Mississippi Sample Letter for Agreement to Extend Debt Payment

Description

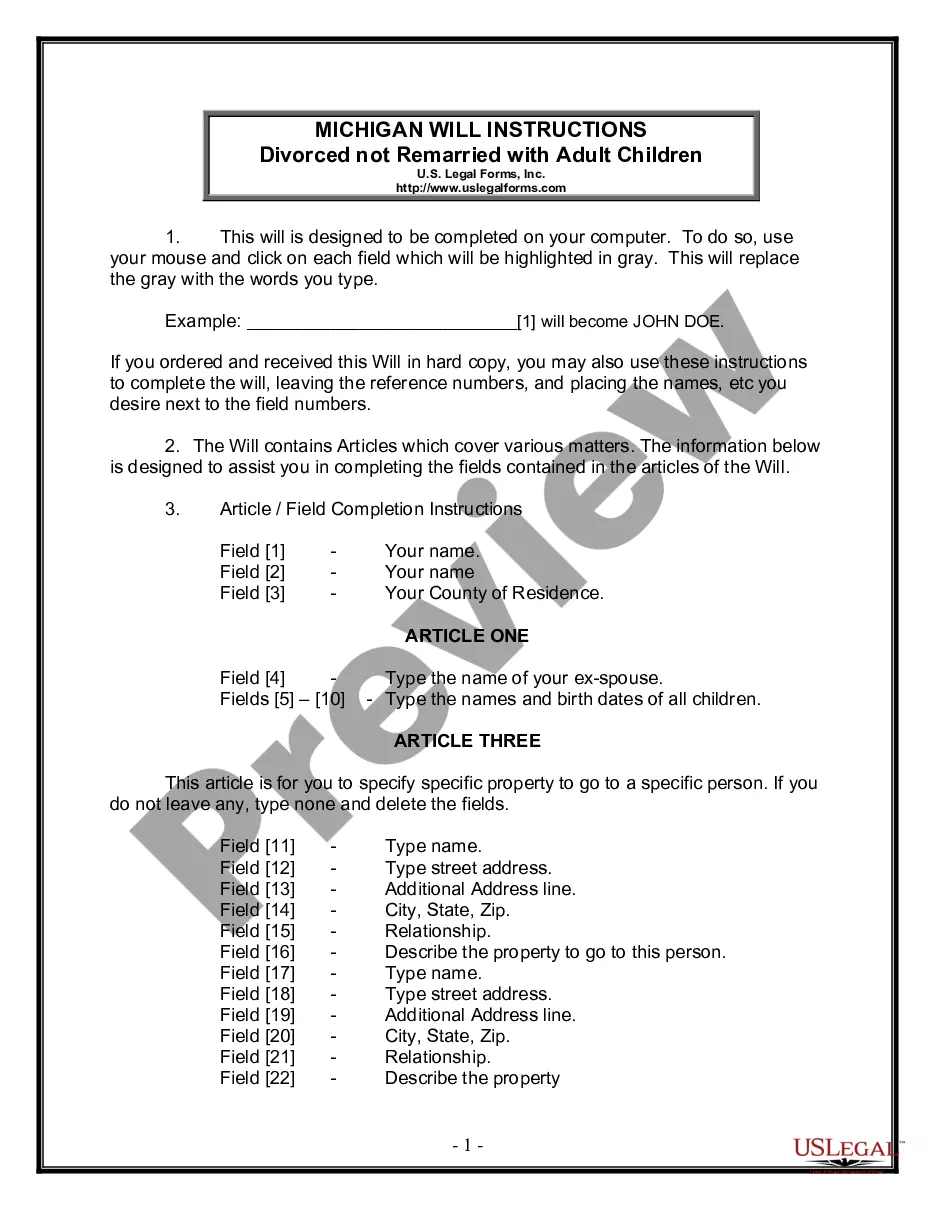

How to fill out Sample Letter For Agreement To Extend Debt Payment?

US Legal Forms - one of the largest collections of legal documents in the United States - provides a selection of legal form templates that you can download or print.

Through the website, you can access thousands of forms for business and personal purposes, organized by categories, states, or keywords.

You can find the latest versions of forms such as the Mississippi Sample Letter for Agreement to Extend Debt Payment within moments.

Review the form description to ensure you have chosen the right document.

If the form does not meet your requirements, use the Search field at the top of the screen to find one that does.

- If you already have a membership, Log In and download the Mississippi Sample Letter for Agreement to Extend Debt Payment from the US Legal Forms library.

- The Download button will appear on every form you view.

- You can access all previously downloaded forms from the My documents section of your account.

- If you wish to use US Legal Forms for the first time, here are simple instructions to help you get started.

- Make sure you have selected the correct form for your area/state.

- Click the Preview button to review the form's content.

Form popularity

FAQ

To write a letter requesting a payment arrangement, clearly explain your current situation and the reason for your request. Propose specific terms that align with what you can manage, ensuring they are reasonable for both parties. For a well-structured example, refer to the Mississippi Sample Letter for Agreement to Extend Debt Payment.

When writing a letter to extend payment terms, begin by stating your appreciation for the recipient’s support. Clearly describe your need for an extension and propose new time frames or terms for payment. If you seek inspiration, consider the Mississippi Sample Letter for Agreement to Extend Debt Payment as a great starting point.

To request a payment arrangement, draft a letter that explains your current financial situation and specifies your request for a payment plan. Clearly communicate your willingness to meet obligations while acknowledging any difficulties you face. The Mississippi Sample Letter for Agreement to Extend Debt Payment can serve as an excellent template for crafting your request.

To request a reduction in monthly installments, outline your reason for the request in a straightforward manner. Provide details about your financial hardship and suggest a new payment amount or schedule. You may find it useful to reference the Mississippi Sample Letter for Agreement to Extend Debt Payment for an effective format.

Writing a payment arrangement letter involves explaining your current financial situation and proposing a feasible payment plan. Be honest about your circumstances and suggest specific terms, such as amounts and due dates. Consider using the Mississippi Sample Letter for Agreement to Extend Debt Payment for a clear framework to express your intention.

To write a polite letter requesting payment, start with a warm greeting and clearly state the purpose of your letter. Detail the amount owed, the due date, and any previous payment reminders. Conclude with a respectful closing, and if needed, refer to the Mississippi Sample Letter for Agreement to Extend Debt Payment for more structured guidance.

To write a simple contract agreement, begin with a clear title, then outline the parties involved and the purpose of the agreement. Include specific terms and conditions, stating what each party must do, as well as the timeframe. A concise format ensures understanding and reduces confusion. The Mississippi Sample Letter for Agreement to Extend Debt Payment can offer you a good template to ensure all key elements are covered.

When negotiating a debt settlement, many advisors suggest starting with an offer of 30-50% of the outstanding amount. This gives you room to negotiate without offering too little. Your financial situation and the creditor's willingness to settle will affect your offer. To formalize any agreement, you might consider creating a Mississippi Sample Letter for Agreement to Extend Debt Payment.

When writing a letter of debt relief, start by clearly stating your intention to seek relief and explain your financial situation. Be sure to include specific details about the debt, such as the amount owed and any relevant account numbers. Using a Mississippi Sample Letter for Agreement to Extend Debt Payment can provide a helpful format and guide your tone, ensuring you communicate your message effectively.

The 777 rule is a guideline that suggests debt collectors may not pursue debt collection once a certain period has passed. Specifically, after seven years, negative credit items should generally be removed from your credit report. Understanding this rule can help you navigate your debts more effectively and manage your financial history. If you find yourself needing to negotiate, consider using a Mississippi Sample Letter for Agreement to Extend Debt Payment as a structured approach.