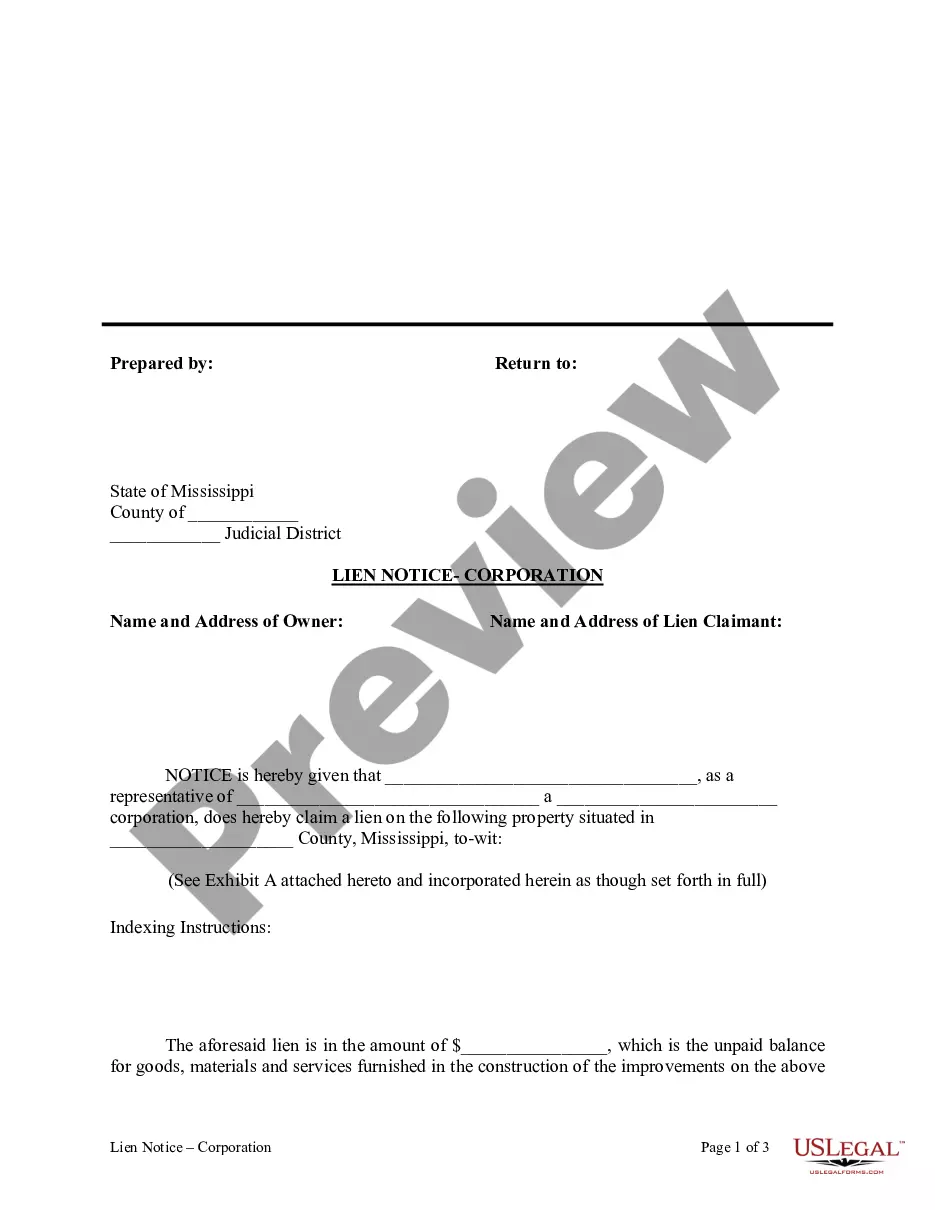

Mississippi Lien Notice - 85-7-131

What this document covers

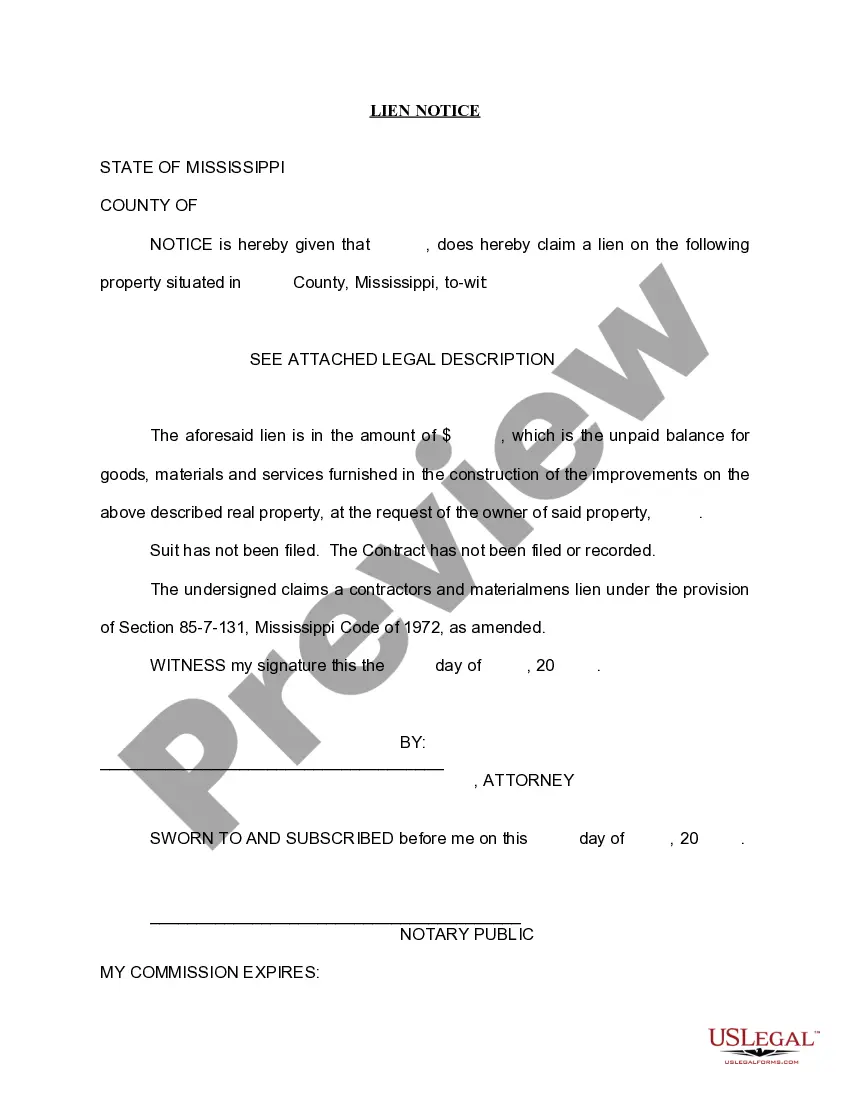

The Lien Notice - 85-7-131 is a legal document specific to Mississippi, used by contractors who have not received full payment for their services. By filing this form, a contractor places a lien on the property of the owner, securing their right to be compensated for their work. This form ensures that the contractor's claim is legally recognized until payment is settled, distinguishing it from other contract forms by its specific focus on unpaid services and property rights.

Key parts of this document

- Identifying information for the contractor and property owner

- Description of the services provided and corresponding amounts owed

- Details of the property subject to the lien

- Legal statement of the claim for payment

- Signature of the contractor or authorized representative

When to use this form

This form is necessary when a contractor has completed work on a property but has not been paid fully for their services. It is typically used in situations where payment disputes arise, and the contractor needs to protect their financial interests by placing a lien on the property. Filing this notice informs the property owner of the claim and may prompt payment to avoid complications.

Who needs this form

Use this form if you are:

- A contractor or subcontractor who has not been paid for services rendered.

- A property owner who wishes to be informed of any liens on their property.

- A legal professional advising clients on lien rights and procedures.

How to prepare this document

- Identify the contractor by entering the name and contact information.

- Provide the property owner's name and contact details.

- Clearly describe the services provided, including dates and amounts owed.

- Specify the property subject to the lien, including its address.

- Sign the document to validate the claim.

Is notarization required?

Notarization is not commonly needed for this form. However, certain documents or local rules may make it necessary. Our notarization service, powered by Notarize, allows you to finalize it securely online anytime, day or night.

Get your form ready online

Our built-in tools help you complete, sign, share, and store your documents in one place.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Typical mistakes to avoid

- Not including all required information about the services provided.

- Failing to correctly identify the property in question.

- Omitting the contractor's signature, leading to invalidation of the form.

- Incorrectly filling in the ownerâs name, which can delay the process.

Benefits of using this form online

- Convenience of completing the form at your own pace without visiting a lawyer.

- Easy to edit or update information before finalizing the document.

- Access to current and compliant legal templates that meet state requirements.

Looking for another form?

Form popularity

FAQ

Where and how should you file the mechanics lien in Mississippi? The mechanics lien must be filed the chancery court where the project is located. You may have the mechanics lien recorded in the court by sending it via email together with the required lien fees, or you may also walk in and personally file it.

If you have unpaid debt of any kind, this can lead the creditors that you owe money to place a lien on your assets.In other cases, liens may be placed on property by a court order as a result of legal action.

To enforce the lien, the contractor must file a lawsuit within 90 days from the date of recording the lien. If this deadline is passed, the contractor may not be able to enforce the lien and may be required to remove the lien.

Be in substantial compliance with the contract or purchase order; File claim of lien within 90 days; Include in the lien a statement of amount due and due date of the claim; Notice the filing of claim of lien within 2 days to contractor and owner;

Prepare the lien document, taking care to include all the necessary information set forth above including the required statements. Sign the document. Deliver the lien must the office of the clerk of the chancery court of the county where the property is located.

When a carpenter, plumber, roofer, or electrician works on a house, he or she can put a labor lien on the property if they are not paid. To file the lien, you must visit the Recorder of Deeds office in the county where the property is located.

While it's unlikely that just anyone can put a lien on your home or land, it's not unheard of for a court decision or a settlement to result in a lien being placed against a property.

While they don't require lien filings to be notarized, they do require a lien filer to jump through various other hoops that, if not done properly, might cause your filing to be rejected or invalidated: Delaware.

Even though these states may permit project participants to secure lien rights and claim a mechanics lien even without a written contract, it is generally best practice to have a signed written contract for work provided.