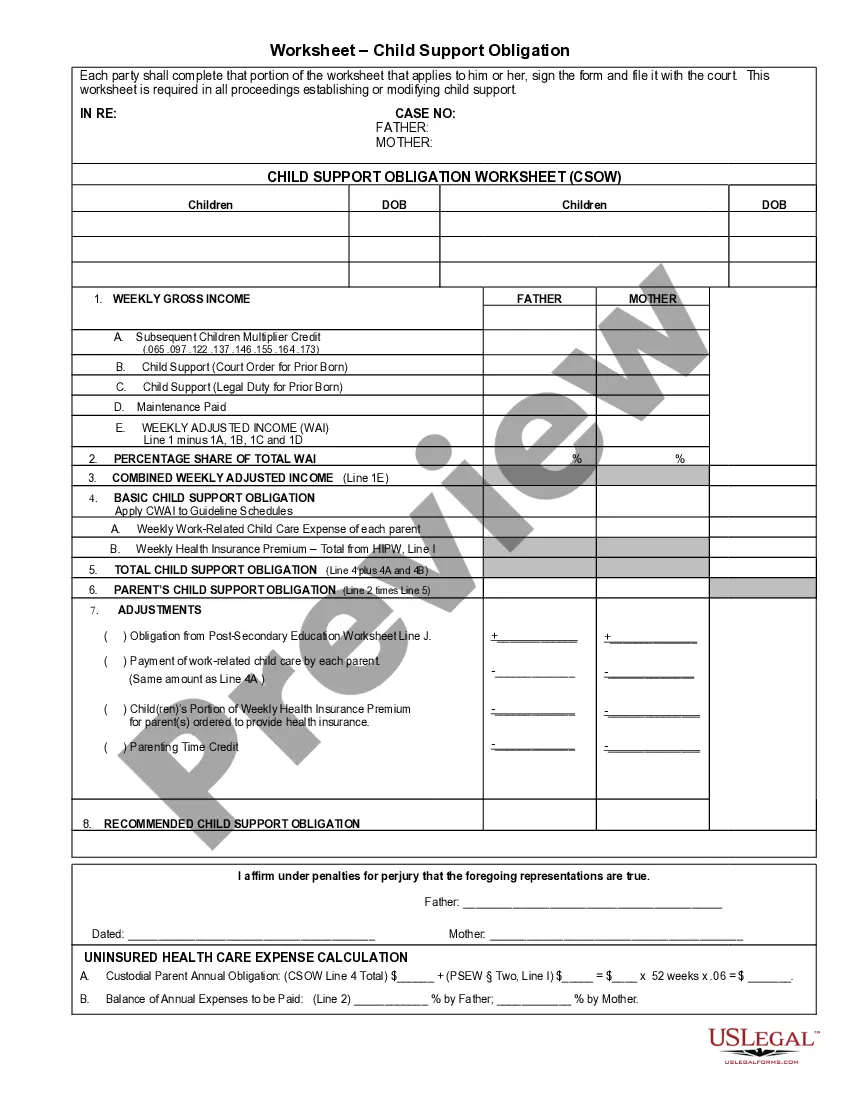

- Utilize the Review button to scrutinize the form.

- Read the description to ensure you have selected the correct form.

- If the form does not meet your requirements, utilize the Search area to find the form that suits your needs.

Form popularity

FAQ

Owner financing and seller financing are often used interchangeably, but nuances exist. Owner financing specifically emphasizes the seller directly providing financing to the buyer, while seller financing may involve more complex arrangements. Regardless of the term, both options are covered under a Mississippi Owner Financing Contract for Home, providing flexible alternatives to traditional mortgages.

While owner financing offers many benefits, it also comes with risks. Buyers may default on payments, or disagreements may arise over contract terms. To mitigate these concerns within a Mississippi Owner Financing Contract for Home, ensure clear communication and legal guidelines are established from the beginning, possibly utilizing resources from USLegalForms.

Setting up a seller financing deal involves identifying interested buyers and discussing terms that work for both parties. Begin by preparing a Mississippi Owner Financing Contract for Home that outlines payment amounts, schedules, and responsibilities. Make sure to address potential risks and include necessary legal protections, which can often be handled using resources from platforms like USLegalForms.

Owner financing may offer some tax benefits, including the potential to spread capital gains taxes over several years rather than paying them all upfront. When structuring a Mississippi Owner Financing Contract for Home, it’s wise to consult with a tax advisor to understand how seller financing affects your tax situation. This ensures you make informed decisions while maximizing benefits.

To draft an effective seller-financed contract, start by including the parties' names, property details, and financing terms. Clearly outline the payment structure, interest rate, and any contingencies to protect both parties. Platforms like USLegalForms provide templates and guidance to help you create a Mississippi Owner Financing Contract for Home that meets legal standards and your specific needs.

In seller financing under the Mississippi Owner Financing Contract for Home, the seller typically owns the deed until the buyer completes all payment terms. This arrangement allows the seller to secure their investment while providing the buyer with a path to ownership. Once the buyer fulfills their obligations, the deed transfers to them. Knowing this can guide both parties in their agreement.

One downside of a Mississippi Owner Financing Contract for Home is that sellers may face a higher risk if the buyer defaults. Sellers also must be prepared to manage the paperwork and ensure compliance with local laws. Additionally, interest rates might be higher compared to traditional mortgages. Balancing these factors is crucial before deciding on owner financing.

If the buyer defaults on a Mississippi Owner Financing Contract for Home, the seller typically retains the right to take back the property. This process usually involves a legal notice and potential court proceedings. Defaulting may also affect the buyer’s credit score, making future financing more challenging. It's essential to understand these implications before entering into any agreement.

The IRS has specific guidelines regarding owner financing, particularly concerning the reportable interest income for sellers. In a Mississippi Owner Financing Contract for Home, sellers must report interest received as taxable income. It is also essential for buyers to understand their mortgage interest deductions. Consulting a tax professional can help ensure compliance with relevant IRS rules.