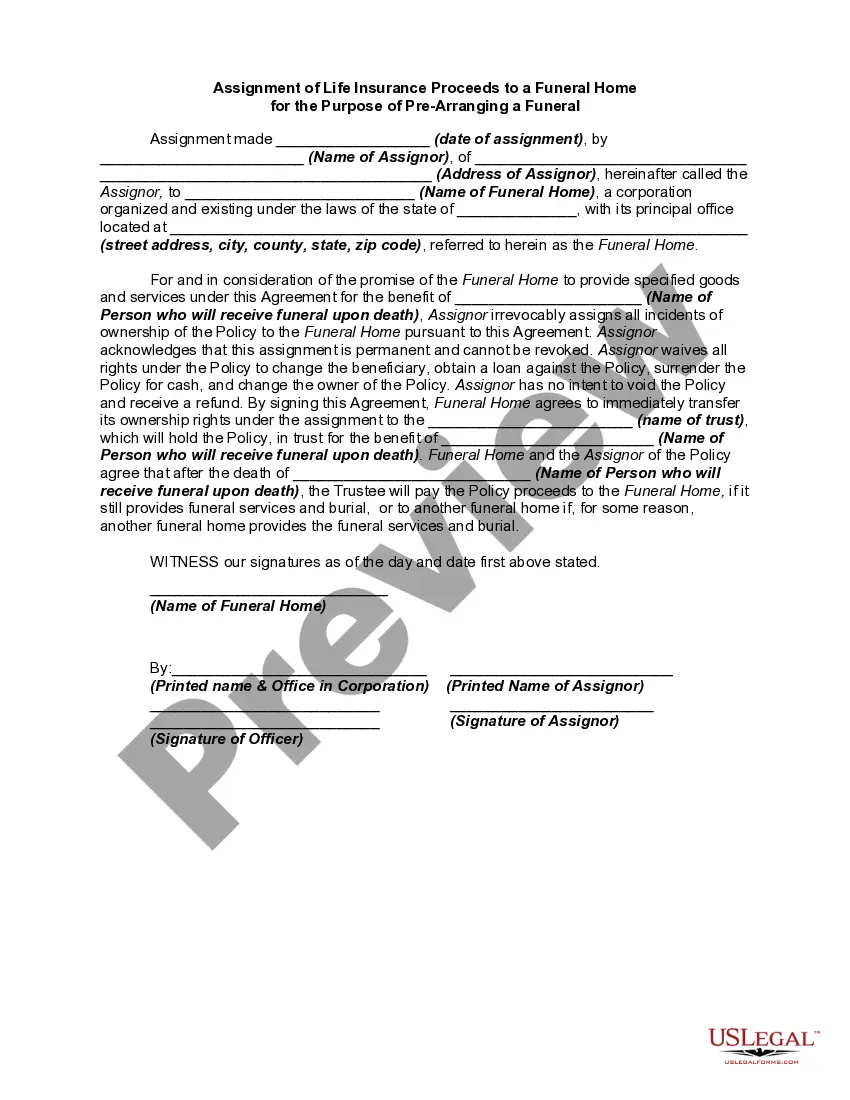

Missouri Assignment of Life Insurance as Collateral

Description

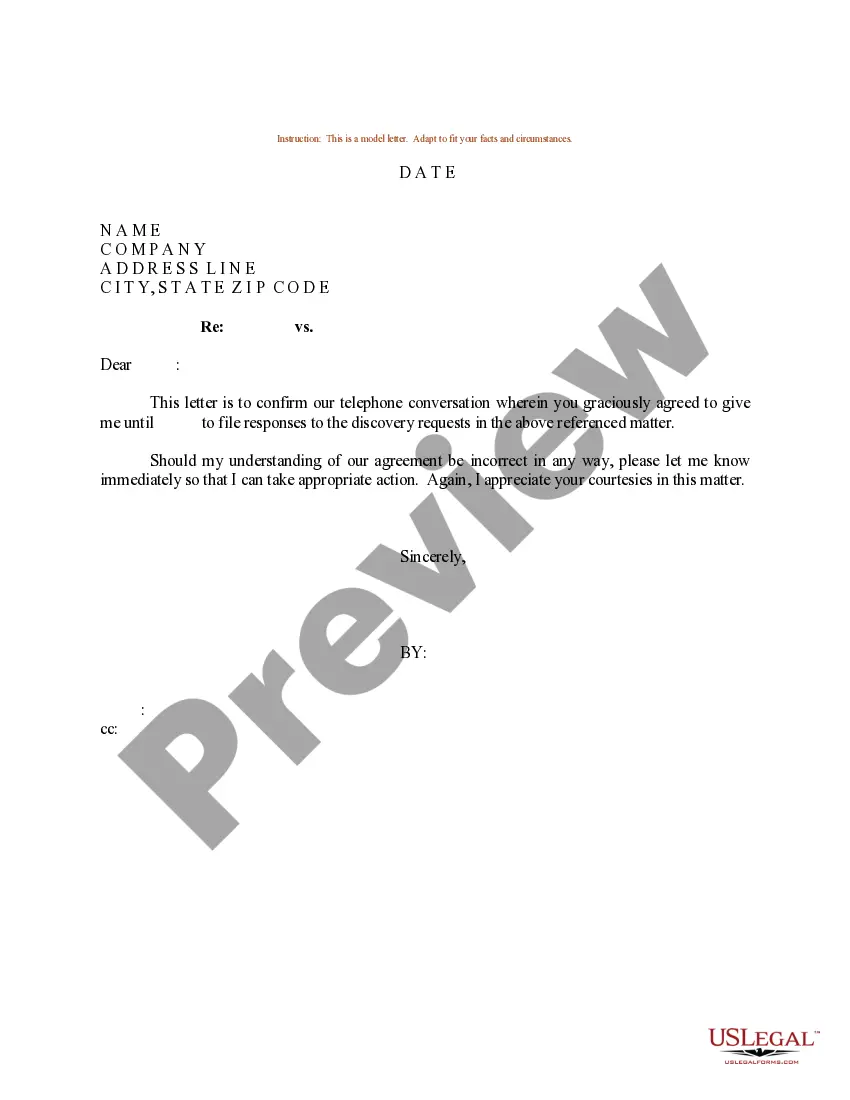

How to fill out Assignment Of Life Insurance As Collateral?

Choosing the best authorized record design might be a battle. Naturally, there are plenty of layouts available on the Internet, but how would you find the authorized develop you will need? Make use of the US Legal Forms website. The service provides thousands of layouts, including the Missouri Assignment of Life Insurance as Collateral, that can be used for organization and private needs. All the varieties are checked by professionals and satisfy federal and state specifications.

When you are previously authorized, log in to your accounts and then click the Down load button to obtain the Missouri Assignment of Life Insurance as Collateral. Use your accounts to look from the authorized varieties you might have bought in the past. Check out the My Forms tab of your respective accounts and obtain one more duplicate of your record you will need.

When you are a fresh customer of US Legal Forms, here are straightforward recommendations so that you can comply with:

- Initial, ensure you have chosen the right develop for your personal town/county. You can look over the shape making use of the Review button and browse the shape explanation to ensure it is the right one for you.

- In case the develop is not going to satisfy your needs, utilize the Seach area to find the correct develop.

- When you are sure that the shape is proper, click on the Buy now button to obtain the develop.

- Choose the costs program you would like and enter the essential info. Make your accounts and purchase your order utilizing your PayPal accounts or credit card.

- Opt for the submit file format and down load the authorized record design to your gadget.

- Complete, revise and print out and sign the received Missouri Assignment of Life Insurance as Collateral.

US Legal Forms is the greatest catalogue of authorized varieties in which you will find various record layouts. Make use of the company to down load professionally-manufactured papers that comply with condition specifications.

Form popularity

FAQ

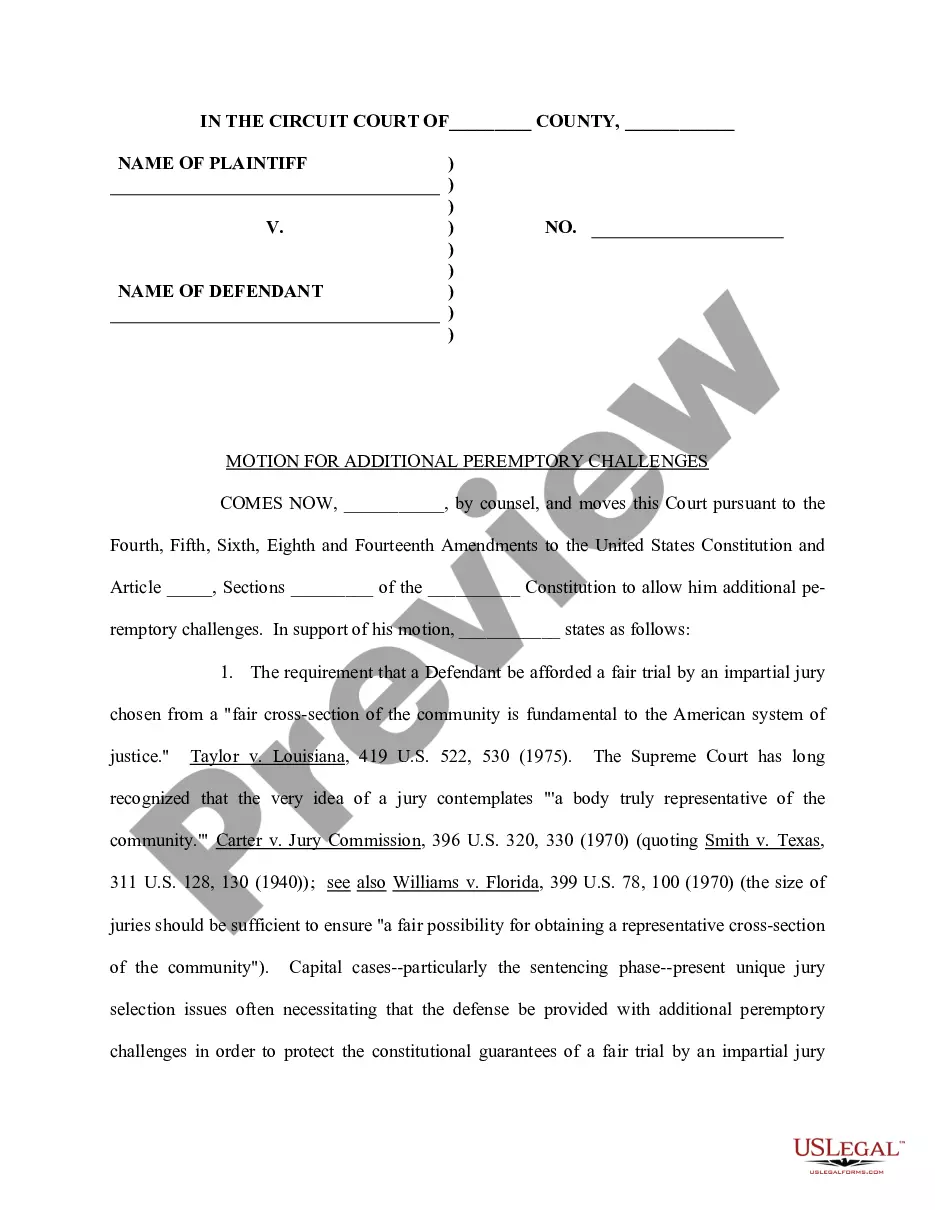

A collateral assignment pledges a permanent life insurance policy's cash value and death benefits to another party and is most commonly used to secure a loan taken out by the policyowner. A collateral assignment primarily serves to protect the repayment interest of the lender.

You can request a loan from your life insurance company for any reason, and there isn't an approval process. The only requirement is that you have sufficient cash value to borrow against (minimum amounts vary by insurer).

A collateral assignment of life insurance is a conditional assignment appointing a lender as an assignee of a policy. Essentially, the lender has a claim to some or all of the death benefit until the loan is repaid. The death benefit is used as collateral for a loan.

A life insurance policy can be assigned when rights of one person are transferred to another. The rights to your insurance policy can be transferred to someone else for various reasons. The process is known as assignment.

A collateral assignment of life insurance is a method of securing a loan by using a life insurance policy as collateral. If you pass away before the loan is repaid, the lender can collect the outstanding loan balance from the death benefit of your life insurance policy.

If you have a life insurance policy, you're in luck, because most businesses typically accept life insurance as collateral as they can guarantee funds if the borrower dies or defaults.

You can freely assign your life insurance policy unless some limitation is specified in your contract (your insurance company can furnish the required assignment forms). Through an assignment, you can transfer your rights to all or a portion of the policy proceeds to an assignee.