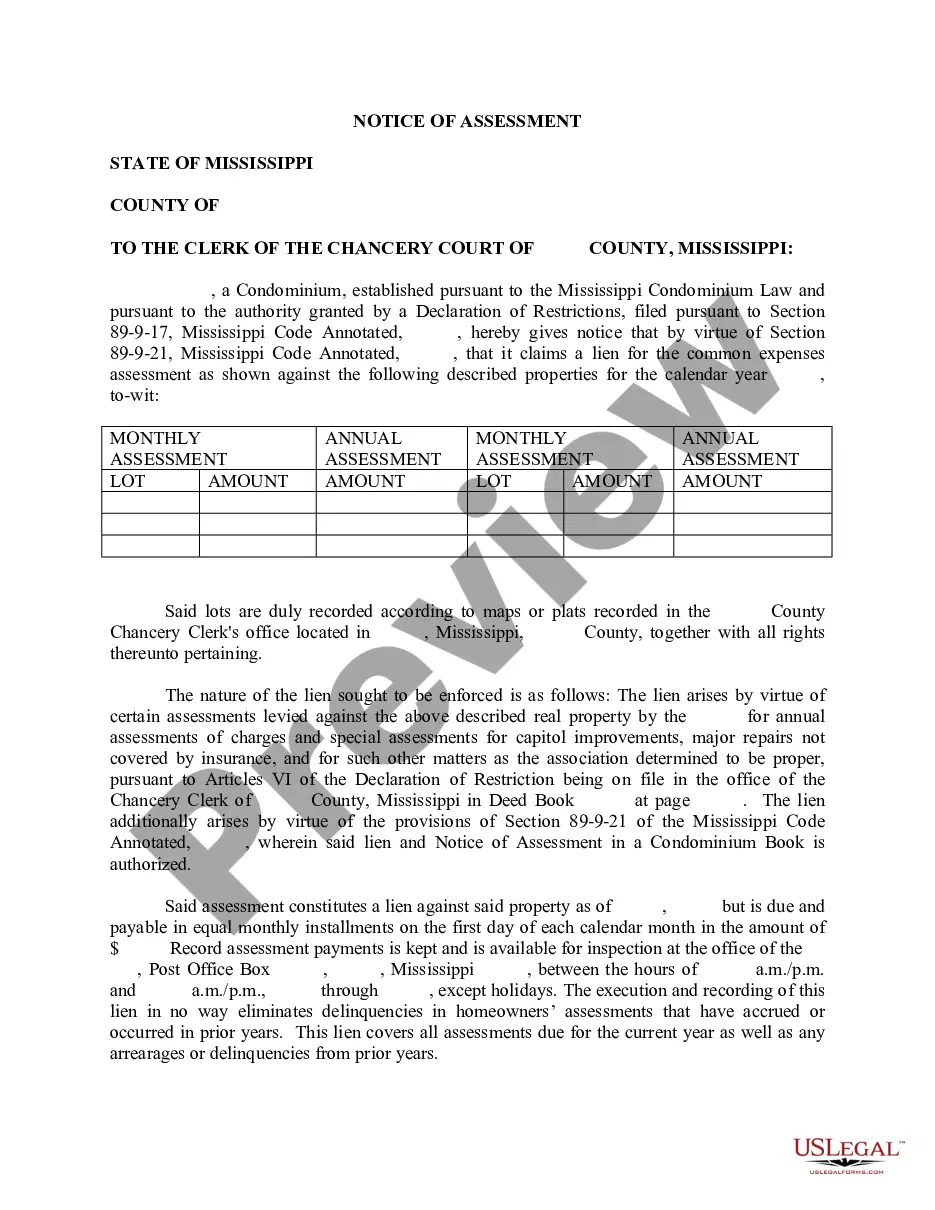

Mississippi Notice of Assessment

Description

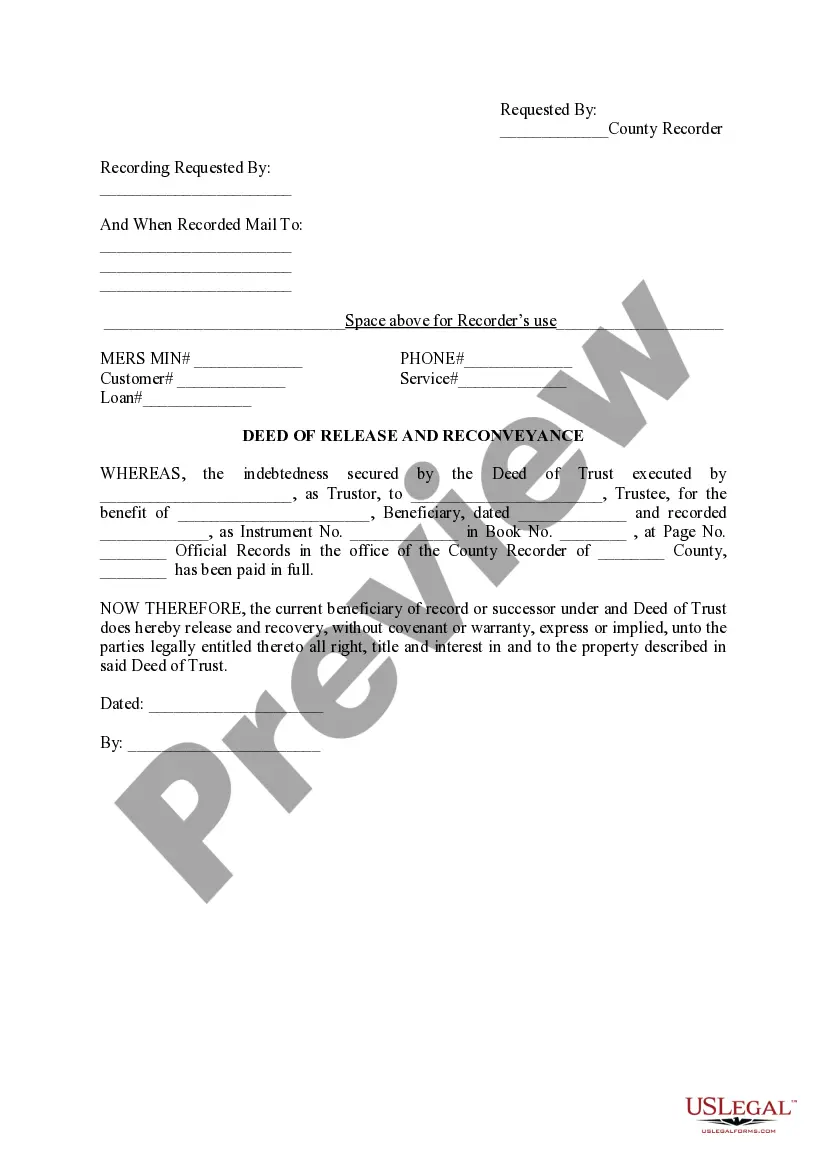

How to fill out Mississippi Notice Of Assessment?

Get a printable Mississippi Notice of Assessment within several mouse clicks in the most comprehensive library of legal e-documents. Find, download and print out professionally drafted and certified samples on the US Legal Forms website. US Legal Forms is the #1 provider of reasonably priced legal and tax templates for US citizens and residents online starting from 1997.

Users who have already a subscription, must log in in to their US Legal Forms account, download the Mississippi Notice of Assessment see it stored in the My Forms tab. Customers who don’t have a subscription are required to follow the steps listed below:

- Make sure your template meets your state’s requirements.

- If provided, read the form’s description to find out more.

- If readily available, preview the shape to view more content.

- Once you’re sure the form meets your requirements, simply click Buy Now.

- Create a personal account.

- Pick a plan.

- Pay through PayPal or bank card.

- Download the template in Word or PDF format.

As soon as you have downloaded your Mississippi Notice of Assessment, you can fill it out in any web-based editor or print it out and complete it by hand. Use US Legal Forms to get access to 85,000 professionally-drafted, state-specific files.

Form popularity

FAQ

Social Security benefits do not count as gross income. However, the IRS does count them in your combined income for the purpose of determining if you must pay taxes on your benefits.

Retirement Income: Retirement income can include social security benefits as well as any benefits from annuities, retirement or profit sharing plans, insurance contracts, IRAs, etc. Retirement income may be fully or partially taxable.

Mississippi Residents As a resident you are required to file a state income tax return if you had any income withheld for tax purposes, earned more than $8,300 (single; add $1,500 per dependent) or earned more than $16,600 (married; add $1,500 per dependent).To file a Mississippi resident return use Form 80-105.

To check the status of your Mississippi state refund online, go to https://tap.dor.ms.gov/?link=RefundStatus. Then, click Search to see your refund status. For specific telephone numbers, refer to the Mississippi Department of Revenue Contact Us page.

It is also one the country's most tax-friendly states for retirees.Mississippi exempts all forms of retirement income from taxation, including Social Security benefits, income from an IRA, income from a 401(k) and any pension income. On top of that, the state has low property taxes and moderate sales taxes.

There is no tax schedule for Mississippi income taxes. 4% on the next $5,000 of taxable income. 5% on all taxable income over $10,000. 200bIf filing a combined return (both spouses work), each spouse can calculate their tax liability separately and add the results.

Persons who are 65 years of age and older or who are disabled, upon application and proof of eligibility, are exempt from all ad valorem taxes up to $7,500.00 of assessed value. The application for exemption must be filed with the individual county on or before April 1.

Mississippi exempts all forms of retirement income from taxation, including Social Security benefits, income from an IRA, income from a 401(k) and any pension income. On top of that, the state has low property taxes and moderate sales taxes.