Mississippi Loan Modification Agreement

What is this form?

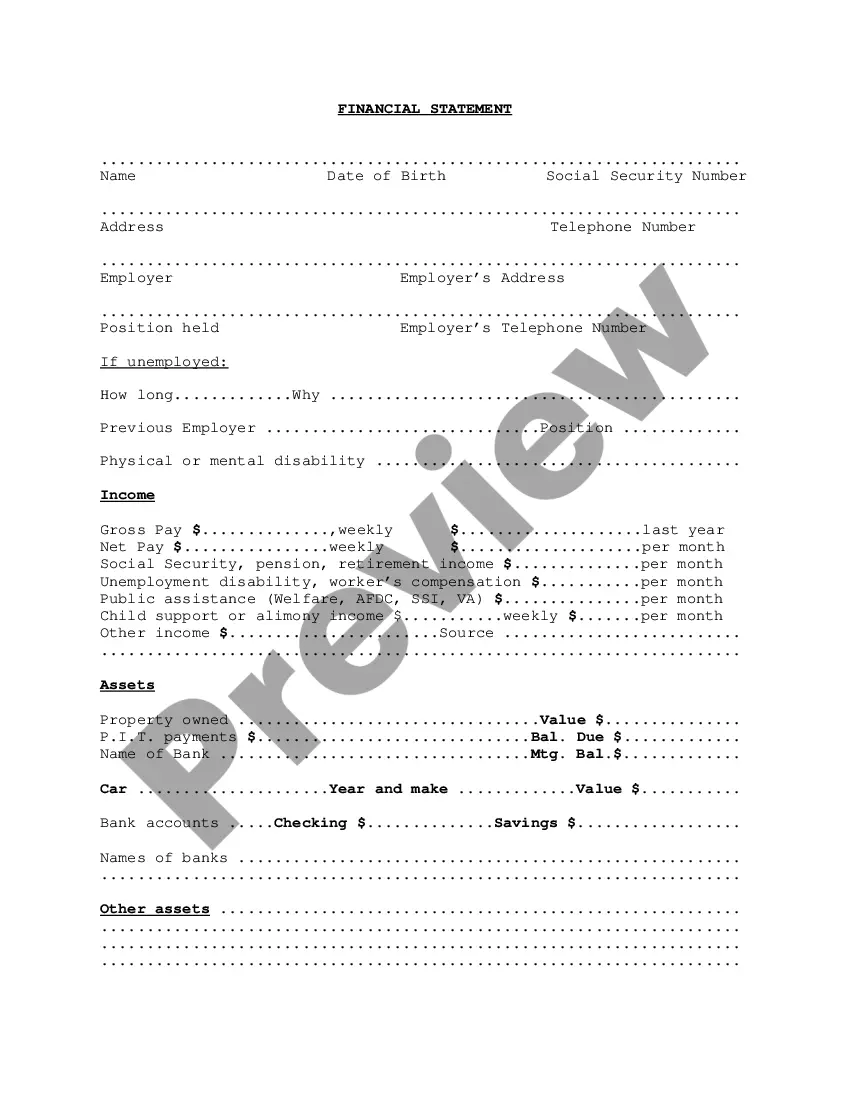

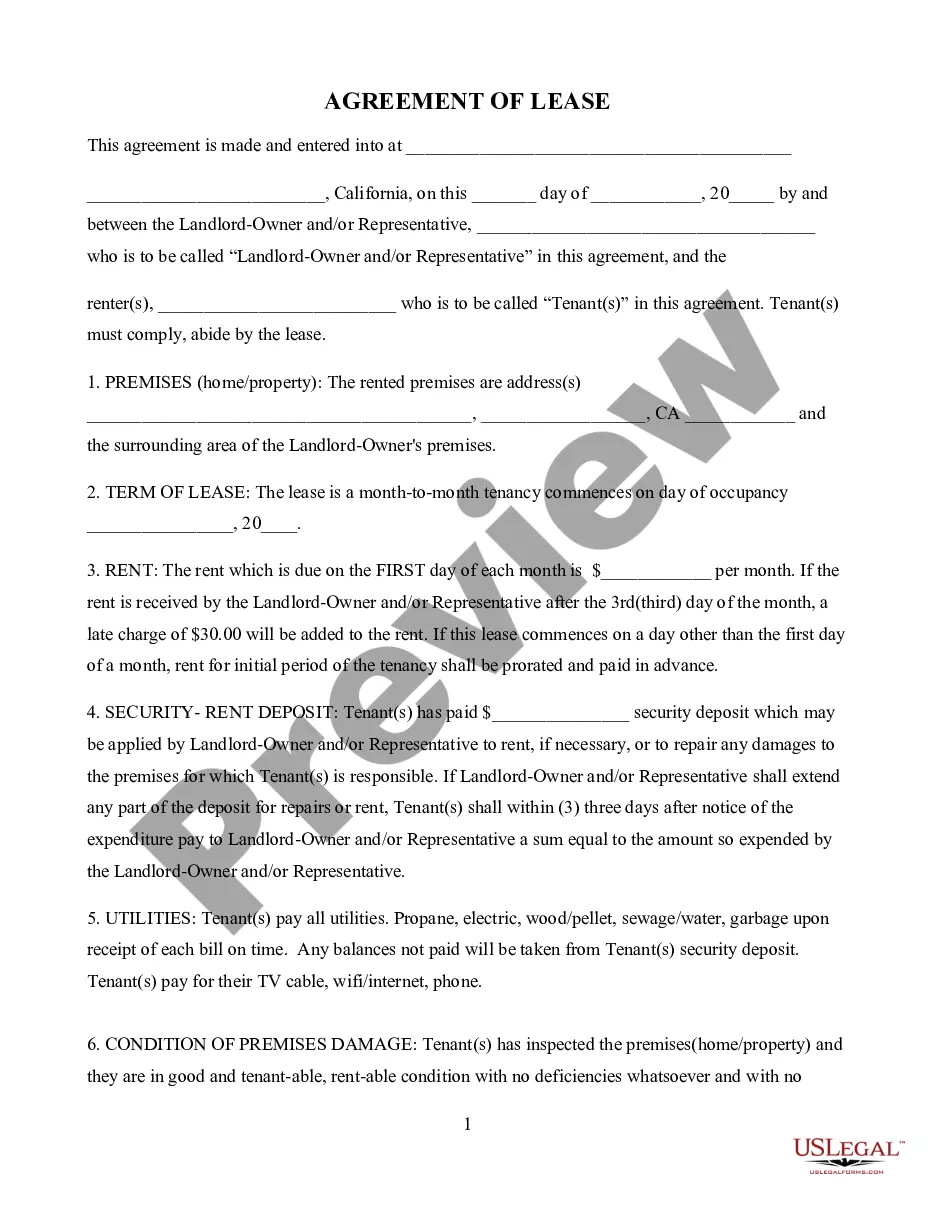

The Loan Modification Agreement is a legal document used to modify the terms of an existing loan agreement. This form, compliant with Mississippi law, is signed by both the borrower and the lender to confirm mutual acceptance of the changes made to the loan. This agreement differs from a standard loan agreement by specifically outlining the adjustments to existing terms rather than establishing new ones.

Main sections of this form

- Identification of the original loan agreement and parties involved.

- Details of the modifications to be made, including interest rates or payment schedules.

- Signatures from both the borrower and lender to confirm acceptance of changes.

- Effective date of the modifications.

- Any additional terms and conditions agreed upon by both parties.

When to use this form

This form is used when borrowers and lenders agree to change certain terms of an existing loan. Common scenarios include situations where the borrower experiences financial difficulties and seeks to lower their monthly payments, adjust the interest rate, or extend the loan duration. It can also be necessary when a lender wishes to modify terms to prevent default.

Intended users of this form

This form is intended for:

- Borrowers seeking to modify their loan terms due to financial circumstances.

- Lenders looking to accommodate borrower requests and preserve the loan agreement.

- Anyone involved in an existing loan agreement who needs to formalize modifications in compliance with legal standards.

How to prepare this document

- Identify the original loan agreement details, including loan amount and date.

- Clearly outline the modifications being made to the loan terms.

- Have both parties review and agree to the modifications.

- Sign and date the form to make the modifications legally binding.

- Keep a signed copy of the agreement for your records.

Notarization guidance

This form usually doesn’t need to be notarized. However, local laws or specific transactions may require it. Our online notarization service, powered by Notarize, lets you complete it remotely through a secure video session, available 24/7.

Get your form ready online

Our built-in tools help you complete, sign, share, and store your documents in one place.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Common mistakes to avoid

- Not specifying all modifications clearly, which can lead to misunderstandings.

- Failing to obtain signatures from both parties, rendering the agreement invalid.

- Neglecting to date the form, which is crucial for determining the effective date of changes.

- Using an outdated version of the form that may not comply with current laws.

Why use this form online

- Easy access to a legally compliant template that saves time.

- Editable fields allow for customization based on specific loan terms.

- Convenient downloading options provide flexibility and immediate use.

- Forms are drafted by licensed attorneys, ensuring reliability and legality.

Looking for another form?

Form popularity

FAQ

Technically, a loan modification should not have any negative impact on your credit score.If that's the case, those the Consumer Data Industry Association missed or partial payments will damage your credit, but the loan modification itself will not.

A lender may agree to a loan modification during a settlement procedure or in the case of a potential foreclosure.A loan modification agreement is a long-term solution. A loan modification may involve a reduced interest rate, a longer period to repay, a different type of loan, or any combination of these.

If your modification is temporary, you'll likely need to return to the original terms of your mortgage and repay the amount that was deferred before you can qualify for a new purchase or refinance loan.

You should contact the lender's loss and mitigation department to discuss the reason of you loan modification rejection. Possible reasons for a modification rejection include insufficient income, high debt-to-income ratio, missing documents, or delinquent credit history.

Some of the most common types of hardship are: job loss, pay reduction, underemployment, declining business revenue, death of a coborrower, illness, injury, and divorce.

Be at least one regular mortgage payment behind or show that missing a payment is imminent. Provide evidence of significant financial hardship, for reasons such as:

Yes, probably. In California, a law called the Homeowner Bill of Rights (HBOR) generally gives borrowers the right to appeal a modification denial. Under HBOR, in most cases, if the servicer denies a borrower's application to modify a first lien loan, the borrower can appeal.

A loan modification can relieve some of the financial pressure you feel by lowering your monthly payments and stopping collection activity. But loan modifications are not foolproof. They could increase the cost of your loan and add derogatory remarks to your credit report.