Mississippi General Form of Receipt

Description

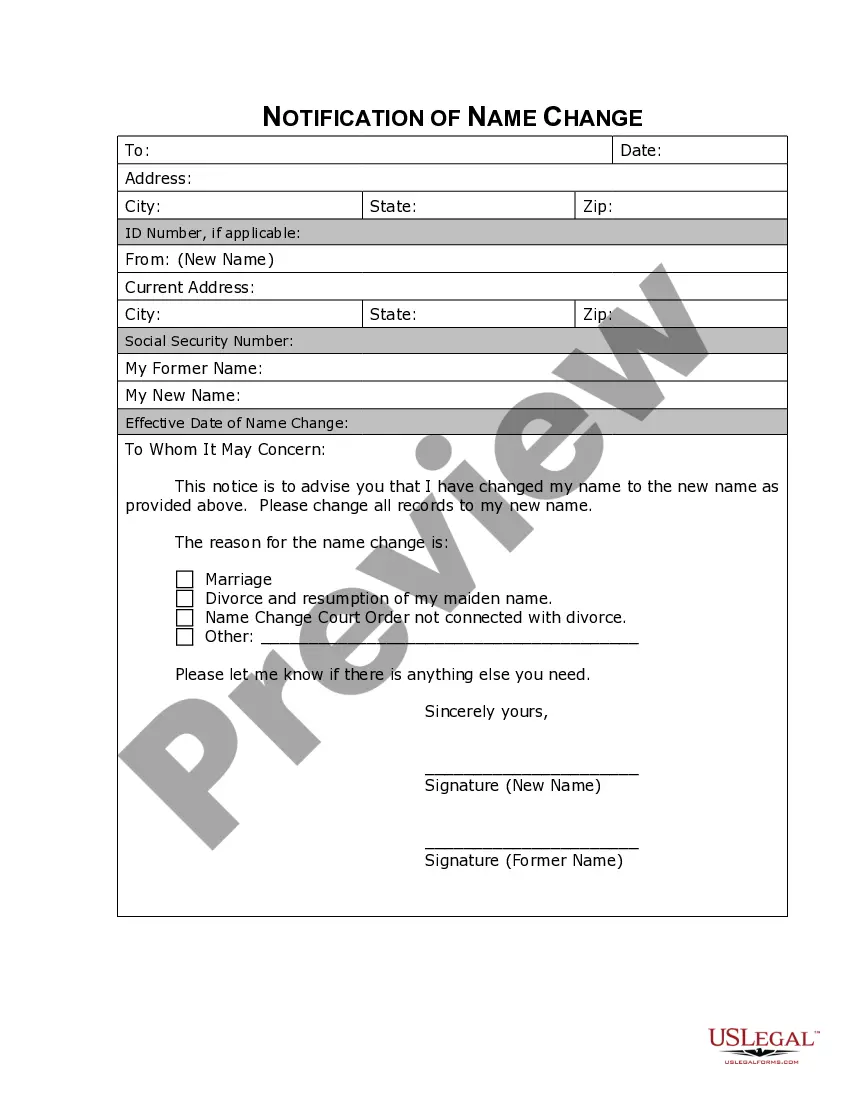

How to fill out General Form Of Receipt?

If you need to finish, obtain, or print legal document templates, utilize US Legal Forms, the largest collection of legal forms, readily available online.

Employ the website’s straightforward and efficient search to locate the documents you require.

Various templates for business and personal uses are organized by categories and states, or keywords.

Step 4. After locating the required form, select the Purchase now button, choose the payment plan you prefer, and provide your credentials to register for an account.

Step 5. Complete the payment process. You may use your credit card or PayPal account to finalize the transaction.

- Use US Legal Forms to access the Mississippi General Form of Receipt in just a few clicks.

- If you are already a US Legal Forms customer, Log In to your account and click the Download button to find the Mississippi General Form of Receipt.

- You can also retrieve forms you previously downloaded in the My documents section of your account.

- If this is your first time using US Legal Forms, follow the steps outlined below.

- Step 1. Ensure you have selected the form for the correct city/state.

- Step 2. Use the Preview option to review the content of the form. Don’t forget to read the description.

- Step 3. If you are not satisfied with the form, use the Search area at the top of the screen to find alternative versions of the legal form template.

Form popularity

FAQ

To download an e-filing receipt, you typically need to access your online tax account. After completing your return, the system usually provides a direct link to download your Mississippi General Form of Receipt. If you use a platform like uslegalforms, it can guide you through the process smoothly, ensuring you obtain all necessary documentation promptly. Always keep this receipt for your records.

If you reside or earn income in Mississippi, you are obligated to file state taxes. Utilizing the Mississippi General Form of Receipt simplifies this process and ensures you provide all necessary information. It’s beneficial to keep accurate records of your income and deductions throughout the year to ease your filing experience. Filing helps you stay on the right side of tax laws and avoid future complications.

Certain types of income are exempt from Mississippi state income tax, including some retirement benefits and Social Security income. It's important to review the specific regulations to determine what applies to your situation. Using the Mississippi General Form of Receipt, you can accurately report what income is taxable and what isn’t. This clarity helps you minimize your tax obligations.

If you do not file your taxes in Mississippi, you may face penalties and interest on unpaid taxes. The state can also take further action, such as garnishing wages or placing liens on your property. To protect yourself, always use the Mississippi General Form of Receipt to keep track of your tax documentation. This helps ensure you remain compliant with state regulations.

Yes, if you earn income in Mississippi, you generally need to file state taxes. The Mississippi General Form of Receipt is essential for documenting your income and tax payments. Make sure to complete the form accurately to avoid any issues with your tax filing. Remember, this filing is a legal requirement and helps support state services.

To receive an IRS tax clearance certificate, you must be in full compliance with all federal tax obligations. This involves filing your tax returns and paying any outstanding debts. Once satisfied, you can request this certificate to validate your tax status. Utilizing the Mississippi General Form of Receipt can assist if you have state tax issues that need resolving before seeking federal clearance.

To reinstate a dissolved LLC in Mississippi, you need to file the application for reinstatement along with any required fees. This process includes paying any outstanding taxes and submitting a Mississippi General Form of Receipt as proof of compliance. Ensure that all your business documents are updated, and check with the Secretary of State for specific requirements. Doing this will help your LLC regain good standing quickly.

Nexus in Mississippi can be established through various activities including having a physical presence, employees, or significant business transactions. Additionally, owning property or inventory in the state also creates nexus. It’s vital to understand these criteria to maintain compliance, particularly concerning the Mississippi General Form of Receipt and your tax obligations.

To calculate Mississippi franchise tax, start by determining your company’s gross revenues and share capital. The tax is based on these figures, so ensure you have accurate financial records. Completing the Mississippi General Form of Receipt helps you maintain a clean record, making the calculation process more manageable.

Filling out the Mississippi employee's withholding exemption form requires basic information like your name, address, and social security number. You will also need to declare your withholding exemption status, which can impact your tax deductions. Ensuring your form is accurate and submitted on time is critical, and the Mississippi General Form of Receipt can help you keep track of your submissions.