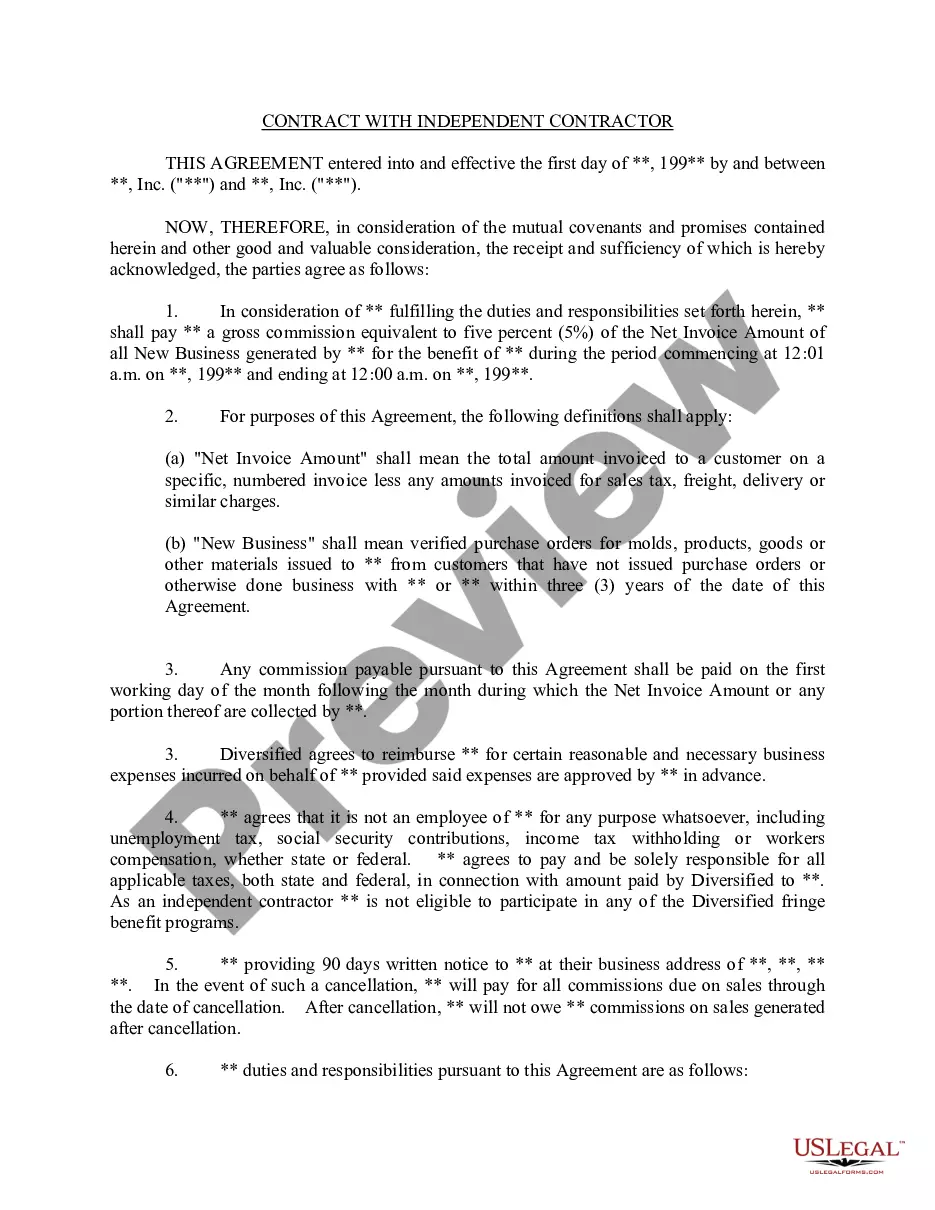

Mississippi Contract with Self-Employed Independent Contractor

Description

How to fill out Mississippi Contract With Self-Employed Independent Contractor?

Acquire a printable Mississippi Agreement with Self-Employed Independent Contractor with just a few clicks in the most comprehensive collection of legal e-documents. Discover, download, and print expertly drafted and certified examples on the US Legal Forms website. US Legal Forms has been the top provider of affordable legal and tax documents for US citizens and residents online since 1997.

Users who already possess a subscription must Log In to their US Legal Forms account, download the Mississippi Agreement with Self-Employed Independent Contractor, and find it stored in the My documents section. Clients without a subscription need to adhere to the instructions listed below.

After you have downloaded your Mississippi Agreement with Self-Employed Independent Contractor, you can fill it out in any online editor or print it and complete it by hand. Utilize US Legal Forms to access 85,000 professionally drafted, state-specific documents.

- Ensure your document complies with your state's regulations.

- If available, read the document's description for additional details.

- If applicable, review the form to see more information.

- Once you're certain the template is suitable for you, click Buy Now.

- Create a personal account.

- Select a plan.

- Make payment through PayPal or credit card.

- Download the document in Word or PDF format.

Form popularity

FAQ

For most types of projects you hire an independent contractor (IC) to do, the law does not require you to put anything in writing. You can meet with the IC, agree on the terms of your arrangement, and have an oral contract or agreement that is legally binding. Just because you can doesn't mean you should, however.

Do not designate someone as a 1099 Employee if: Company provides training on a certain method of job performance. Tools and materials are provided. Employees must follow set schedule. You provide benefits such as vacation, overtime pay, etc.

Do employers need to complete employment verification checks for independent contractors? No.However, it is important to note that businesses and individuals may not hire independent contractors if they are aware that the independent contractor is not authorized to work in the United States.

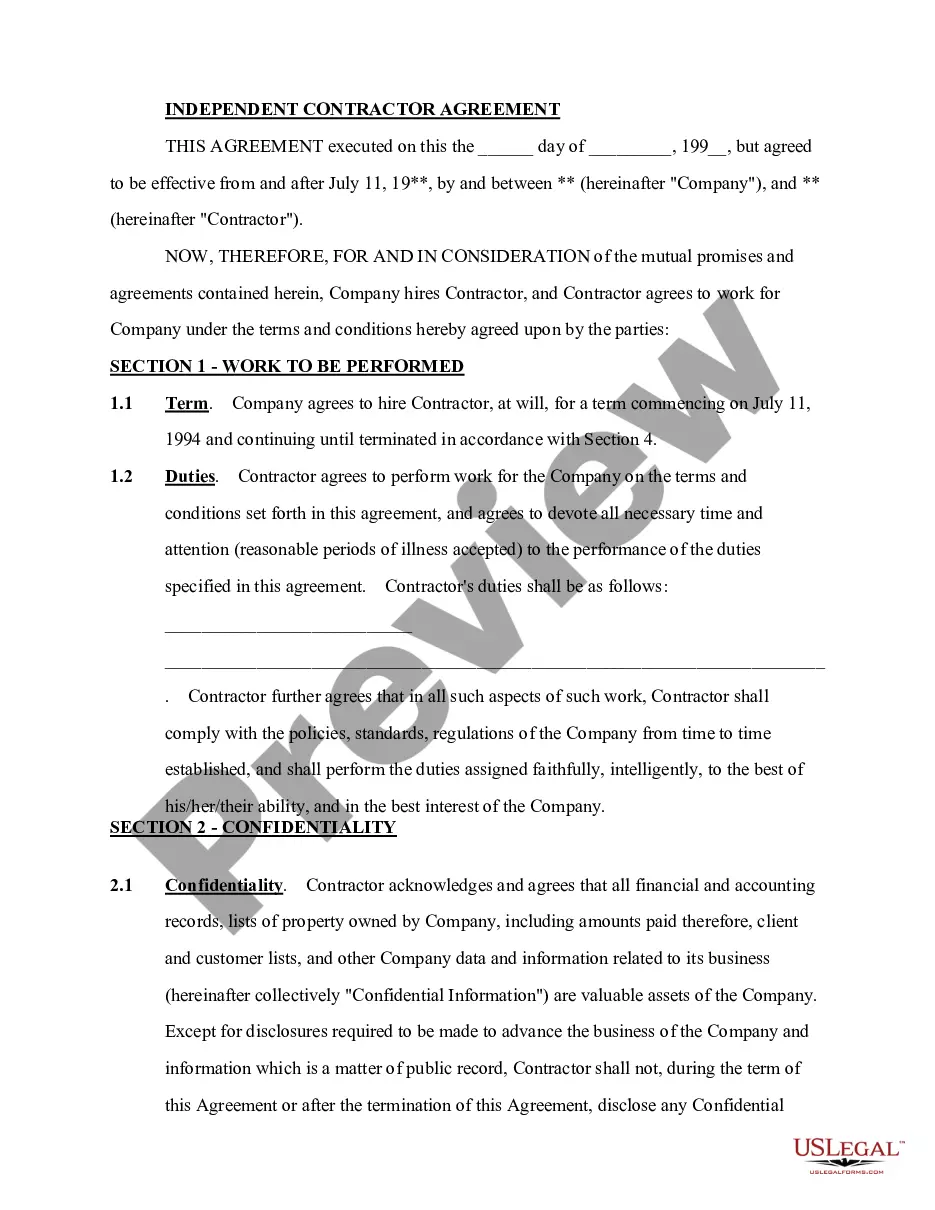

A self employed person will not usually have a contract of employment; they will usually be hired for a certain amount of time. The contract that exists between the self employed person and the person or company supplying the work will have a number of rules or conditions set down within it.

CARES Act II contains a new provision: unemployed or underemployed independent contractors who have an income mix from self-employment and wages paid by an employer are still eligible for PUA. Under CARES Act I, any such worker was typically eligible only for a state-issued benefit based on their wages.

The earnings of a person who is working as an independent contractor are subject to Self-Employment Tax. If you are an independent contractor, you are self-employed.However, your earnings as an employee may be subject to FICA (Social Security tax and Medicare) and income tax withholding.

1. Not Having a Written Contract.The taxing, labor and employment, and insurance authorities expect a written contract that states that the worker is an independent contractor and will be paid as such with no tax withholding, no benefits, etc.

For most types of projects you hire an independent contractor (IC) to do, the law does not require you to put anything in writing. You can meet with the IC, agree on the terms of your arrangement, and have an oral contract or agreement that is legally binding. Just because you can doesn't mean you should, however.