Mississippi Warranty Deed - From Widow or Widower

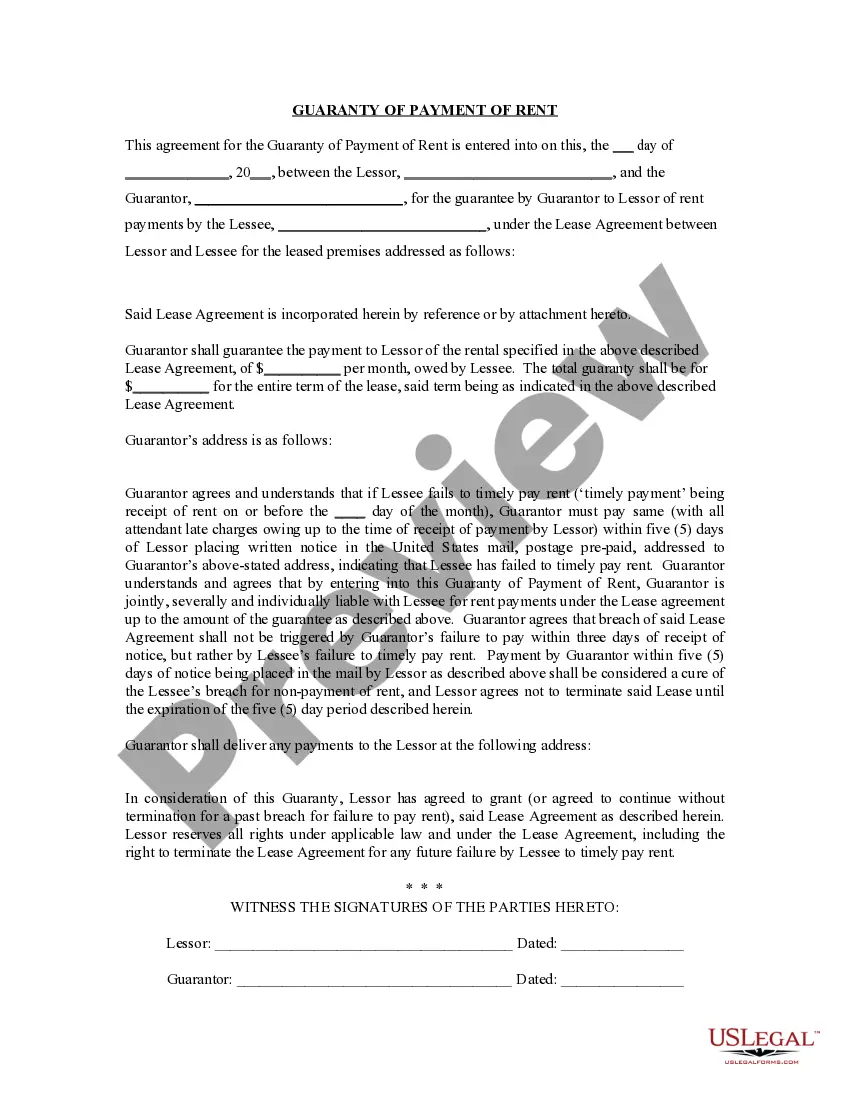

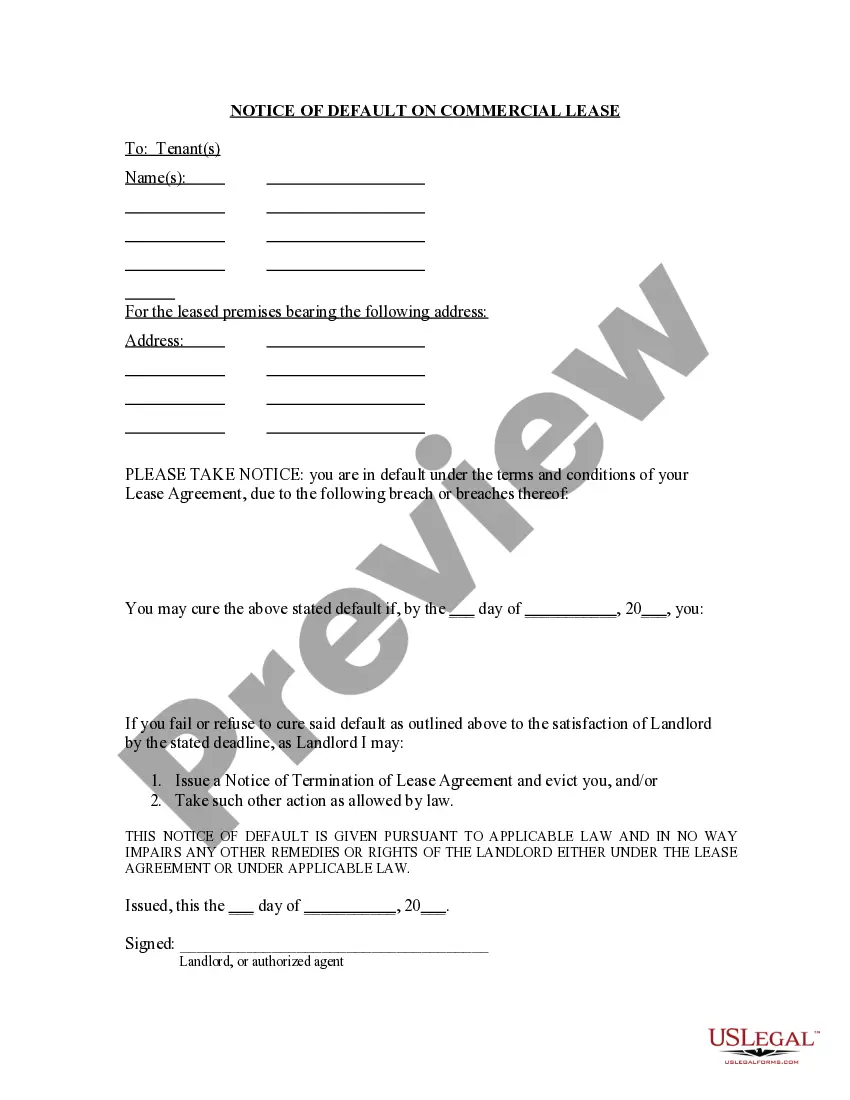

What is this form?

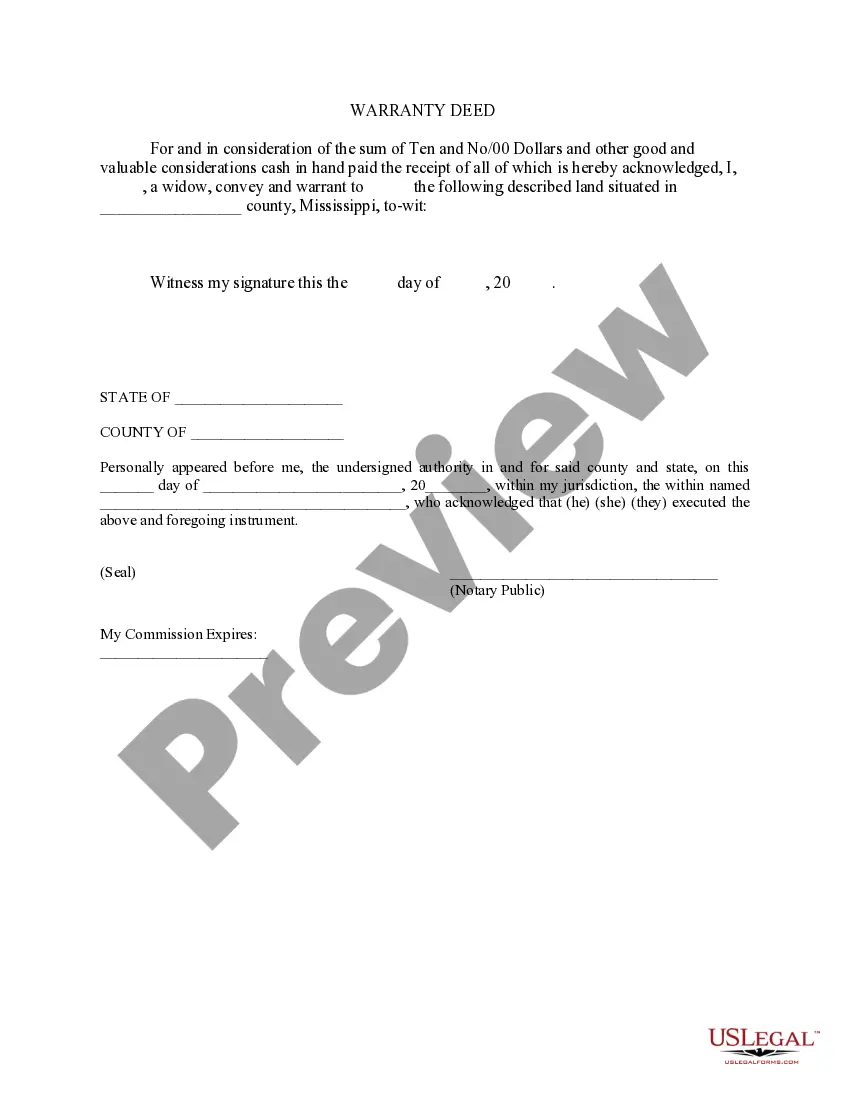

The Warranty Deed - From Widow or Widower is a legal document used to transfer ownership of real estate from a surviving spouse. This form serves as proof of transfer and helps clarify ownership rights following the death of one spouse. Unlike other types of deeds, this specific warranty deed ensures that clear title is conveyed, protecting the grantee against future claims on the property.

Key parts of this document

- Preamble: Identifies the grantor (the widow or widower) and grantee (the recipient of the property).

- Legal Description: Detailed description of the property being transferred.

- Consideration: The amount paid or agreed upon for the property transfer.

- Warranties: Guarantees provided by the grantor about the title to the property.

- Signature: Space for the grantor to sign and date the document.

When to use this form

This form is typically used when a widow or widower wishes to transfer real estate that was held jointly by spouses. It is often required during estate settlements or when selling or transferring property that was owned before a spouse's death.

Who can use this document

- Surviving spouses who need to transfer property ownership.

- Executors or administrators of an estate handling property after a spouse's death.

- Anyone involved in a real estate transaction where a surviving spouse is the grantor.

Steps to complete this form

- Identify the parties: Enter the names and addresses of the grantor and grantee.

- Specify the property: Provide a detailed legal description of the property being transferred.

- Enter consideration: Indicate the amount agreed upon for the property transfer.

- Review warranties: Ensure all warranties and representations are accurately stated.

- Sign and date: The grantor must sign the form in the presence of a notary, if required.

Notarization requirements for this form

This document requires notarization to meet legal standards. US Legal Forms provides secure online notarization powered by Notarize, allowing you to complete the process through a verified video call, available 24/7.

Get your form ready online

Our built-in tools help you complete, sign, share, and store your documents in one place.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Common mistakes

- Failing to include a complete legal description of the property.

- Not obtaining a signature from a notary when required.

- Leaving out consideration details, which may cause confusion during the transfer.

Advantages of online completion

- Convenience of accessing and completing the form from home.

- Editable templates that can be tailored to fit specific needs.

- Reliability of having documents reviewed by licensed attorneys.

Looking for another form?

Form popularity

FAQ

To transfer it, you will have to get a succession certificate (for moveable property) and a letter of administration (for Immoveable property). While doing so, get the son and daughter to give no objections in court that they have no objection if all the property is transferred to the widow.

How long will home warranty coverage last? Most home warranty terms are one year. This is a 12-month contract which in many cases is renewable from year to year. Make sure to renew your home warranty promptly each year so that you're not caught without coverage.

Purchasing a home warranty, though, can help alleviate some of the financial burden new homeowners face when a major appliance or home system goes out. Yes, you'll pay for a warranty upfront but the savings could be worth the added expense.

If you don't want to worry about paying out of pocket when a key household item breaks down, spending $25 to $50 per month for protection is often worth it. The average home warranty costs between $300 and $600 per year, typically covering more than $20,000 worth of appliances and systems in your home.

What does a $500 home warranty cover? An annual service contract for $500 will typically cover basic systems like air conditioning, electrical, and plumbing, and important appliances like your refrigerator, dishwasher, washer, and dryer.