Mississippi Sample Letter for Compromise on a Debt

Description

How to fill out Sample Letter For Compromise On A Debt?

Selecting the appropriate legal document template can be a challenge.

Of course, there are numerous templates accessible online, but how do you locate the legal form you need.

Utilize the US Legal Forms website. The service offers a multitude of templates, including the Mississippi Example Letter for Compromise on a Debt, suitable for both business and personal needs.

You can browse the form using the Review button and read the form description to confirm it is the right one for you.

- All of the forms are reviewed by professionals and comply with national and state requirements.

- If you are already registered, Log In to your account and click the Obtain button to access the Mississippi Example Letter for Compromise on a Debt.

- Use your account to review the legal forms you may have previously purchased.

- Go to the My documents tab in your account to download another copy of the documents you need.

- If you are a new user of US Legal Forms, here are some basic steps for you to follow.

- First, ensure you have selected the correct form for your city/region.

Form popularity

FAQ

An offer in compromise in Mississippi allows you to settle your debt for less than the full amount owed. By using a Mississippi Sample Letter for Compromise on a Debt, you can propose a payment amount that both you and your creditor can agree on. This option is beneficial as it can help ease your financial burden while allowing you to resolve the debt efficiently. Utilizing resources like USLegalForms can simplify this process by providing templates that ensure your offer is clear and formal.

The new tax law in Mississippi includes several changes aimed at simplifying tax filings and adjusting tax rates. It is important to stay updated, as these changes can affect your financial decisions and obligations. Keeping track of these adjustments can help you manage your taxes effectively. If you face challenges with tax debts, consider utilizing a Mississippi Sample Letter for Compromise on a Debt to help negotiate your payment options.

In Mississippi, the statute of limitations for state tax debts is generally three years from the date the tax is owed. However, if a tax return was not filed, or if there was fraud, this period may be extended. It is crucial to understand the statutes surrounding tax responsibilities to avoid complications. For individuals seeking a structured approach to debt resolution, a Mississippi Sample Letter for Compromise on a Debt can be an effective tool.

Generally, an IRS offer in compromise takes about six months to process, though some cases may take longer when additional information is needed. The timeline can vary based on the complexity of each case and whether you submitted a complete application. It is important to follow up and provide any requested documents promptly. The Mississippi Sample Letter for Compromise on a Debt can help streamline your communication with the IRS during this waiting period.

The 30% figure you may hear typically encompasses both federal income tax and self-employment tax, factoring in average scenarios for self-employed individuals. This combined rate varies based on total income and deductions available. Understanding this helps in planning for taxes when you are self-employed. Consider preparing a Mississippi Sample Letter for Compromise on a Debt if you face challenges meeting these tax requirements.

Self-employment tax in Mississippi typically consists of Social Security and Medicare taxes. For 2023, the self-employment tax rate is 15.3% on net earnings. This tax applies to income earned from self-employment activities, and it's essential to calculate this accurately to avoid hefty payments later. If you're seeking to negotiate tax obligations, the Mississippi Sample Letter for Compromise on a Debt might be a valuable resource.

In Mississippi, an LLC is generally taxed as a pass-through entity. This means that the profit of the LLC passes through to the owners, who report it on their personal tax returns. Additionally, depending on the choice of taxation, some LLCs may select to be treated as corporations for tax purposes. Using a Mississippi Sample Letter for Compromise on a Debt could help address any tax disputes that arise.

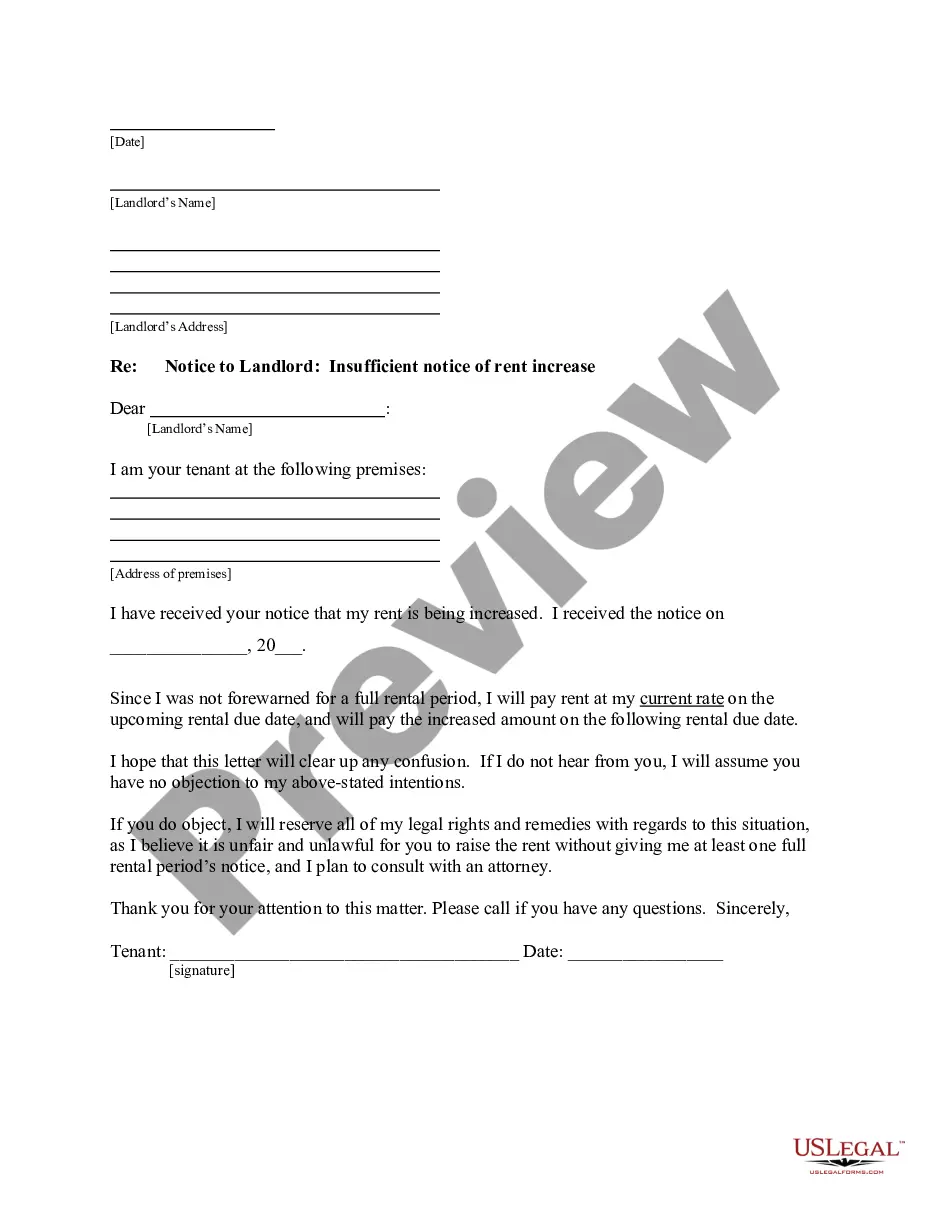

A good debt settlement letter should start with your personal information and the creditor's details. Include an introduction that outlines your debt and your intent to negotiate a settlement. The Mississippi Sample Letter for Compromise on a Debt can guide you in structuring your letter effectively. Be sure to propose a specific settlement amount and explain how it benefits both parties, showcasing your willingness to resolve the issue amicably.

Begin your settlement request letter by addressing the creditor clearly. State your circumstances and express your desire to settle the debt for less than the full amount. The Mississippi Sample Letter for Compromise on a Debt can serve as an effective framework for drafting your message. Be specific about the terms you are proposing and include any supporting documentation that may help your case.

To write a letter to clear debt, start by clearly stating your intention to resolve the matter. Include relevant details such as your account number, the amount owed, and a clear request for the debt to be settled. You can use the Mississippi Sample Letter for Compromise on a Debt to guide you through this process. Ensure you express your willingness to negotiate a mutually agreeable payment plan.